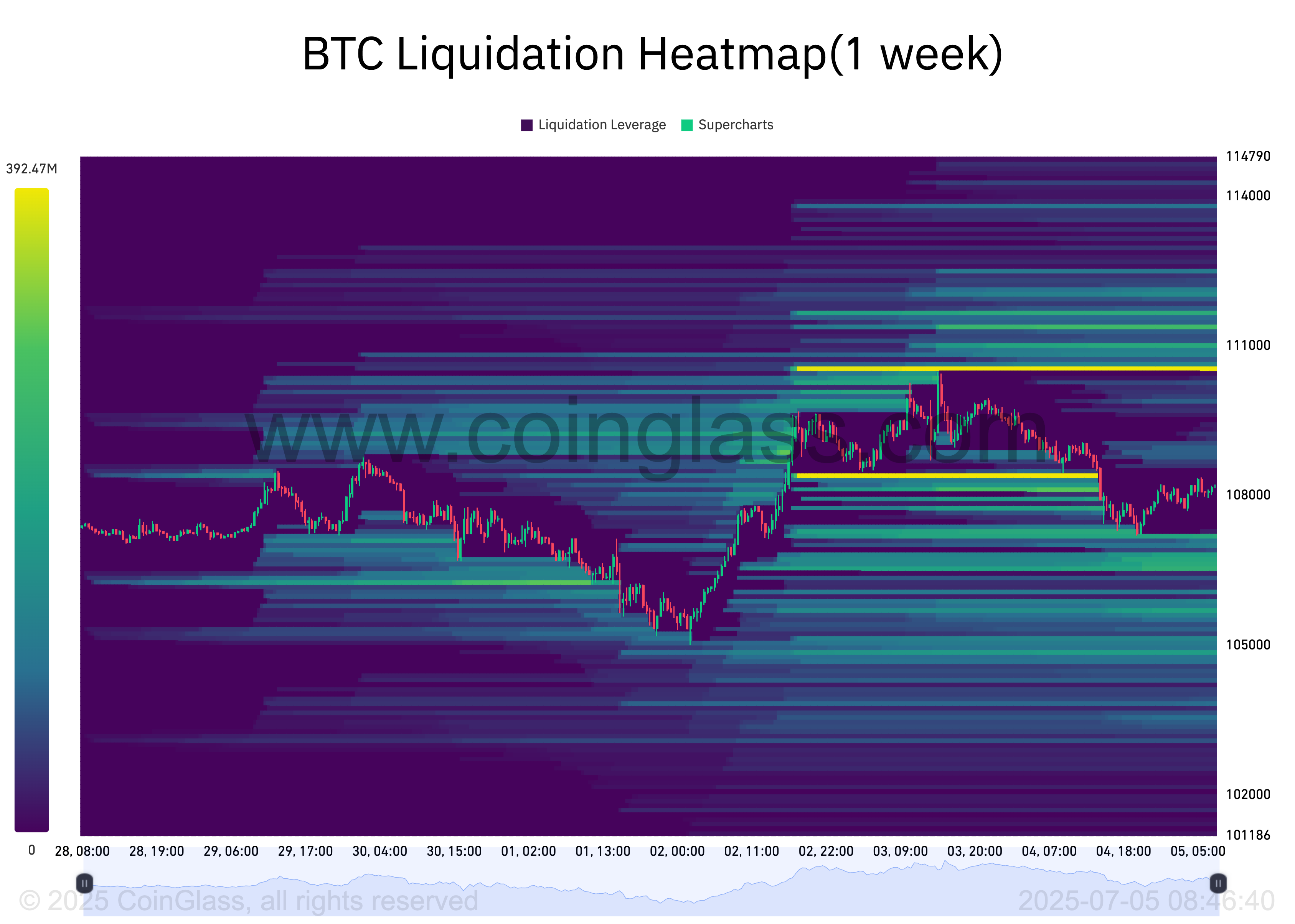

Hayes, that grizzled prophet of profit—if only Mother Russia had fewer prophets and more potatoes—utters his warning beneath fluorescent office lights, not prison moonlight. Mark my words, he says. When the orange czar Trump signs his “Big Beautiful Bill,” Bitcoin shall stumble, face-first, into the snow. The U.S. Treasury will borrow with appetite unmatched since GULAG soup lines; liquidity will dry like the Volga in July. Oh, but do not weep for Bitcoin, comrades! After licking its wounds at $90,000—just a mere pittance, hardly worth a ration card—it shall rise, fueled by hope and perhaps a little vodka. Hayes chuckles: The government has a taste for stablecoins—not for commerce, mind you, but to paper over the vast black pit of U.S. debt. 🤡