Meme Coin Meltdown 2025: The Great Crypto Circus Collapses! 🦆💥

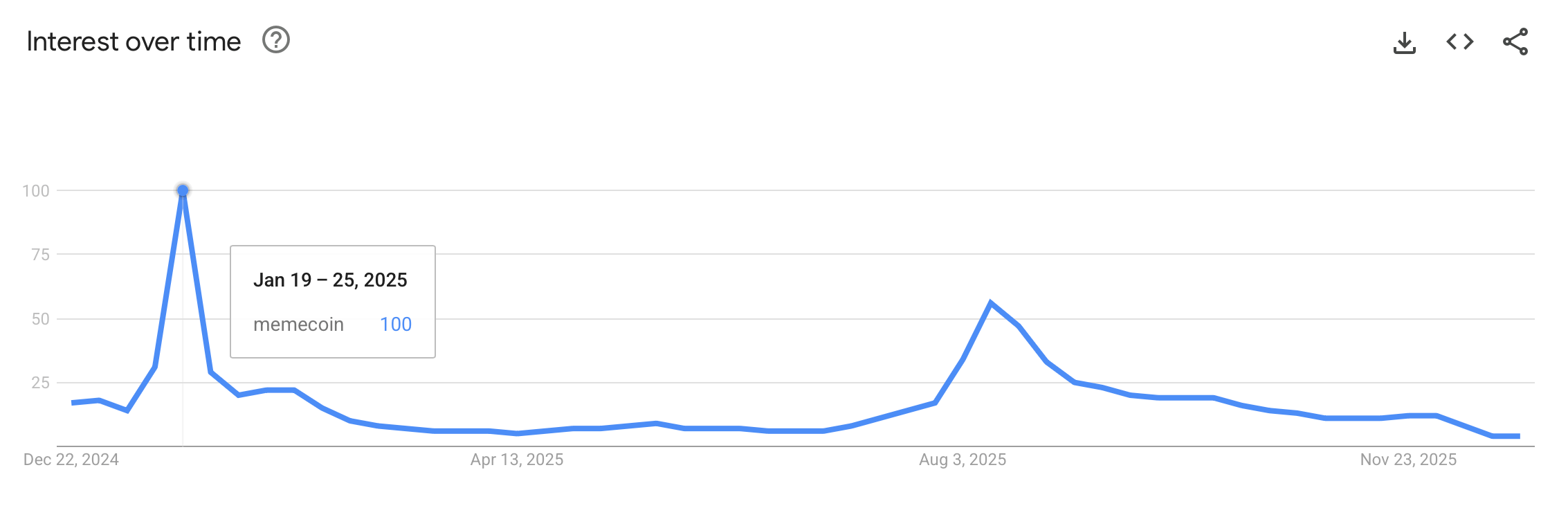

The meme coin sector began the year with a market capitalization near $130 billion, a bloated beast fed by late 2024 hype and a never-ending parade of new launches. Early optimism briefly inflated its belly, but by December, the beast had shrunk to $42 billion-a 67% collapse that left traders clutching their portfolios like drowning men clutching driftwood. 🐟💸