Bitcoin’s 2021 Déjà Vu: Whales Bailing, ETFs Crying, HODLers Praying 😱

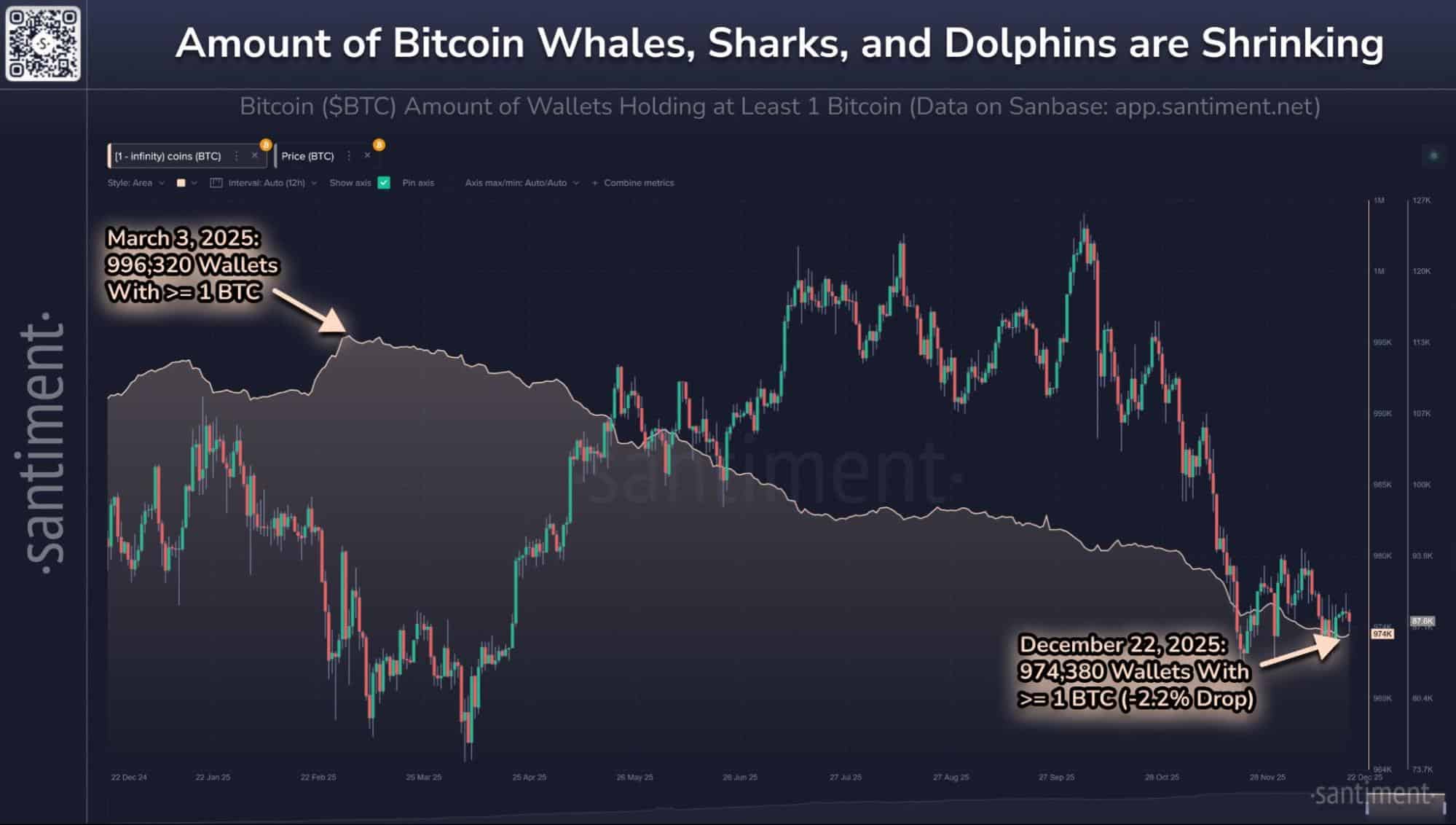

So, Bitcoin’s still acting like it’s got a date with the floor. Every time it tries to bounce, someone’s there with a “NOT TODAY, SATOSHI!” sign. Now, it’s flirting with $87k, and the whales and sharks? They’re swimming for the exits. 🚀→🚪 Couple that with ETFs bleeding like a stuck pig, and you’ve got a recipe for “bearish.” Or as I like to call it, “Monday.”