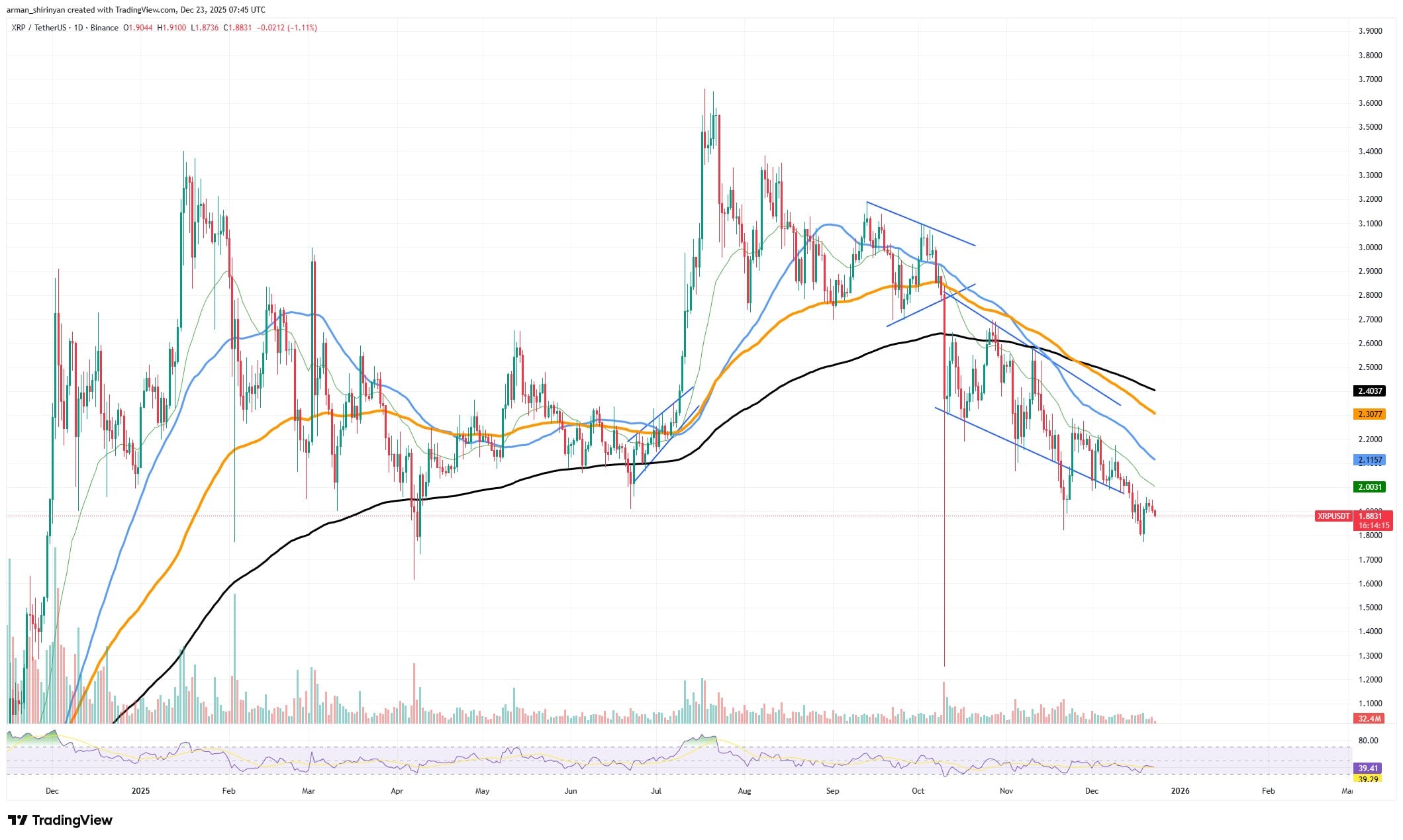

XRP: The Snail Race to Glory 🌟💤

Price-wise, XRP is the equivalent of a first date who talks about their cat too much-not exactly impressive. Rallies? Capped faster than a bottle of cheap prosecco. Still stuck in a declining structure, trading below moving averages like it’s stuck in traffic. Volatility? Thin. Volume? Thinner. Momentum? Probably out for a smoke break. 🚬💨