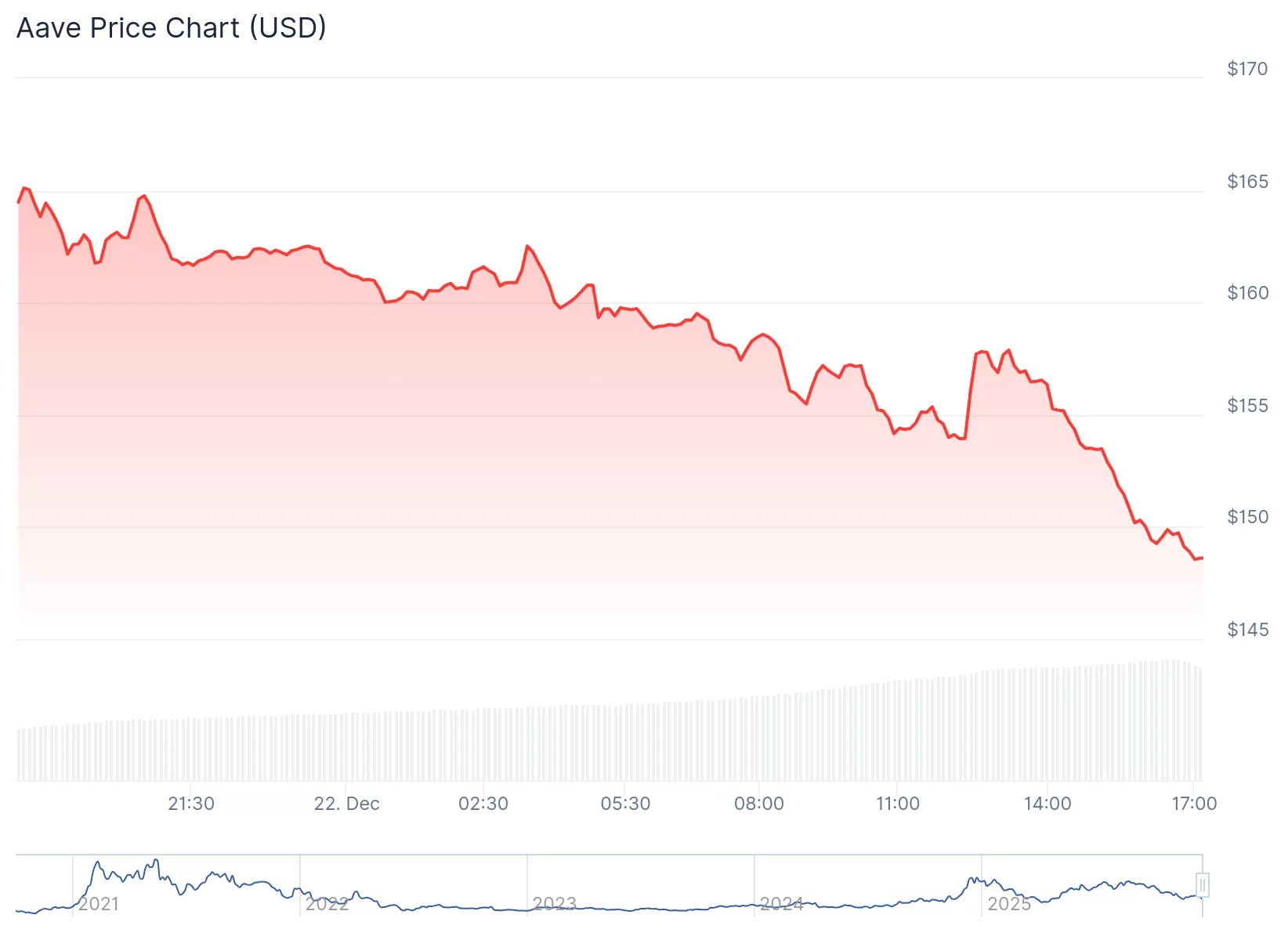

ETHZilla’s Fire Sale! 📉

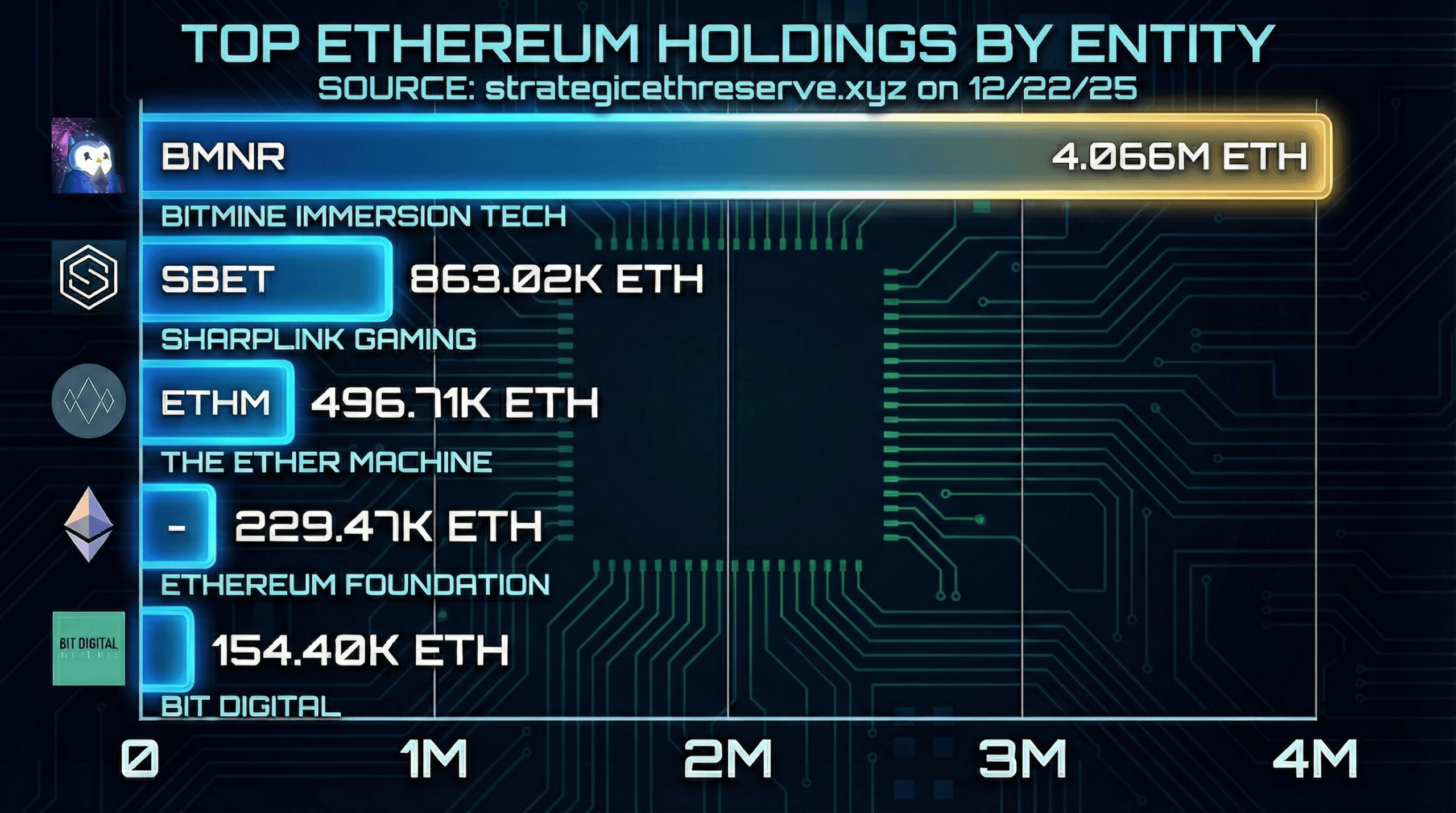

ETHZilla, that ambitious venture, has been…re-evaluating. One might even say, slightly panicked. They’ve sold a rather substantial chunk of their ether holdings – $74.5 million worth, to be precise – to pay off debts. Apparently, relying on the whims of the cryptocurrency market wasn’t the most robust plan. One wonders who approved that initial strategy… 🤔.