- Long-term SOL investors are about as relaxed as a cat in a room full of rocking chairs.

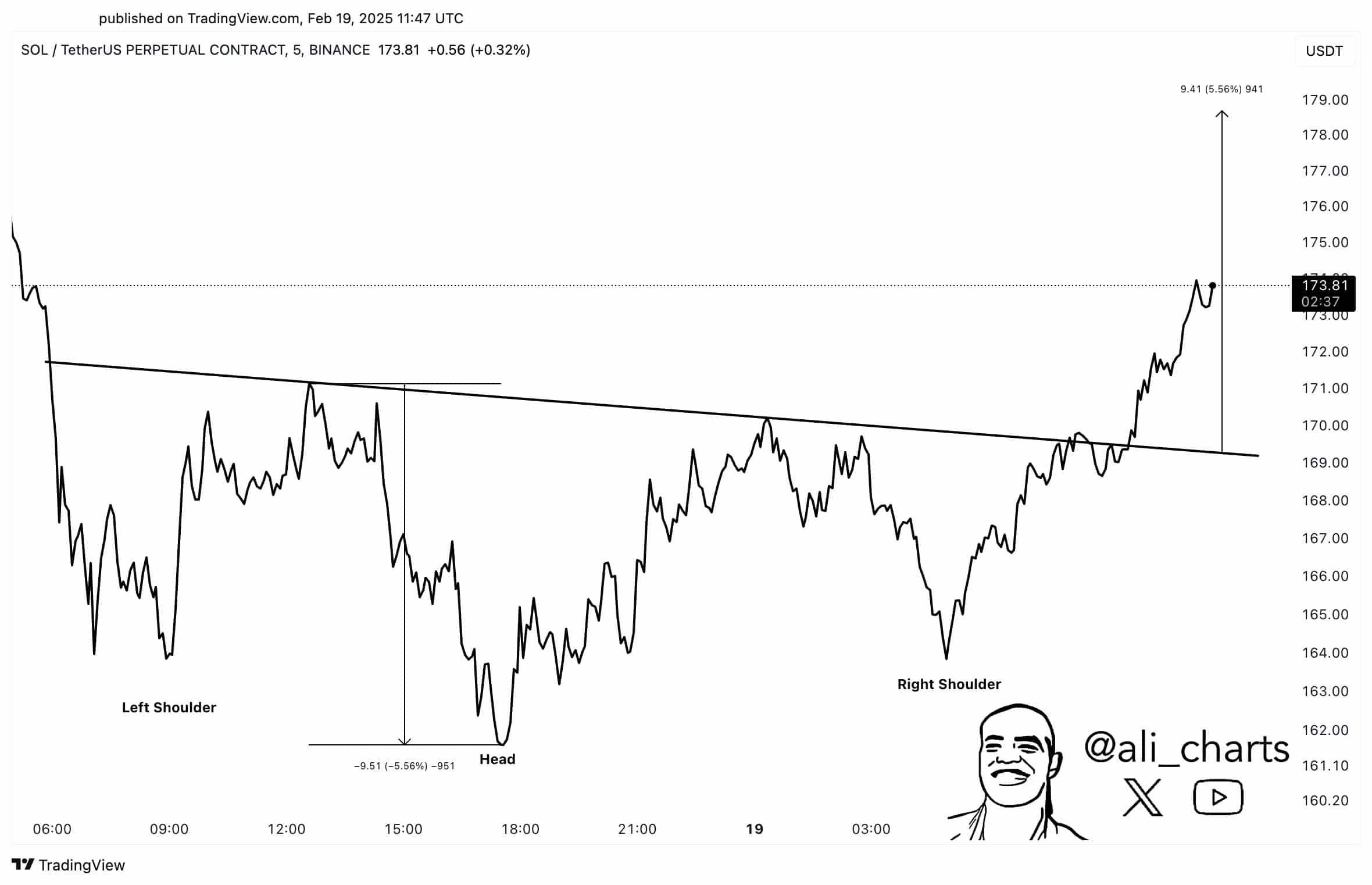

- SOL has done a marvelous jig out of an inverse head-and-shoulders pattern, suggesting it’s feeling a bit bullish.

As of the last nibble of data, Solana’s (SOL) Long-term Holder Net Unrealized Profit/Loss (NUPL) was performing the cha-cha between periods of mild amusement and flat-out panic among investors.

Essentially, this NUPL was engaged in a high-stakes game of leapfrog, hopping between 0.4 and 0.6. This means that while some holders had clutched their treasure confidently, there was also an ominous whisper of concern about the potential for losses looming like a bad smell.

Now, let’s clear this up: the NUPL hasn’t yet dipped into negativity, which would indicate that everyone is having a really bad day. However, its recent waltz toward the lower number has many stockpiling their emergency snacks and preparing for the worst—an understatement of epic proportions.

Whenever the price gets a bit wobbly, it seems to send ripples through the NUPL, creating a relationship more dramatic than a soap opera. For instance, on the 5th of February, when SOL decided to practice its free-fall routine, the NUPL dipped lower than a limbo champion, edging everyone into the anxiety phase.

In the grand scheme of things, it looks like a hold-your-horses strategy is the name of the game until a clearer reversal pattern decides to show up—a bit like waiting for a bus that never arrives.

In light of market history and current melodrama, investors might do their best deer-in-the-headlights impersonation, bracing themselves to either cash in on a possible upswing or protect their assets should the market choose to be extra dramatic.

SOL’s fancy inverse head-and-shoulders dance

Our friend Solana executed a breakout from an inverse head-and-shoulders pattern, suggesting a possible royal romp back into bullish territory after feeling a bit blue. The neckline lounging around $173.81 proved to be a stubborn barrier before this breakout decided to strut its stuff.

Following this slight turn of events, SOL’s fans may want to brace for a delightful rise—perhaps by about 6%—aiming for a glorious $180. Long-term SOL investors might just find a pop of optimism poking through the prevailing clouds of anxiety like a daisy in a coal mine.

This inverse head-and-shoulders pattern – a bullish bit of business – could very well mark accumulation phases, where investors might nestle back in or look to scoop up more in prep for future bounty.

This breakout could drive buying pressure like a caffeinated rabbit, leading to a potential leap toward the coveted $180 mark. However, if SOL decides to pull a disappearing act and struggles to stick around the breakout level of approximately $173.81, it could backtrack to test lower supports, making the cautious folks grip their wallets a bit tighter.

On the flip side, should this breakout flake out and Solana tumble below the neckline again, it would effectively toss the bullish forecast out the window and into the nearest muddy puddle, leading to a troubling retest of lower supports around $160.

All of this aligns seamlessly with the perpetual anxieties among long-term holders, who now face a choice between pulling the plug on losses or holding out for a better opportunity, like waiting for the kettle to boil amidst a commotion of doubts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-02-20 09:49