- The expected rally in TIA faces potential delays as profit-taking activity intensifies.

- While market sentiment remains solidly bullish, with key metrics hinting at positive movement.

As a seasoned researcher with years of experience navigating the complex world of cryptocurrencies, I find myself intrigued by the current state of Celestia [TIA]. The bullish outlook remains strong, but profit-taking activity has become increasingly evident, potentially causing temporary setbacks in the much-anticipated rally.

Despite experiencing a 19.23% loss last month, Celestia [TIA] has demonstrated resilience, recording a 6.10% increase in the last 24 hours. The ongoing market dynamics and technical indicators suggest a positive, or bullish, trend moving forward.

Yet, since traders transfer their TIA assets to exchanges for potential sell-offs, this rally might experience a brief halt or face momentary downturns.

Traders favor profit-taking over long-term gains for TIA

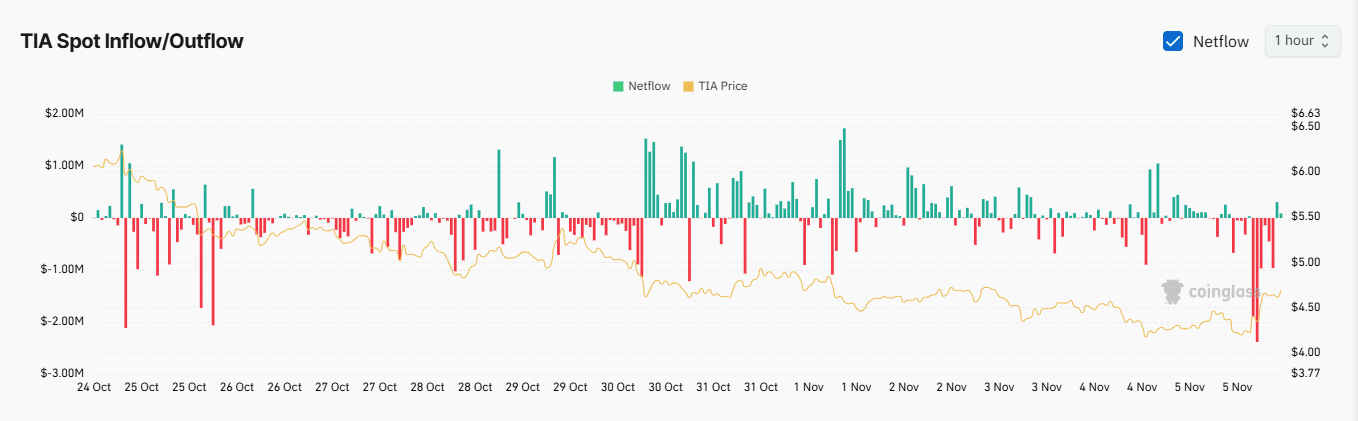

Based on data from Coinglass, it appears that TIA started seeing some profit-taking actions, since Exchange Netflow has shifted into a positive position.

A rise in Exchange Netflow suggests that traders are transferring TIA from their personal wallets to exchanges, preparing to sell the asset and take advantage of the recent market increases.

Currently, approximately $277,000 worth of TIA has moved to exchanges over the past hour, potentially indicating a desire to cash in on profits. Such transactions could potentially dampen TIA’s upward trend if these coins are sold.

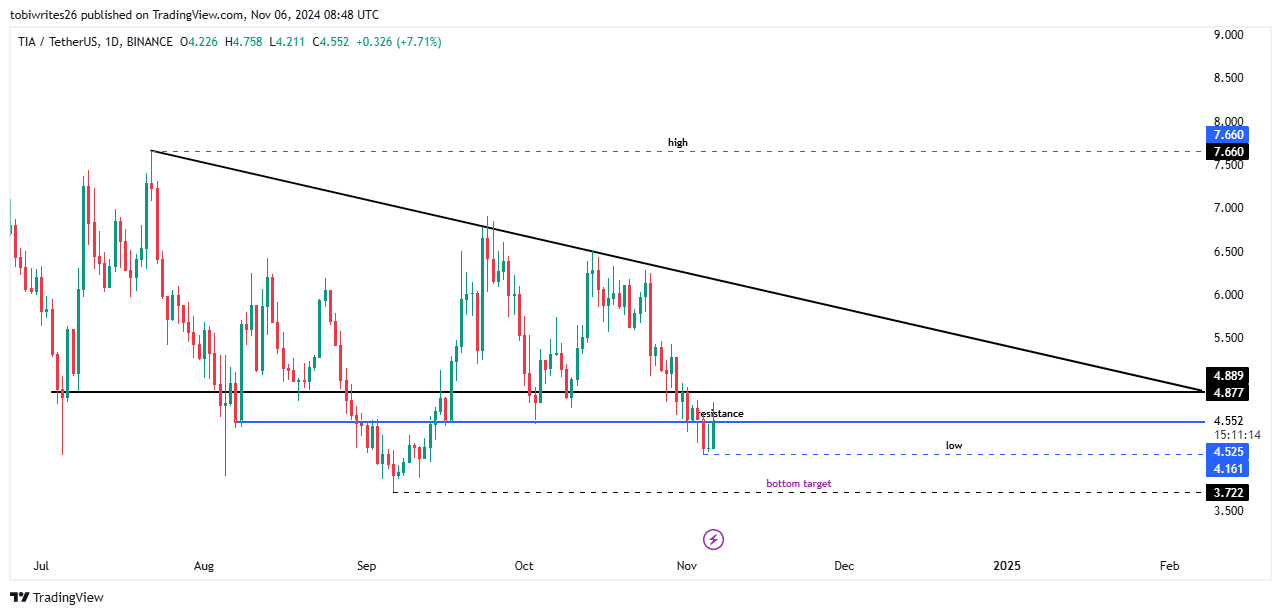

The pattern seems consistent with a potential resistance point at 4.525 as indicated on the graph, which might trigger substantial selling that causes the asset’s value to decrease toward 4.161. If this pressure continues, it may lead to a further decline in TIA’s price to around 3.722.

Bullish structure holds as TIA profit-taking begins

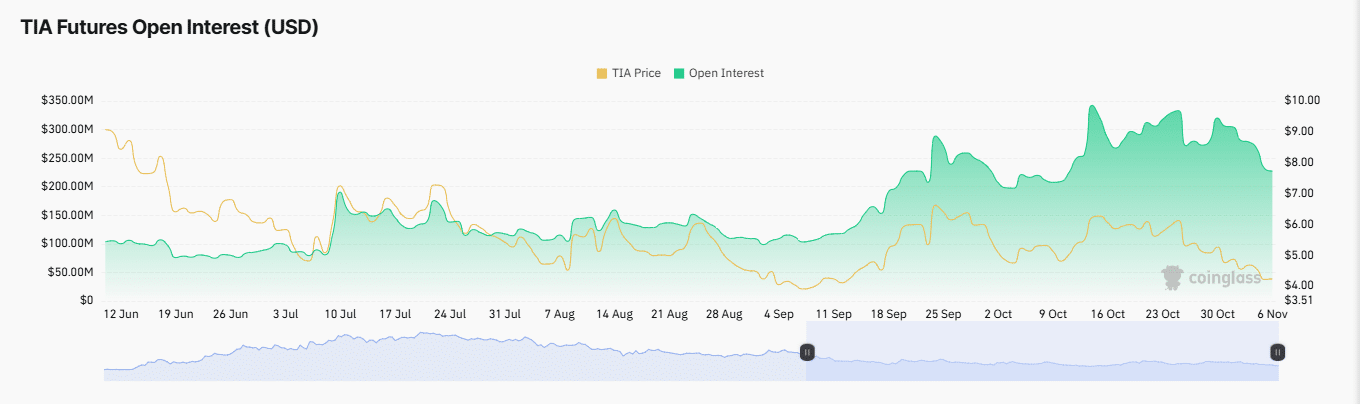

Despite recent profit-taking on TIA spot positions, Open Interest remained high, with traders opening more long contracts.

At the moment, the Open Interest rate stands at 14.69%, equating to approximately $266.49 million. This significant figure implies a high volume of unresolved futures contracts, suggesting that the market is actively participating and engaged.

This uptick in Open Interest is likely to support further upward momentum for TIA.

Moreover, the Funding Rate continues to be favorable, as long-term traders are compensating short-term ones to offset any differences in market prices.

This consistent financing showed a rising belief in the rally, as well as more optimistic trading stances taken by market players.

Should these measures remain consistent, it’s likely that any dip in TIA’s pricing will be short-lived, with a swift rebound predicted in the near future.

Read Celestia’s [TIA] Price Prediction 2024–2025

Long liquidations weigh on TIA rally

Currently, the situation indicates that the market is experiencing a continued bearish trend, as evidenced by the large-scale liquidation totalling approximately $1.11 million. This heavy selling has continued to weigh down on the price of TIA, preventing any significant rise in its value.

If prolonged selling pressure continues, the price trend might persist downwards until there’s sufficient buying power to push prices up and surpass resistance points.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-11-07 00:55