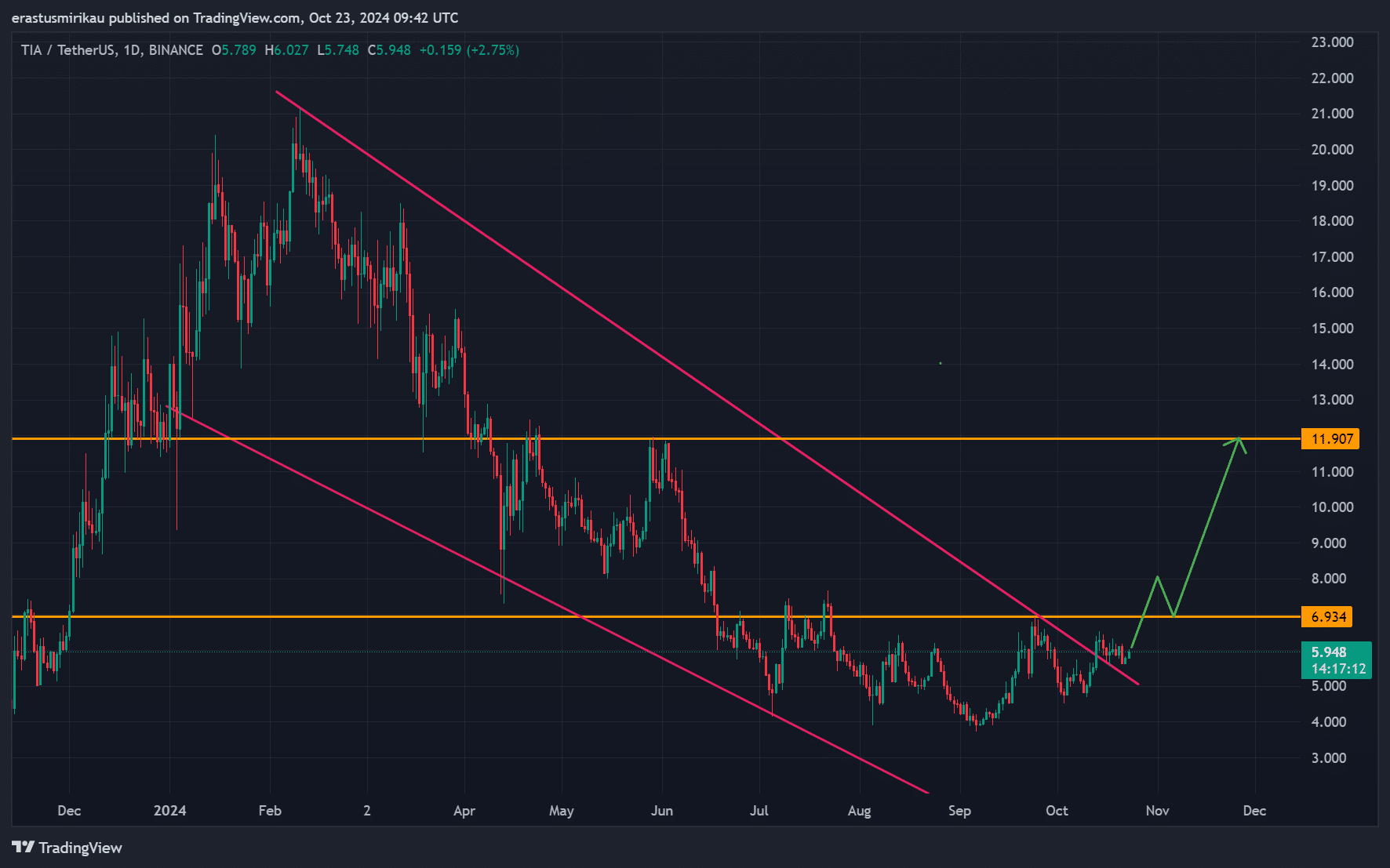

- Celestia has broken out of its descending channel, targeting $6.9 as the next resistance.

- Rising social dominance and increased open interest signal growing market confidence in TIA.

As a seasoned researcher with years of experience navigating the dynamic cryptocurrency market, I find myself intrigued by Celestia’s [TIA] recent breakout from its descending channel. With a discerning eye for technical patterns and an appreciation for the unpredictability of this space, I can’t help but feel a sense of anticipation for what lies ahead.

Celestia’s TIA has seen significant growth following its successful breakout from the downward trendline, hinting at a possible upward trend or bullish movement.

Currently trading at $5.97, representing a 4.39% increase, analysts are considering if TIA can maintain this positive trajectory.

Yet, the asset is about to encounter a significant hurdle: Will it manage to surpass the upcoming significant barrier at $6.9, thereby instigating a more extensive upward trend?

TIA descending channel breakout

The emergence from a downward trending pattern that’s been developing over several months has fueled hope and positivity within the market.

Currently, a significant hurdle lies at $6.9 for Celestia. Overcoming this barrier might trigger a prolonged upward trend. If it manages to do so, the next significant price point to aim for could be around $11.9.

If TIA fails to maintain a price above $6.9, it may retreat back to its previous consolidation range. Consequently, the upcoming days are significant, as traders keep a close eye on these key levels.

TIA technical analysis: RSI and MACD

Looking at some technical indicators, the Relative Strength Index (RSI) currently stands at 55.19, indicating a market that’s leaning slightly towards the bulls, yet still maintaining a balance overall.

However, it still remains below the overbought threshold, indicating that Celestia has room to move higher without hitting exhaustion.

Furthermore, the MACD (Moving Average Convergence Divergence) indicator is about to experience a bullish crossover, potentially boosting Celestia even more. These indicators imply that, should present tendencies persist, the token might continue to grow in value.

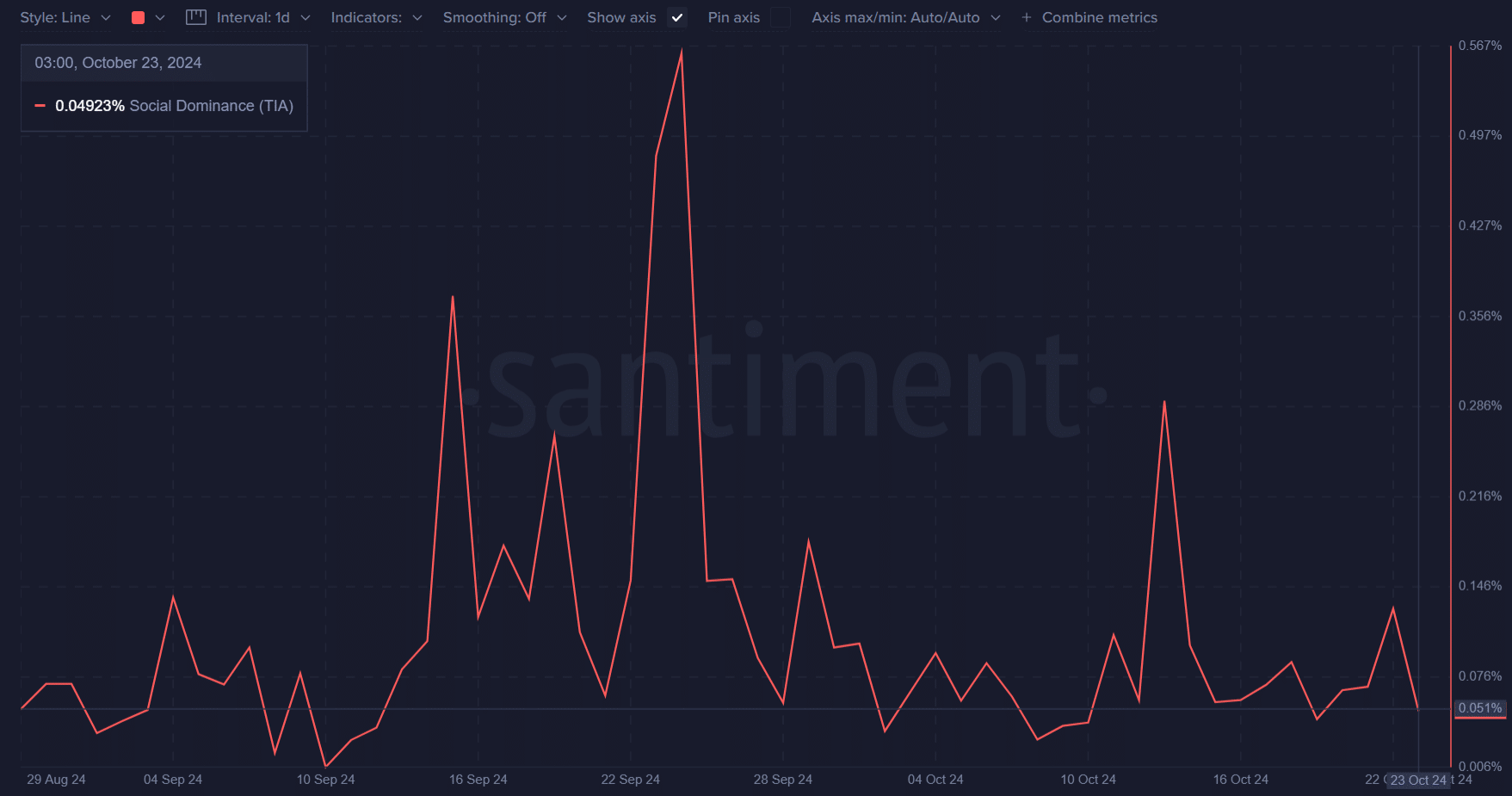

Social dominance and market sentiment

In the world of cryptocurrency, social sentiment can significantly impact price movement. Recently, TIA’s social dominance reached 0.049%, showing that it’s slowly gaining traction among retail investors.

A smaller-scale boost in social interaction frequently goes hand-in-hand with a rise in shopping enthusiasm. This could potentially fuel additional growth in prices.

Consequently, as TIA’s profile becomes more prominent, it might fuel a positive trend if an increasing number of investors begin to talk about and invest in the token.

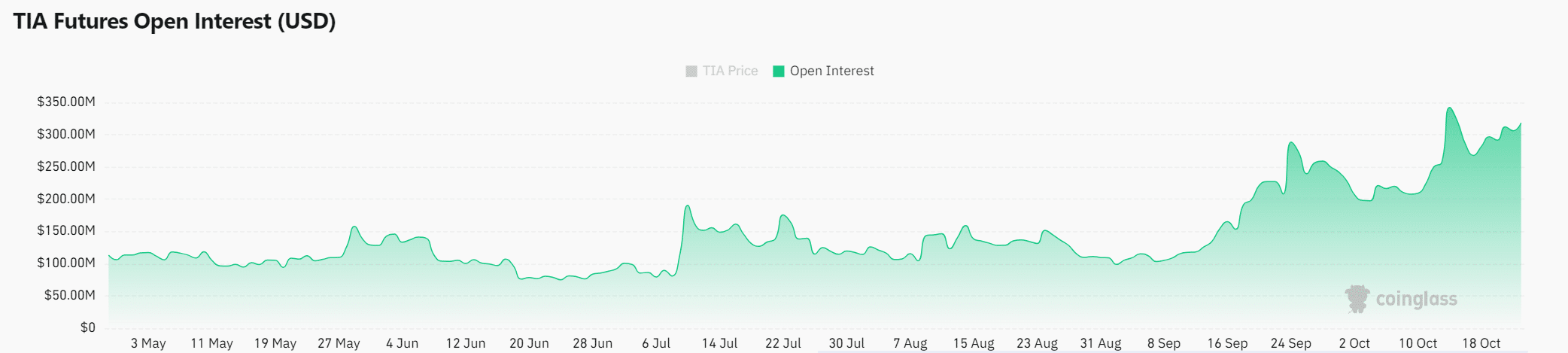

Open interest and market confidence

Open Interest for TIA futures currently stands at $317.32 million, marking a 0.66% increase. This rise suggests that traders are gaining confidence in the token’s short-term performance.

As a researcher, I observe that an escalation in Open Interest often signifies heightened involvement of traders, which might strengthen the market’s momentum. The surge in futures interest towards TIA not only intensifies my curiosity but also adds another dimension to my optimism about its potential breakthrough.

In summary, given its advanced technical infrastructure and increasing market attention, it seems that Celestia has strong potential for continued growth.

However, breaking through the $6.9 resistance is essential for the token to sustain its bullish momentum. Should TIA successfully clear this hurdle, it could target higher levels like $11.9.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-24 05:43