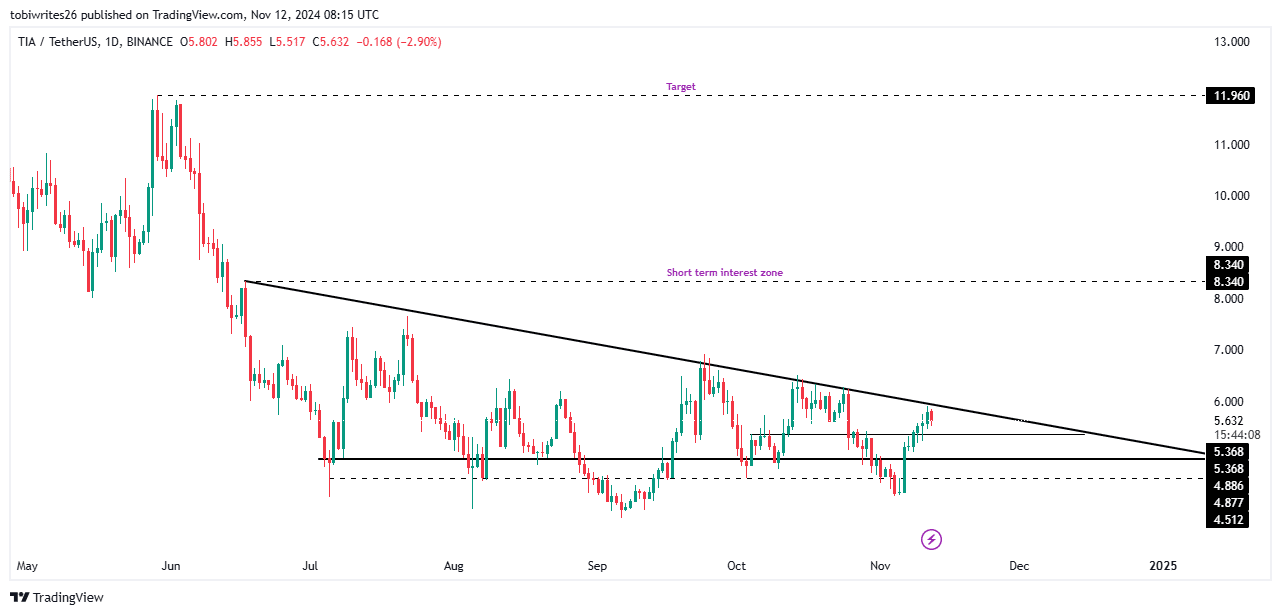

- TIA appears poised to climb to $8.3 if it clears its immediate resistance.

- To continue its larger rally toward $11.96, TIA must hold its bullish momentum.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by Celestia [TIA]. Despite a minor hiccup, it’s holding strong and showing promising signs of a larger rally. The bullish triangle pattern is a clear indicator of potential growth, but TIA must break through its resistance to truly soar.

Celestia TIA has proven to be one of the leading altcoins during the current surge in the market. However, it experienced a slight dip of 3.45% over the last day. Yet, its performance for the week shows an impressive rise of 22.80%, indicating a consistent upward trajectory overall.

As of the current reporting, TIA finds itself at a critical juncture, with AMBCrypto carefully monitoring its subsequent actions to foresee what it might do next.

A barrier to TIA’s rally

TIA’s recent surge has been primarily fueled by a bullish triangle formation. For it to continue its upward trajectory, it needs to breach the resistance level set by this pattern.

In this arrangement, we offer several possible price outlooks. If the market is optimistic (bullish), it’s predicted that TIA could break through its resistance level initially toward a temporary goal of $8.34. However, with further positive momentum, there’s potential for it to eventually rise as high as $11.96.

Alternatively, it could find support at $5.368 before attempting a breakout.

If the market takes a pessimistic turn, Total Immersion Association (TIA) could drop to the bottom of its price channel around $4.886. Under continued bearish influence, there’s a possibility it might even descend to $4.512.

Market sentiment is mixed

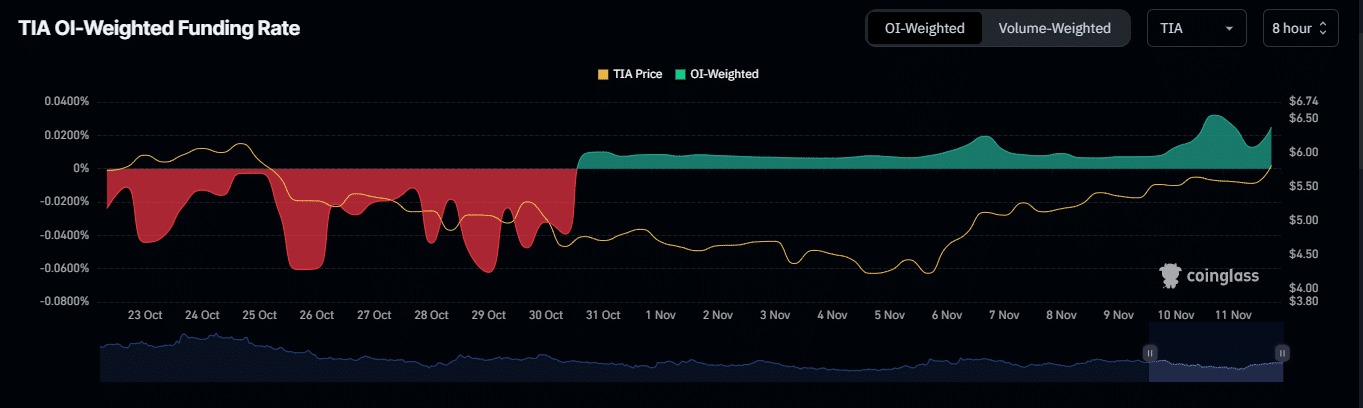

Currently, the feelings towards TIA in the market are divided, but the data from Coinglass indicates a positive trend in Open Interest and Open Interest Weighted Sentiment, suggesting a potentially bullish outlook.

As a crypto investor, I observed an upward trend in the open interest for TIA, indicating more pending derivative contracts. At the moment of writing, this figure stood strong at approximately $248.39 million, marking a 5.45% increase.

The Open Interest Weighted Sentiment, a measure that evaluates the intensity and direction of traders’ positions according to contract volumes, continues to show optimism. It has been on an upward trend since October 31st and recently peaked at a level of 0.0453%.

Both metrics suggested a likely sustained run for TIA with its recent gain.

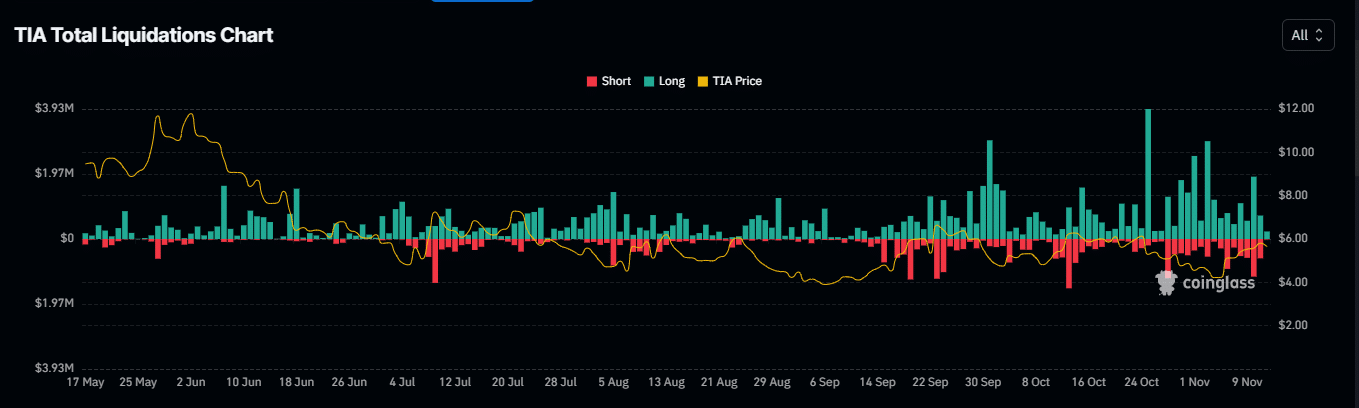

On the other hand, further signs point towards possible downward price pressure. Over the past day, there were approximately $1.67 million worth of long positions being closed out, suggesting that traders expecting a price surge have experienced losses instead.

Read Celestia’s [TIA] Price Prediction 2024–2025

Furthermore, the analysis of Netflow data revealed a substantial surge of TIA moving into trading accounts, suggesting that certain traders might be planning to offload their holdings, possibly to cash in on their earnings or because they are uncertain about future returns.

As a crypto investor, I’m keeping my eyes on TIA. For it to show a strong upward trend and potentially reach $11.96, the overall market sentiment needs to be bullish. If the positive momentum prevails, that could be the direction we see this cryptocurrency moving towards.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-13 07:03