-

LINK has climbed to its highest price level in six weeks.

Most LINK transactions continue to return profit.

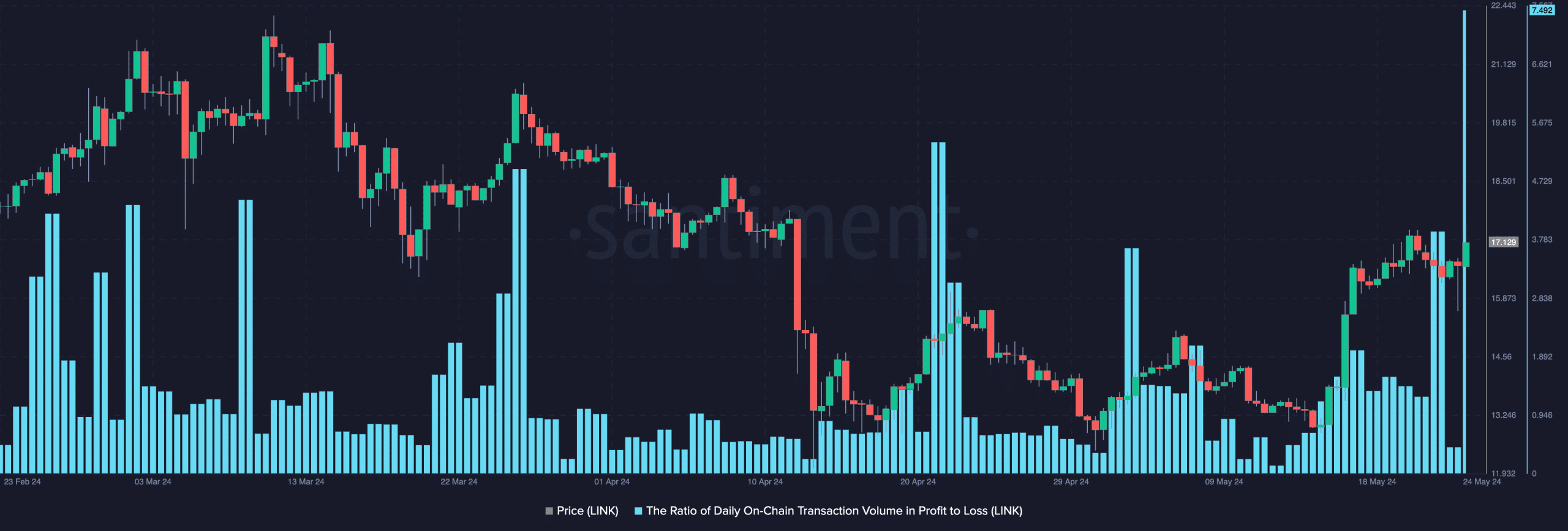

As a researcher with experience in analyzing cryptocurrency markets, I’m excited to see Chainlink (LINK) leading the altcoin rally following its six-week high price level. The recent surge in LINK’s price has been profitable for many investors, as indicated by the high ratio of daily transaction volume in profit to loss and the significant number of wallet addresses holding the token at a profit.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing trend emerging: Chainlink (LINK) is currently spearheading the altcoin surge after hitting a six-week high in price, according to recent data from Santiment.

Based on the information provided by the on-chain data source, I discovered that the altcoin reached a price of $17.53 during the intraday trading on May 23rd. However, it experienced a small correction afterwards.

s of this writing, LINK exchanged hands at $17, according to CoinMarketCap’s data.

LINK holders in gains

Holding LINK has become highly lucrative due to its recent price increase.

On May 23rd, AMBCrypto analyzed the financial data of LINK‘s daily transactions and calculated the profit-to-loss ratio. The result indicated that for every 11 losing transactions, there were 11 corresponding profitable ones during that trading period.

From my perspective as a crypto investor, the current reading of this metric stands at 7.49. This implies that profitable trades continue to be common in the market.

Additionally, the MVRV ratio of the token stood at 71.56%, implying that the current market value of LINK was noticeably greater than the average purchase price for all its owners.

The price surge for LINK indicated that it was overvalued, but at the same time, it offered a guaranteed profit for those who chose to sell their holdings.

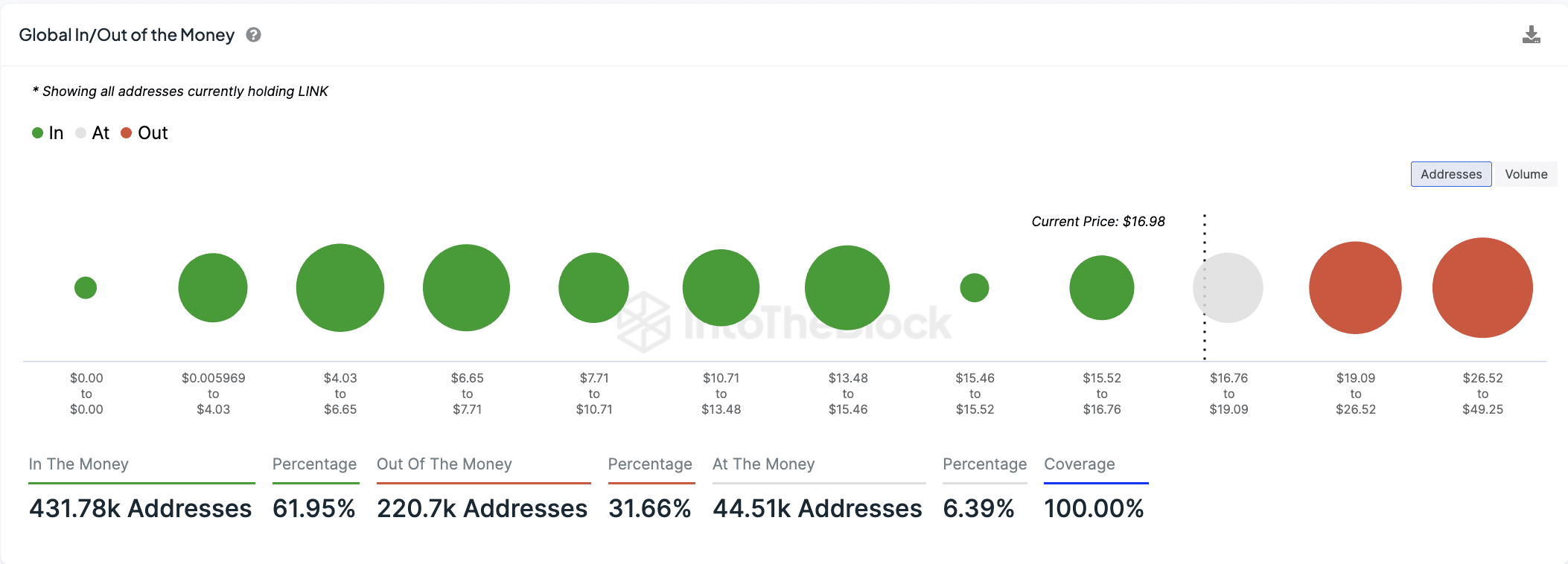

Approximately 62% of LINK investors, representing around 432,000 unique wallet addresses, currently hold the altcoin at a price higher than their initial purchase price. (IntoTheBlock’s data)

As an analyst, I’ve discovered that over 32% of LINK token holders, amounting to approximately 221,000 addresses, are currently experiencing losses on their investments. In simpler terms, these individuals are “underwater” or “in the red,” as they own tokens worth less than what they initially paid for them.

Do not get carried away

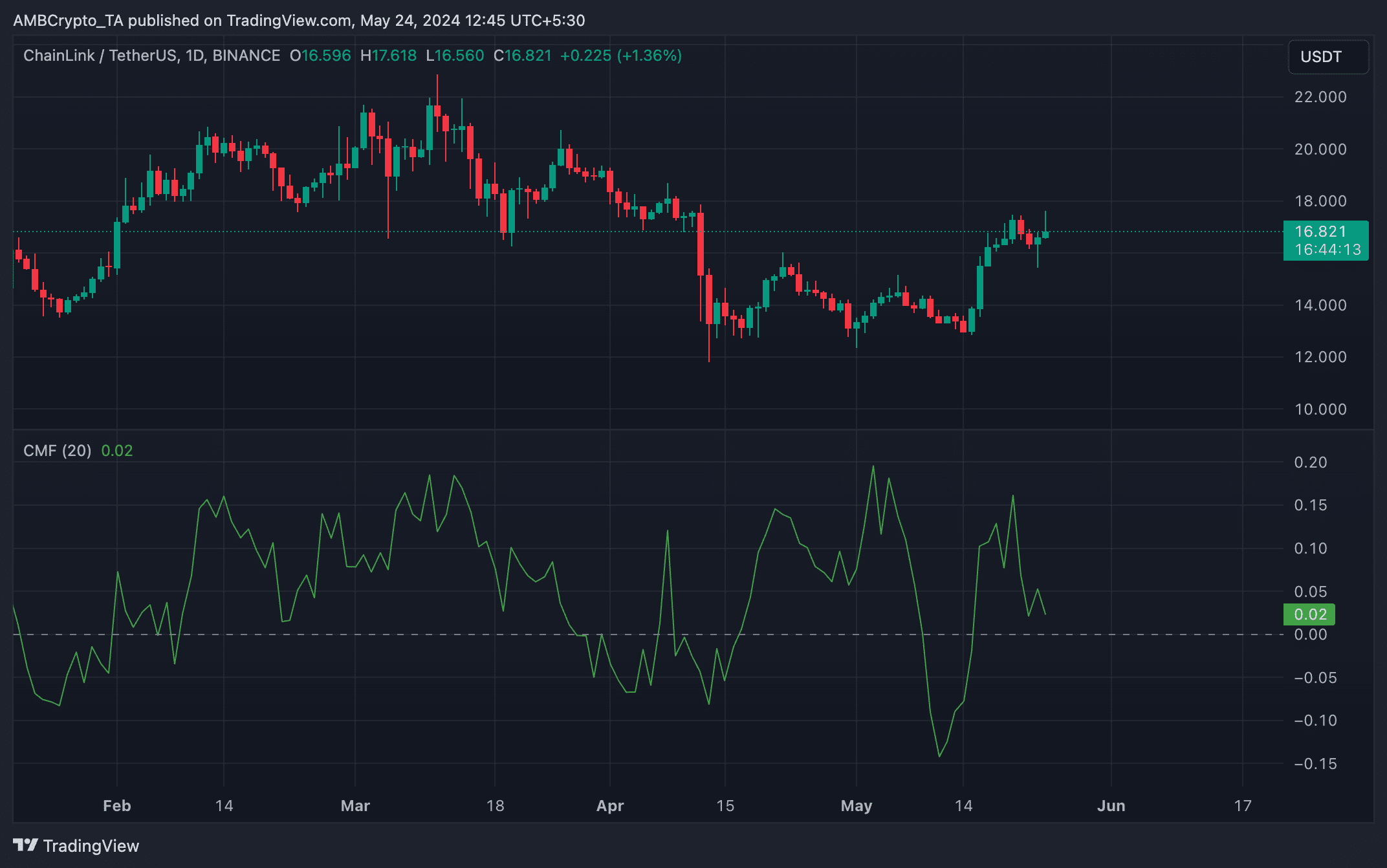

As a researcher studying the market trends of LINK, I’ve noticed an intriguing development. While the cryptocurrency has experienced a significant price surge over the past week, a crucial technical signal has been moving in the opposite direction. This bearish divergence between price action and the indicator is a warning sign that may foreshadow a potential reversal or correction in LINK’s upward trend.

As a crypto investor, I’ve been closely monitoring LINK‘s daily chart, and I noticed an intriguing discrepancy between its price action and the Chaikin Money Flow (CMF) indicator. Over the past week, LINK’s price has been on a bullish run, but the CMF, which measures the amount of money flowing into and out of LINK’s market, has taken a downturn. At present, LINK’s CMF hovers around its zero line, specifically at 0.02. This divergence could be an early sign of potential price reversal or continued buying pressure despite weakening inflows.

When a bearish divergence occurs, it signifies that an asset’s price is climbing, but its Chaikin Money Flow (CMF) is declining. In simpler terms, this indicates weaker buying momentum despite the rising prices.

It suggests to market participants that the price rally may not be sustainable.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-24 22:15