- Chainlink bulls have remained cautious since the price neared $11.

- The bearish short-term sentiment promised a move toward $8.

As a seasoned crypto investor with battle-scarred fingers from the volatility of this exciting market, I find myself treading cautiously amidst the current Chainlink scenario. After witnessing the bullish momentum stall at $11, I can’t help but feel a sense of deja vu. The bearish short-term sentiment seems to have ushered in a move towards $8, a familiar dance we’ve seen before.

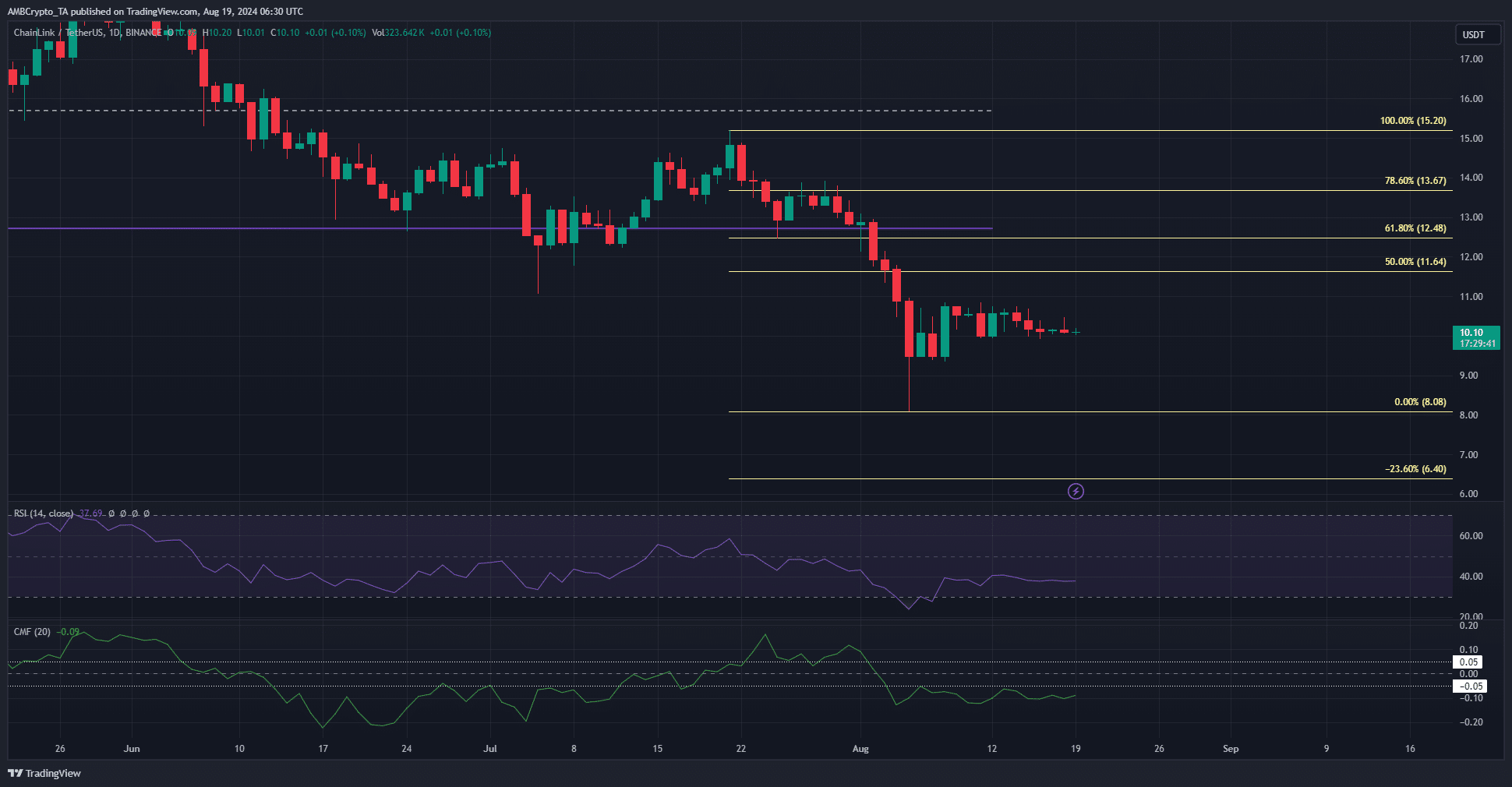

Chainlink’s LINK token was moving within a bearish triangle formation, suggesting a potential further decline in its price. Over the recent period, technical indicators have shown consistent selling pressure.

Meanwhile, it’s worth noting that Chainlink has connected four of its offerings over 12 different blockchain platforms. This growth in usage and advancement could be encouraging for investors who are looking at a longer-term perspective.

The hesitation below $11

Following the significant declines on the 5th of August, buyers attempting to support Chainlink managed to push the price up to $10.8, yet they failed to sustain further growth. Sellers have held the upper hand throughout August, as the Capital Momentum Factor (CMF) remained below -0.05, suggesting a significant outflow of capital from the market.

For several days now, the RSI (Relative Strength Index) has shown a downward trend because LINK dipped beneath its previous minimum levels at $12.7. In the short term, potential bearish price points at $9.45 and $8 could be reached.

It’s expected that the range between $10.8 and $11.2 will act as a barrier for further price increase, offering short-sellers an opportunity to enter the market here. If prices fall below the recent low of $8.08, an additional bearish target at approximately $6.4 could be reached due to a Fibonacci extension level.

LINK’s bullish sentiment was quick to evaporate

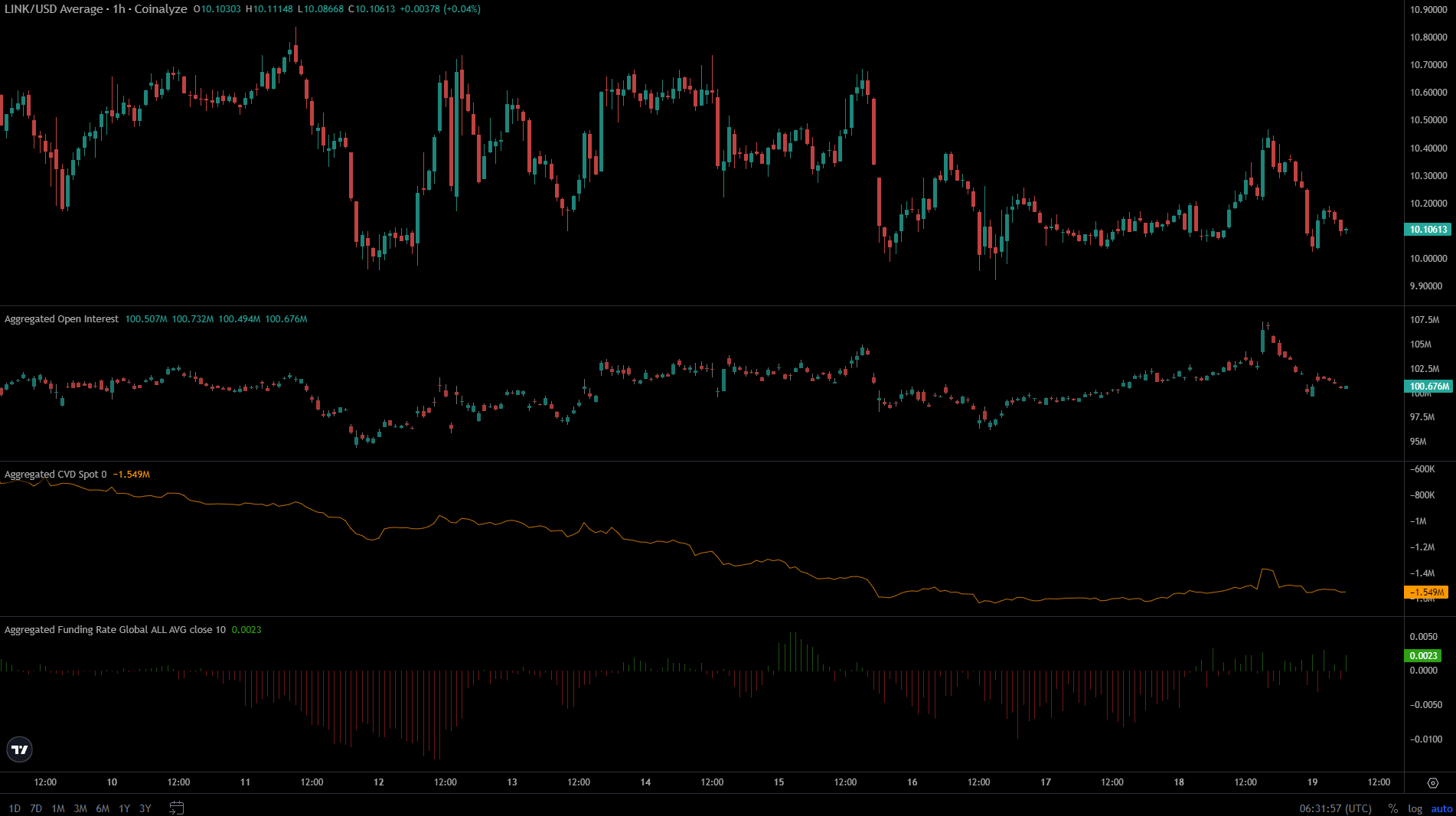

Over the past three days, the Open Interest behind LINK gradually increased as the price went from $10 to $10.4. This 4% move higher was accompanied by a slight uptick in the spot CVD as well.

Over the last 24 hours, the bulls’ modest advancements were significantly halted. Chainlink encountered resistance at $10.4 and saw a quick drop in Open Interest, suggesting a dominant bearish outlook.

1. Regarding the specific location (CVD), its status dipped slightly. The fluctuating funding rate indicated a market of speculators with a fluctuating outlook, leaning both towards optimism (bullish) and pessimism (bearish).

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-08-20 00:07