- LINK bulls must flip the $24 resistance into solid support to reinforce a breakout toward $30.

- Without this crucial move, FOMO may stay subdued.

As a seasoned researcher with years of experience tracking and analyzing the crypto market, I find myself intrigued by Chainlink’s [LINK] recent surge and its potential to breach the $30 mark. The impressive 30% daily gain and the close proximity to its 3-year high are certainly promising signs. However, as history has shown us, the crypto market can be unpredictable, and there are always hurdles to overcome.

In my analysis, I observed that Chainlink (LINK) commenced December on a robust note, experiencing an impressive 30% growth in a single day. This significant increase is evident from the extended ‘green’ candlestick that appears on its daily chart.

Instead of most other assets, LINK has taken advantage of Bitcoin‘s [BTC] persistent move towards the $100K mark. Entering the rally at a later stage seems to have been strategically beneficial for it, as several competing assets exhibit indications of overheating.

Currently, the value of LINK is only 10.8% from hitting its highest point over the last three years, which was $28.50 back in January 2022. As market fluctuations reach their peak, the strong foundations of this project will likely propel it beyond the $30 mark. This way, it can maintain a balance between market uncertainty and retail enthusiasm for fear of missing out (FOMO).

Buyers must plan their LINK strategy wisely

In contrast to its usual monthly trends, LINK trailed its peers. However, with a significant 40% increase over the last week, it has certainly outperformed and drawn attention as a leading contender.

As a researcher, I couldn’t fully leverage the subsequent rise, instead choosing to cash out with substantial profits. This decision resulted in a noticeable dip around the $24 mark.

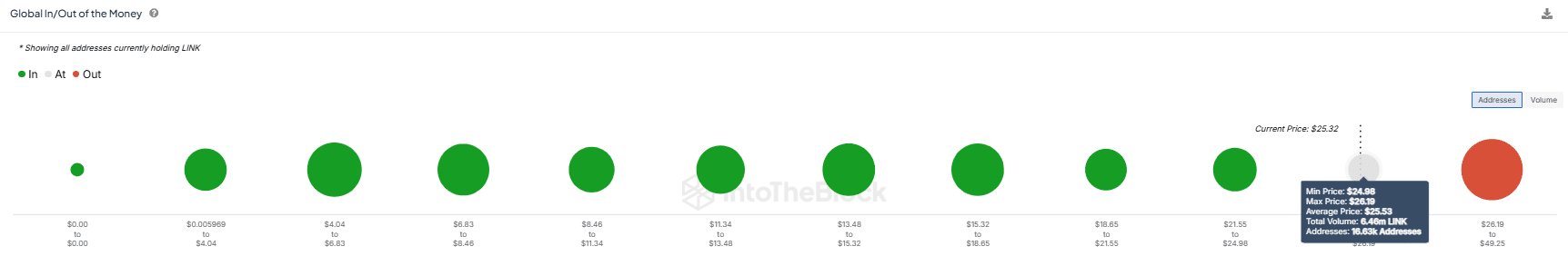

Even though progress has been made, there’s still quite a distance to cover. As it stands, roughly 17,000 addresses owning approximately 6.64 million LINK tokens, which were purchased at a minimum of $24.98 each, are currently in profit. This price level presents a substantial obstacle for further increases due to the number of holders who would likely sell if the price reaches this point.

Consequently, making this level firm and robust will be essential for achieving a breakthrough towards $30. If the price drops below this point, it might spark widespread selling.

Based on its meaning, ‘support’ indicates robust buying activity by institutional investors and optimistic market bulls. They perceive this price level as a potential floor, expecting substantial growth in the near future.

If this approach succeeds, LINK might regain a level not seen since the past three years. This situation could trigger significant Fear of Missing Out (FOMO).

What odds of this strategy playing out?

Considering a financial viewpoint, each sale signifies a buy from another party. While indicators suggesting a heated market might lead some investors to sell in expectation of a correction, robust demand has the potential to effortlessly counteract the selling force.

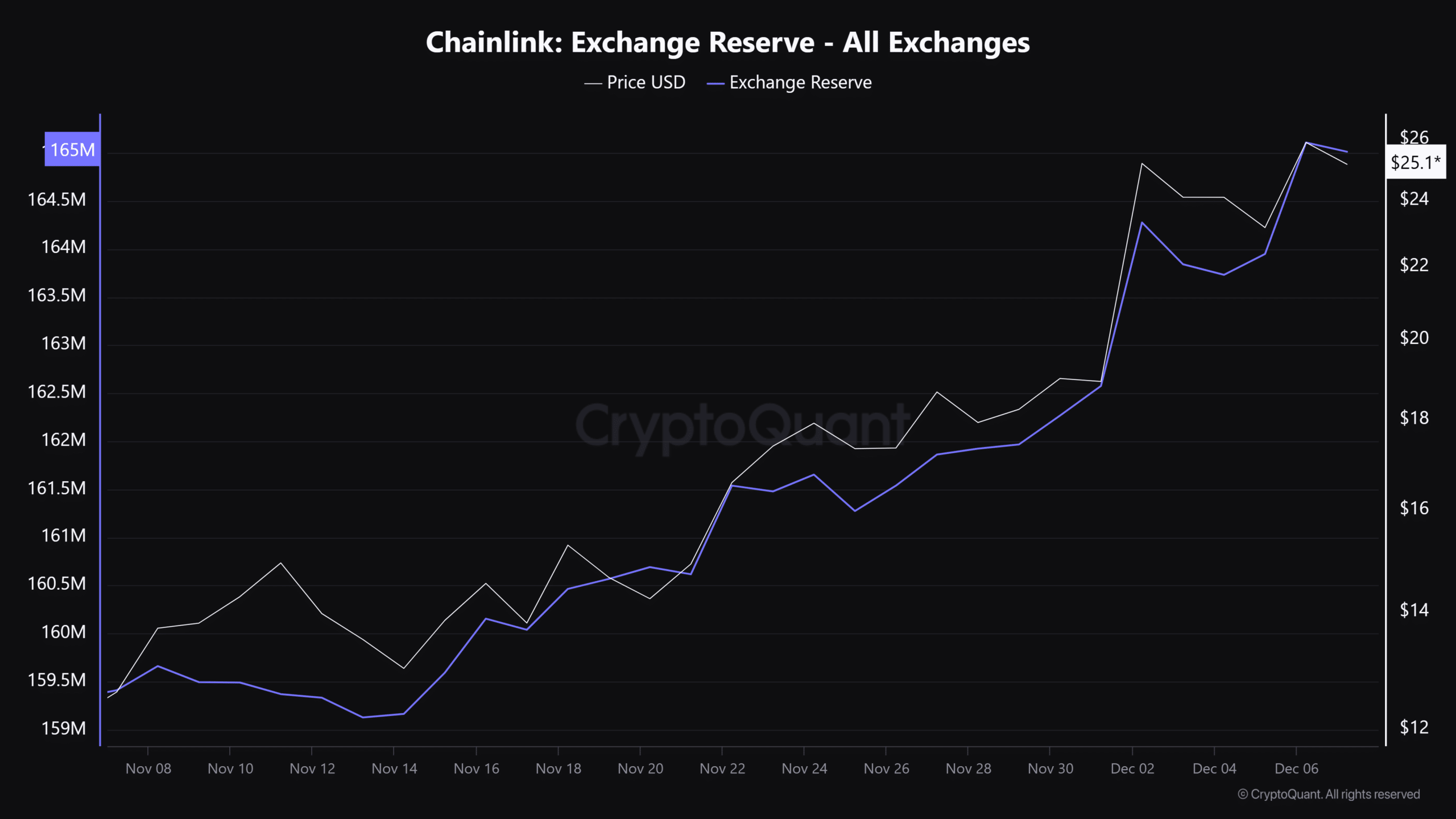

Although the volume indicators and a positive MACD crossing suggest this theory, it’s worth noting that the bulls haven’t completely validated it yet. Interestingly, more than 165 million LINK tokens have been put into exchanges, reaching a peak for the year so far.

Source : CryptoQuant

Reflecting on LINK’s progress a year past, the previous year witnessed a period of consolidation that was capped off by a robust bull run during the last quarter, pushing its value approximately to $16. At present, it appears that cashing in, or profit-taking, would be the astute move.

In simpler terms, the overall feeling among investors plays an important role. If Bitcoin doesn’t exceed $103K and set a new record, it’s expected that altcoins will see a significant influx of investment funds.

Investors are choosing to invest in high-value alternative cryptocurrencies because they’re unsure about Bitcoin’s next major price level. This move provides a safer buffer against market volatility and the high risks associated with investing in Bitcoin at its current high-risk entry points.

Read Chainlink’s [LINK] Price Prediction 2024–2025

To ensure LINK maintains its lead, investors should view the present cost as an excellent chance for acquisition, boosting their confidence and paving the way for a potentially explosive surge towards $30. This rise could trigger substantial fear of missing out (FOMO).

On the flip side, if the $24 support is broken, this could spark panic selling, causing investors to offload their positions at breakeven points. This situation could result in LINK pulling back, making it more susceptible as its competitors take advantage of the market’s momentum.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-12-07 20:08