- Chainlink plunged 38% this week, breaking past major support zones.

- Potential further declines could target the $5 support level, with a recovery possible if resisted.

As an analyst with over a decade of experience in the financial markets, I have witnessed numerous market cycles and observed how different assets react to them. The recent 38% plunge in Chainlink (LINK) is yet another reminder that even the most promising cryptocurrencies are not immune to market turbulence.

In the midst of a tough stretch for the cryptocurrency sector, I’ve noticed my Chainlink [LINK] investment taking a hit, mirroring the larger market’s downward trend.

Over the last seven days, the value of LINK has decreased by 38%. Remarkably, there was a significant drop of 25% within the past day alone.

Apart from the recent rise in Chainlink’s price that surpassed $21 in March, the subsequent drop can be attributed to technical trends noticed on its price graph.

Technical outlook on Chainlink

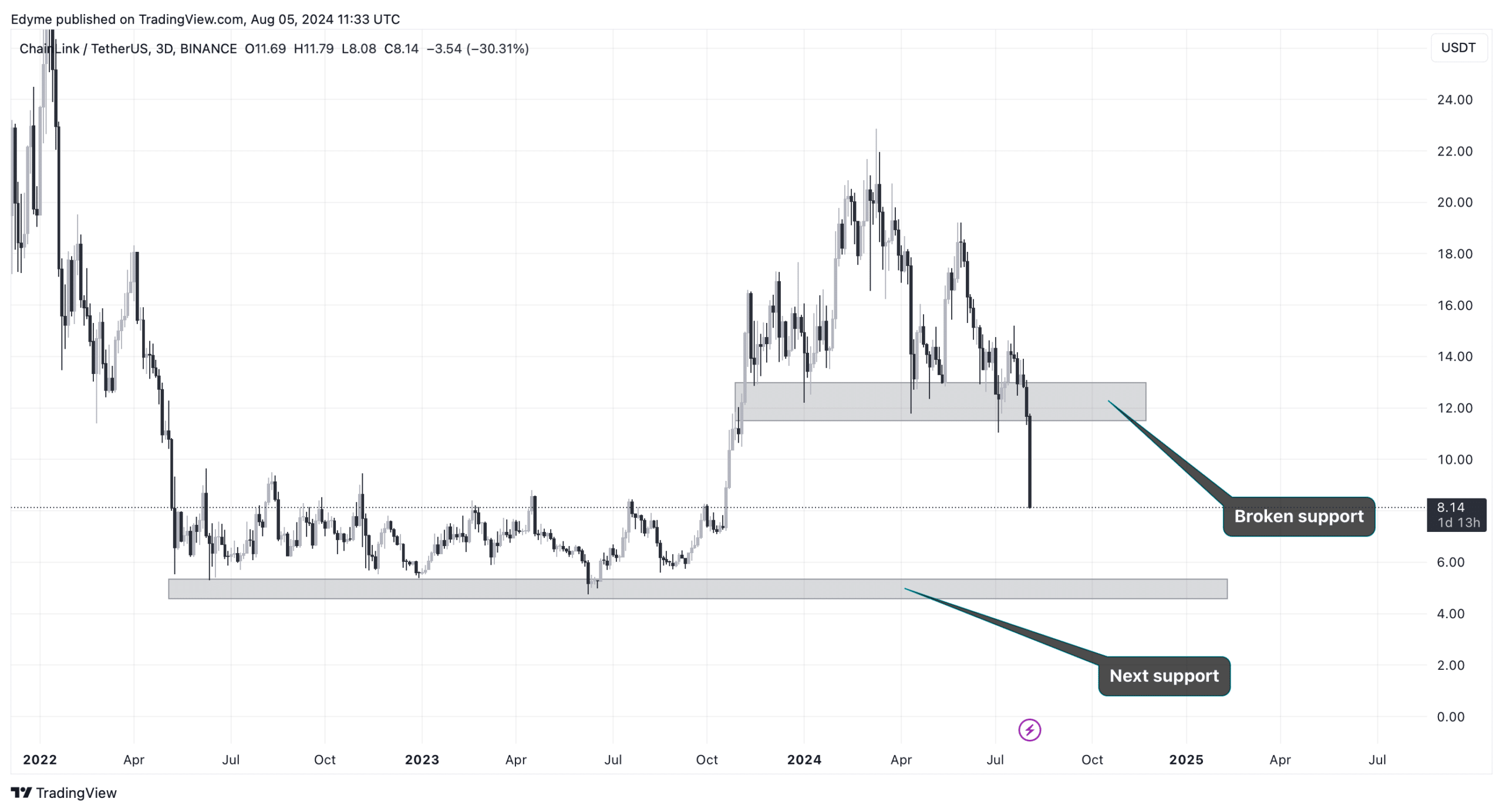

Examining the past three days’ data shows that LINK has breached a significant support line, suggesting it may continue to fall.

In the context of trading, a “support level” is a significant price where an asset usually doesn’t drop further because there’s sufficient demand from buyers to offset the supply pressure from sellers.

To date, once LINK dropped below the $13-$11.40 resistance level, its value has continued to decrease, indicating a diminishing interest among buyers and potentially signaling a bearish trend.

Examining the graph, it seems possible that the value of LINK could continue dropping until it encounters another significant level of resistance, which is presently located around the $5 mark.

If LINK manages to surpass its current support level once more, there might be increased selling activity, potentially leading to a decrease in value. On the flip side, if the price remains steady or rebounds at this point, it could signal a possible recovery and renewed trust among investors in LINK.

Who is seeing this as an opportunity?

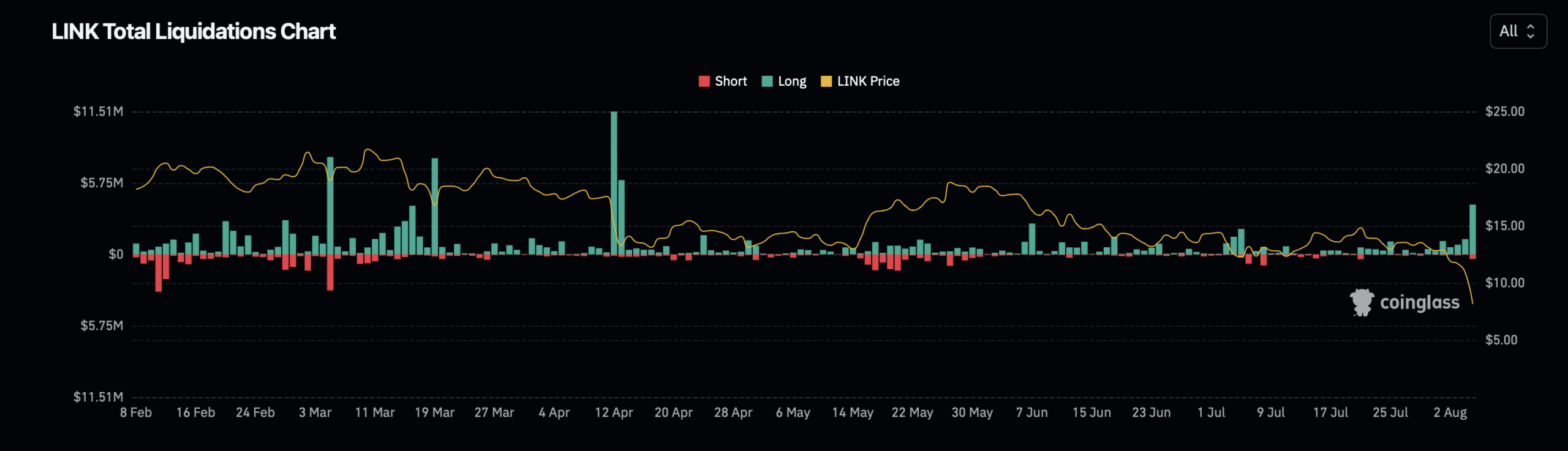

In response to recent fluctuations, the crypto market’s reactions have been varied. According to Coinglass, within the past day, approximately 290,799 traders have had their positions closed, resulting in a collective liquidation of around $1.11 billion.

Among the total amounts, liquidations related to LINK accounted for more than $6 million. The majority of this sum, approximately $5.11 million, came from the liquidation of long positions, while short positions contributed around $384,430.

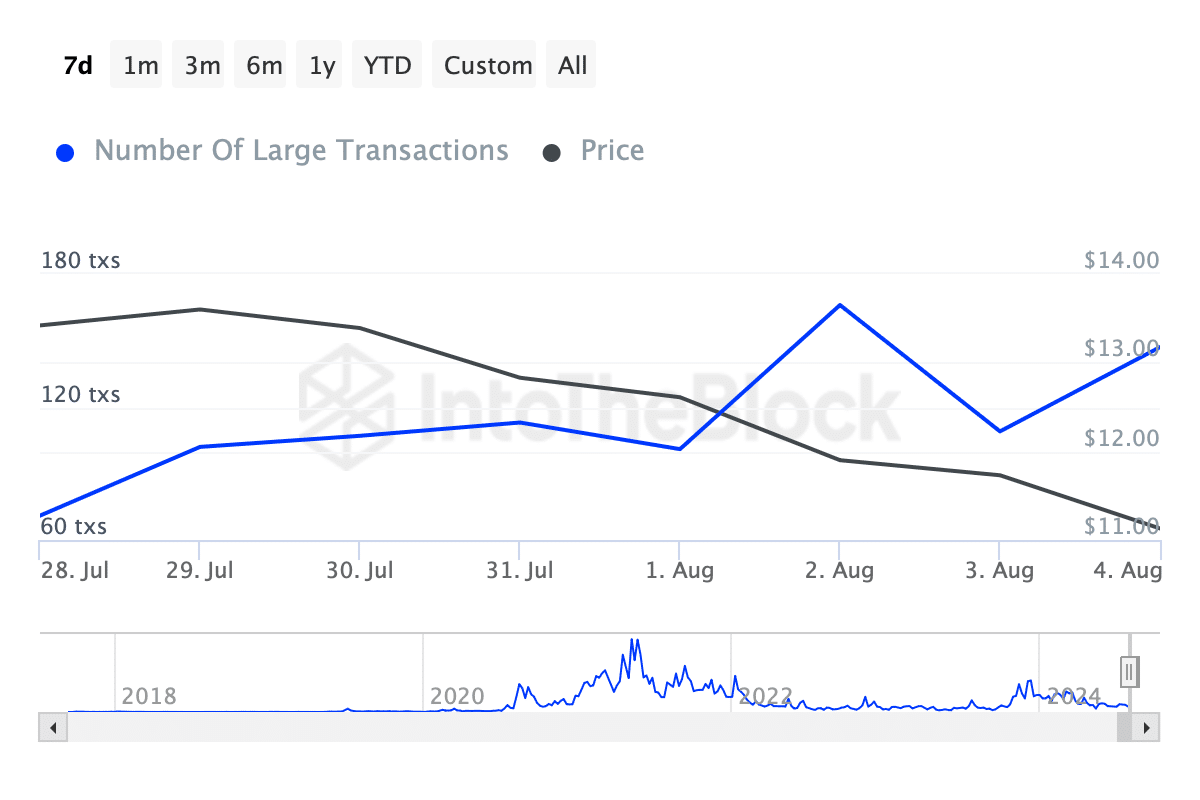

It’s intriguing to note that even during this economic dip, certain big-time investors, often referred to as ‘whales,’ seem to consider the reduced prices as chances for investment.

Read Chainlink’s [LINK] Price Prediction 2024-25

According to IntoTheBlock’s data, there has been a notable surge in large transactions exceeding $100,000. This number grew from 71 transactions last week to 147 transactions as of today.

As someone who has been following the market trends for a significant portion of my career, I have learned to read between the lines and interpret even subtle shifts in patterns. The recent uptick in the market might seem bearish at first glance, but it strikes me as more than just a short-term fluctuation. Based on my experience, I see certain investors positioning themselves for what they believe could be a favorable long-term trajectory. This is an approach that has often paid off in my own investment strategy, and I find myself drawn to follow their lead.

Read More

2024-08-06 05:11