-

LINK was down by more than 6% in the last seven days.

Buying pressure on LINK was high, but indicators suggested a price drop.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to read between the lines when it comes to market trends and price movements. LINK‘s recent dip by over 6% in just seven days was certainly concerning, but I wasn’t alarmed yet.

On July 7th, Chainlink (LINK) began an encouraging surge in price, indicating potential for recuperation following the previous week’s setbacks. Yet, this bullish trend did not last as LINK relinquished its upward trajectory shortly thereafter.

Let’s have a closer look at what’s going on and what can be expected from LINK in the coming days.

A sell signal on LINK’s chart

According to CoinMarketCap’s data, the price of LINK experienced a significant decrease of more than 6% over the past week. Yet, there was a glimmer of hope in the last day as the token reached a price point of $13.2. Unfortunately, this uptrend did not persist.

As a researcher studying the cryptocurrency market, I’ve observed that Chainlink’s price experienced a modest increase of approximately 2% within the last 24 hours. Currently, its value hovers around $12.81 in the market. Notably, this digital asset boasts an impressive market capitalization surpassing $7.79 billion.

Ali, a well-known cryptocurrency analyst, shared on Twitter his theory as to why the price drop occurred. According to his post, an indicator signaling a sell position appeared on the token’s 4-hour graph.

If that’s the case, we may observe a few additional red candlesticks on the token’s four-hour chart. However, the prolonged duration of this bearish trend depends on the indicators’ readings. Let’s examine the data for more information.

Buying pressure on LINK is high

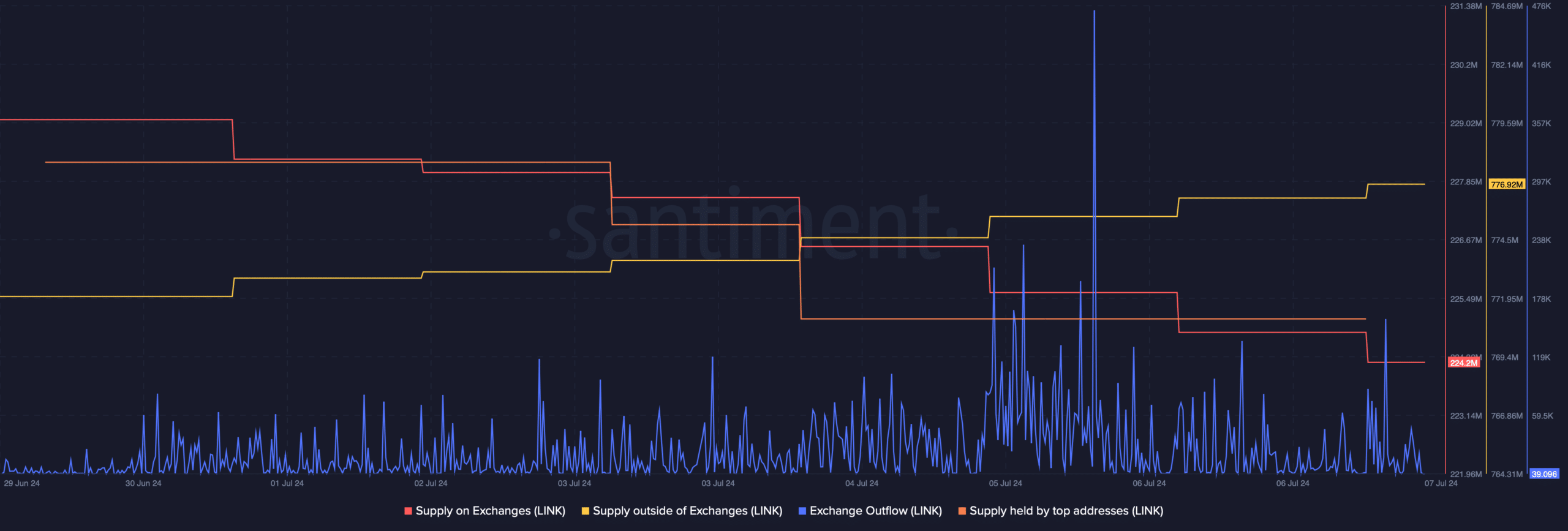

As an analyst, I’ve examined AMBCrypto’s interpretation of Santiment’s findings. It appears that investors continue to purchase Chainlink (LINK) based on the data, which is indicative of a bullish trend. Notably, there was a significant increase in LINK’s exchange outflows a few days prior.

Furthermore, there was a decrease in its availability on cryptocurrency exchanges, whereas its circulation off the exchanges grew. This implies a strong demand for purchasing the asset.

Despite their lack of faith in LINK, the whales disposed of their tokens as the token’s supply held by large holders decreased noticeably last week.

Additionally, Chainlink’s fear and greed index was another favorable indicator. With a reading of 23% at current market conditions, this signified a “fear” stage in the market.

When such an occurrence takes place, I would examine the token’s daily chart to assess the potential for a price rise.

Despite the ominous signals from the market indicators, the MACD showed a bearish crossover while the Chaikin Money Flow (CMF) headed in a downward direction.

Additionally, the RSI mirrorred the same pattern, implying an impending price decrease.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Based on our examination of Hyblock Capital’s findings, if bears gain control and cause a downturn in LINK‘s price chart, it wouldn’t be unexpected for LINK’s value to fall to the $11 mark.

To the contrary, if the bulls start to dominate, then investors might witness LINK touch $15 soon.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-08 01:12