- LINK spiked by over 30% in the last 24 hours.

- It remained undervalued overall despite this spike in price.

As a seasoned analyst with over two decades of experience in both traditional and digital markets, I’ve seen my fair share of market movements that would make even the most experienced traders blush. The recent spike in LINK by over 30% is indeed an intriguing development, but it’s crucial to delve deeper into the fundamentals to truly understand its potential.

With Chainlink [LINK] reaching notable achievements such as a market capitalization of $15.87 billion and a price surge to $25.08, one can’t help but ponder if LINK continues to be underestimated in value.

Through its significant contribution to the world of Decentralized Finance (DeFi) by providing Oracle services, Chainlink’s core aspects and on-chain statistics seem to tell a tale of increasing functionality and desire.

Examining AMBcrypto’s breakdown of Total Value Secured (TVS), regular user activity, MVRV ratio, and market trends helped determine if Chainlink’s current worth corresponded with its predicted value.

Rising demand for Chainlink oracles

According to data from DeFiLlama’s TVS chart, it was evident that Chainlink was asserting more control within the Decentralized Finance (DeFi) landscape in 2024. By the end of this year, the Total Value Locked (TVS) had soared past $60 billion.

The rise in usage indicates a higher number of decentralized apps adopting Chainlink’s data feed services.

As decentralized finance (DeFi) activities surge, so does the growth of TVS (Total Value Staked), and this trend coincides with Chainlink seeing an advantage due to more projects adopting its Oracle services.

As an analyst, I find that the market capitalization-to-TVS (Total Value Secured) ratio of LINK seems relatively low when considering its significant role in safeguarding decentralized ecosystems. This suggests to me that LINK could potentially be undervalued in the current market.

Uptick in network participation

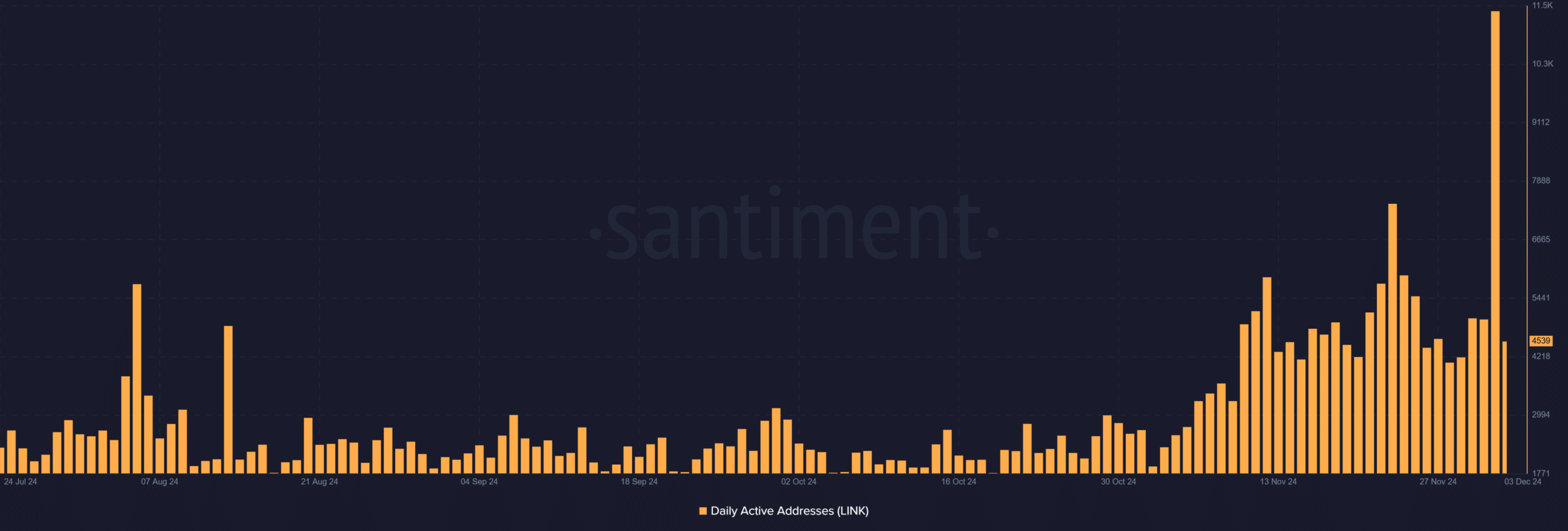

On the 2nd of December, there was a significant increase in the number of active addresses on the network, reaching approximately 11,455, indicating a rise in user participation and interaction.

It’s worth noting that the spike occurred around the same time as LINK’s price surge, suggesting that new investors might be joining the system as the market is experiencing a bullish trend.

An increase in active addresses often indicates greater on-chain usage, which can boost the usefulness of Chainlink. Continued expansion in this area may also strengthen the potential for Chainlink’s price increase.

Evaluating LINK’s valuation

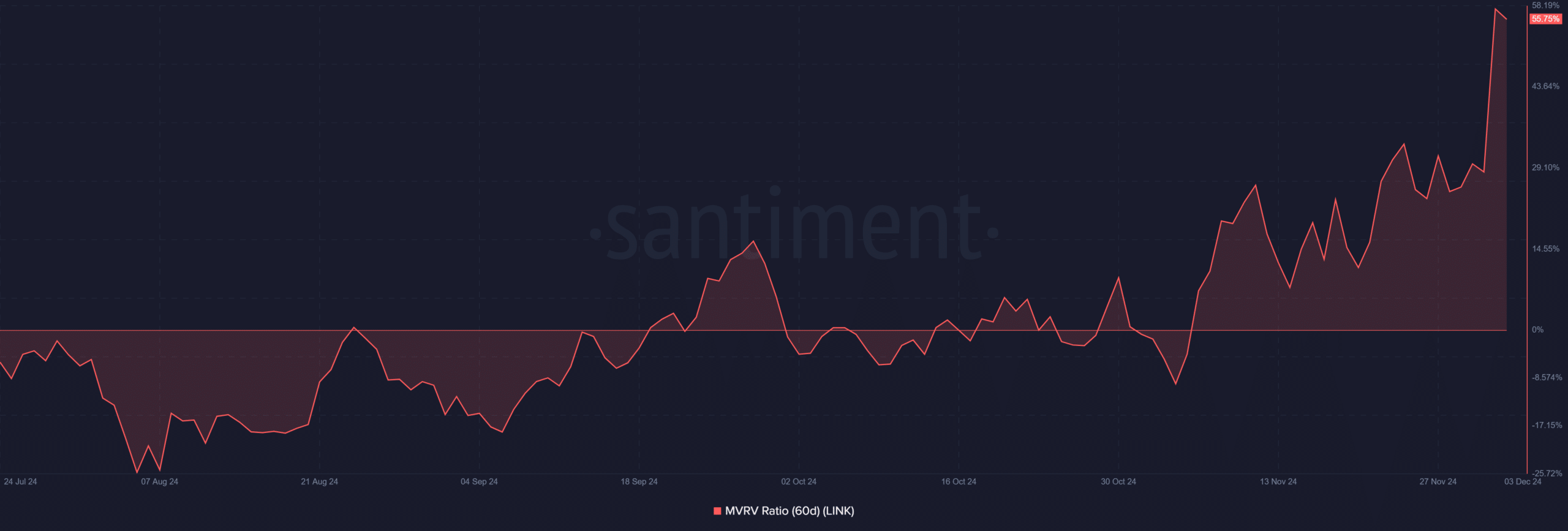

The 60-day MVRM (Market Value Realized to Market Value Ratio) for Chainlink has climbed over 55%, suggesting that most Chainlink holders are currently enjoying substantial, unreaped profits.

Previously, high MVRV (Maker’s Value Realized to Maker’s Value Ratio) levels have often indicated a greater chance of investors realizing their profits and a possible brief market correction. Nevertheless, the rising trend of LINK during such periods demonstrates robust investor faith in the market.

As I delve into the analysis of LINK’s market trends, it seems that, based on the MVRM ratio, there might be a potential for short-term overselling. However, I find myself encouraged by its robust long-term trajectory, which appears to be bolstered by the consistent growth in its Total Value Staked (TVS).

Technicals back a bullish narrative

As a crypto investor, I’ve been closely following the Chainlink chart, and the recent breakout above significant resistance levels has caught my attention. The robust trading volumes backing this move instills confidence in its sustainability.

The digital asset has been consistently rising, with its value exceeding both its 50-day and 200-day price trends. Nevertheless, the Relative Strength Index (RSI) reads 81.97, which hints at potential temporary price reductions in the near future due to overbought conditions.

The Fibonacci retracement levels have pinpointed $23.78 and $20.43 as possible areas of support should the price of LINK pull back from its recent peak.

Looking on the positive side, potential resistance points may lie at $28 and $30. If bullish trends continue, these levels could offer chances for additional growth.

Realistic or not, here’s LINK’s market cap in BTC’s terms

In simpler terms, based on current indicators like a high MVRV ratio and an overbought RSI, there might be temporary price decreases ahead (short-term corrections). However, looking at the bigger picture, the overall direction seems to indicate continued long-term expansion.

Given Chainlink’s increasing usefulness, rising popularity, and comparatively smaller market capitalization compared to its Total Value Locked (TVL), it seems that LINK is currently underpriced within the cryptocurrency landscape due to these factors.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-03 23:04