-

LINK has moved closer to breaking its short-term resistance.

More discussions have been seen around LINK in the last 48 hours.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I have witnessed countless trends and fluctuations. Based on my observations, the recent developments surrounding Chainlink (LINK) seem to be quite intriguing.

Following around two weeks of downward trends, Chainlink’s [LINK] price action hints at a possible turnaround, demonstrating a promising upward trend. This recent change in direction coincides with an impressive surge in social influence, reaching an all-time peak.

Increased social buzz surrounding Chainlink implies a rising interest and positivity among its community members, possibly foreshadowing an upcoming bull market.

Chainlink sees a rise in dominance

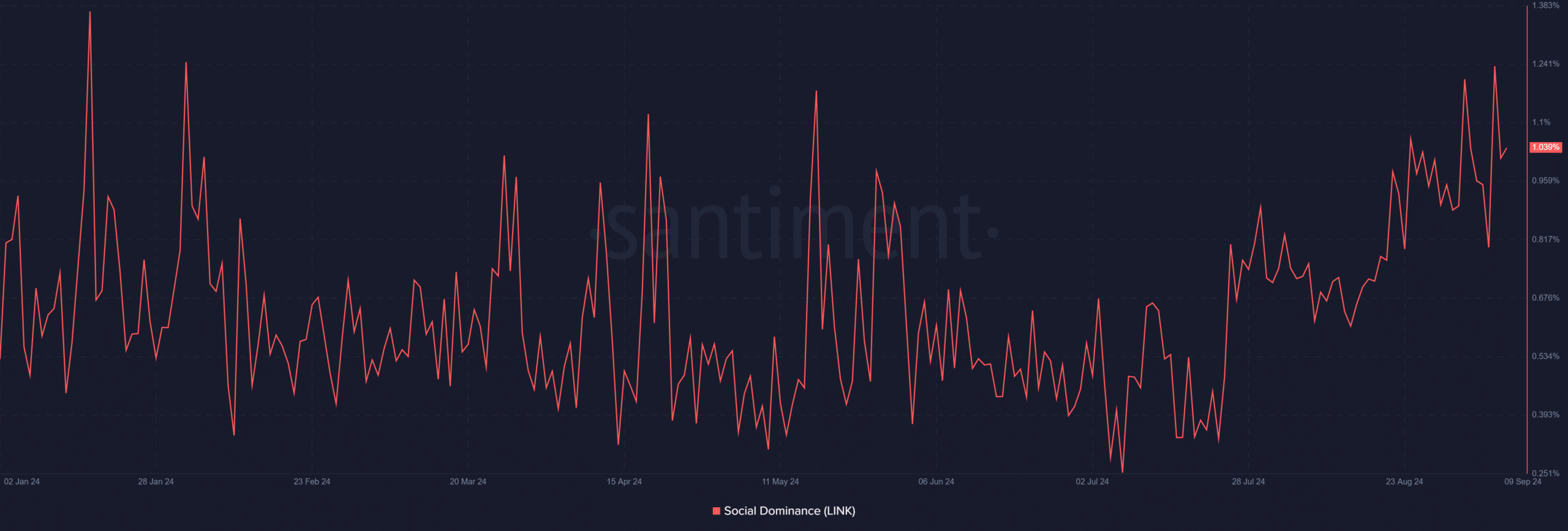

As per information from Santiment, the social influence of Chainlink (LINK) has significantly increased, reaching around 1.24%.

This stands out as notable since LINK hasn’t been this influential since January, marking the second strongest social influence it has held this year.

As a crypto investor, I’ve noticed an uptick in discussions about Chainlink, which accounts for over 1% of the overall crypto conversation. This heightened attention and interest within the community could be a positive sign, as it often indicates increased visibility and engagement. More investors and traders might be drawn in by this surge in social dominance, potentially leading to more price increases.

The increasing popularity of LINK on social media platforms might indicate the emergence of a positive trend, potentially leading to price increases for the asset.

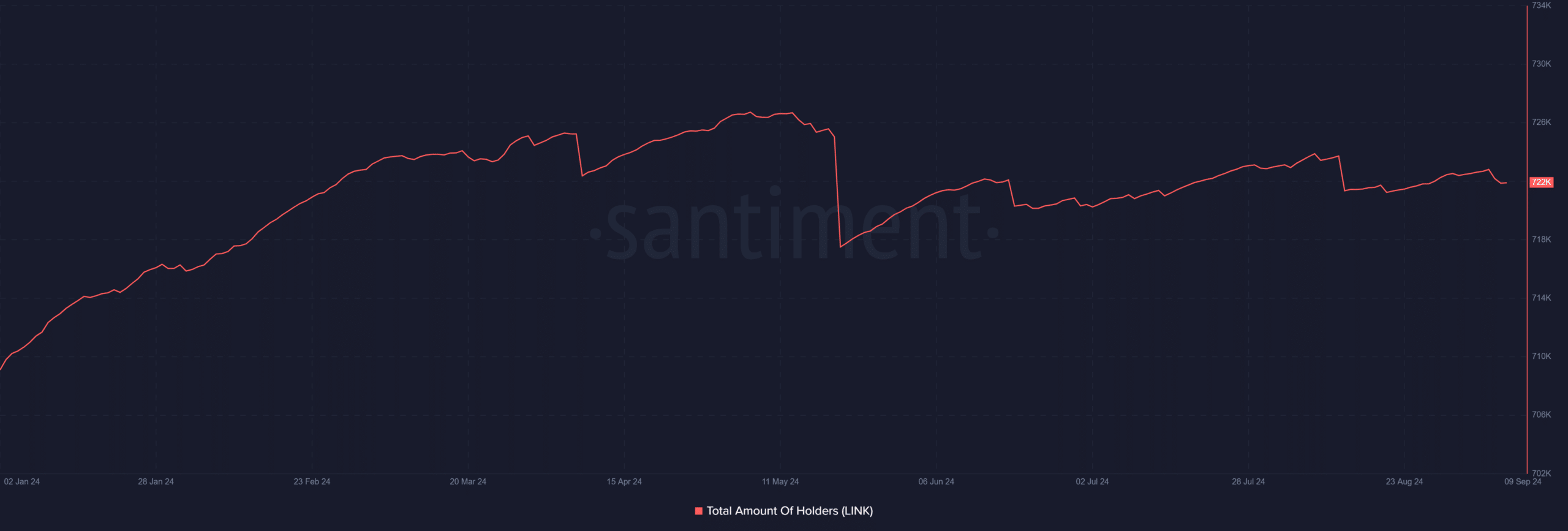

Total LINK holders see a slight decline

Over the last few days, a slight drop in the count of Chainlink holders has been observed according to an analysis by Santiment. As of September 6th, there were roughly 723,000 holders, but that number has since dropped to around 722,000 at this current moment.

The decrease in active LINK account numbers implies that some owners may have recently disposed of their LINK tokens over the past few days.

At first glance, a drop in the number of holders could appear as a pessimistic sign. However, when coupled with an increase in social influence and a favorable price response, this situation points towards a bullish trend.

The market’s ability to withstand the selling pressure without experiencing a major downturn indicates that LINK‘s market has hidden vitality and robustness.

An increase in social conversations and continuous upward price trend even during sell-offs might indicate that Chainlink is set to experience additional growth, suggesting increasing faith in the asset’s future possibilities.

Chainlink sees a positive setup

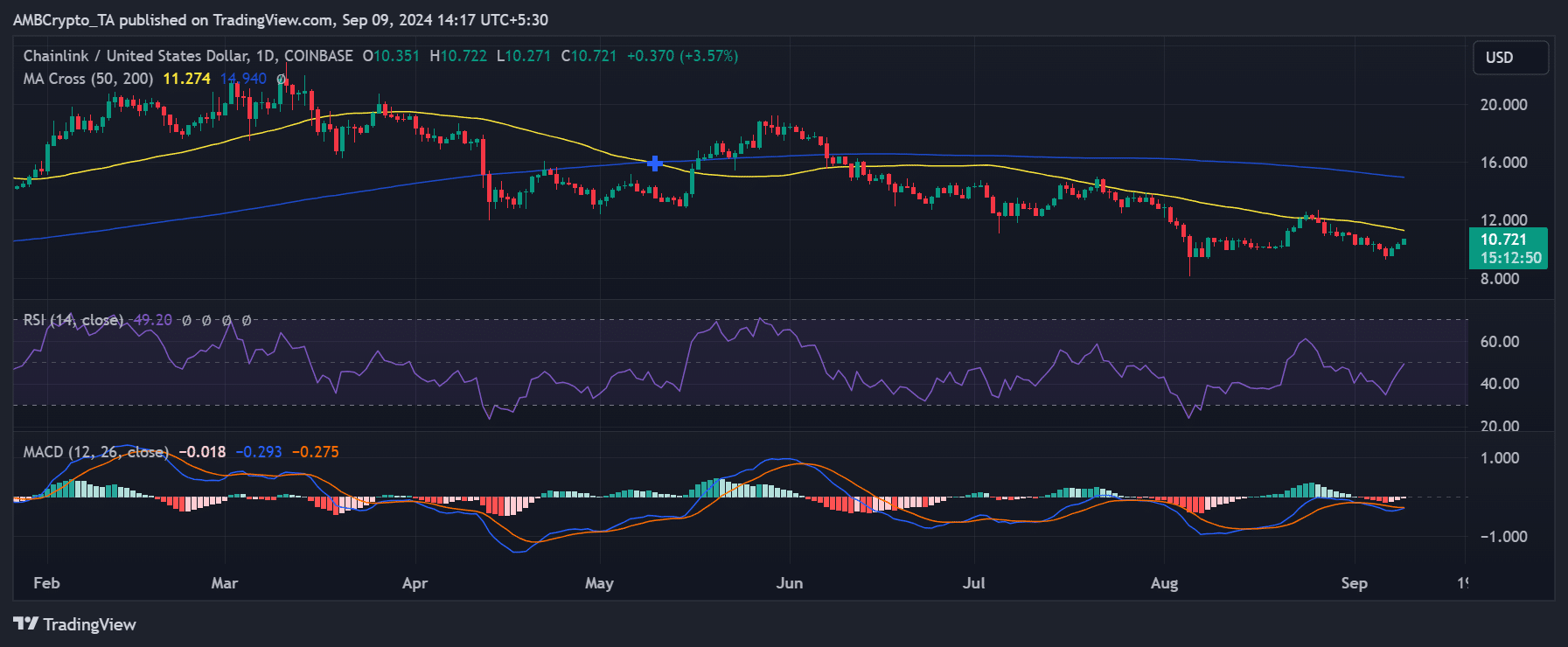

Examining Chainlink’s (LINK) day-by-day graph reveals that the short-term moving average (represented by the yellow line) has been acting as a barrier near the $11 level. For the last three days, however, LINK has shown an upward price trajectory.

From my analysis, at present, LINK is roughly trading around $10.7. However, it hasn’t managed to breach the existing resistance level as yet. Nevertheless, considering the current trend, there’s a potential for a stronger upward momentum if LINK successfully surpasses this barrier.

Furthermore, the analysis using the Relative Strength Index (RSI) suggests that it’s getting close to the neutral zone. If the RSI surpasses this point, it may indicate a more robust upward trend.

If Chainlink’s price surges past the $11 barrier and its Relative Strength Index (RSI) shifts towards bullish indicators, it might trigger additional bullish movements for Chainlink.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-09-09 22:15