-

Chainlink was down by 0.49% in the last 24 hours, as the outlook is bearish.

Majority of LINK active holders are in the red.

As a seasoned analyst with a decade of experience in the crypto market under my belt, I must say that Chainlink (LINK) is currently painting a rather bearish picture. The 0.49% drop in the last 24 hours, coupled with the fact that the majority of active holders are in the red, suggests that LINK’s struggle in the broader downtrend is far from over.

At the moment of reporting by CoinMarketCap, Chainlink (LINK) has experienced a slight increase in its value, with a growth of 1.35% over the past month and an increment of 0.69% for the week.

Nevertheless, even with these advancements, LINK‘s present value of $10.64 showed a minor decrease of 0.49%, indicating its challenges during the ongoing downward trend initiated post the conclusion of the previous bull market.

As a researcher, I’ve observed that this slump persists, albeit with occasional spikes of growth, yet the overall trajectory aligns with the broader trends within the cryptocurrency market, pointing towards a predominantly descending trend.

The behavior of the LINK/USDT pair suggests a pessimistic outlook, with the price moving inside a symmetrical triangle pattern and breaking below the support line.

If LINK experiences a break and remains under its current trendline, that could be a strong indication of a possible downward continuation. A potential new price point to watch for LINK is around the $8 mark, which may offer some support and possible chances for a rebound.

The MACD (Moving Average Convergence Divergence) signal indicated a buildup of selling power, since the momentum lines grew increasingly dark, signaling an increase in downward pressure or bearish sentiment.

Furthermore, the Stochastic Relative Strength Index suggested that LINK was overbought, implying that buyers had been predominantly in control of the market.

Although over-selling situations don’t guarantee a rebound, they make it more probable that the price will continue falling towards $8, contradicting optimistic expectations of a strong fourth quarter in the cryptocurrency market.

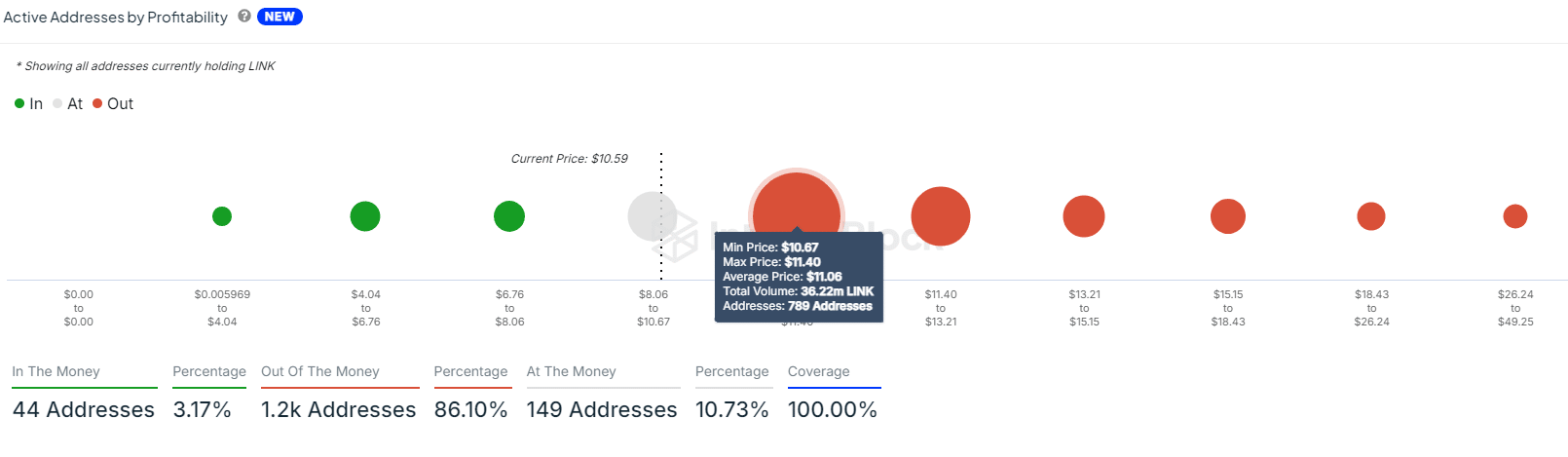

LINK’s In/Out of the Money

Looking at the on-chain data for Chainlink, there are some points that raise suspicion. At the moment, about 86% of the active wallets are in a negative position, implying that most owners are currently experiencing losses.

Approximately 97% of active cryptocurrency addresses are experiencing losses, while a smaller group of 10% are barely breaking even. This unfavorable situation has led to increased selling activity among traders, who might choose to sell their tokens in an attempt to minimize further financial setbacks.

Given that so many addresses are showing a significant increase, it seems that Chainlink’s immediate future may lean towards more decreases, making a fall to around $8 appear increasingly probable.

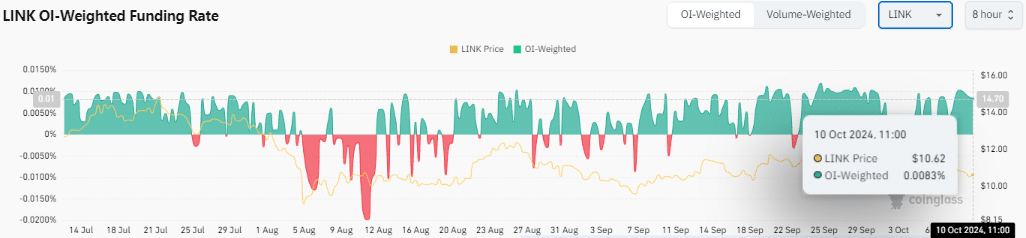

LINK OI-Weighted Funding Rate

As a crypto investor, I’ve been keeping an eye on the Open Interest-Weighted Funding Rates, and there seems to be a faint spark of hope. These rates have shown positivity recently, standing at 0.0083%.

Read Chainlink’s [LINK] Price Prediction 2024–2025

This situation suggests that longer-term traders are compensating shorter-term traders, potentially hinting at the possibility of a turnaround. However, it’s important to note that this single factor might not be strong enough to overcome the prevailing pessimistic trend in the market.

In the near future, it seems that a jump towards $8 could be on the cards for Chainlink. However, a brief period of growth might be needed first, after which Link could regain its upward momentum and continue rising.

Read More

2024-10-11 07:03