- Chainlink shows potential for a 40% rally, but breaking $13 resistance is crucial for the move.

- Large transactions spike while on-chain metrics reveal sustained accumulation of LINK over the past month.

As a seasoned crypto investor with over half a decade of experience navigating the cryptosphere, I find myself intrigued by the potential breakout that Chainlink (LINK) seems to be teetering on the edge of. The sustained accumulation over the past month coupled with the recent surge in large transactions is reminiscent of a tiger poised to pounce on its prey.

At the moment of reporting, Chainlink’s [LINK] price stood at $11.09, marking a 6.16% decrease in value over the last 24 hours. Currently in circulation are around 630 million LINK tokens, which equates to an estimated market capitalization of about $6.95 billion.

In the past 24 hours, the trading volume amounted to approximately $594.2 million, suggesting that there’s been a lot of activity even with the recent decrease in price.

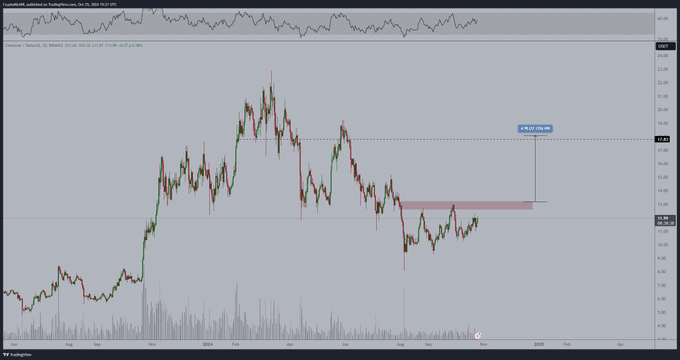

Recently, the price action follows a phase where it stayed between $11 and $12 after a descending trend. The experts are keeping an eye on the $13 mark, which historically has acted as a significant hurdle. If we observe a leap above this level, it might indicate a transition towards a bullish trend.

Potential breakout and key resistance

Michael van de Poppe, a cryptocurrency analyst, remains optimistic about Chainlink (LINK). He anticipates a potential surge in its price within the next fortnight if LINK manages to surpass the current resistance at around $13. He terms this barrier as a significant level that could potentially impact its upward momentum.

“the key to trigger further upward movement.”

Should LINK surpass the $13 mark, it might propel further towards approximately $18, which would signify a 40% increase from the breakout price. At present, the Relative Strength Index (RSI) indicates a balanced state, implying there’s scope for price growth.

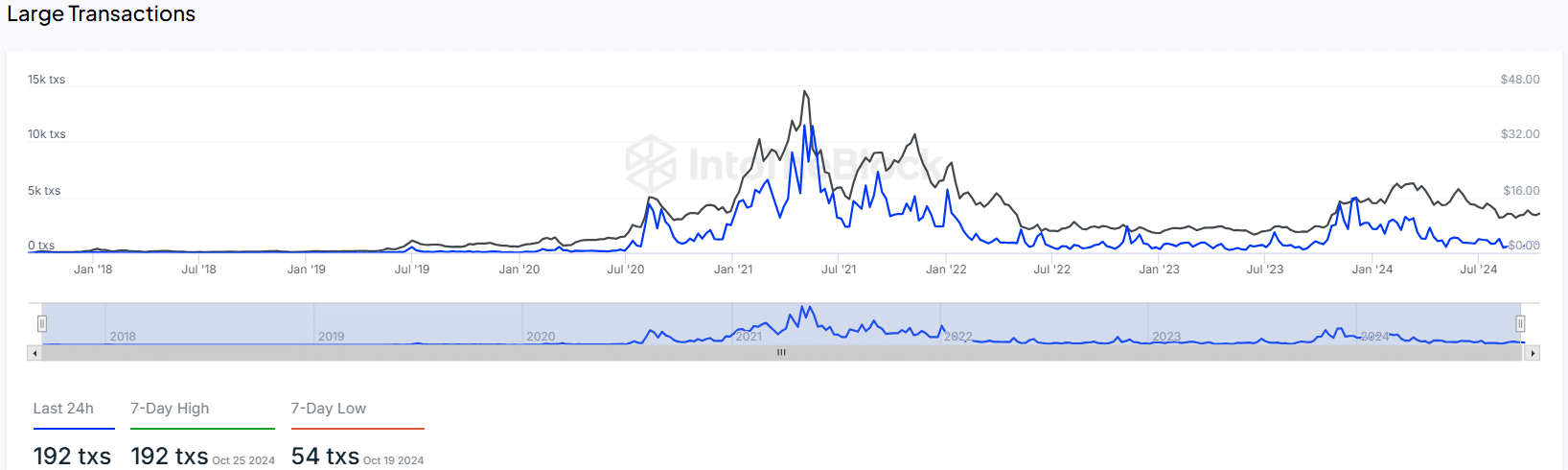

On-chain metrics: Large transactions surge

Over the last day, there were 192 major transactions processed on the Chainlink network, which equals the highest activity level seen on October 25th over the past week. This surge in activity surpasses the lowest point of 54 transactions recorded on October 19th, marking a significant improvement.

A rise in large transactions implies increased attention or substantial transfer of funds by prominent investors.

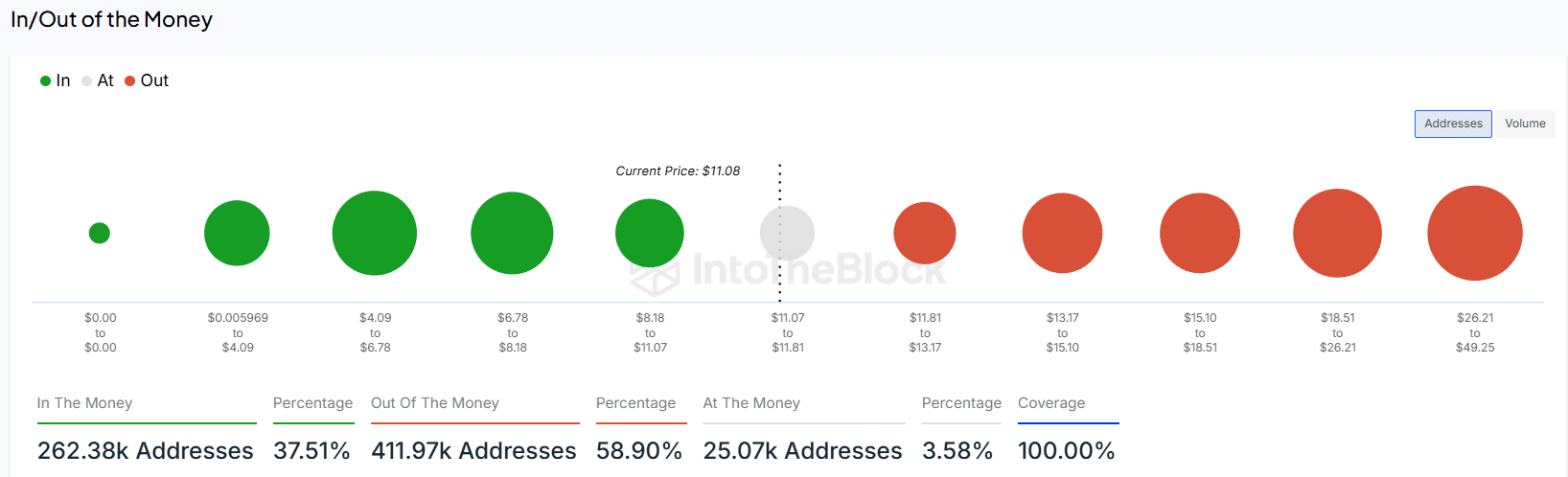

As a researcher examining Chainlink’s transaction data, I’ve found that approximately 37.51% of the addresses (262,380 to be exact) represent individuals who purchased LINK at prices lower than $11.08, which means they are currently “in the money.” Conversely, a substantial majority of 58.90% of the addresses (411,970 to be precise) indicate that those investors acquired their LINK tokens at higher prices, positioning them as “out of the money” for now.

This could create stronger resistance if prices approach the $11.81-$13.17 range.

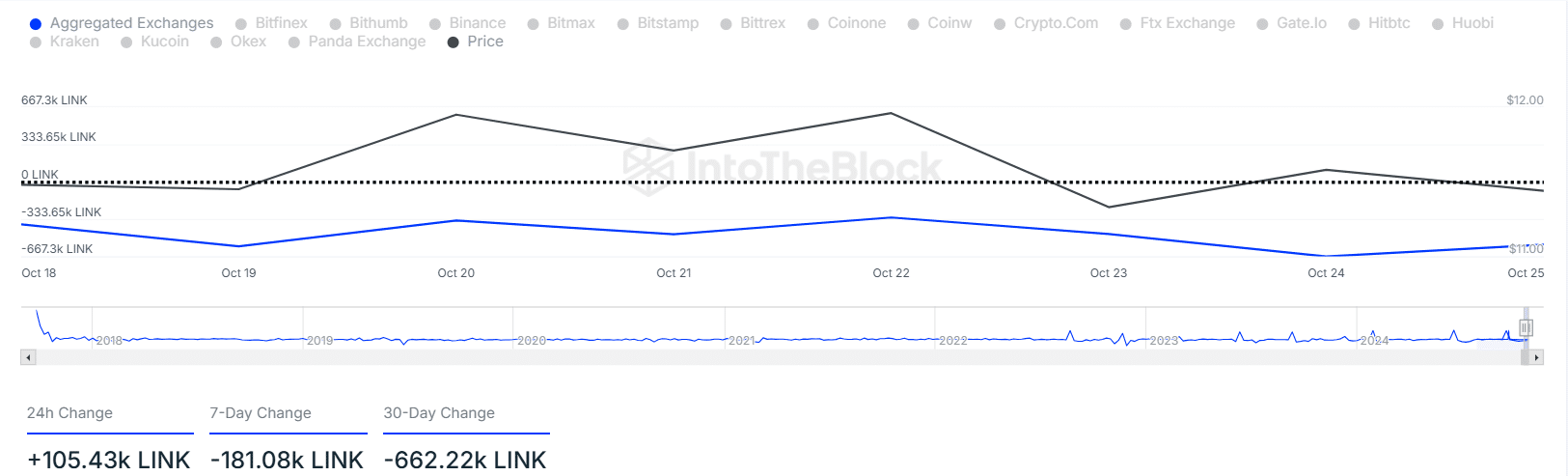

Exchange inflows and outflows

24-hour data from IntoTheBlock indicates a transfer of approximately 105,430 LINK to exchanges, which might hint at short-term selling pressure. On the other hand, over the last week, there has been a withdrawal of about 181,080 LINK from exchanges, suggesting that holders are accumulating LINK on a larger scale.

Over the past 30 days, there’s been a total withdrawal of approximately 662,220 LINK, indicating continued long-term buying patterns.

The fluctuation between incoming and outgoing trends suggests there might be temporary sell-offs, occurring amidst an overall picture of long-term buying or stockpiling.

The recent increase in exchange inflows could be a temporary reaction, while the larger outflows over the past month reflect confidence in LINK’s longer-term prospects.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 10:16