-

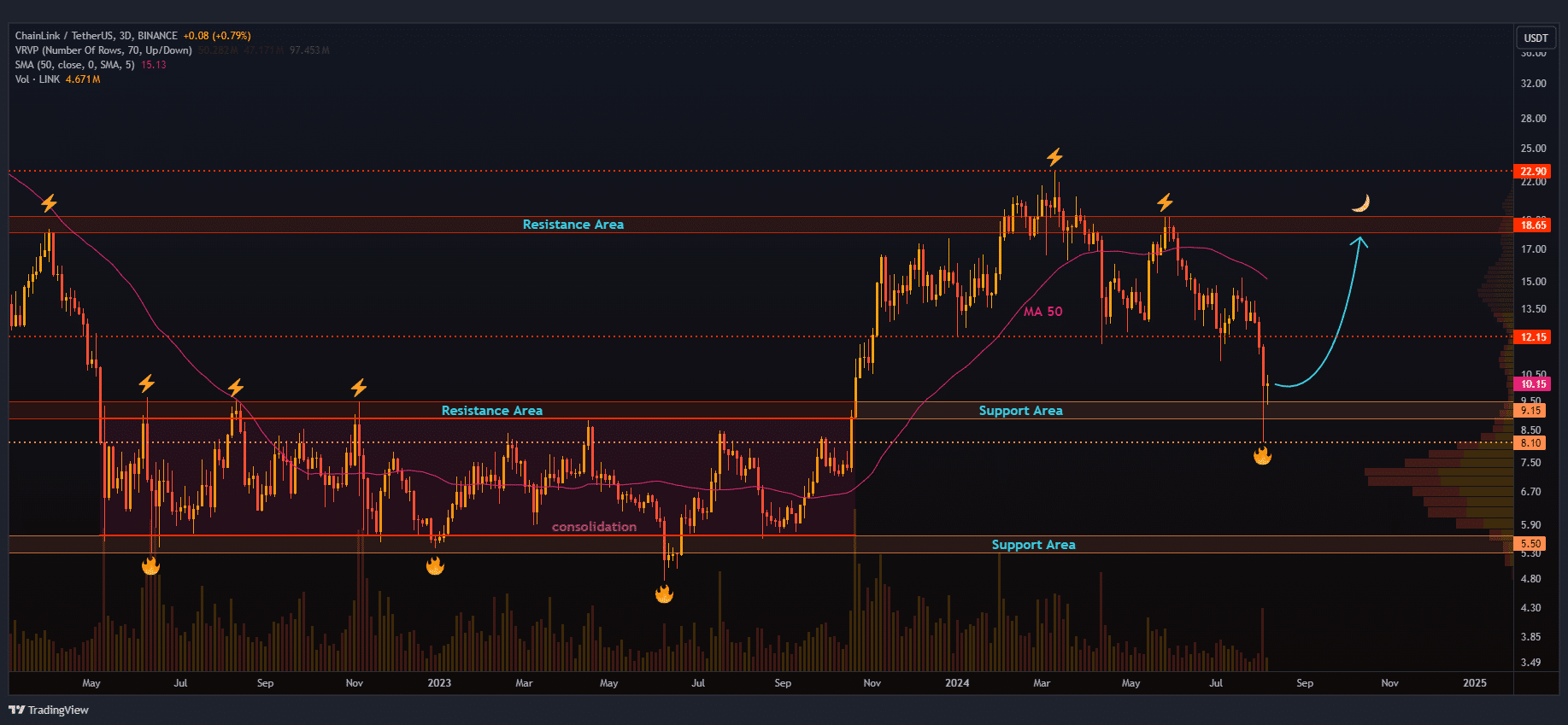

LINK bounced off a critical support level after holding for years

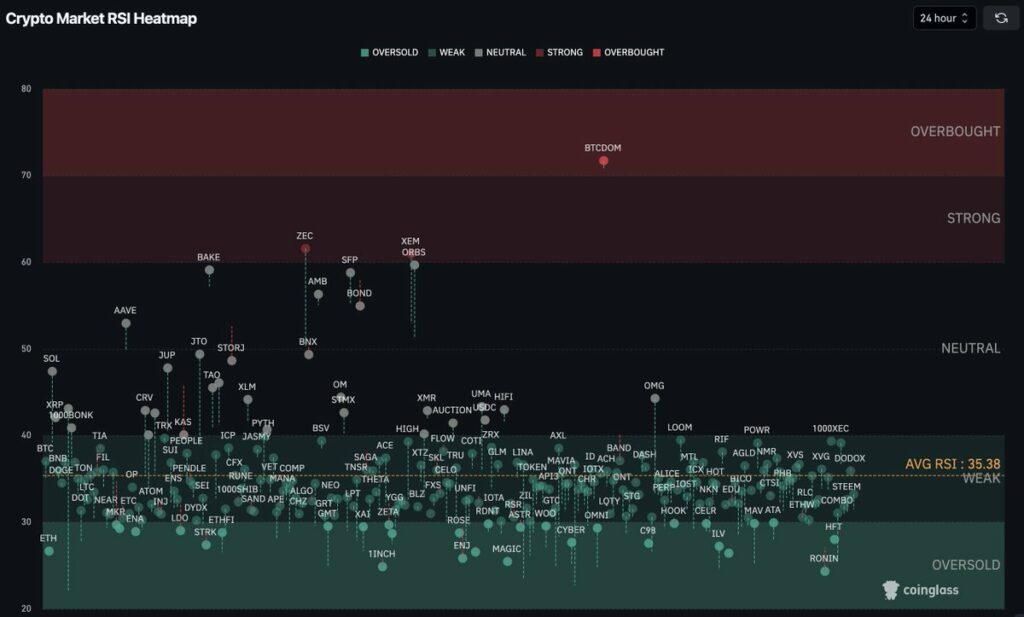

RSI heatmap revealed lowest average as sector performance underlined bullish sentiment

As a seasoned analyst with over two decades of experience navigating the volatile crypto markets, I find myself intrigued by the current positioning of Chainlink (LINK). Having weathered several bull and bear cycles, I can confidently say that the recent bounce off a critical support level, one that LINK has held for years, is indeed noteworthy.

At the present moment, Chainlink (LINK) appears to be bouncing back from a significant support and resistance level on its charts – A level it has maintained for a considerable amount of time in the past.

A well-executed repeat test on this area might open up possibilities for LINK to reach unprecedented peaks within the upcoming months.

Purchasing when the price was near $12.71 seemed promising because of a significant support level at that point. Interestingly, the price has just dropped to a crucial area around $9.8. This might indicate a potential bullish trend if the $12.71 level is re-established as a support in the future.

In other words, there’s a potential for a continued drop to finish off a bearish trend. If $9.39 is broken this week, it might lead to another test of the significant support level.

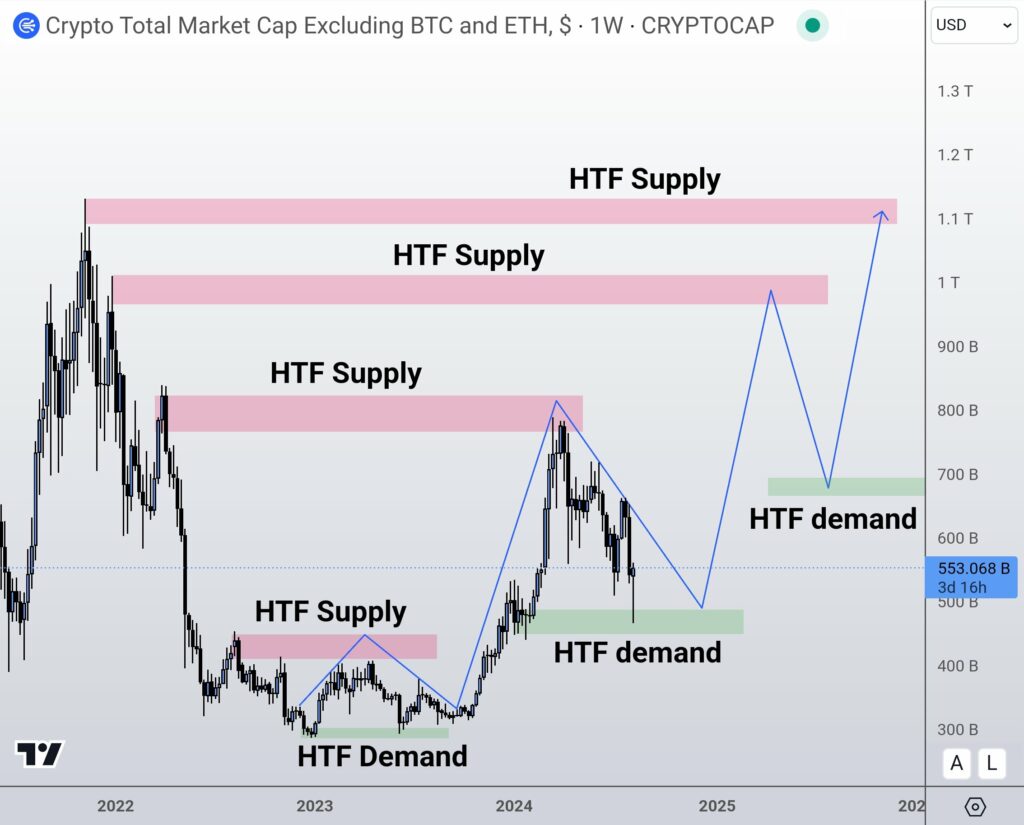

HTF demand zone for altcoins

Recently, various altcoins have experienced significant rebounds. Some have even seen substantial weekly increases. With Bitcoin surpassing $60K and Ethereum maintaining its position, this surge might be an early indicator of a bull market’s commencement.

After initially being turned away from a crucial support area on their graphs, altcoins appear to have rebounded, hinting that they could potentially continue to increase in value as well.

Monitoring the progress of LINK closely is essential, given its potential for outstanding performance in the forthcoming months, owing to its significant function in managing data decentralization.

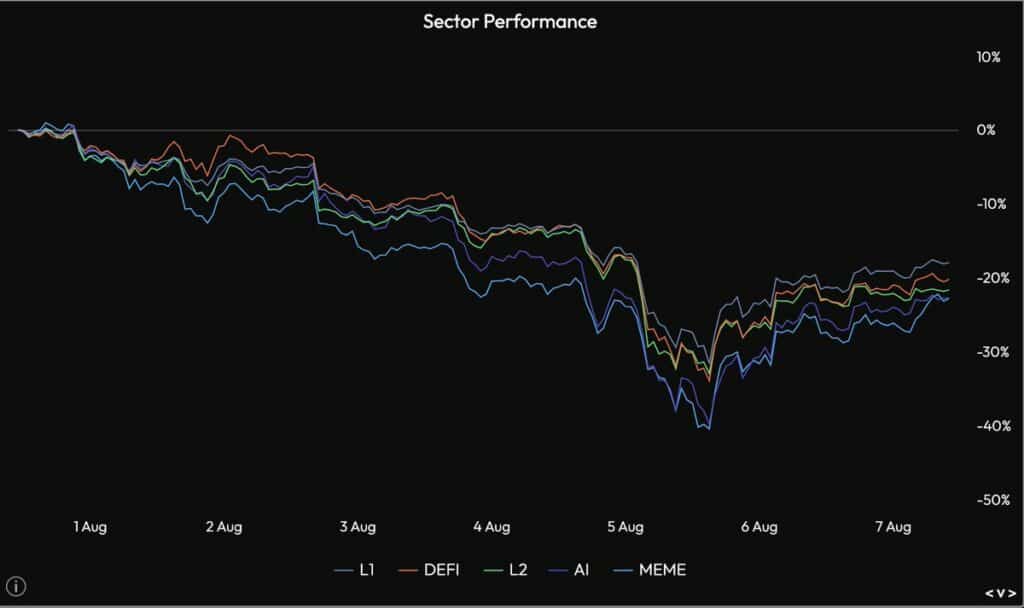

Sector performance in crypto

Over the last seven days, altcoins faced some tough times as a significant portion (around 40%) of their worth dropped compared to the preceding week.

However, roughly half of those losses have since been recovered. Even so, no specific sector stood out, as most sectors have moved similarly, despite some bullish sentiments.

Based on my extensive experience and observations of the cryptocurrency market, I firmly believe that the recent broad recovery is a positive sign for Chainlink. As someone who has closely followed the crypto space for many years, I have noticed that such recoveries often signal an uptrend in the market cycle. Therefore, I am optimistic about Chainlink’s potential participation in this current market cycle’s upward trend.

‘Lowest average’

Reflecting on the Crypto Daily RSI Heatmap, I noticed that the average Relative Strength Index (RSI) dipped to a record low of approximately 35%. Historically, such low readings often signify a bear market scenario.

Based on my years of trading experience, I believe this situation can be seen as a positive sign that prices have dropped significantly, making it an opportune moment for both traders and investors like myself to invest. Historically, I’ve found that when prices reach such low levels, they often rebound strongly, leading to substantial returns. So, I recommend taking advantage of this situation while the opportunity lasts.

Keep in mind that these numbers might shift swiftly, as demonstrated by the considerable fluctuations in the prices of different cryptocurrencies observed within the last seven days.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-08-10 10:16