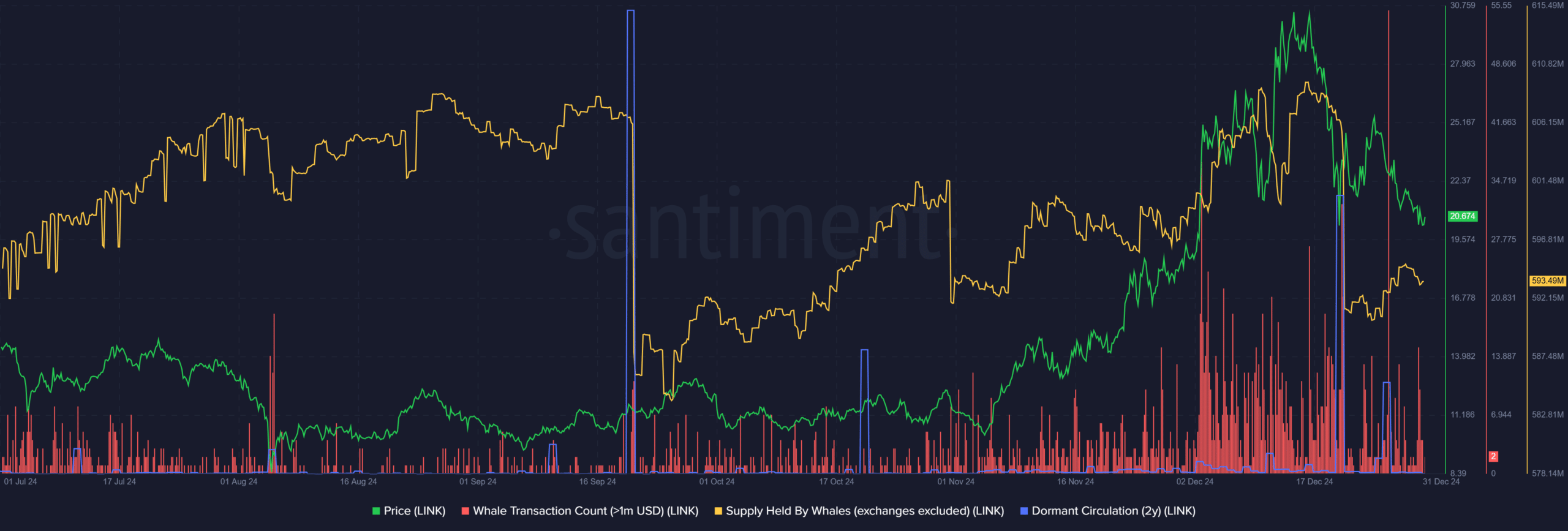

- Chainlink saw dormant circulation spikes from long-term holders after the rejection at $30.

- Lack of conviction from the large holders meant the rally was unlikely to continue.

As a seasoned researcher with years of experience under my belt, I have seen numerous market cycles come and go. The recent events surrounding Chainlink [LINK] have caught my attention due to their striking similarities with past price movements.

The spike in whale transactions toward the end of November was a red flag for me. It hinted at accumulation above $20, but the lack of conviction from large holders meant the rally was unlikely to continue. The rejection at $30 only served to confirm my suspicions.

Looking at the daily transaction activity from whales, it’s clear that they were cashing out when the rally didn’t continue as expected. The increased selling pressure over the past ten days is evident, especially after the bounce at $25 was rejected.

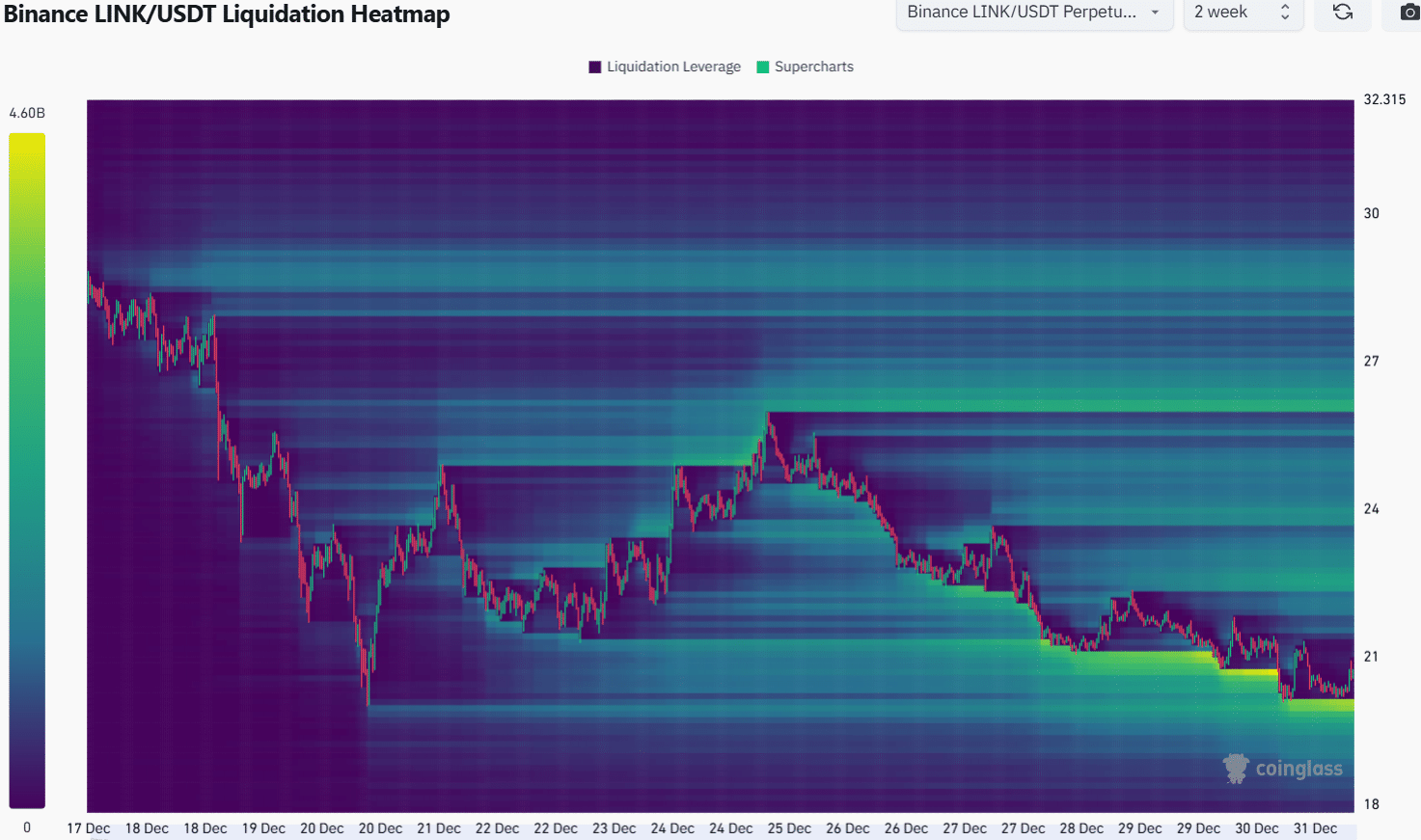

The liquidation heatmap further supports this analysis, showing a steady fall in LINK prices over the past two weeks. If this pattern continues, I fear that the $20 level might attract prices downward in search of liquidity, fueling another drop.

However, as they say, “the market can stay irrational longer than you can stay solvent.” In this case, it’s possible that LINK could surprise us all and find a way to bounce back. After all, the crypto market is known for its unpredictability!

And on a lighter note, remember: never underestimate the power of a tweet from Elon Musk or a sudden announcement from a major player in the crypto space. They can send prices soaring faster than you can say “Buy the dip!

Earlier this month, Chainlink’s token [LINK] saw a significant surge, with a 21% increase in just one day. This spike occurred after the World Liberty Financial, a company linked to Donald Trump, purchased approximately $1 million worth of LINK tokens.

Over the last fortnight, I’ve noticed a surge in sell pressure from significant investors, as suggested by certain on-chain indicators. It appears that these investors have been taking advantage of the market movement to sell at the $30 price point, aiming to realize their profits.

Can we expect a Chainlink accumulation above $20 and a renewal of the upward momentum?

Whale transaction spike sparks fear

By late November, when LINK’s price surpassed the $20 level, there was an increase in the number of large transactions, each worth over a million dollars.

Whale transactions remained frequent during the period when Chainlink’s trading price exceeded $22.

Over the last fortnight, it’s been gradually decreasing, with the second and third busiest transaction days occurring within this period being the second and third most active in the preceding three months.

They occurred on the 20th and the 26th of December.

Later on, when LINK’s price was turned down at $25, this suggested growing anxiety among major investors and a surge in selling activity over the previous ten days.

Daily transactions by whales reached a level comparable to the latter part of 2021, implying that these large investors may have been taking profits as the rally didn’t sustain further.

Chainlink continues to hunt liquidity pockets to the south

Over the last fortnight, the price chart for LINK showed a consistent downward trend. Particularly over the past week, this decline has persisted with a bearish bias.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Temporary safe areas were created beneath the short-term resistance levels, yet these weren’t sufficient to deter the bears for an extended period.

Based on my years of trading experience and observing market trends, if this pattern persists, I strongly believe that the $20 level, which previously bounced on the 30th of December, could potentially attract prices downward due to a search for liquidity. This could lead to another drop in the market. I’ve seen similar situations before where such levels act as resistance points and cause price fluctuations. It’s important to keep a close eye on this situation and be prepared for potential changes in the market dynamics.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-01 09:11