- Chainlink mirrored a historical pattern of Ethereum, suggesting a potential rally.

- Whales and institutions continue to accumulate LINK tokens.

As an experienced crypto investor with a knack for spotting patterns and trends, I can’t help but feel a sense of anticipation when I observe the parallels between Chainlink (LINK) and Ethereum (ETH). The historical price action suggests that LINK might be gearing up for a rally towards $90 if it mirrors ETH’s performance.

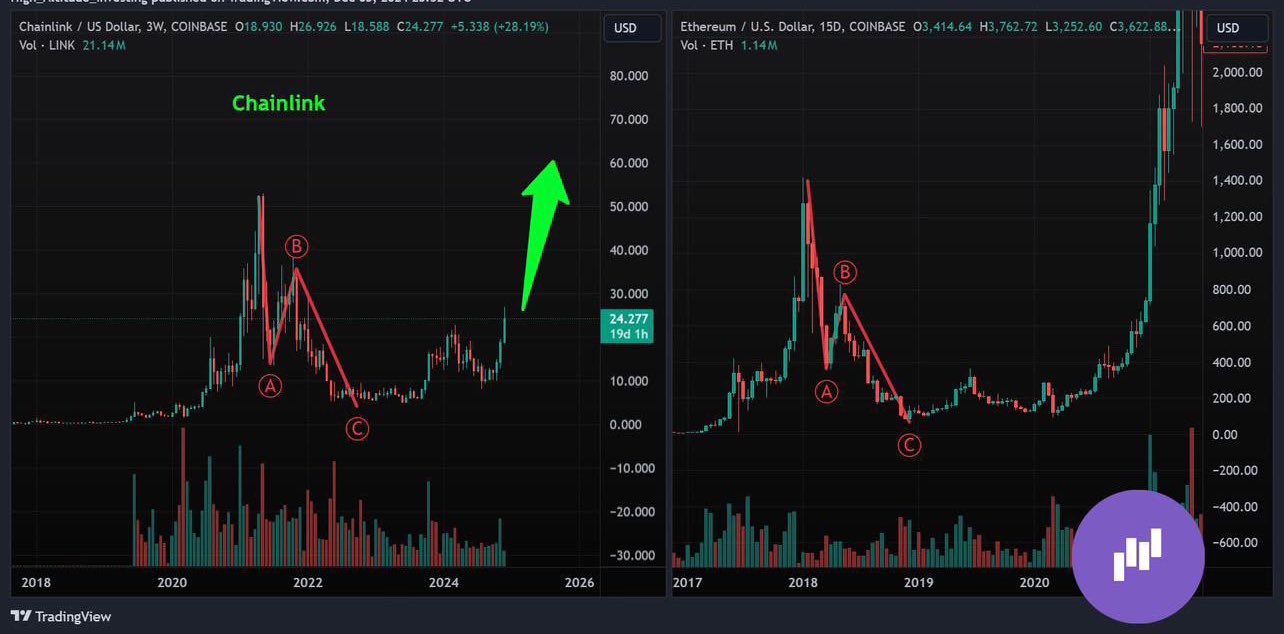

Analyzing the price trends of Chainlink (LINK) and Ethereum (ETH) revealed a striking resemblance in their price movements.

From 2018 to 2024, the highs and lows of LINK experienced a significant rise, reaching approximately $52 as its peak, then a notable drop down to point B before a more gradual and sustained climb towards point C.

During a comparable timeframe, this movement seems to have followed Ethereum’s price trend, implying that LINK might replicate Ethereum’s previous market behavior.

Contrarily, Ethereum displayed more significant upward momentum, reaching unprecedented levels in its latter phases, with an especially notable surge during the robust uptrend following 2020. This culminated in a fresh high of $4800.

If Chainlink maintains its pattern of following Ethereum’s past price movements, it might rise towards approximately $90. This trend suggests a positive forecast for Chainlink, as long as the present market trends persist.

LINK’s Open Interest

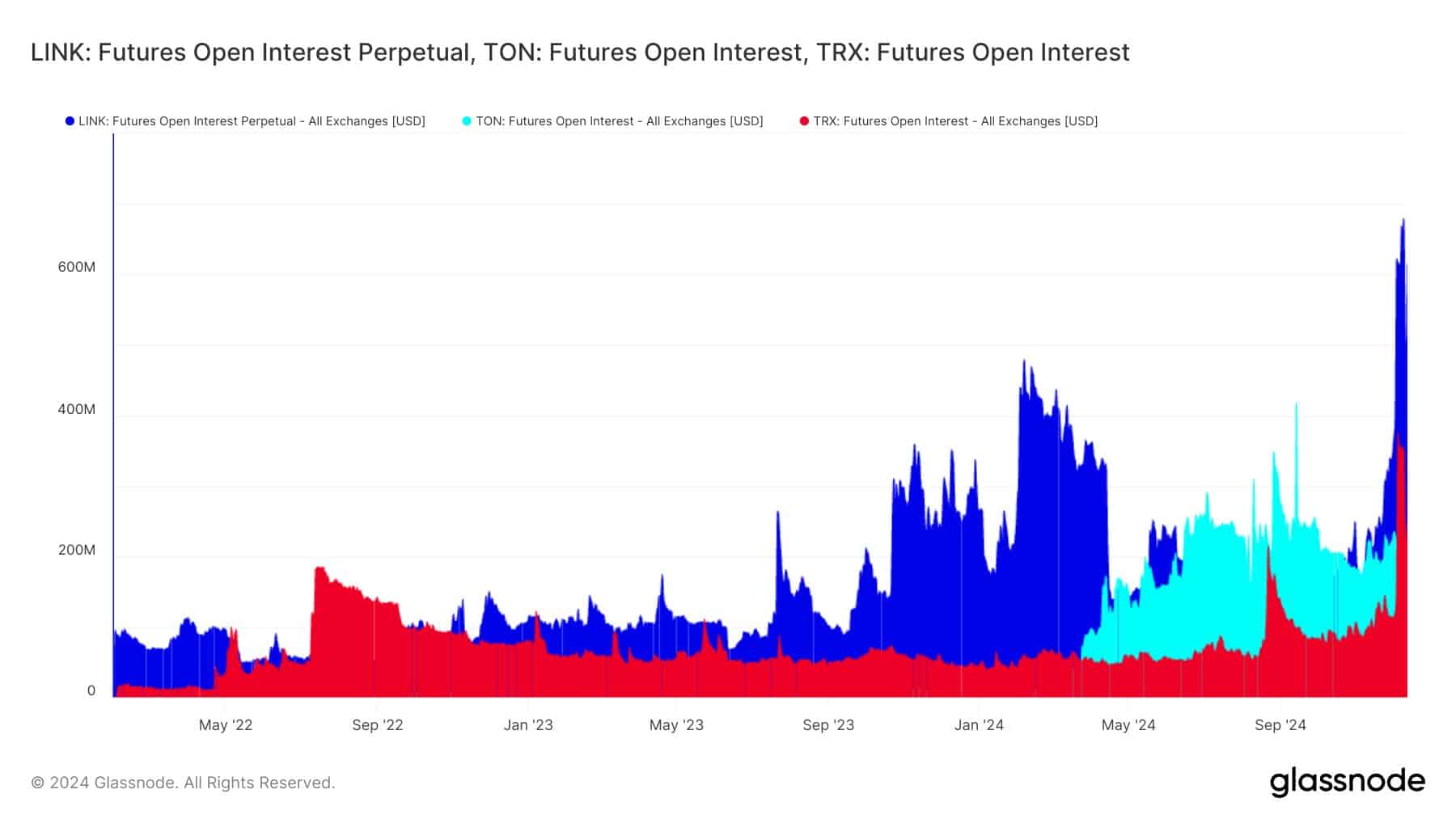

Additionally, the Futures Open Interest (OI) of LINK reached an all-time high of $770.27 million, outperforming both Toncoin [TON] and Tron [TRX] in terms of this particular metric.

The significant increase in trading activity around LINK (as represented by Open Interest) – approximately thrice as much as for TON and double that of TRX – suggests a rising level of trust or anticipation among traders regarding its potential price fluctuations in the near future.

During this timeframe, LINK reached its peak price almost two years ago, suggesting increased curiosity and potentially speculative excitement about its future value.

Lately, there’s been a significant increase in the Open Interest (OI) of LINK, which suggests increased trader involvement. This could mean that some traders are preparing for potential future price growth or protecting themselves from losses in other trades.

The pattern indicated that the behavior of LINK was significantly impacted by derivative trading, with the potential to either reduce or amplify its fluctuations.

Whale and institutional buying

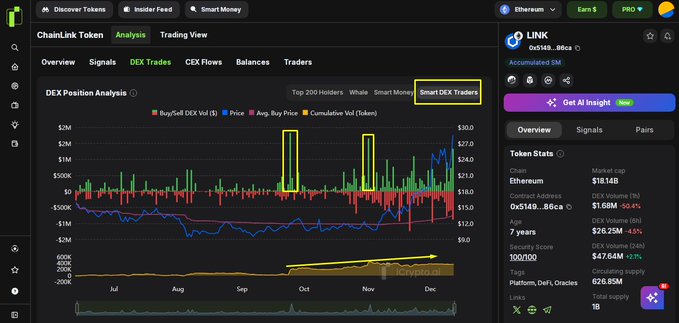

As an analyst, I’ve conducted a thorough review of our DEX position data, and here are my findings. Notably, there has been a substantial increase in the accumulation of LINK tokens by prominent players (whales) and savvy Smart DEX traders. Remarkably, their buying activity has significantly outpaced selling, indicating a strong bullish sentiment towards LINK. This trend could potentially drive the price upward, making it an intriguing asset for further analysis.

The increase in purchasing activity aligns with the rise in LINK’s prices, implying that large investors could be stockpiling it, anticipating further price rises.

This suggests a significant demand for purchasing LINK, potentially leading to its market price remaining steady or even rising. If this pattern persists, it might result in additional value growth.

Moreover, the World Liberty Financial Fund expanded its investment portfolio by acquiring more LINK and AAVE tokens. Specifically, it bought an extra 37,052 LINK worth a million dollars and 685.4 AAVE for approximately $247,000.

As a researcher, I’ve just completed a transaction where I purchased a total of 78,387 LINK tokens for approximately $2 million, with each token costing an average of around $25.51. This investment has already yielded a significant return, as it has increased in value by about $232,000. This represents an impressive 11.6% growth in value since the purchase.

Following this, Zach Rynes heaped praise for the U.S. President-elect on X (formerly Twitter):

“Donald Trump is the Michael Saylor of Chainlink $LINK”

The persistent buying activity emphasized the fund’s optimistic view on LINK, suggesting possible profits should the positive trend continue.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-13 22:16