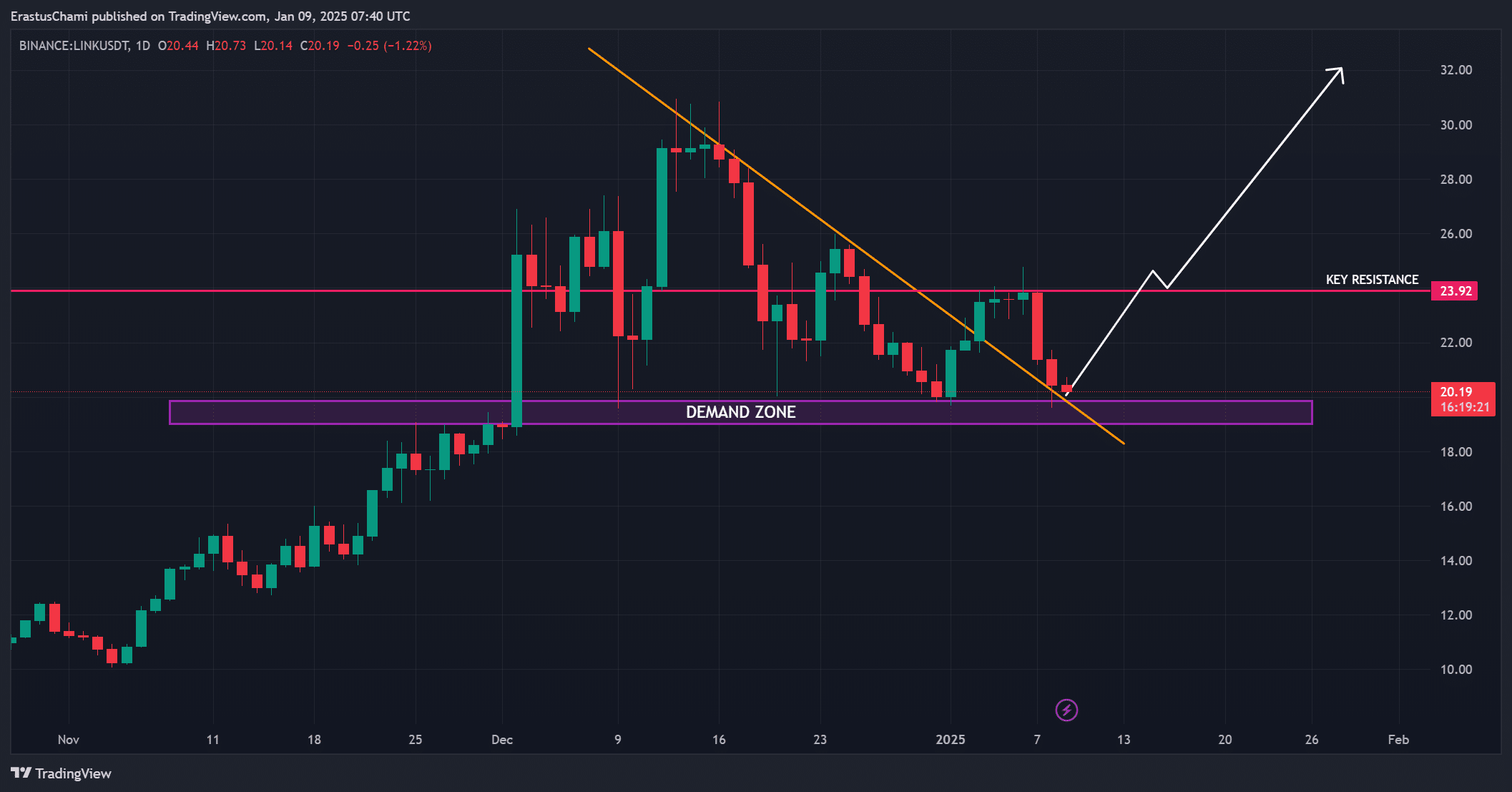

- LINK retested its demand zone; $23.92 breakout could trigger a rally to $32.

- Network growth and exchange outflows signaled accumulation.

Chainlink (LINK) is garnering notable interest as it approaches its falling trendline and demand area, positioning itself for a possible breakthrough.

Currently, LINK is being traded at $19.84, representing a 4.39% decrease in value over the course of the day. However, even with this dip, there seems to be an optimistic outlook from both the general public and more sophisticated investors. This bullish sentiment hints at the possibility of a future recovery.

LINK price action: Can it overcome key levels?

At the moment, the trend in LINK’s price seems to indicate a critical juncture. Following a test of its support area near $20, the price has shown a degree of stability, which could imply that there might be some accumulation taking place.

Nevertheless, overcoming the hurdle at $23.92 is essential; if achieved, it could pave the way for resuming a bullish trend.

A successful escape might bring about a substantial rise towards $32, indicating a profound change in investor attitudes.

If the price doesn’t manage to stay within the demand area, LINK could potentially continue falling, challenging the resolve of its owners.

Therefore, the next few trading sessions will be pivotal in shaping LINK’s trajectory.

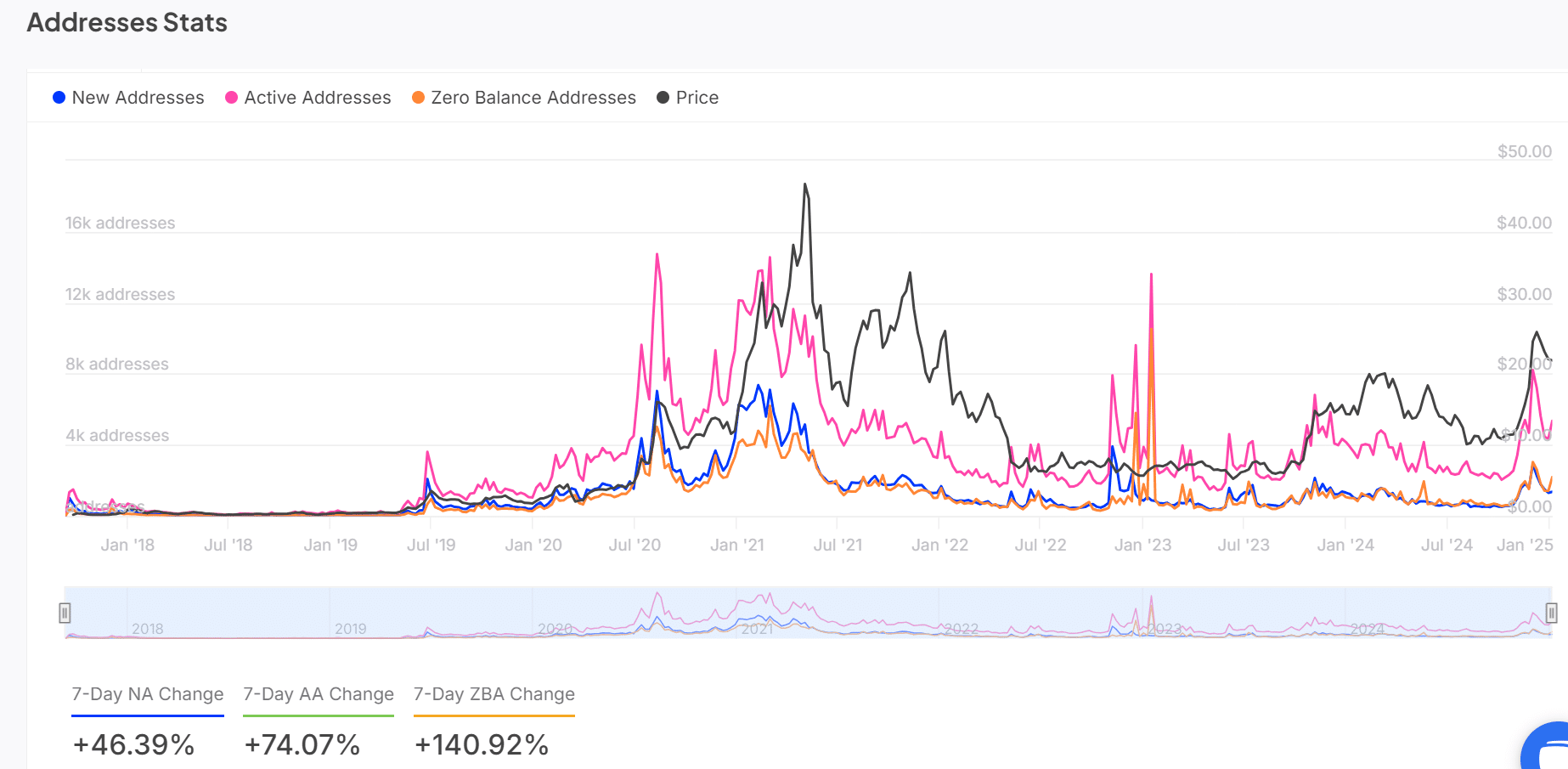

Analyzing Chainlink address stats

As a crypto investor, I’ve been noticing some encouraging signs in the Chainlink (LINK) ecosystem. The latest on-chain data suggests an uptick in activity, which is a promising indication of the network’s overall health. This development has me optimistic about the future prospects of LINK.

Over the last week, there’s been a 46.39% increase in the number of new addresses, and an active address growth of 74.07%.

Furthermore, there’s been an impressive 140.92% rise in the number of zero balance accounts, implying a surge of interest from formerly dormant users. This increased involvement mirrors a strengthening faith in LINK’s practicality.

To ensure long-term robustness and pricing consistency within our network, it’s crucial that we continue to foster steady development in these key aspects.

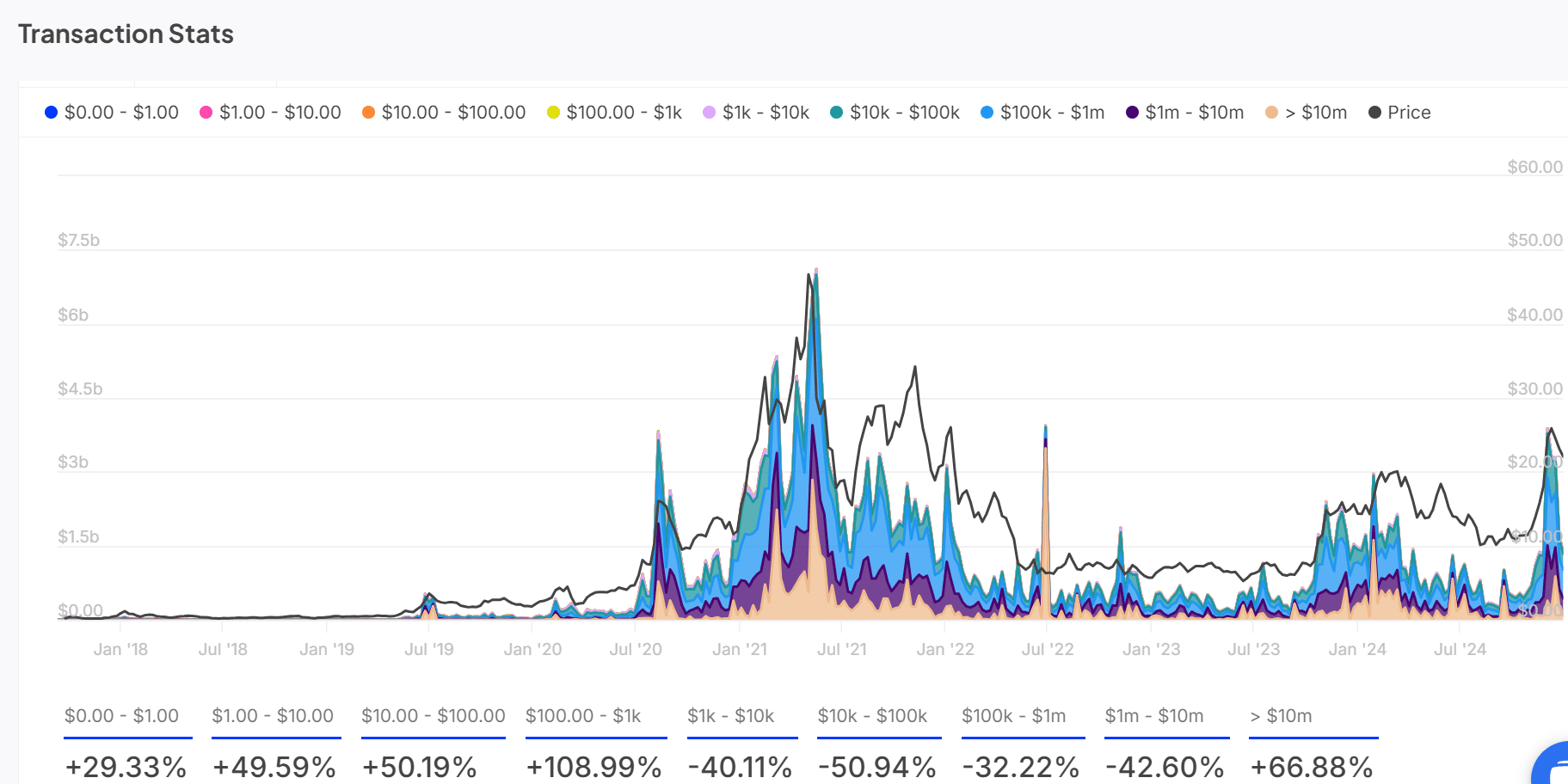

Transaction volume trends by size

The data from transaction volumes suggests a blend of investor opinions. On one hand, there was a significant surge of 50.19% in smaller transactions ranging from $10 to $100. Conversely, the number of large transactions over $10 million grew impressively by 66.88%.

This points to confidence from both retail and institutional investors.

On the other hand, there’s been a significant decrease in medium-sized transactions, mainly those valued between $1k and $100k. This trend indicates that some investors might be holding back, underscoring the importance of providing clear insight into LINK’s price fluctuations.

Therefore, maintaining momentum will be crucial to regaining broader investor confidence.

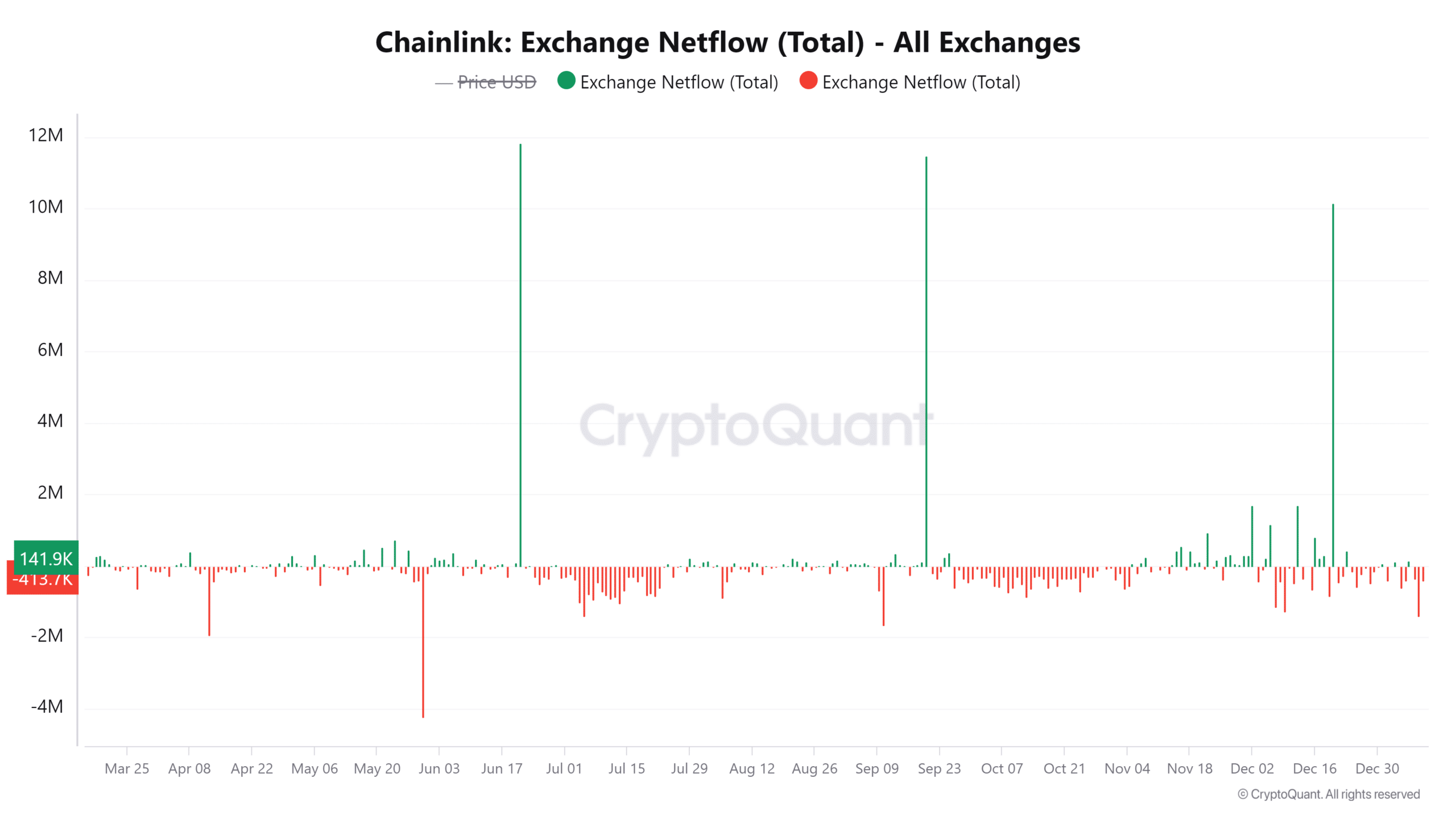

Exchange netflow: What does it signal?

Over the last day, a 3.79% rise was observed in the outgoing netflow data, suggesting a decrease in selling activity. This trend seems to coincide with possible accumulation patterns.

Historically, similar patterns tend to come before price increases. But for this trend to continue and push the price of LINK upwards, there needs to be a prolonged period of investors withdrawing their funds.

Conclusion: Is a breakout likely?

Considering its current infrastructure, rising transaction volume, and continuous transfers leaving the network, Chainlink appears poised to surge beyond the $23.92 barrier, should it manage to overcome this resistance level.

Reaching around $32 looks feasible, but it’s essential to keep up with the demand area for continuous positive development. This implies that LINK seems poised for expansion, as long as the market allows for a bullish surge.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-09 20:42