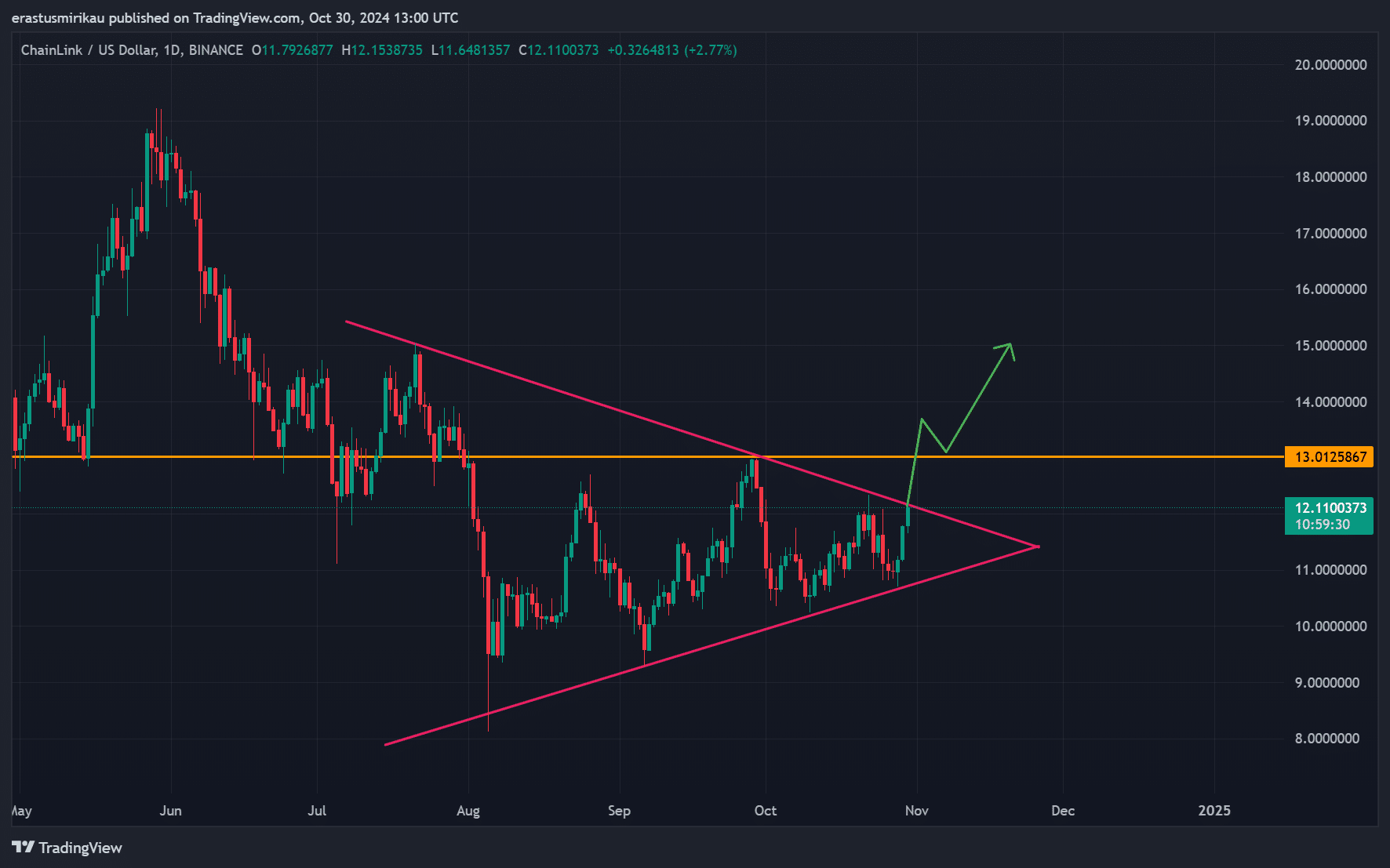

- Chainlink seemed to be nearing a crucial $13.01 resistance within a symmetrical triangle

- Technical indicators and rising Open Interest pointed to a likely breakout if resistance is breached

As a seasoned analyst with over two decades of experience in trading and market analysis, I have witnessed numerous market cycles and trends across various asset classes. In this case, Chainlink [LINK] presents an intriguing setup that could potentially lead to a bullish move.

Chainlink’s digital token [LINK] has been attracting the crypto world’s focus due to its consolidation within a large symmetrical triangle pattern on the daily chart, which is typically indicative of impending price fluctuations. The triangle resistance at approximately $13.01 looms as a significant level for LINK. If this level is surpassed, it could trigger bullish energy, potentially driving another surge in Chainlink’s value.

Currently, LINK is being exchanged at $12.00, after posting a daily increase of 4.55%. This strong upward movement could potentially signal a bullish trend, making it an intriguing opportunity for traders who are hoping to witness LINK surpassing this level and initiating a prolonged uptrend.

Is the symmetrical triangle pointing to a bullish move?

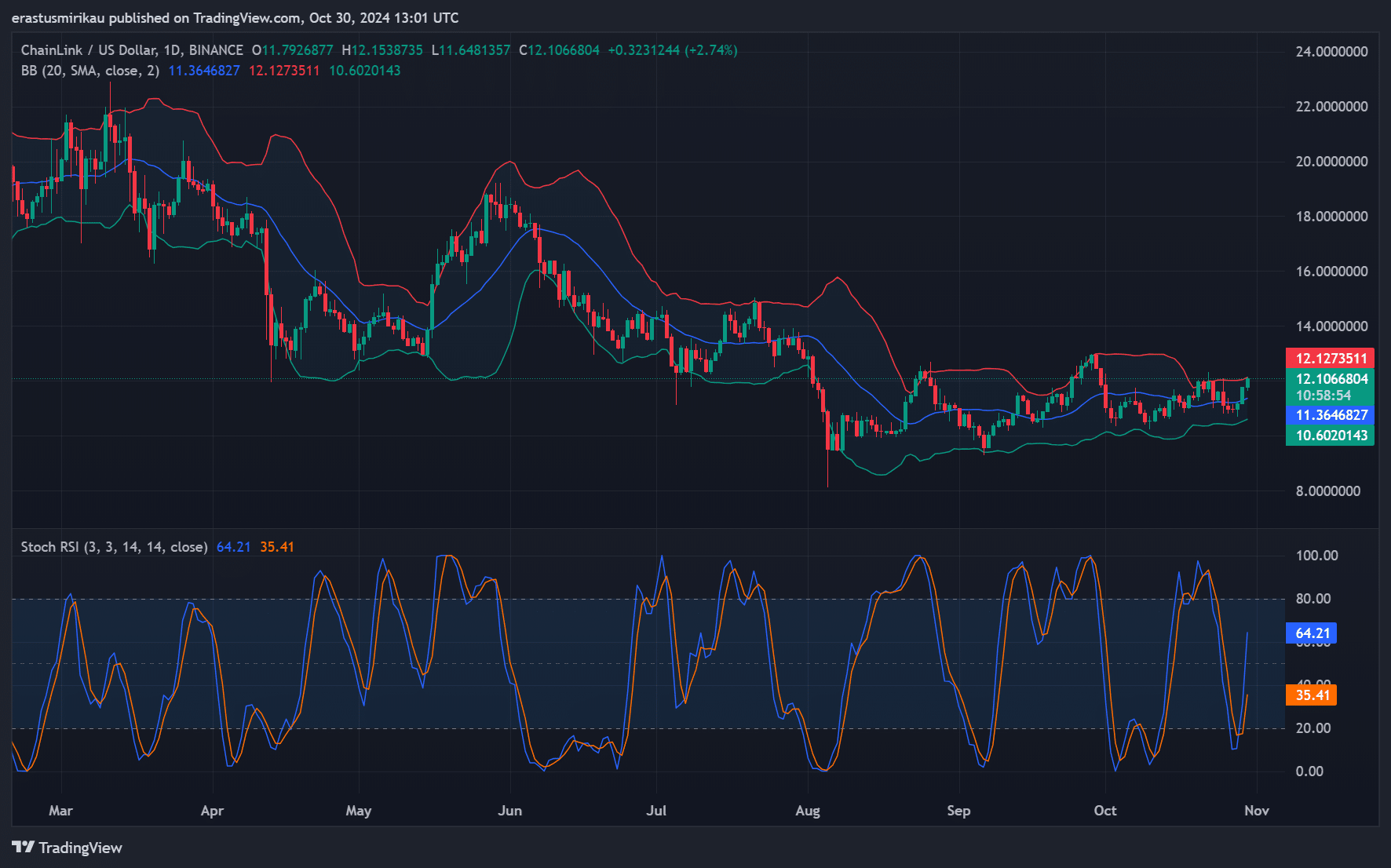

Nevertheless, the breakout potential isn’t limited to chart patterns alone; various technical indicators also bolster the likelihood of a bullish trend. For instance, the Bollinger Bands (BB) on the daily scale suggest that volatility may increase soon. As Chainlink’s price nears the upper band at approximately $12.12, a powerful surge above this level could indicate a transition towards bullish energy.

As a crypto investor, I noticed that the Stochastic RSI was indicating increasing buying pressure with a value of 64.21. Despite this, it stayed below the overbought territory, suggesting there might still be room for further price increases.

As a result, there seems to be potential for LINK to keep rising, as it hasn’t yet reached a significant barrier on the price charts.

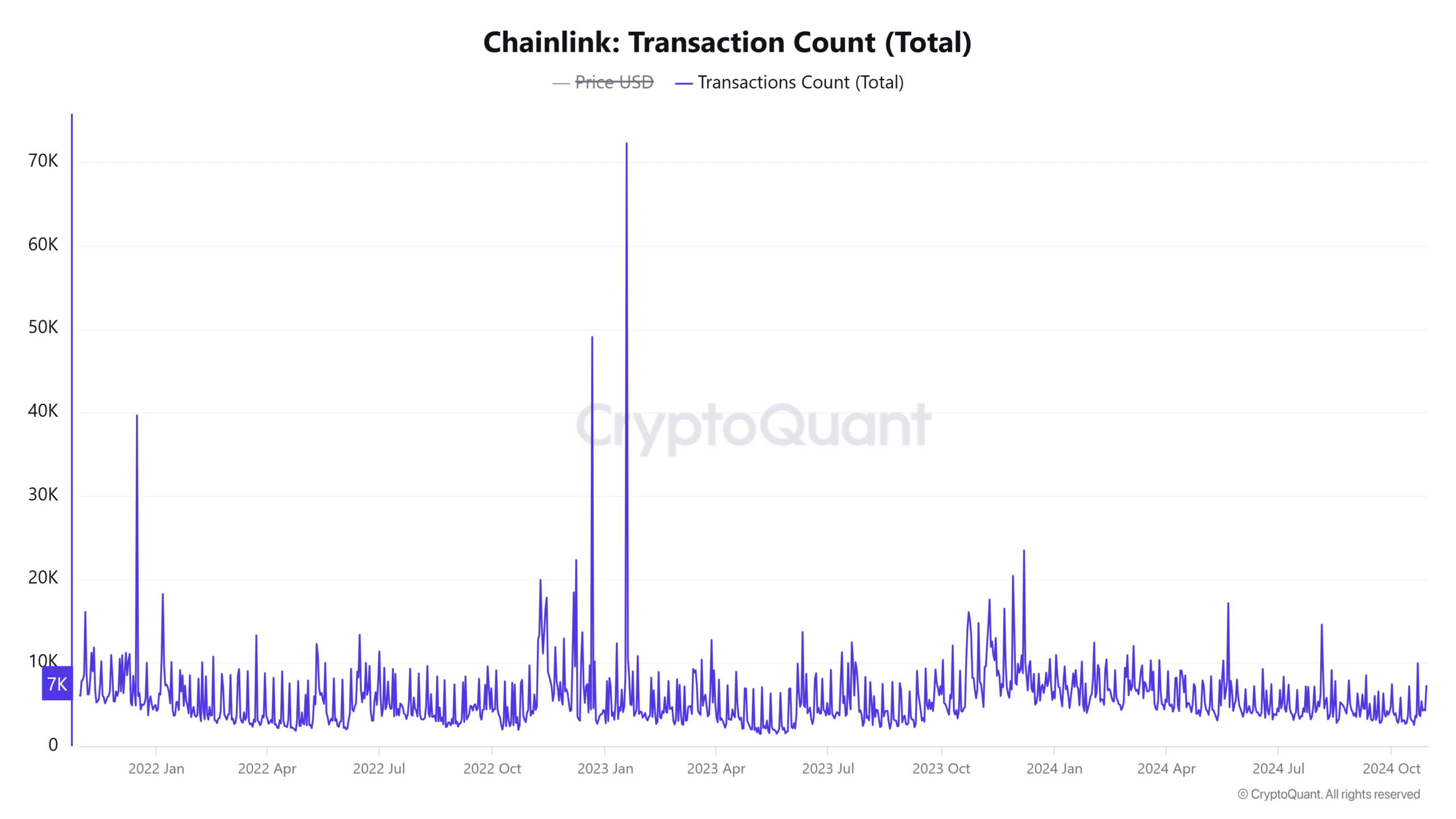

What do LINK on-chain signals say?

Furthermore, the on-chain data provided useful insights, suggesting an ongoing increase in network activity that hinted at potential bullish trends. The number of active addresses increased by 1.03% within the last 24 hours. Typically, a surge in user engagement is associated with price growth since escalated activity usually indicates heightened curiosity about LINK.

Additionally, there’s been a 0.63% increase in transactions, suggesting persistent usage of the network – a strong indication that demand for LINK is steady. Collectively, these figures underscore a vibrant network environment as LINK gets closer to its significant growth point.

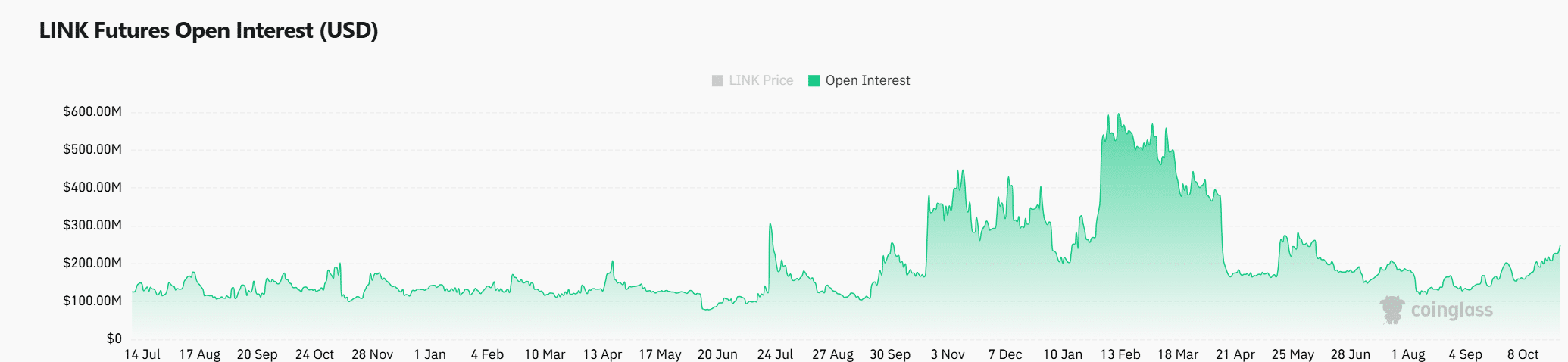

Will the surge in Open Interest fuel the breakout?

In summary, the Open Interest for LINK Futures contracts has jumped by 13.14% to reach approximately $274.29 million. This increase suggests an uptick in traders preparing for significant price action in the LINK market.

An increase like this is frequently interpreted as a symbol of confidence, as market players anticipate significant price changes in the short term. Given that technical indicators and on-chain signals are concurring, Chainlink (LINK) seems to be primed for a possible breakout if it manages to surpass the $13.01 threshold.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Will LINK break out and trigger a rally?

As Chainlink approached its resistance level of $13.01, its chart, indicators, and on-chain data pointed towards a significant turning point. The technical patterns and increasing network activity seem to bolster a positive trend, suggesting that Chainlink might be ready to experience an uptrend.

Nevertheless, if LINK manages to surge past this resistance level, it would strongly indicate that Chainlink’s upward trend is indeed imminent. Could we see LINK surpassing this barrier and sparking the anticipated rally among its advocates soon? The coming days should provide us with the answer.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-31 12:40