- Chainlink reflected bearish structure and momentum.

- The CMF showed significant buying pressure but the spot demand was weak in the short term.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen bull markets turn bearish and bears become bullish again more times than I can count. In the case of Chainlink [LINK], it seems we are witnessing another cycle unfold.

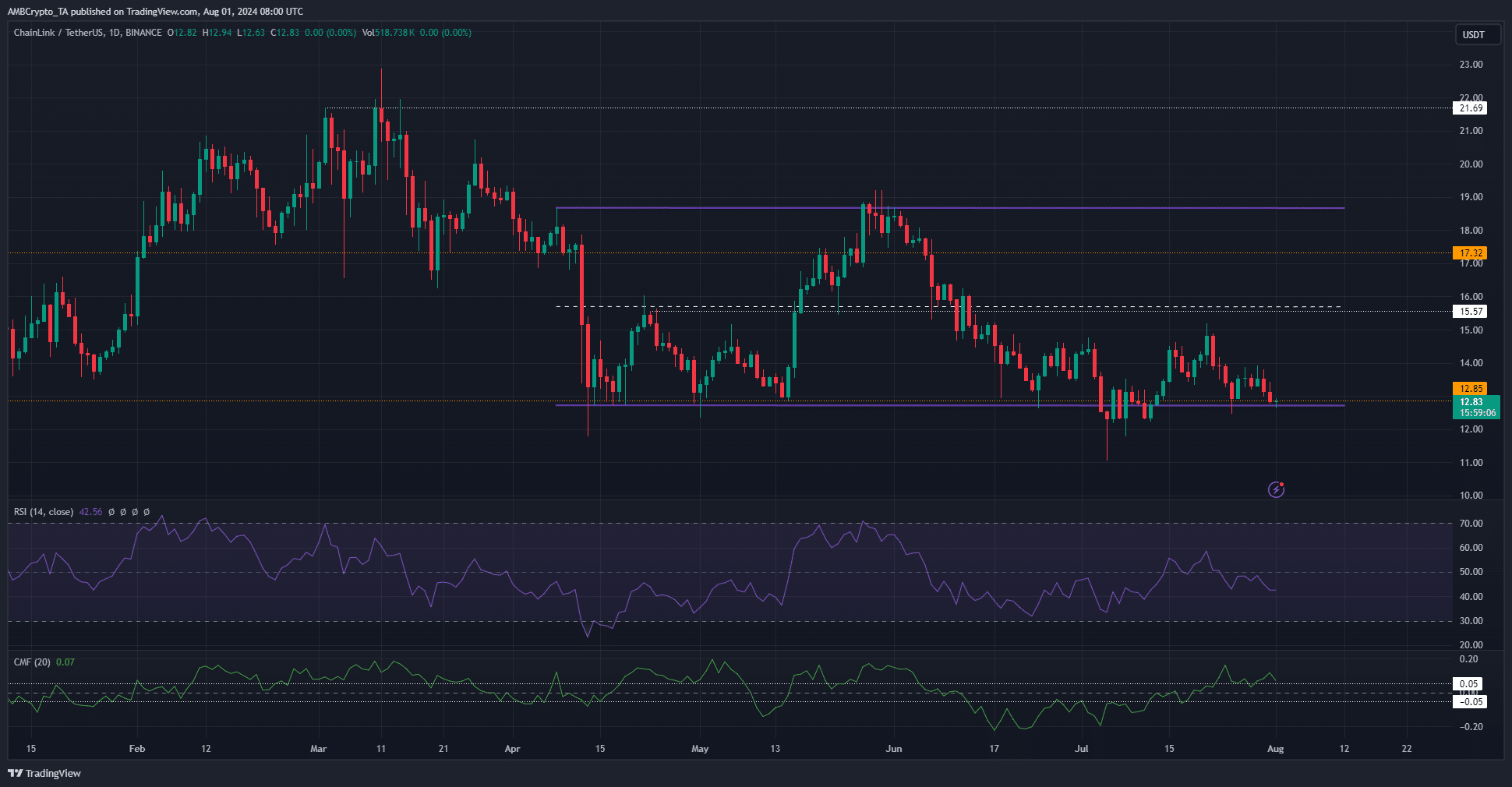

For the majority of the period between May and July, Chainlink’s [LINK] price has been declining. However, on July 21st, an important change occurred as the price surpassed $14.75, indicating a potential break in the market structure on the daily timeframe.

Over the last week’s trading sessions, I observed a reversal of the price increases I had recorded back in mid-July. This setback has left me pondering about potential market shifts. Interestingly, my momentum and volume indicators presented contrasting views, but I find myself anticipating a possible price rebound.

The range lows could save the bulls

Over the past couple of months, from April onwards, Chainlink has been moving between $12.73 and $18.68. A bearish trend emerged in early July, causing the price to dip to $11.07, with brief periods of trading at $12.33. Consequently, it’s possible that $12.3 could act as a support level in the near future, potentially leading to a price reversal.

Despite a drop in prices lately, the Crowd Momentum Factor (CMF) remained above 0.05, demonstrating that strong buying interest persisted overall. On the contrary, the Relative Strength Index (RSI) dipped below the neutral 50 level, suggesting a potential shift towards bearish momentum.

As a researcher studying market trends, I’ve observed contrasting indicators within my analysis. While there are signs that might trigger a potential recovery among bullish investors in the coming week, it’s crucial to exercise caution due to the current low ranges we’re observing.

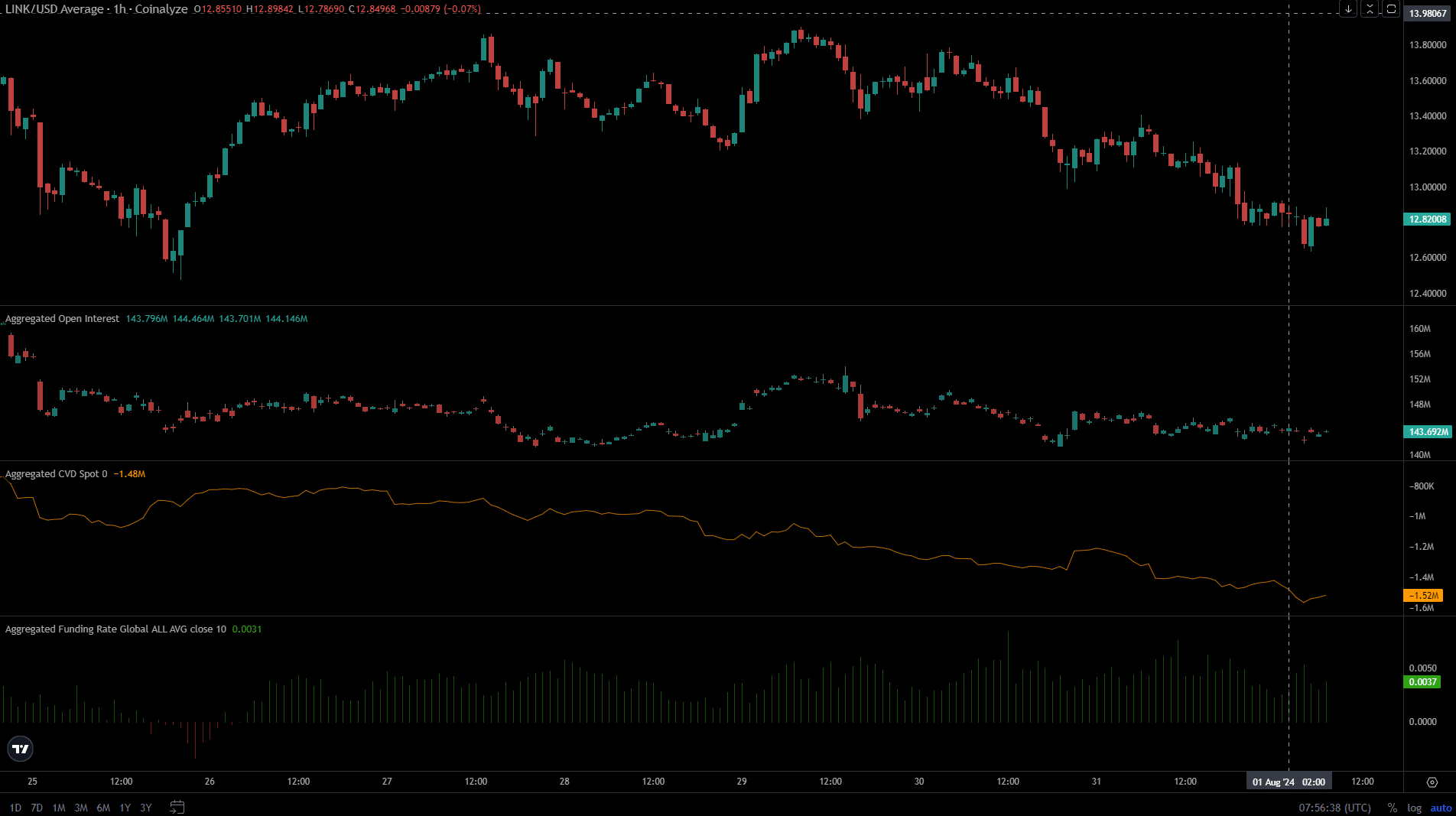

The short-term Chainlink price prediction is bearish

Over the last three days, the value of LINK has gradually dropped downwards. Simultaneously, the Open Interest decreased from $152 million to $143.7 million. This combined trend suggests a bearish outlook, as both the price drop and reduced Open Interest indicate pessimistic sentiment among traders.

Read Chainlink’s [LINK] Price Prediction 2024-25

Speculators lack confidence and were not willing to go long on the token.

It was observed that the market for Cardiovascular Disease (CVD) was decreasing, with low demand and pessimism among future traders. Collectively, this suggested that Chainlink might experience further drops.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-08-02 02:15