- Whale accumulation highlighted a potential breakout as LINK battled a key resistance level.

- Declining exchange reserves and rising transactions created bullish conditions.

As a seasoned crypto investor with a knack for deciphering market trends, I find myself captivated by the recent developments surrounding Chainlink (LINK). The whale activity, as highlighted by the 30 newly created wallets withdrawing over $34 million worth of LINK from Binance within five days, has undeniably caught my attention. Such a move often serves as a beacon for potential price surges and market breakouts – a sight that never fails to excite this old-timer’s heart!

30 recently established digital wallets have suddenly drawn attention towards Chainlink [LINK], as they collectively withdrew approximately 1.37 million LINK, equivalent to around $34.1 million, from Binance over a five-day period.

This accumulation coincided with a 4.01% price increase, pushing LINK to $24.93 at press time.

According to Lookonchain on X (formerly Twitter),

Notice of unusual $LINK buildup! In the last five days, approximately 30 freshly made wallets have withdrawn a total of around 1.37 million dollars worth of $LINK (equivalent to about 34.1 million dollars) from Binance.

This frequent whale behavior tends to spark curiosity about an impending breakthrough, causing investors to ponder if Chainlink (LINK) might be gearing up for another significant market shift.

LINK price momentum faces resistance

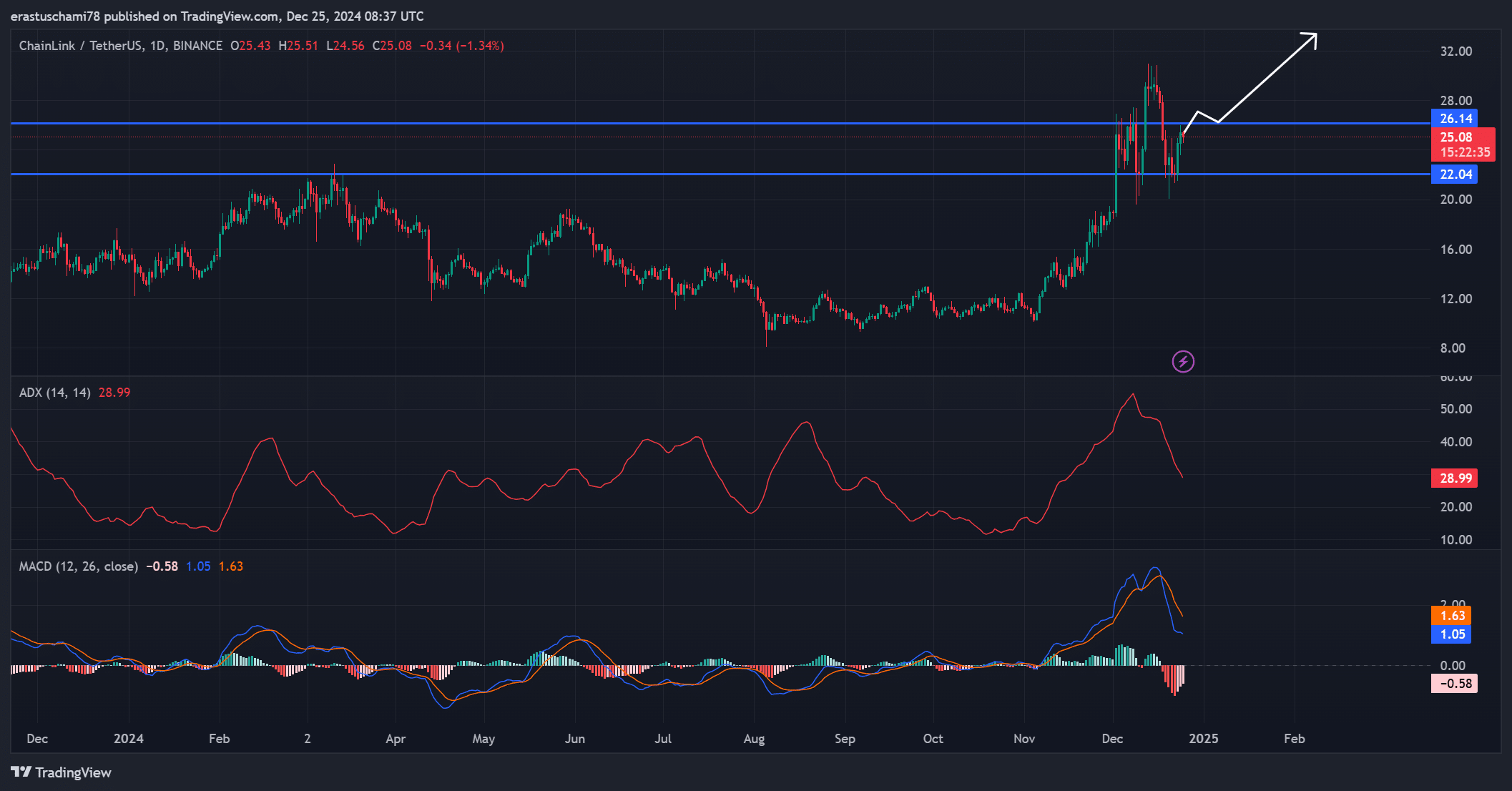

Technically speaking, LINK faced a significant hurdle at around $26.14, whereas $22.04 functioned as a strong foundation.

The MACD indicator displayed bearish momentum, yet the ADX reading of 28.99 highlighted a strengthening trend.

Furthermore, the market behavior hinted at buyers gathering around the support level, implying a potential surge if the trend’s strength continues.

If the price surpasses $26.14, it could trigger a surge toward $30 and beyond, generating enthusiasm among optimistic investors. But if this level isn’t maintained, there might be more consolidation in store.

Address statistics reflected mixed on-chain activity

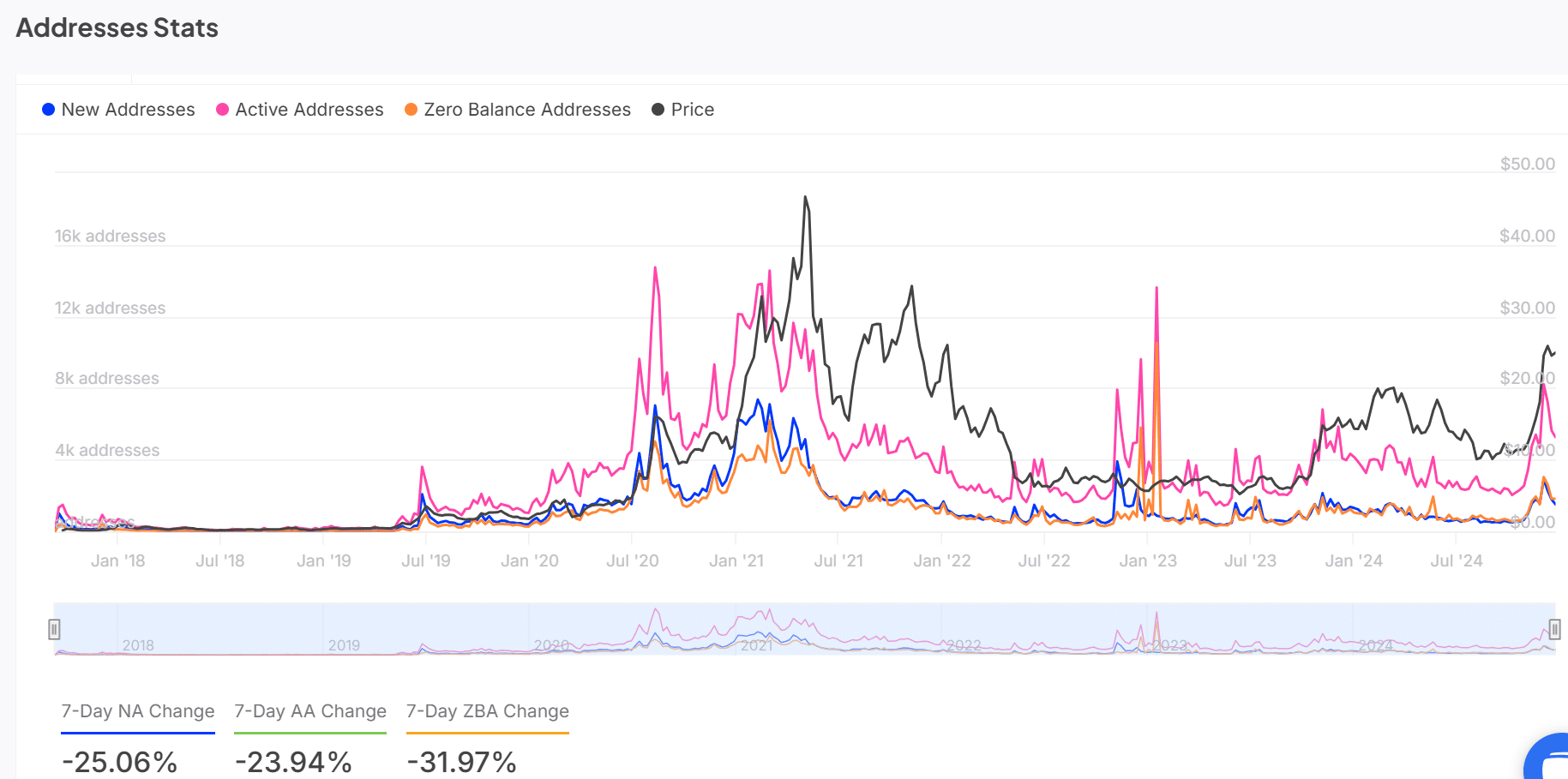

Over the last week, on-chain analysis shows a somewhat contradictory scenario for ChainLink accounts. The number of new addresses and active wallets has decreased by approximately 25.06% and 23.94%, respectively.

Zero-balance addresses decreased noticeably by 31.97%, implying a drop in retail interaction or participation.

As an analyst, I’ve noticed something interesting: while the general market activity is relatively subdued, there’s been a significant increase in whale activity. This could imply that larger investors are strategically preparing for a possible price spike in the near future.

The difference between how retail investors and whales are behaving might signal the beginning of an accumulation period, where significant buying is taking place strategically.

LINK: THIS bolsters optimism

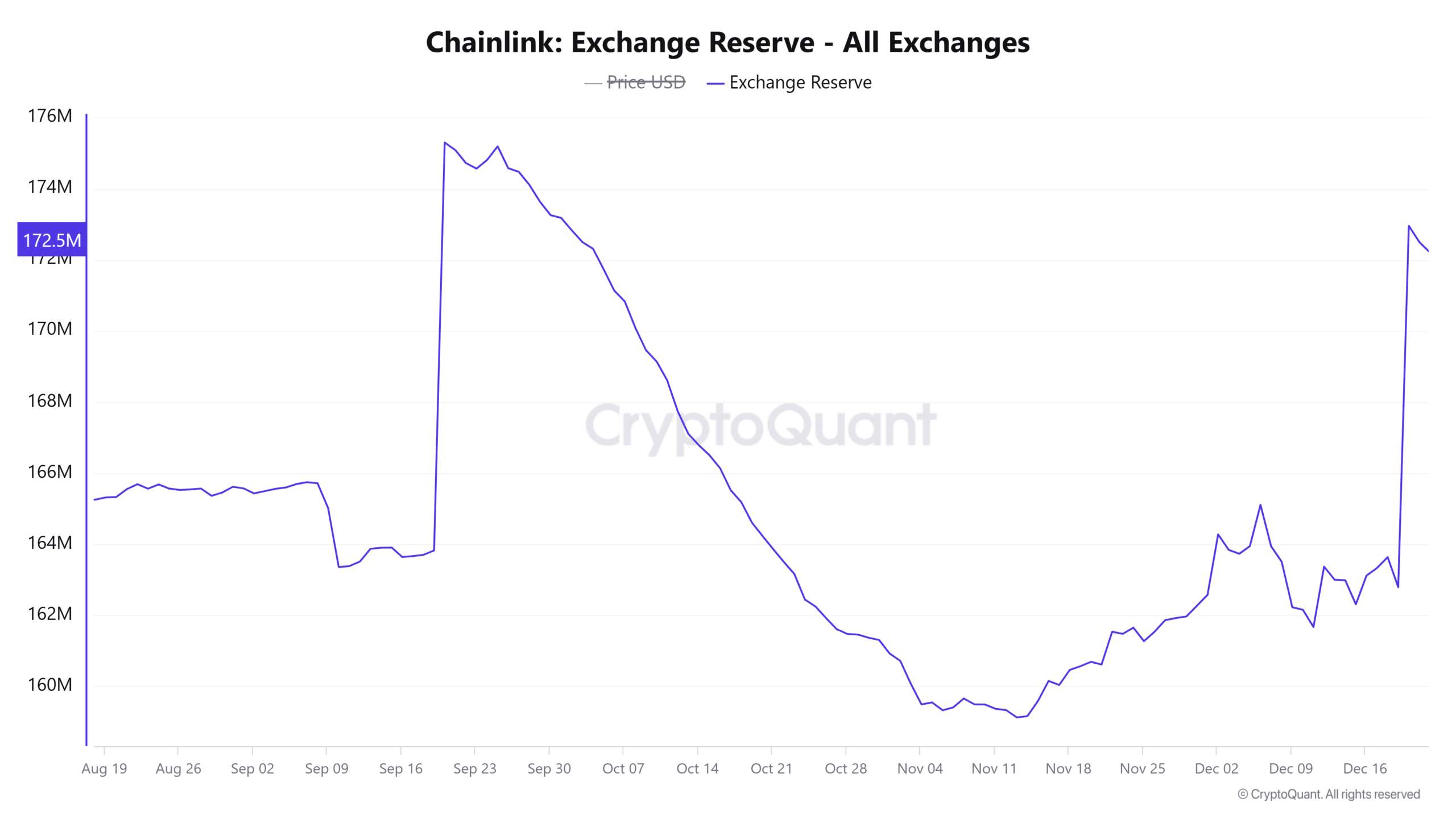

On a daily basis, the number of transactions on LINK increased by approximately 1.05%, reaching over 11,466 transfers. According to CryptoQuant analytics, this rise in activity could indicate a growing enthusiasm for ChainLink, possibly stimulated by recent significant transfers by large investors.

Furthermore, the reserves decreased by a small amount of 0.06%, landing at 172.5 million. This decline suggests there’s less sell-side liquidity available.

When reserves are low, it suggests a tightening of the supply, which could lead to increased prices if demand stays consistent. In other words, this situation seems to favor a rise in prices or bullish trends.

Conclusion: Is a rally inevitable?

Evidence points towards LINK experiencing a major surge soon, as large investors are amassing it, exchange reserves are shrinking, and transaction volume is increasing – all signs that the market sentiment is becoming increasingly optimistic.

Should LINK surpass the price point of $26.14, it appears extremely probable that it will surge towards $30. This potential rise presents attractive investment possibilities.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-25 13:45