- LINK prices have surged by 18% in just three days after retesting a critical support level near $19.

- The token whale activity intensified as over 1.40 million LINK were accumulated, signaling potential for further rally.

Over the past few days, Chainlink’s cryptocurrency, LINK, has been drawing interest from crypto investors due to a substantial rise it experienced. In just the last three days, LINK increased by approximately 18% following its rebound from a crucial support level situated around $19.

The rebound indicates the asset strength despite the volatile market.

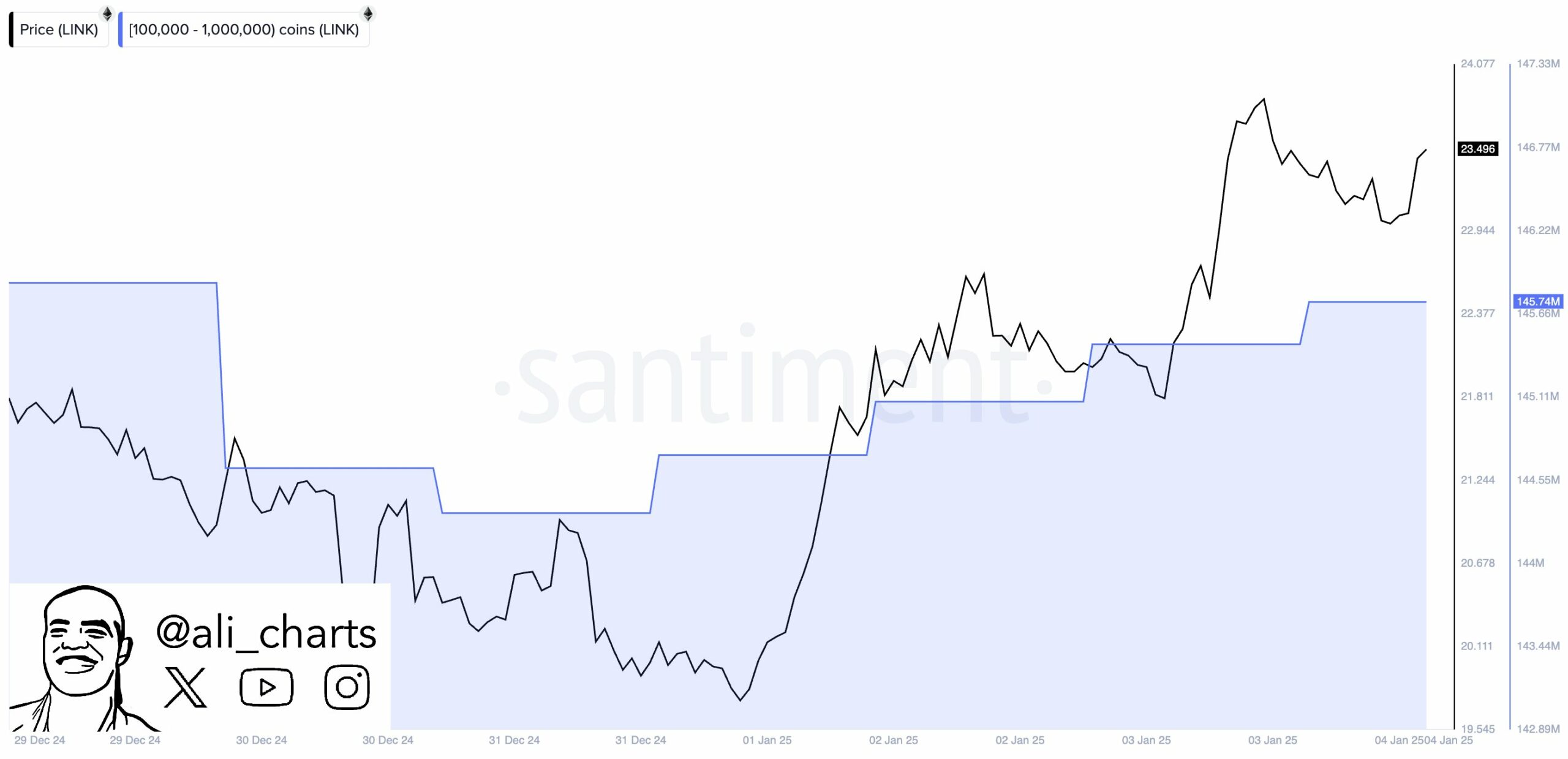

Boosting the momentum of the rally is a significant surge in whale transactions. As per an esteemed expert on platform X (previously Twitter), major investors have bought approximately 1.40 million LINK within the past 96 hours.

A significant buildup usually suggests increasing faith among key Chainlink investors, potentially indicating a prolonged optimistic outlook.

Exchange outflows decline, but LINK whales show confidence

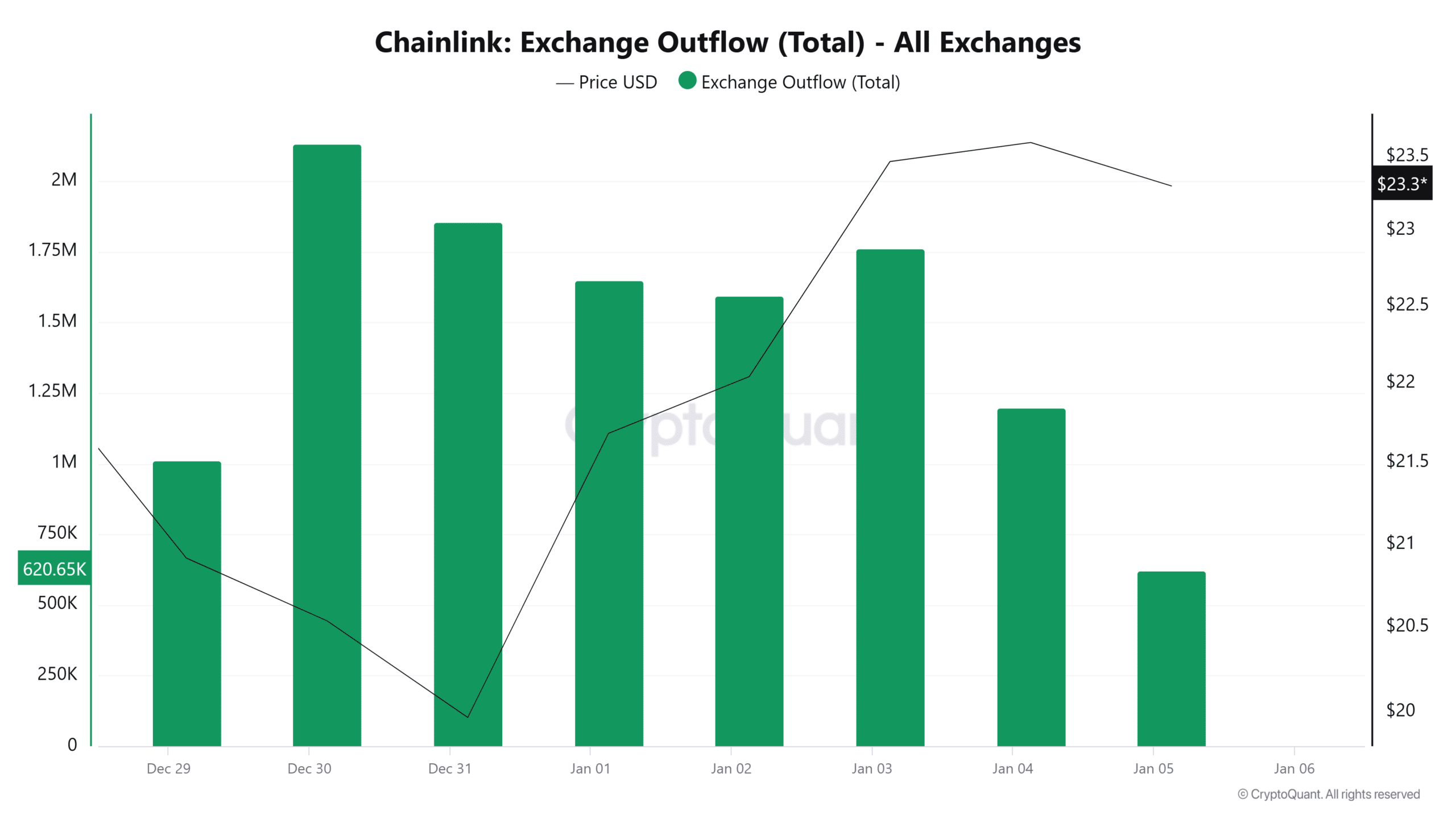

AMBCrypto’s closer look at LINK’s on-chain metrics revealed positive trends for the token.

Over the past three days, there’s been a consistent decrease in the amount of tokens leaving trading platforms, usually a sign of their departure from these platforms.

This implies that a smaller number of exchange LINK users may not be transferring their assets for possible sales, which could indicate growing market confidence.

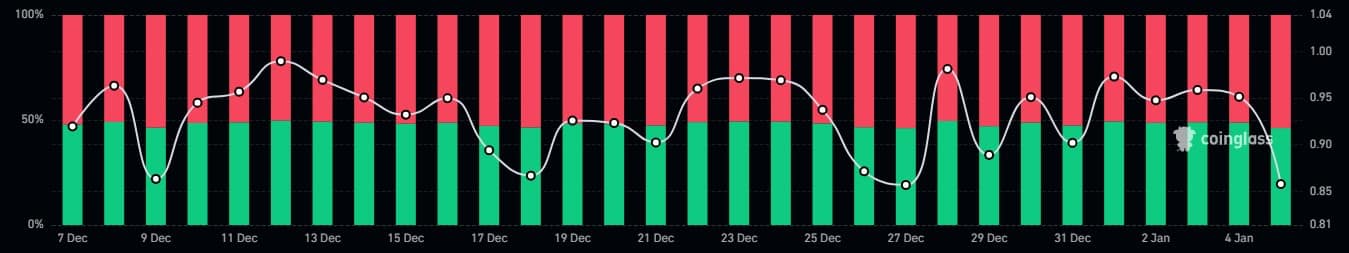

It’s worth noting that despite the Long/Short Ratio suggesting a bearish outlook, the number of short positions, according to Coinglass, was gradually decreasing. This could be due to traders taking profits following the recent market surge.

Instead, the continuous buildup by whales implies they are prioritizing long-term profits over quick, speculative investments.

Could whale activity propel prices higher?

Building on the steady growth of whale holdings might indicate an upcoming surge in prices. Typically, heightened whale involvement tends to predict positive price trends within the cryptocurrency market.

If this trend continues, LINK could experience a stronger upward momentum in the coming days.

Read Chainlink’s [LINK] Price Prediction 2025–2026

Furthermore, the slow decrease in the long/short ratio suggests a potential lessening of selling pressure.

With strong faith in whales, this situation might help LINK to challenge stronger resistance points.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-06 06:15