-

LINK experienced a sharp bearish reversal, losing most of its gains from earlier in the month.

There is a decline in trading volume and a predominance of bearish positions in the derivatives market.

As a researcher, I have closely observed Chainlink’s [LINK] price action over the past month and cannot help but feel concerned about its recent bearish reversal. After an impressive recovery with the bulls, LINK experienced a sharp correction, losing most of its gains from earlier in May.

Following an impressive bounce back with the bulls earlier this year, Chainlink (LINK) appears to have shifted allegiances, aligning with the bears recently. In May alone, the cryptocurrency lost nearly all of its previously gained value.

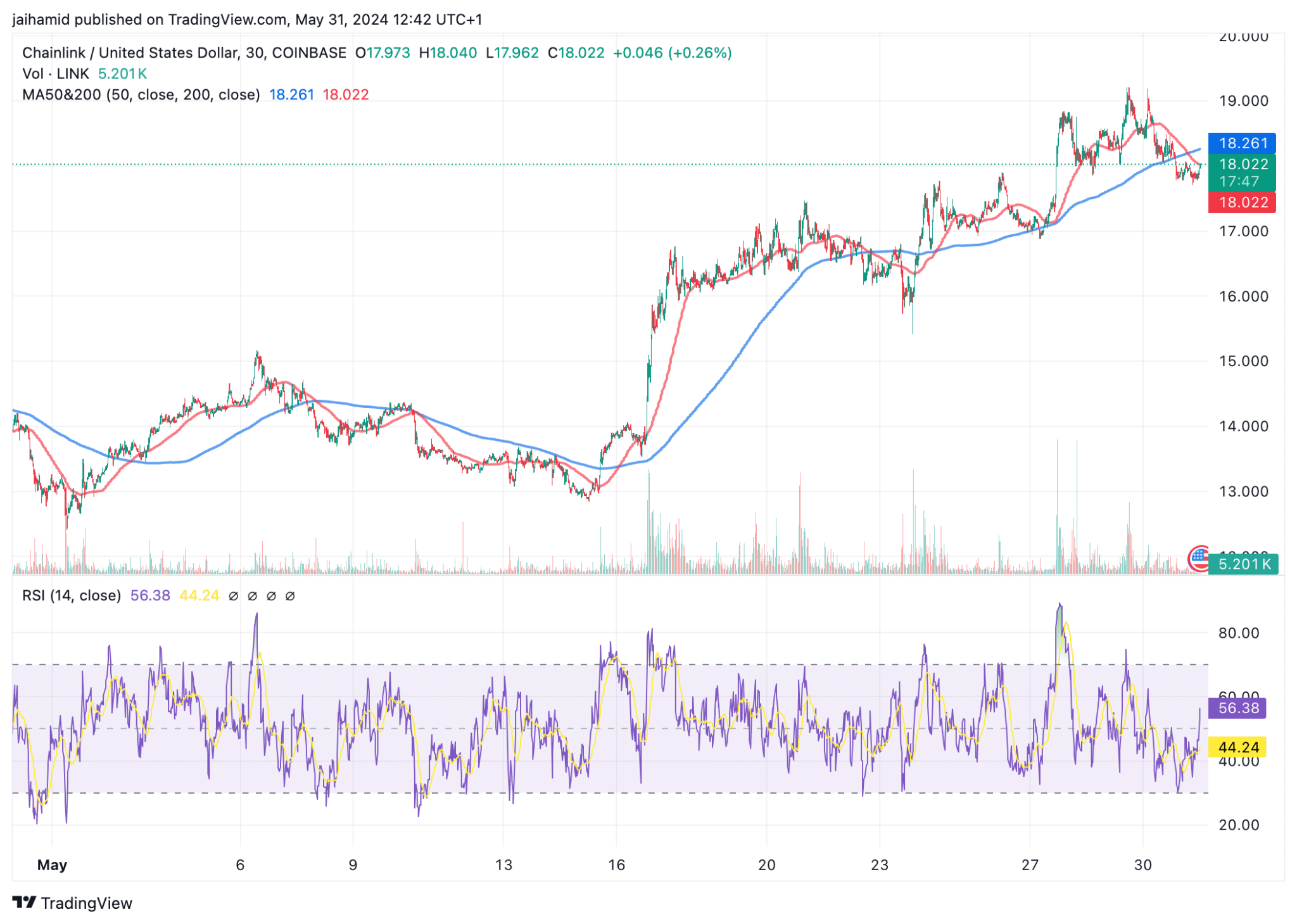

Examining the monthly price chart for LINK reveals an intriguing trend. In early May, there was a surprising and substantial price surge. However, this was swiftly followed by a significant downward correction.

Chainlink’s bearish U-turn

At the onset, Chainlink displayed robust buying pressure, as indicated by its significant price surge. This trend peaked approximately mid-May, an outcome of the prevailing optimistic market climate for cryptocurrencies.

Starting on May 27th, Chainlink experienced a significant shift in price behavior, giving back the majority of its previous gains over the following weeks.

As an analyst, I’ve noticed that the moving averages, specifically the 50-day moving average (MA50) in red and the 200-day moving average (MA200) in blue, have recently intersected. This occurrence is commonly seen as a bearish sign within technical analysis. Additionally, the price has dropped below both the MA50 and MA200, adding weight to the pessimistic outlook towards LINK.

The RSI indicator follows this pattern, fluctuating near the middle and moving in a descending direction, implying a weakening of bullish pressure and a shift towards bearish control.

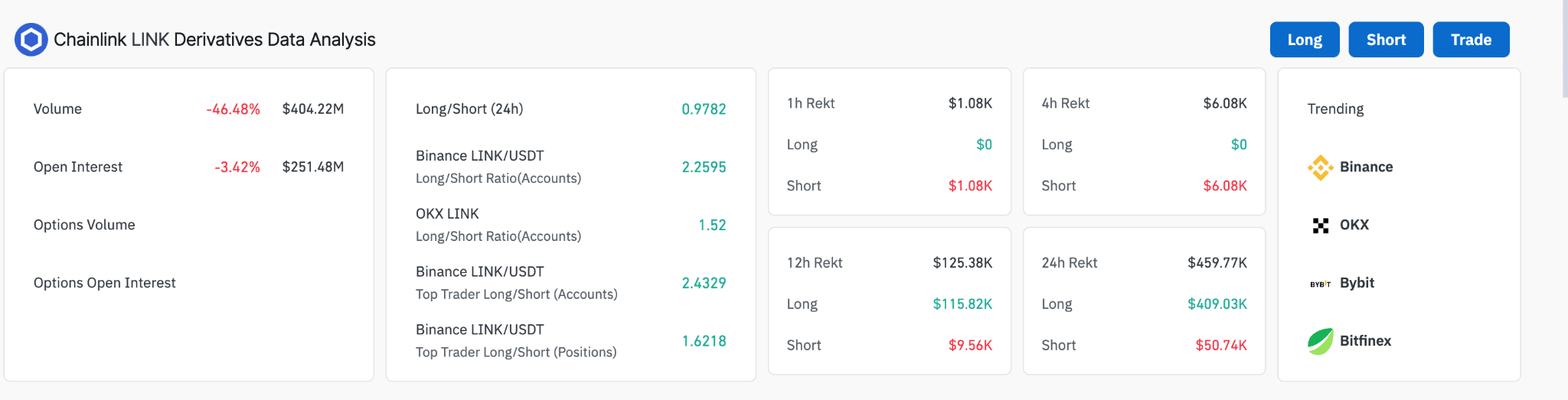

In the derivatives sector of LINK, there’s been a significant decrease in trading activity. This is evident in the 46.48% reduction in volume, suggesting that traders have pulled back substantially and altered the market’s previous bullish trend.

In the past 24 hours, the number of short positions exceeded the number of long positions, as indicated by a ratio less than one. This implies a greater preference for selling among traders.

On Binance and OKX, the attitude of top traders is somewhat optimistic, but the preponderance of short positions among the larger trading community indicates a complex market stance at the very least.

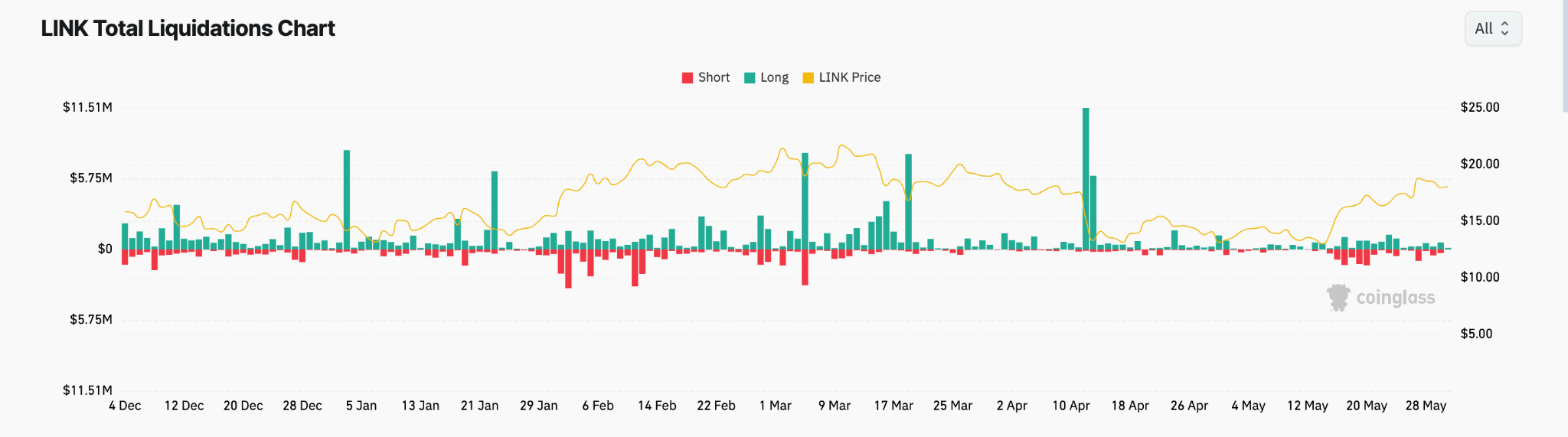

The liquidation chart for LINK reveals a market characterized by sudden price reversals, resulting in frequent disappointments for buyers and potential financial setbacks.

Based on its unpredictable pattern and the current decrease in both trading activity and outstanding contracts, it seems likely that LINK may continue to follow the bearish trend for an extended period.

Hitting $20 before Ether ETFs start trading seems highly unlikely.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-01 02:15