-

Traders have taken short positions against LINK

At press time, LINK was trading in the negative for the third straight day

As an experienced analyst, I believe that Chainlink (LINK) is currently undergoing a challenging phase with bearish sentiment dominating the market. Over the past three days, LINK has witnessed a significant decline in price and breached several critical support levels. This downturn could potentially lead to sustained bearish pressure and further downward movement in LINK’s price.

As a researcher studying the cryptocurrency market, I’ve noticed that Chainlink (LINK) is currently facing one of its toughest stretches in the past few months. In just the last 24 hours, we’ve seen several crucial support levels give way, causing a noticeable downturn in LINK’s price. This price decline has resulted in a shift in market sentiment, with sellers now taking control and driving demand. Over an extended period, this could mean that bearish pressure continues to build on LINK, potentially leading to even more price drops.

Chainlink breaks support

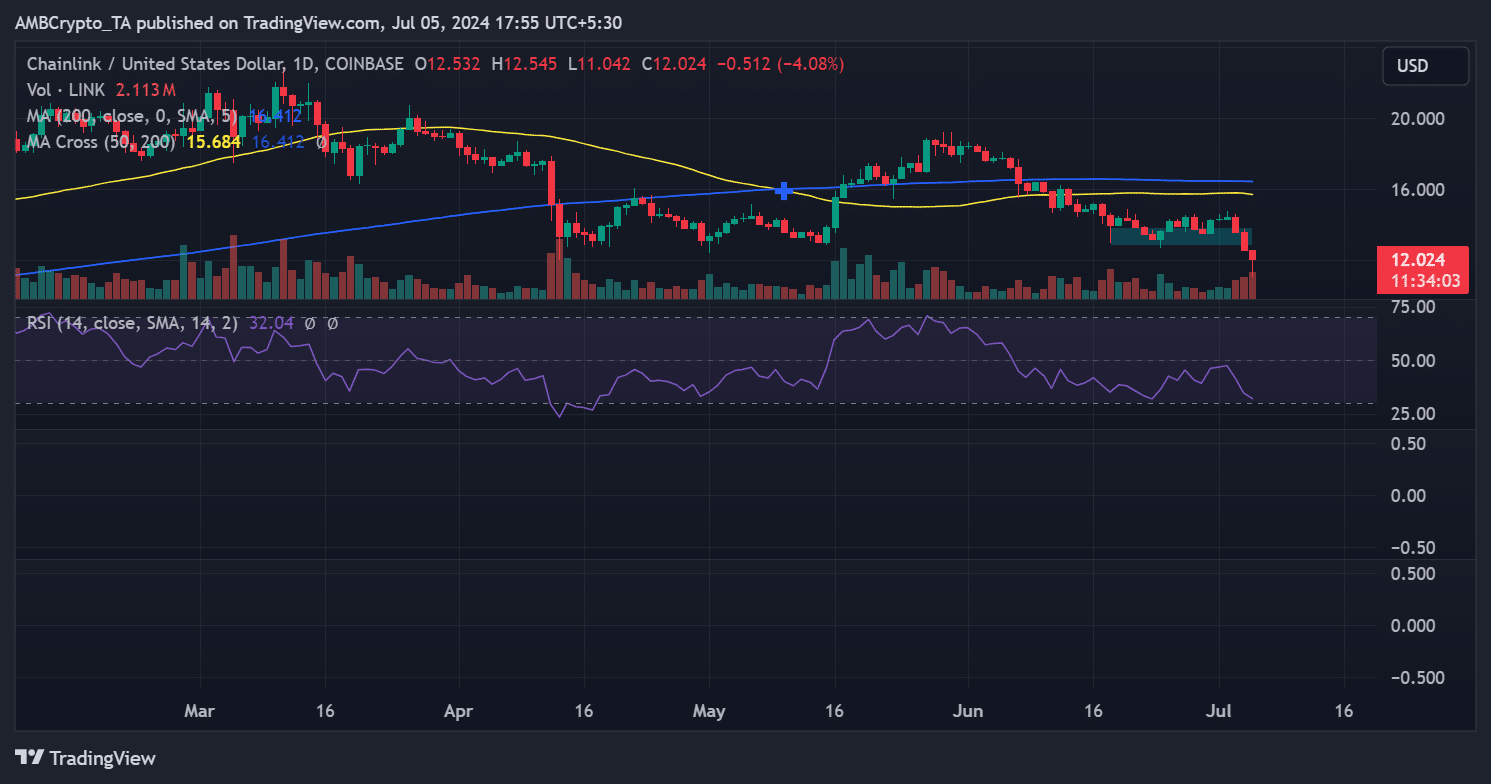

Over the last three days, the price of Chainlink (LINK) has been heading downward. Specifically, there was a 5.70% decrease initiated on June 3, causing the price to approximate $13.5.

The next day, the altcoin experienced a decrease of 7.66%, causing its price to dip down to roughly $12.5. Currently, it is being traded at approximately $12 following another drop of more than 4%.

As a researcher examining Chainlink’s price action, I discovered an intriguing development. The technical indicators showed a noticeable reversal. Specifically, the long-term moving average, denoted by the yellow line, and the short-term moving average, signified by the blue line, switched roles. Instead of serving as support levels, they now acted as resistance points.

These resistance levels are now at the price levels of $15.6 and $16.2.

Previously significant support zones for the altcoin, priced at approximately $13.8 and $12.8, have now transformed into barriers of resistance as a result of the cryptocurrency’s decline.

The data suggests a significant increase in demand to sell LINK in the current market, which could prevent this altcoin from exhibiting a trend reversal.

Sellers take charge of LINK’s market

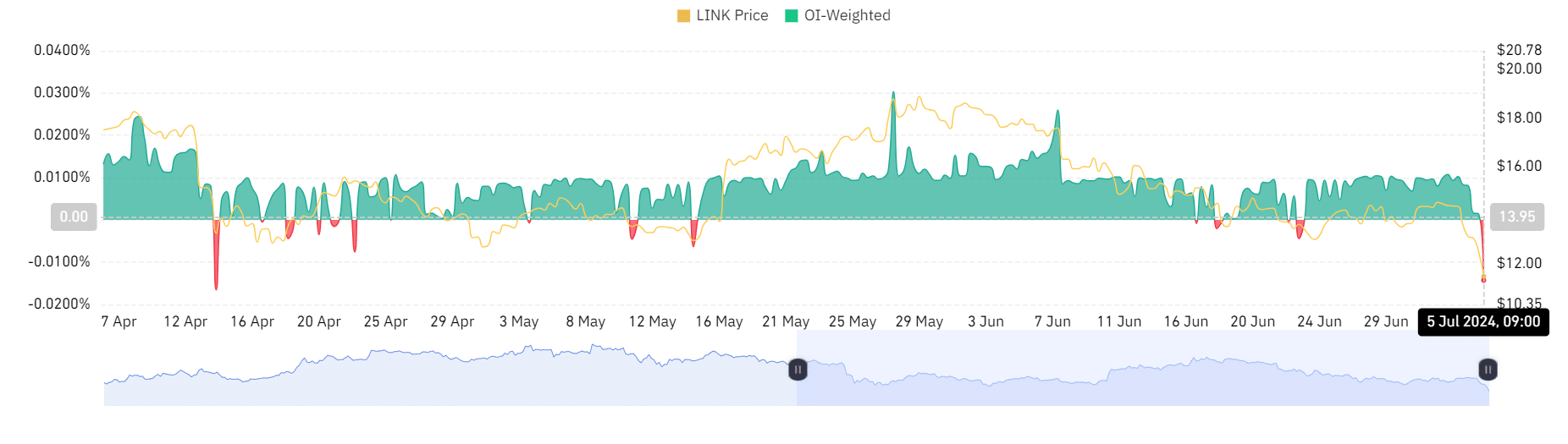

I conducted an examination of the weighted funding rates on Coinglass and identified a substantial change within the past 24 hours. Prior to market close on July 4th, the funding rate experienced a significant decrease, dropping down to approximately 0.0016%.

Despite a decrease, there was continued buyer enthusiasm as the figure remained positively above the zero mark – Indicating a slightly optimistic outlook.

Yet, another dataset revealed some noteworthy findings – the funding rate dropped dramatically to a low of -0.0143. This significant decrease indicates a possible change in market behavior, suggesting that sellers are now dominating over buyers. The negative funding rate signifies an increased number of traders holding short positions and anticipating LINK‘s further decline.

Where will Chainlink go from here?

The funding rate forChainlink, which takes into account opened long and short positions, indicates a large number of short positions currently held. This implies a dominant bearish attitude among traders. To change this trend, investors would have to put in considerable effort to flip the market sentiment around.

As a researcher examining the market trends, I noticed that Chainlink’s Relative Strength Index (RSI) was getting close to dipping below the 30-mark. Once the RSI falls beneath this level, we can label it as having entered the oversold territory.

Historically, delving into this area has the power to spark a market reversal. Buyers, sensing an opportunity, may perceive the asset as underpriced and begin amassing it, thereby potentially pushing up prices. As such, current market circumstances could pave the way for a potential turnaround if buyers react to supposedly low prices.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-07-06 05:11