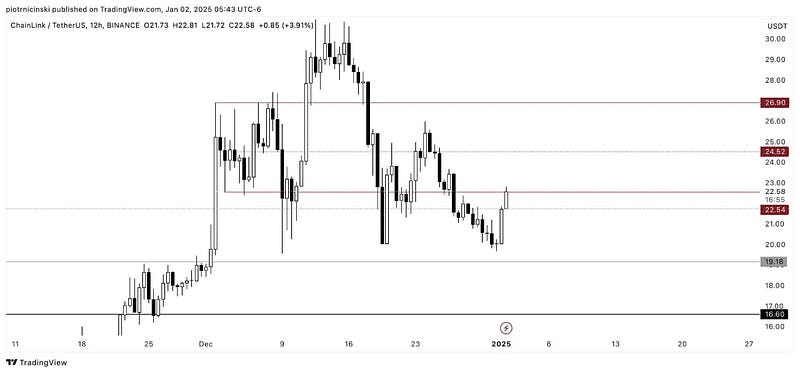

- LINK found significant support at $22.54, previously a resistance level.

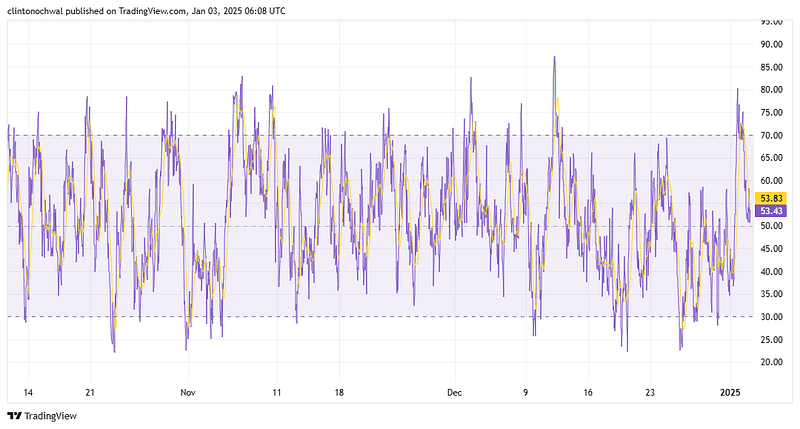

- Historically, rising Open Interest during a consolidation phase, as seen in LINK’s chart, often precedes a significant price move.

As an analyst with over two decades of trading experience under my belt, I’ve seen more market cycles than I can count on one hand. Having witnessed the crypto boom and bust, I can confidently say that Chainlink [LINK] is a gem in this digital landscape.

Recently, LINK has demonstrated resilience at new support levels, which could potentially set it on a path to new all-time highs. However, as we’ve learned from the markets, past performance is no guarantee of future results, and traders should remain vigilant.

In the 12-hour chart, LINK found significant support at $22.54, previously a resistance level. This classic “support flip” has me speculating whether we’re witnessing the early stages of another bull run. The Relative Strength Index (RSI) hovering near 50 suggests market indecision, as LINK struggles to close decisively above $22.58.

Open Interest for LINK has seen a steady increase in recent days, signaling heightened trader activity and interest in the market. This rising OI during consolidation phases often precedes significant price moves. If the price breaks above the $24.52 resistance, we could see an influx of new positions, further driving OI upwards.

However, if LINK falters and dips below $22.01, OI could decline as traders liquidate positions to minimize risk. This trend emphasizes the importance of monitoring OI alongside price action to effectively predict potential breakouts or breakdowns.

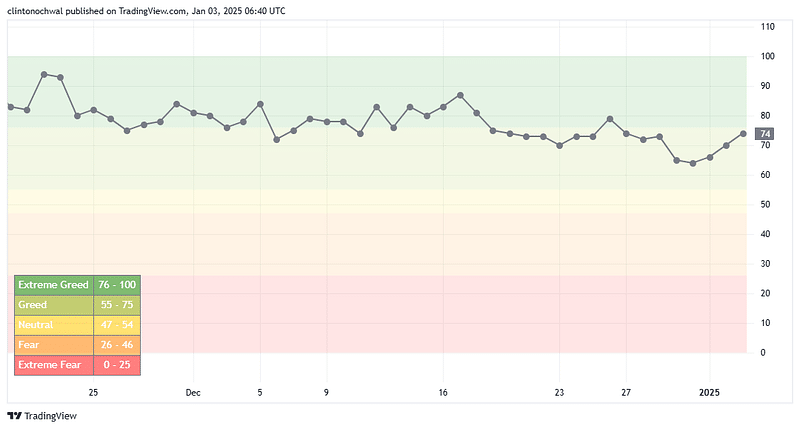

The Crypto Fear and Greed Index recently registered a reading of 64, indicating growing optimism among market participants. While this suggests increasing confidence, often aligning with price surges, I’ve learned that elevated greed mostly precedes short-term corrections. So, while LINK may attempt to challenge the $26.90 level or higher if sentiment pushes further into the extreme greed zone (above 76), it’s essential to remain cautious and be prepared for any potential pullbacks.

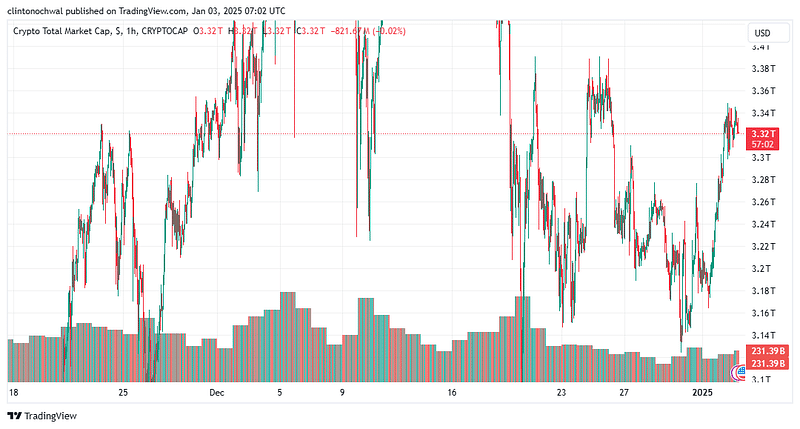

In conclusion, Chainlink’s performance mirrors the broader market dynamics. The coin’s consolidation around the $22.54 support level reflects the market’s hesitancy to make significant upward moves. A sustained increase in the Total Market Cap above $3.65 trillion could serve as a bullish catalyst for LINK, pushing it toward $26.90 and potentially $30+. Conversely, a decline below $3.2 trillion may reinforce bearish sentiment, causing LINK to re-test lower levels.

And remember, in the world of trading, the only thing certain is uncertainty. As they say, “I’d rather have a bottle in front of me than a frontal lobe.” Cheers!

Chainlink (LINK) is recognized for its significant function in linking smart contracts with real-world data feeds. Lately, it has displayed encouraging trends in its price fluctuations.

The robustness shown at these fresh support points hints towards a potential surge above current levels, possibly propelling it towards unprecedented peak values.

On the other hand, previous patterns and external indicators show conflicting signs, urging traders to stay alert.

Resistance turns to support

On the 12-hour graph, LINK encountered strong backing at approximately $22.54 – a price point that was earlier acting as a resistance level. This notable reversal of roles, where resistance transforms into support, has sparked speculation among traders about whether this digital coin will resume its upward trend.

At the moment, the Relative Strength Index (RSI) was found close to 50, indicating that the market’s overall sentiment is currently neutral.

TradingView

At present, the market seems undecided, as the ongoing consolidation mirrors LINK’s difficulty in definitively surpassing $22.58. Typically, this type of pattern signals an upcoming breakout or breakdown.

Based on my extensive experience analyzing financial markets, I believe that if LINK manages to break through its next resistance level at $24.52, it could potentially reach $26.90 or even higher. However, it’s crucial to keep an eye on the support level at $22.54, as a failure to hold this position might lead us back to re-testing the $19.16 region. I have seen similar patterns in other assets throughout my career, so it’s essential to be cautious and adapt your strategies accordingly.

TradingView

Based on the double increase in revenue for Chainlink software services between 2022 and 2023, increased institutional investment might lead to a positive trend (bullish push).

While past price trends suggest that LINK may continue to move cautiously within this range, given its volatile short-term fluctuations, traders are advised to keep a close eye on the RSI and price dynamics for more distinct signs.

Open Interest analysis

As a seasoned trader with over two decades of experience in the financial markets, I’ve learned to pay close attention to Open Interest (OI) levels as they often provide valuable insights into market sentiment and dynamics. Recently, I’ve noticed that Open Interest for LINK has been steadily increasing, which is a clear sign that both bullish and bearish traders are showing renewed interest in the market. This trend suggests heightened activity and a potential shift in market conditions, which could lead to increased volatility and potentially profitable opportunities for those who can capitalize on it.

In my experience, such a surge in OI often precedes significant price movements, as traders with opposing views engage in a battle of wits, pushing the price back and forth until one side eventually gives way. In this case, LINK’s OI has climbed by approximately 8%, indicating that both bullish and bearish traders are committed to their positions, which is an encouraging sign for those looking to enter the market.

While past performance is not a guarantee of future results, I believe that keeping a close eye on these trends and adapting my strategy accordingly can help me navigate the complex world of cryptocurrency trading more effectively. In the coming days, I’ll be monitoring LINK closely and looking for opportunities to capitalize on this renewed interest in the market.

In the past, an increase in Open Interest (OI) during a period of consolidation for assets like LINK has frequently been followed by a major price shift. If the price surpasses the $24.52 resistance level, it may trigger a wave of new positions, potentially causing Open Interest to climb even higher.

If LINK falls and drops below $22.01, Open Interest (OI) might decrease because traders may choose to close their positions to reduce risk. Paying attention to OI in tandem with the price movement can help anticipate possible breakouts or downturns more accurately, underscoring its significance in trading analysis.

Market sentiment remains neutral

In simpler terms, the Crypto Fear and Greed Index has just shown a value of 64, which suggests that people are feeling particularly optimistic about cryptocurrencies right now. Earlier, the index had been indicating a more neutral mood, but this new reading indicates a significant increase in bullishness or confidence among investors.

TradingView

Historically, a score over 60 typically indicates an increase in confidence, which can coincide with price increases or asset acquisition. In the case of LINK, this rising sense of greed could result in continuous buying interest, possibly causing the price to exceed its current resistance at $24.52.

Nevertheless, investors need to exercise caution. Excessive enthusiasm often leads to temporary adjustments, since selling for profits becomes more common in overexcited market scenarios.

If the sentiment continues to escalate beyond 76 into the extreme greed territory, LINK might aim to surpass the $26.90 mark or even exceed it. On the flip side, if sentiment moderates and moves towards neutral levels, LINK could potentially revisit the $22.01 price point or even lower.

Broader market trends

The total value of all cryptocurrencies combined, an essential indicator used to assess the general condition of the crypto market, has bounced back from approximately $3.2 trillion and is currently hovering near $3.3 trillion.

The ongoing recovery is in line with the broader market’s tentative positivity, fueled by increasing institutional attention towards altcoins like Chainlink (LINK), Solana (SOL), and Ethereum Name Service (ENA).

Yet, despite this, the overall market capitalization has yet to surpass its previous peak of $3.65 trillion, suggesting that the market may still be going through a period of correction.

TradingView

In simpler terms, Chainlink’s price movement follows the general trend in the crypto market. Its persistent presence near the $22.54 support suggests that the market is cautious about initiating substantial upward price jumps.

If the overall market capitalization consistently surpasses $3.65 trillion, this could act as a strong signal for Chainlink (LINK), propelling it towards approximately $26.90 and possibly beyond $30. On the flip side, a drop below $3.2 trillion might intensify negative expectations, potentially driving LINK back to lower price points.

As an analyst, I consistently monitor external elements like regulatory changes and broader economic patterns, understanding that these factors significantly impact the overall market capitalization, including LINK.

Last year’s financial disclosures by the UK government showing that Chainlink nearly doubled its earnings in 2023 highlight the increasing practical value of blockchain technology, which could draw even more investment towards this sector.

Chainlink continues to stand out as one of the most intriguing ventures within the cryptocurrency sector, boasting substantial financial gains and escalating attention from established institutions. However, the current technical configuration and overall market mood point towards consolidation. Nevertheless, it’s essential to acknowledge that a significant surge remains a possibility that should not be overlooked.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2025-01-04 01:12