- Whale withdrawals and resistance tests highlighted Chainlink’s pivotal position at $24–$25.

- Mixed on-chain metrics and declining exchange reserves suggested reduced selling pressure but uncertain momentum.

As a seasoned researcher with a penchant for deciphering market trends and a knack for reading between the lines of whale activity, I find the recent developments surrounding Chainlink (LINK) particularly intriguing. The series of whale withdrawals from Binance, totaling over $17M in LINK, have left me pondering whether we’re witnessing a long-term confidence play or a prelude to a major market event.

Over the past week, whale activity has stirred the Chainlink [LINK] market, as a whale withdrew 594,998 LINK, valued at $17.31M, from Binance, including a recent 65,000 LINK withdrawal worth $1.81M.

As a researcher, I find myself pondering over this recent shift – do these actions point towards lasting optimism or anticipation for substantial market fluctuations? Currently, LINK is being exchanged at $24.63, representing a 9.11% decrease in the last 24 hours.

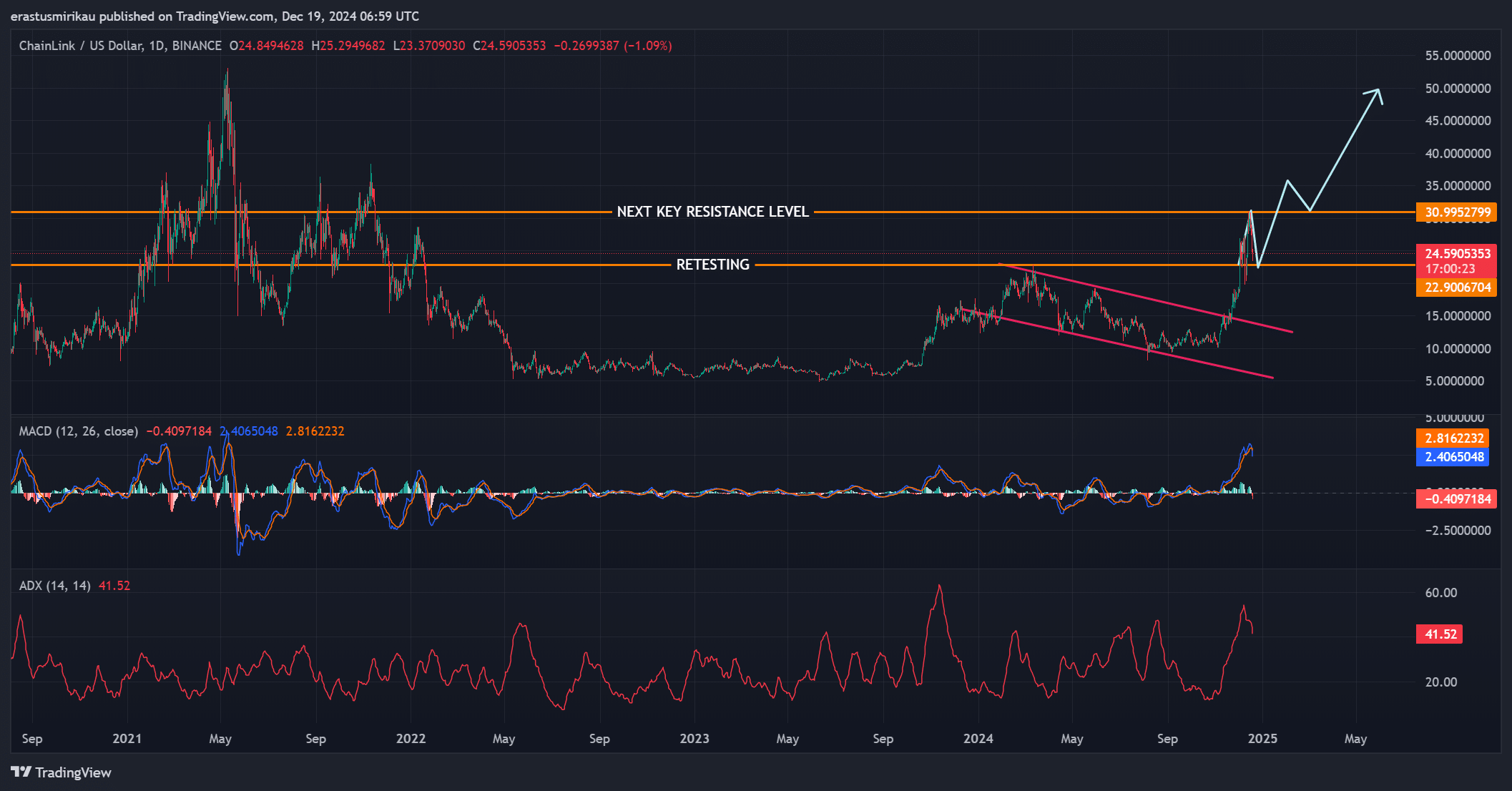

Analyzing price momentum and resistance levels

Currently, Chainlink is undergoing important tests at the resistance range of $24-$25, which historically has served as a strong hindrance during market uptrends. The Moving Average Convergence Divergence (MACD) indicates ongoing bullish energy, but it seems this momentum might be weakening.

Moreover, the high ADX value of 41.52 underscores the robustness of the prevailing trend. Should LINK successfully breach the current resistance, its subsequent objective lies at $30.99 – a significant psychological and technical milestone.

Maintaining the current pace is crucial to avoid a potential retreat back towards the $22 level, which serves as a significant area of support.

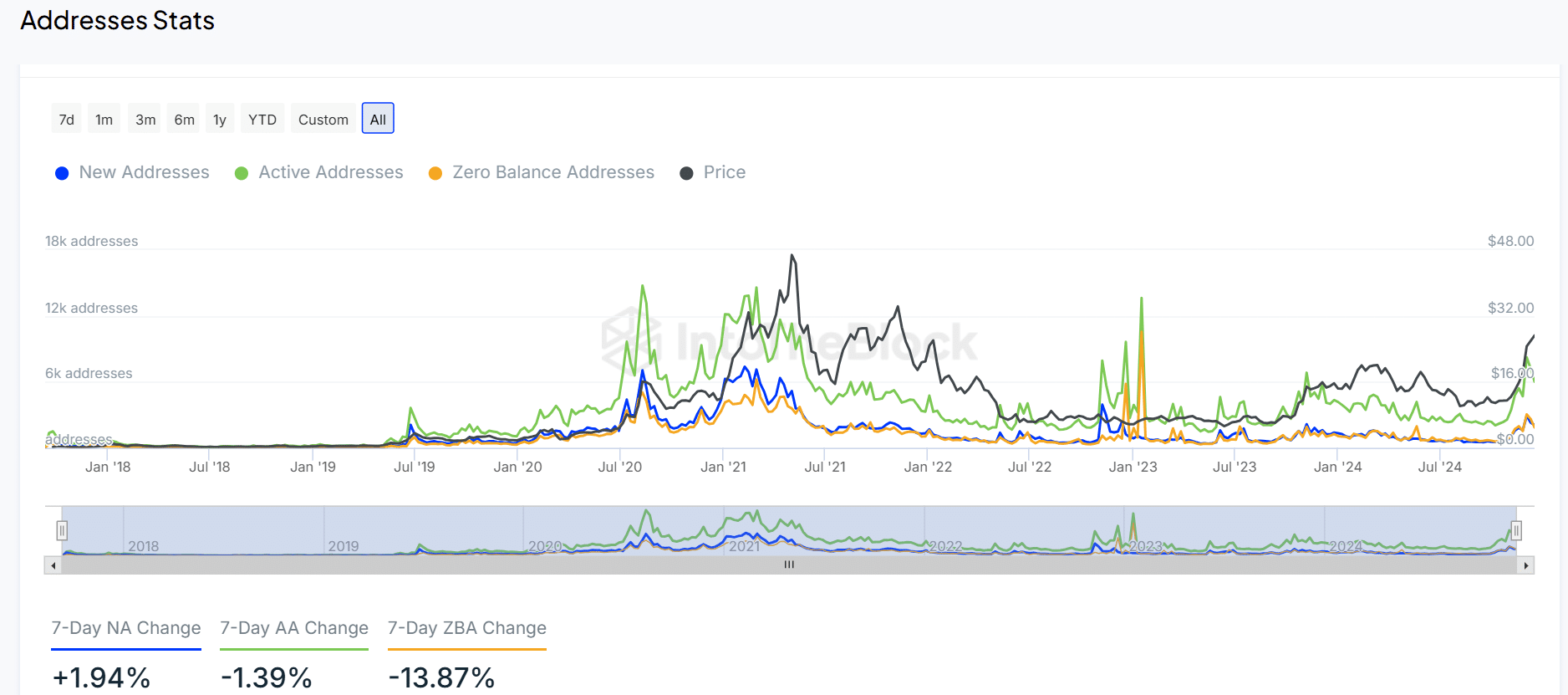

LINK address activity reveals mixed trends

The data from on-chain analysis reveals divergent patterns in the usage of LINK. There’s a growth of 1.94% in newly created addresses, hinting at newfound curiosity. Yet, the number of active addresses has decreased by 1.39%, suggesting a slight drop in user interaction.

Furthermore, there’s been a notable decrease of around 13.87% in the usage of zero-balance addresses. This suggests that LINK holdings are being moved to wallets more often, which could mean increased confidence among long-term investors. However, this pattern also hints at both growing curiosity and apprehension about the asset’s immediate future direction.

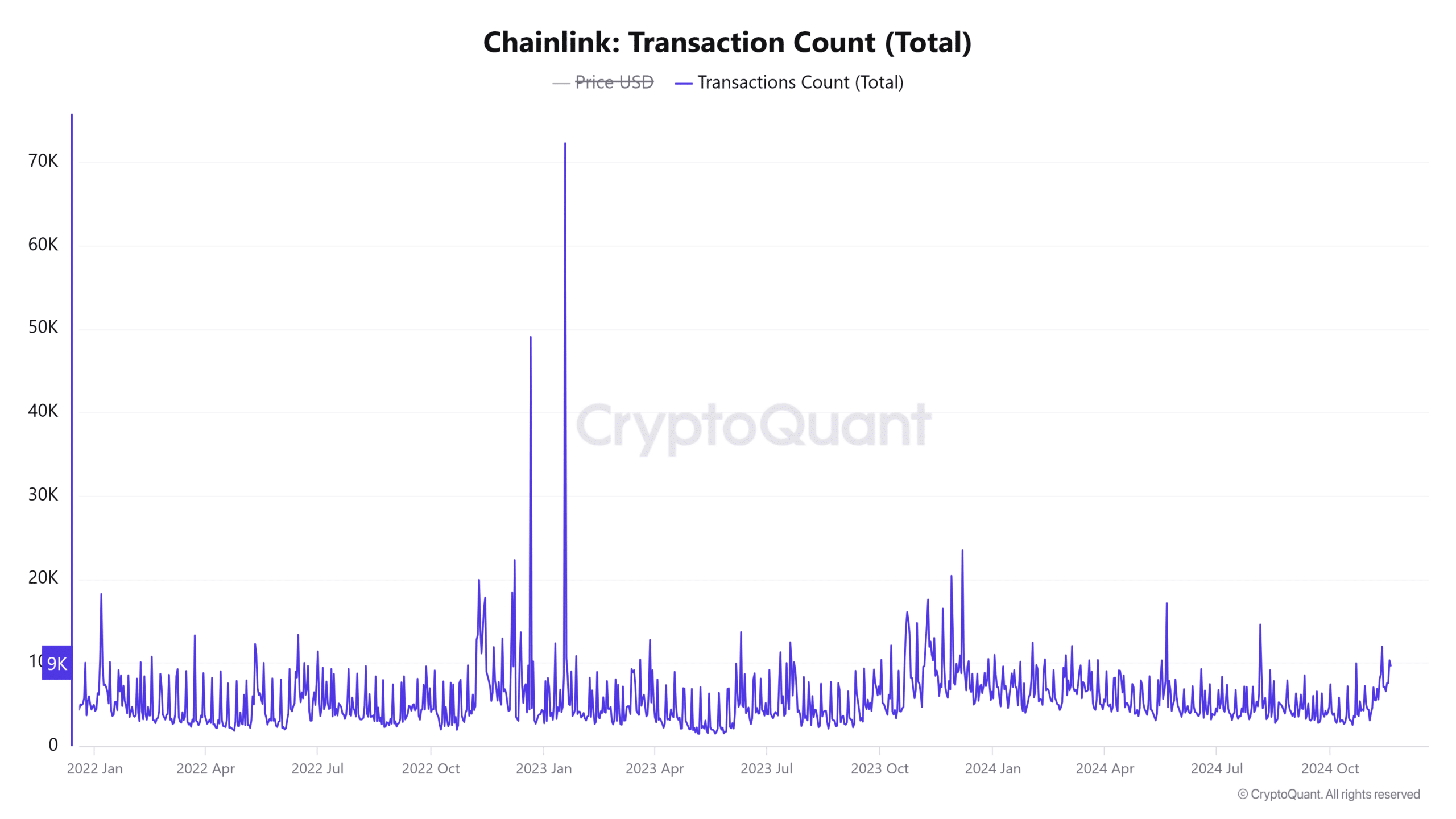

Transaction count reflects growing market activity

Transaction activity has seen steady growth, further reinforcing the narrative of increased market engagement. Over the past 24 hours, the transaction count rose by 0.69%, reaching 12.11K transactions. This uptick points to a growing number of participants actively adjusting their positions.

It’s uncertain if these moves are due to whale activities or general market conditions. Yet, the increase in trading activity hints at a market gearing up for potential major price fluctuations.

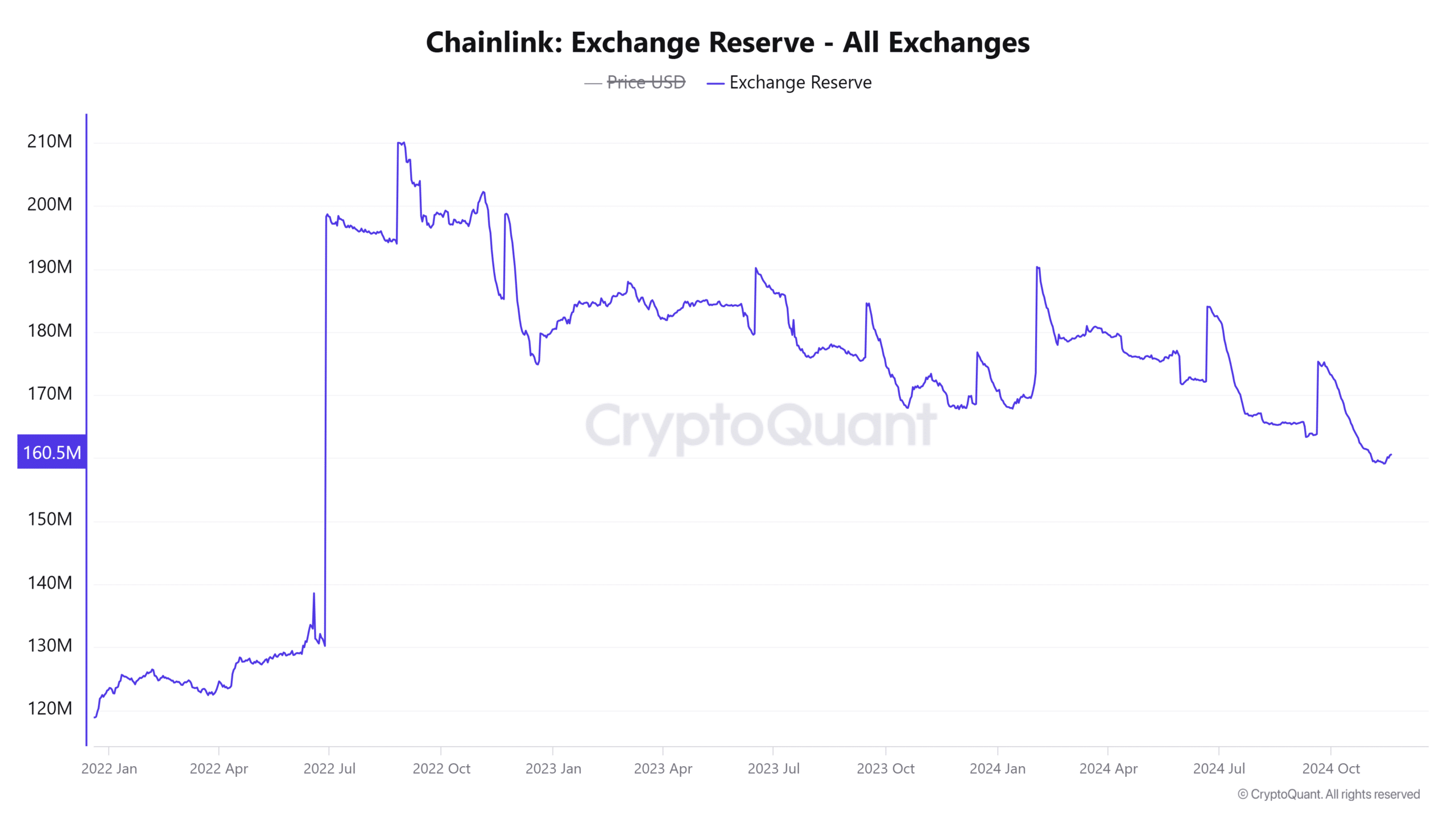

LINK exchange reserves show lower selling pressure

Exchange reserves for LINK have declined slightly by 0.17% over the past week, now standing at 163.1489M LINK. This drop aligns with whale withdrawals and suggests a reduction in immediate selling pressure as large quantities of LINK move off exchanges.

A decrease in available reserves can suggest increased confidence among holders since it usually means coins are being moved to long-term storage from exchanges. However, this pattern can boost optimism (bullish sentiment), yet it’s essential to exercise caution due to the reduction of liquidity as the supply shrinks.

Currently, the latest whale transactions and price obstacle tests have put Chainlink in a crucial standpoint. Should LINK maintain its current pace and successfully breach the vital resistance area, a bullish surge seems very likely.

If the momentum weakens, it seems likely that LINK may head towards lower support areas. Whether or not LINK can surpass the $25 resistance level will dictate its immediate market trend.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-19 13:11