Ah, the glorious dance of markets—where the weak falter, and the confident rise! Despite the whispers of short-term weakness, on-chain data and various key indicators paint a picture of growing investor confidence, though not without a few delightful bumps along the way. 🏞️

Technical signals suggest that accumulation continues, even as LINK hesitates below its breakout zone. So, here we are, wondering whether bulls can muster enough strength to break through that pesky $19.50 resistance and make a run for the coveted $21.71 ceiling. 🍿

Technical Structure Stumbles, But LINK Holds its Ground (Barely)

On our beloved daily chart, LINK is perched at a modest $18.42—an oh-so-polite 1.66% intraday gain. Since June, it’s been playing the game of higher lows and higher highs, although recently it met a rather curt rejection at $19.53. Ouch! Talk about hitting a glass ceiling! ✨

That rejection coincides with the top resistance zone hanging around $19.50 to $21.70—the sweet spot where LINK’s last rally met its untimely end. Until a breakout occurs, LINK remains trapped in consolidation limbo. Sigh.

buying pressure is still here, folks! The CMF’s positive readings over July give us hope, though rising volume is the key to confirming this move toward the stars. 🚀

The Bull and Bear Power (BBP) is currently reading +0.38, showing that bulls are still holding the reins, but their energy seems to be waning. That flattening BBP histogram is like a toddler who’s just about to crash after too many cookies—either we get a second wind or a long nap. 😴

A push above $19.50, with BBP’s assistance, could reignite that bullish fervor. If not, well, brace for a potential revisit to $17.00 support. Oh, the drama! 😱

Short-Term Dips, But LINK Stands Tall (Mostly)

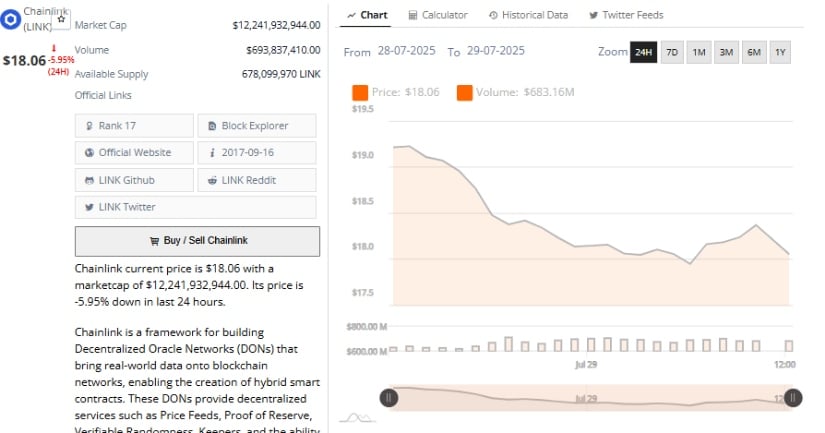

From July 28 to 29, LINK took a little tumble—down by a hefty 5.95%, sliding from around $19.40 to $18.06. The sudden dip looked like a classic case of profit-taking or maybe just a broad market correction. Whatever it was, it didn’t feel good. 🐂💥

Despite the sell-off, volume surged to a not-so-shabby $693 million. More participants, more drama, more excitement! Maybe those buying near the low, or covering their shorts, are in it for the long haul. LINK bounced back to $18.20, but the lack of volume left the rebound a bit flat. A stable $18.50 would do wonders for rekindling that bullish spirit. ✨

Although short-term sentiment might seem a little weak, the long-term structure stays intact. At $17.00, we’ve got psychological support that could keep things from falling apart. If LINK surpasses $19.50 in the coming sessions, we might just see a glorious run to $21.71. But let’s not get ahead of ourselves. 🌌

The Exchange Balances: A Tale of Fewer Tokens, More Hope

Here’s a fun tidbit—on-chain data from Coinglass reveals that LINK balances on centralized exchanges have taken a downward stroll from 160 million in March to a more modest 130 million in July. This could mean less immediate selling pressure. Oh, the beauty of a tighter supply! 👏

This decline in exchange balances hints at long-term accumulation. Fewer tokens up for grabs might mean big things are brewing. After all, this is the same pattern we saw when LINK recovered from $13 to above $18. Can the same magic happen again? Time will tell. 🕰️

With fewer LINK tokens on exchanges, the stage could be set for a potential rally—one where the supply gets tighter, and demand picks up. If this happens, we might just see LINK pushing toward that elusive $21.71 level. Keep your eyes on the charts, folks. It’s about to get interesting. 🎢

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

2025-07-29 21:46