-

LINK prices rose by 4.24% over the past 24 hours.

Analyst eyes $22 if the altcoin holds $12 resistance level.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I’ve seen my fair share of market swings and trends. The recent recovery of altcoins, including Chainlink (LINK), has certainly piqued my interest.

For the past two months, I’ve been closely tracking the altcoin market, and it’s been quite the rollercoaster ride. As I speak now, there appears to be a promising recovery trend in the altcoin market.

With altcoins on an upward trend, Chainlink (LINK) has shown positive responses, notching up modest increases. At this moment, LINK is being traded at $10.23, marking a 4.24% surge over the past 24 hours.

Previously, the value of LINK had been on a steep descent. Reaching $12.6 in August, this digital coin then started to form a falling wedge shape. As a result of this trend, its price plummeted to a minimum of $9.2.

Although LINK has shown some progress recently, it’s currently not far from the $15 peak reached in July. Moreover, its value is roughly 80.6% lower than its all-time high of $50.88.

Consequently, these latest increases have sparked debate over whether this cryptocurrency is set for more growth or if it’s simply correcting the market. Notably, well-known crypto expert Cryptojack thinks that LINK could potentially increase fourfold in value.

Prevailing market sentiment

As per Jack’s assessment, there are two crucial requirements for LINK to reach $22. The experts suggest that LINK’s descending triangle should remain above the $6 resistance point to maintain its upward trend.

He noticed that the altcoin’s falling wedge is nearing a crucial point, and if it breaks below, there could be a subsequent drop.

To expand on this point, the analyst suggests that the price of LINK must escape its descending triangle in order to set the stage for a powerful upward trend. He proposes that an escape from this structure would significantly boost the value of the altcoin, potentially leading to 4 times increase and reaching $22.

According to our analysis, if LINK manages to break away from its current pattern, it could lead to more price increases. Historically, whenever LINK breaks out of a descending triangle, it has seen substantial growth. For example, it previously went up from a local minimum of $8.0 to a local maximum of $12.6.

What LINK charts suggest

Without a doubt, Jack’s conditions paint an optimistic picture. But, let’s also consider what other market signs suggest.

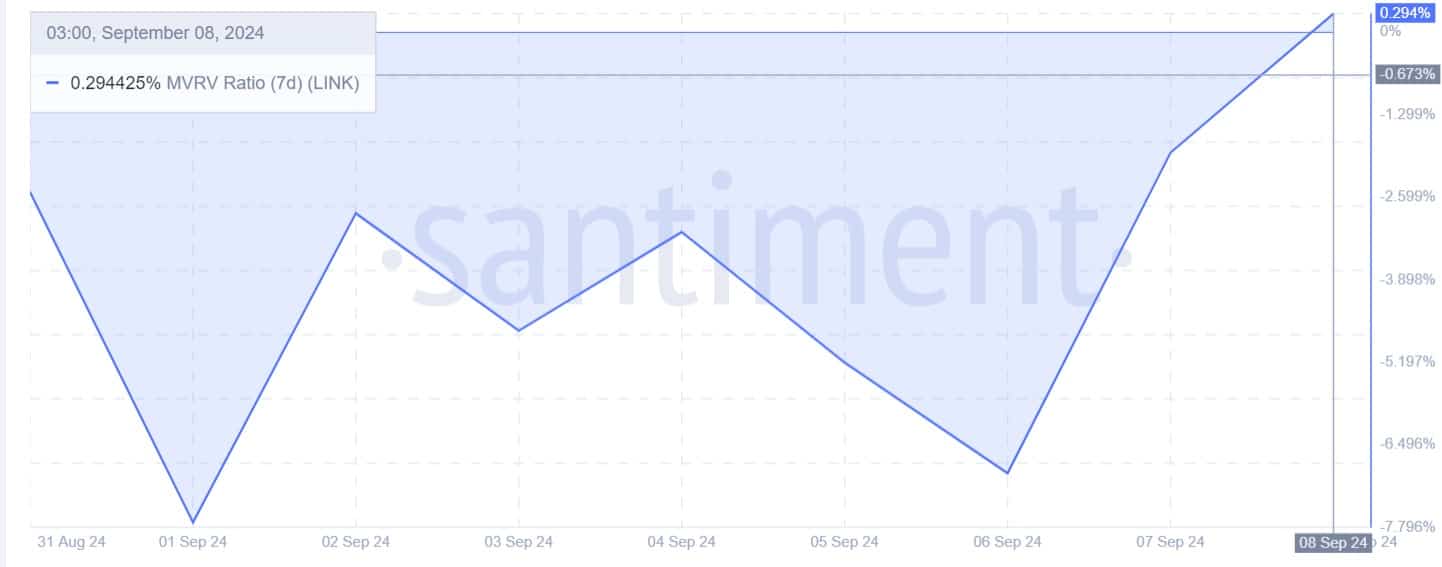

Initially, the Market Value to Realized Value (MVRV) ratio of Chainlink has recently shifted into positive territory following a prolonged period of negative values. Over the past week, the MVRV has predominantly remained negative.

In my analysis, as I’m writing this, the MVRM (Market Value to Realized Value Ratio) has moved positively to 0.29. This transition from negative to positive suggests a market rebound, as the current market value surpasses the realized value, signaling an upward trend.

As a researcher observing the market, I’m noticing a transition towards a recovery phase, marked by an uptick in bullish sentiments. This shift is evident in the growing demand and optimism that characterizes current market behavior.

Moreover, there’s been a rise in LINK‘s open interest across different exchanges during the last seven days. Consequently, open interest on these platforms have shown signs of activity this week.

It has increased rom a low of $36 million and settled at $40 million. The increase in open interest per exchange shows more investors are betting on further price increases.

This indicates a positive or optimistic trend since investors are buying new assets and also willing to pay extra to secure their investments, even if the market might potentially drop.

If the price ranges from $10 to $12, it’s likely to increase. If the daily candlestick ends above $10.5, the LINK token might have a favorable setup for trying to break through the near-term resistance at $15.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-08 16:08