-

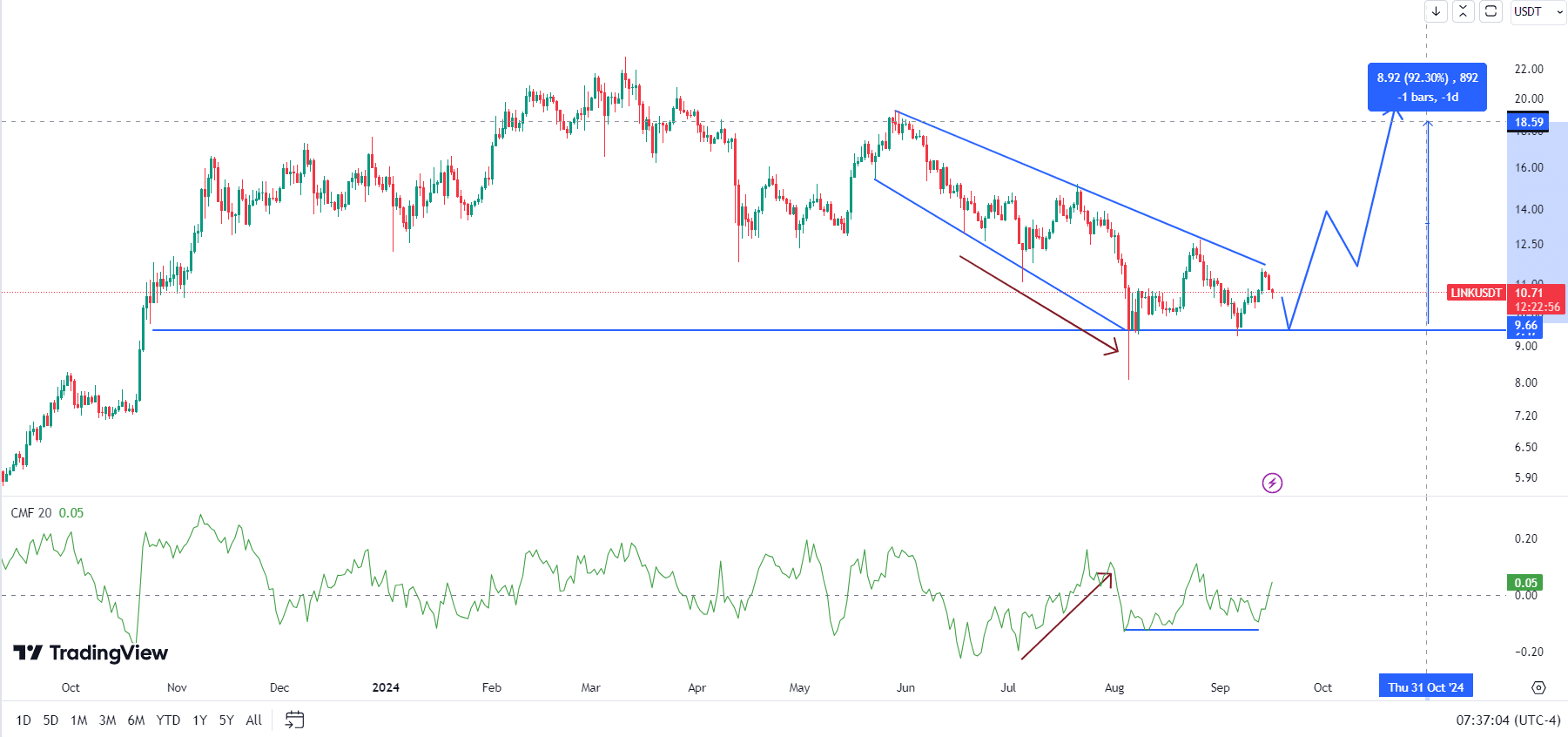

Chainlink formed a double bottom at press time.

LINK whales were buying more tokens.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I find myself consistently drawn to Chainlink (LINK) as one of the most promising projects out there. The recent price action and technical indicators are truly captivating, and it seems like LINK is poised for a significant upward move.

Chainlink (LINK) is a notable cryptocurrency worth keeping an eye on, with its market capitalization surpassing the $6.4 billion mark, positioning it at number 14 on CoinMarketCap’s list.

Lately, the trends in the LINK/USDT exchange rate are proving promising for traders seeking profitable opportunities, whether they’re looking at short-term or long-term returns.

On a day-to-day basis, Chainlink’s price has created significant chart formations, such as a widening triangle.

Near the $9.5 mark, a robust base or ‘floor’ has developed, strengthened by a double bottom formation that might even see a third touch, typically indicating an impending shift towards price increases.

This level is becoming increasingly important for LINK’s price as it pulls back toward this zone.

A surge past the upper boundary of the triangle might suggest that the price increase will continue, especially if it rebounded from the $9.5 support point.

Furthermore, the Chaikin Money Flow (CMF) showed a positive value, implying strong buying activity, supporting the possibility of an increase in price.

A difference often arises when the cost is falling while the Chaikin Money Flow (CMF) increases, which might indicate that a price reversal may soon take place.

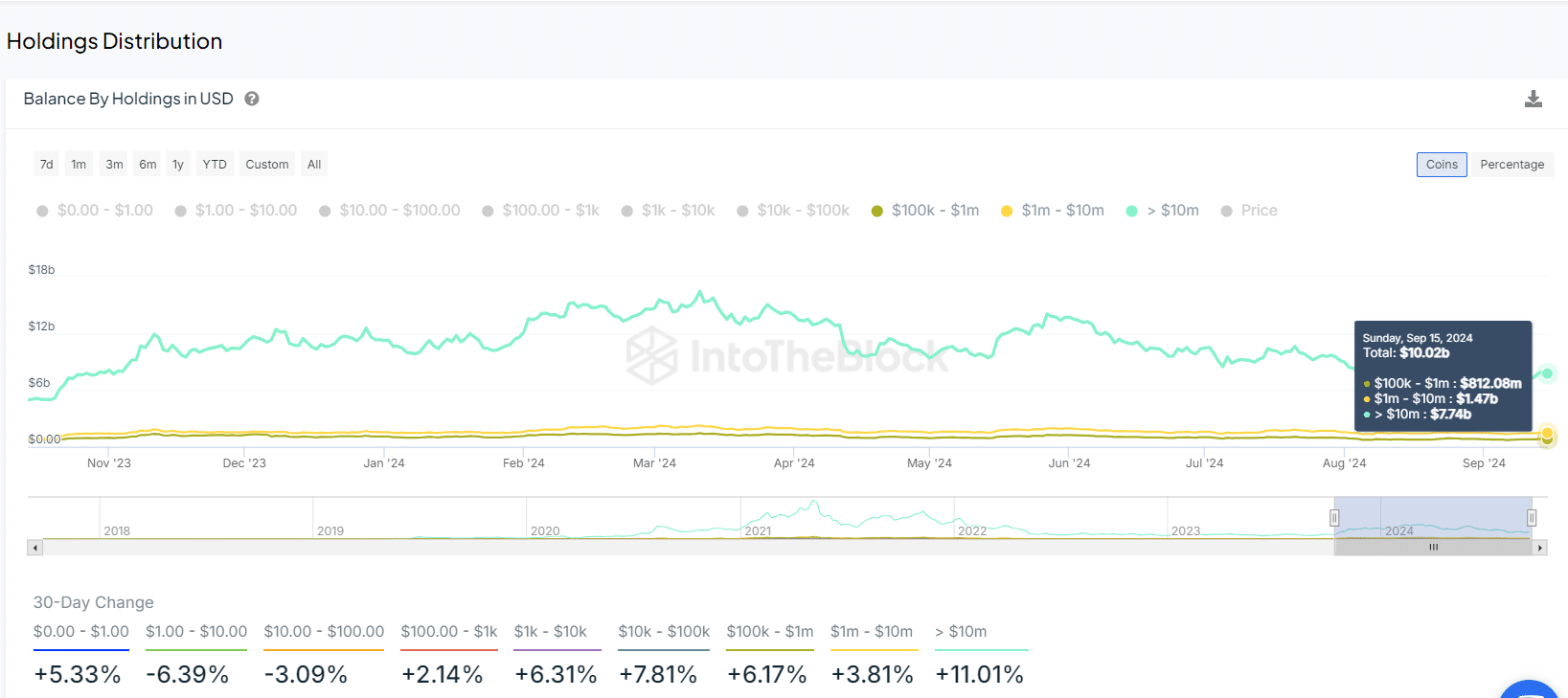

LINK balance by holdings

A significant factor to consider is the distribution pattern of Chainlink tokens, which lends credence to a positive projection.

Over the past 30 days, there was a noticeable growth in LINK holdings across various investment groups, ranging from individuals owning as little as $100 in LINK to high-value investors with more than $10 million in LINK.

As an analyst, I’ve observed a significant increase in whale activities, these influential entities in the market have been expanding their holdings of LINK. Specifically, those holding over $10 million LINK have experienced a 11% rise in their balances, which now totals approximately $7.74 billion.

Large LINK holders who possess more than a million dollars’ worth of this cryptocurrency have observed an uptick in their balances, currently aggregating to approximately $1.47 billion. This consistent amassing by significant investors highlights the burgeoning enthusiasm for LINK.

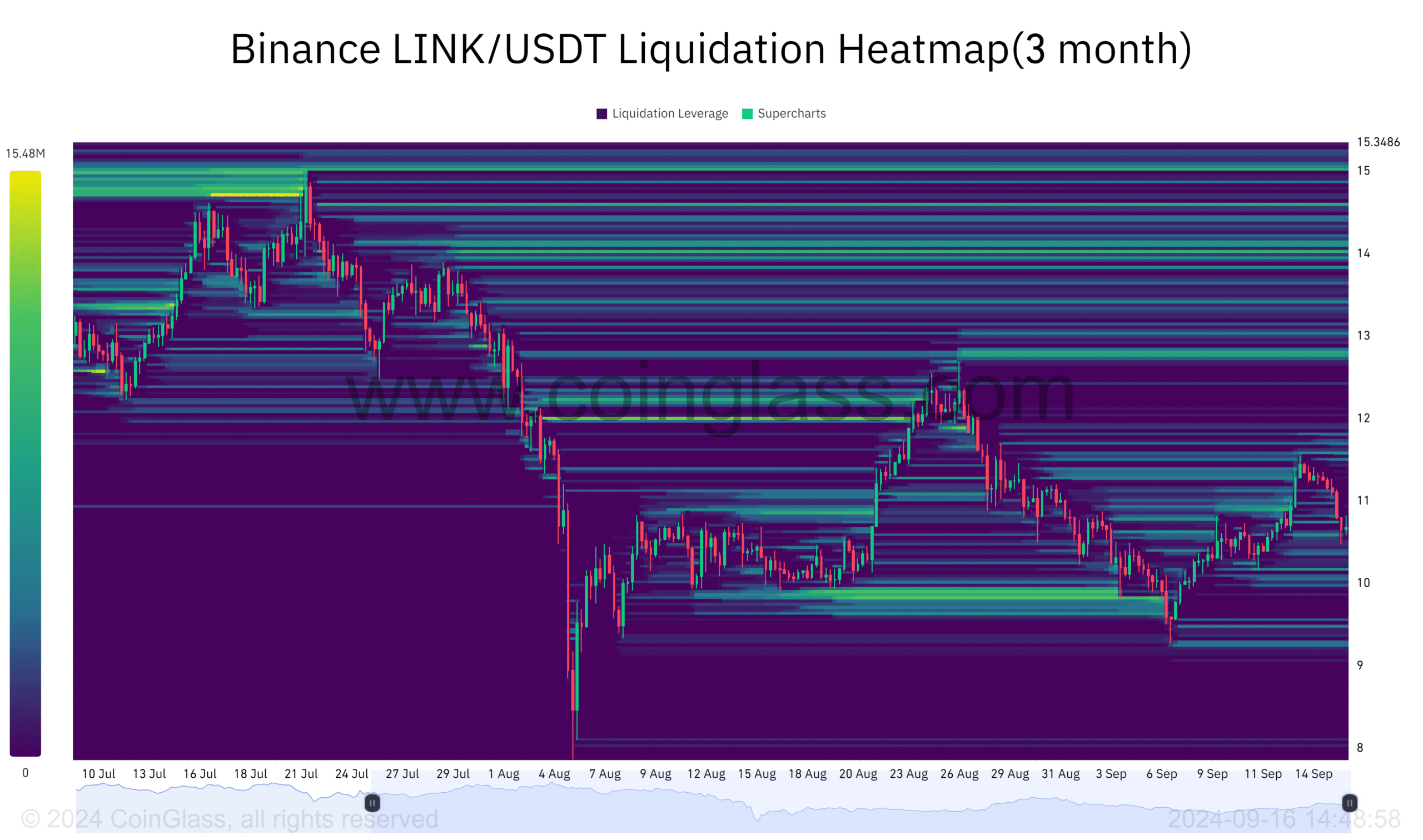

Liquidation levels

The level of liquidity significantly impacts the movements in LINK‘s price fluctuations. Frequently, the price will shift from areas with less liquidity towards regions with more, mirroring a pattern that was evident in the Binance liquidation map.

As a researcher, I’ve observed an interesting development in the LINK/USDT market. The price recently breached the liquidity zones hovering near the $9.89 mark, which saw approximately $9.77 million being traded. Since then, the price has maintained a distance from this particular area.

This indicates a likely move toward the next liquidity target, sitting above $12.81.

Traders might view this point as a temporary goal, offering potential profits if the price moves towards regions with increased trading volume (higher liquidity), potentially even surpassing $14.04.

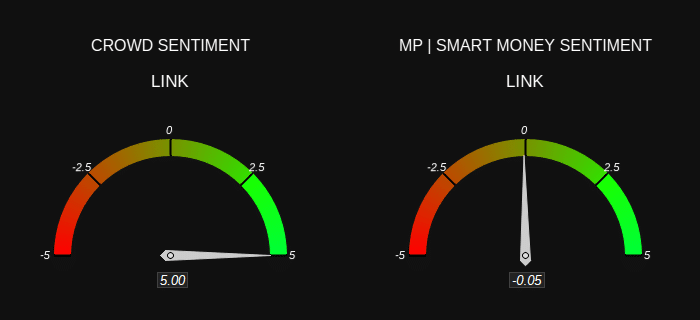

LINK market sentiment

In summary, the perception towards Chainlink among retail investors (often referred as ‘the crowd’) differed significantly from that of institutional investors (or ‘smart money’).

The crowd is notably bullish, while Smart Money is slightly bearish. However, the Smart Money bearish value is weak at -0.05, compared to the strong bullish sentiment of 5 for retail traders.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Generally speaking, there’s a tendency for a positive or optimistic viewpoint regarding LINK‘s future direction, but the actual decision will be determined by the market conditions themselves.

The blend of these technical indicators, fluidity fluctuations, and overall market mood points towards a potential rise in LINK‘s value, making it a promising investment option for the upcoming months.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-09-17 14:16