In the grand theater of the cryptocurrency market, where the plot thickens with every tweet and tariff, Chainlink finds itself in the midst of a tumultuous saga. As the world’s financial stage creaks under the weight of geopolitical dramas and the whims of leaders who fancy themselves puppeteers, LINK is caught in a suspenseful act of consolidation.

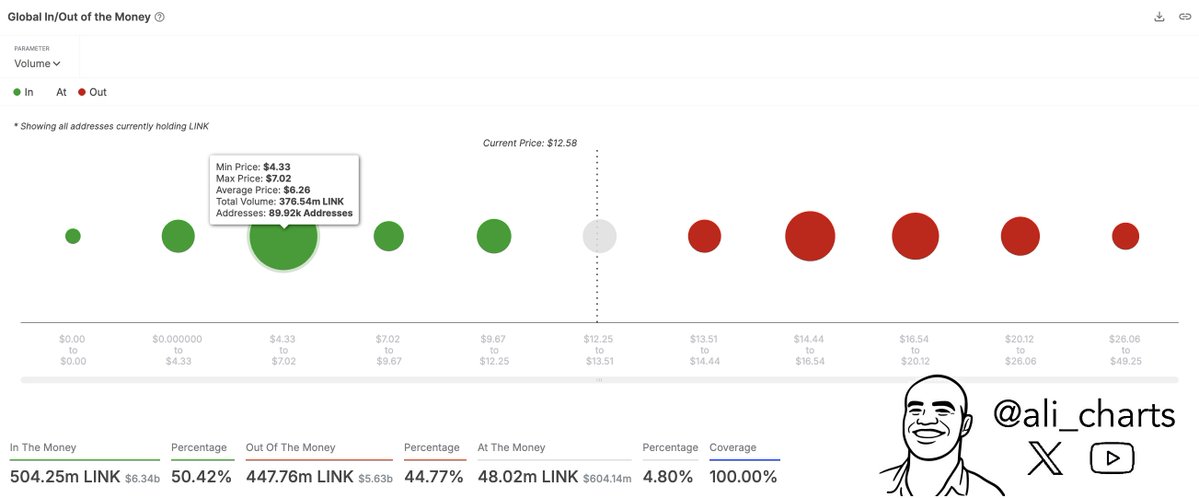

Imagine, if you will, a line drawn in the digital sand at $6.26—a veritable fortress manned by nearly90,000 valiant investors, holding steadfast with their376 million LINK tokens. It is here, at this critical juncture, that the fate of Chainlink hangs in the balance. Will the bulls defend this bastion with the ferocity of a Tolstoyan hero, or will the bears breach the walls and send the price tumbling into the abyss?

As the market’s heartbeat races in sync with the erratic pulse of global finance, all eyes are fixed on Chainlink’s valiant stand. A successful defense could herald a triumphant rebound, a narrative twist worthy of the great Russian epics. Yet, should the line falter, we may witness a tragic descent into the depths of correction—a plot twist none would welcome, save for the most stoic of investors.

Despite the overarching gloom that pervades the crypto landscape, Chainlink remains a beacon of promise in the realm of real-world asset tokenization—a tale of potential growth that reads like a thrilling chapter in the annals of blockchain lore. Its oracle technology, the bridge between the old world and the new, stands as a testament to innovation amid adversity.

But alas, in the short term, LINK’s price mirrors the broader market’s melancholy, down17% since March26. The bulls, though weary, have not yet conceded defeat. They rally at the $12.3 support level, a modest victory in the grand scheme, yet one that offers a glimmer of hope.

Ali Martinez, with data in hand, unveils the magnitude of the $6.26 demand wall—a rallying point of epic proportions. Here, in this digital fortress, the seeds of stabilization are sown, awaiting the resurgence of bullish sentiment to bloom into a full-fledged recovery.

While the specter of further decline looms ominously, the resilience of Chainlink’s support zones offers a narrative thread of defiance. The long-term prospects, particularly in the RWA space, shine brightly, a subplot of enduring interest even as the main narrative unfolds.

At $12.8, LINK holds its ground, a testament to the tenacity of its defenders. Yet, the path to recovery is fraught with challenges. To herald a true revival, the bulls must conquer the $14.6 resistance—a formidable obstacle aligned with both the4-hour200-day moving average and the exponential moving average. Success here would signal a triumphant return to form, a narrative twist that could rally the troops and reignite the flame of investor enthusiasm.

But beware, dear reader, for the tale is not without peril. Should the $12.3 demand zone crumble, the specter of further decline beckons—a descent towards the $10 mark, a psychological threshold that looms like a shadow over the narrative. In these uncertain times, LINK stands at a crossroads, its fate intertwined with the broader market’s ebb and flow.

As the curtain rises on the days to come, all eyes remain fixed on Chainlink’s next move. Will it reclaim its lost glory, or will it succumb to the forces of correction? Only time will tell, in a saga as unpredictable and captivating as any penned by the great Tolstoy himself. 🎭📈

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-04-05 14:12