- LINK’s Open Interest (OI) surged by 9.5% indicating growing trader interest in the asset

- Major liquidation levels were at $13.55 and $14.40, with traders over-leveraged at these levels

As a seasoned crypto investor with battle scars from countless market fluctuations, I find myself increasingly intrigued by Chainlink (LINK)’s recent price action and on-chain metrics. The bullish pattern on LINK’s daily chart, coupled with rising Open Interest (OI), indicates growing trader interest in the asset – a sight for sore eyes after the rollercoaster ride we’ve all been on.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastAt the moment, it’s challenging to predict the crypto market’s mood due to its extreme fluctuations. Amidst this confusion, however, Chainlink (LINK) has displayed a bullish trend on its daily chart, suggesting that it could soon experience a significant price surge.

Beyond just its rising price trend, strong on-chain indicators and optimistic investor feelings also bolstered Chainlink’s bullish forecast.

Technical analysis and key levels

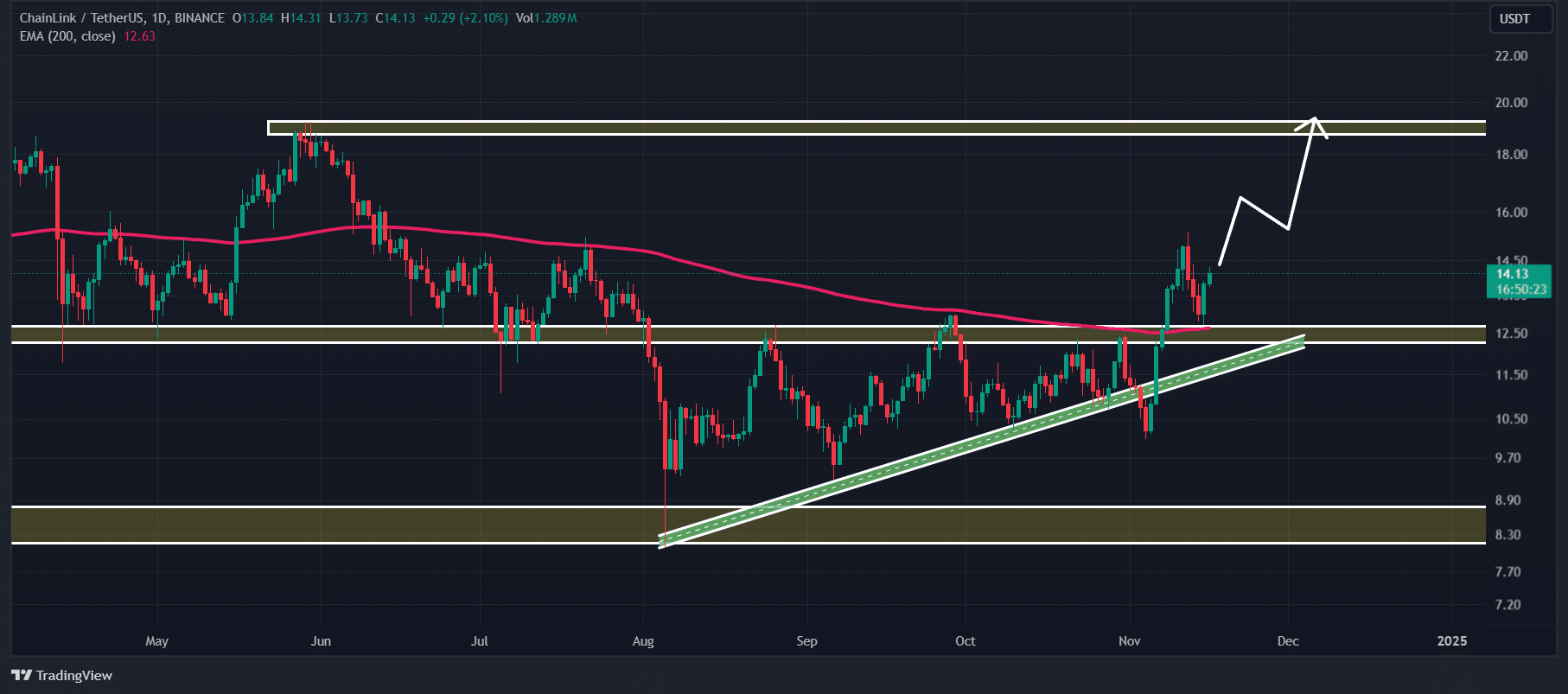

As per AMBCrypto’s evaluation, Chainlink (LINK) appears to have passed the resistance level indicated by the ascending triangle formation in its price action. At this moment, it seems to be trending upwards.

As a researcher, I’ve been analyzing the price movements of LINK recently, and based on its historical momentum, it appears there’s a significant chance that the value could surge by approximately 35%, potentially reaching the $19 mark in the near future.

Currently, as I compose this text, the value of LINK is being transacted above its 200-day Exponential Moving Average (EMA), suggesting a bullish trend on the daily chart. Furthermore, the Relative Strength Index (RSI) suggests there may be increasing momentum for this asset in the near future.

Bullish on-chain metrics

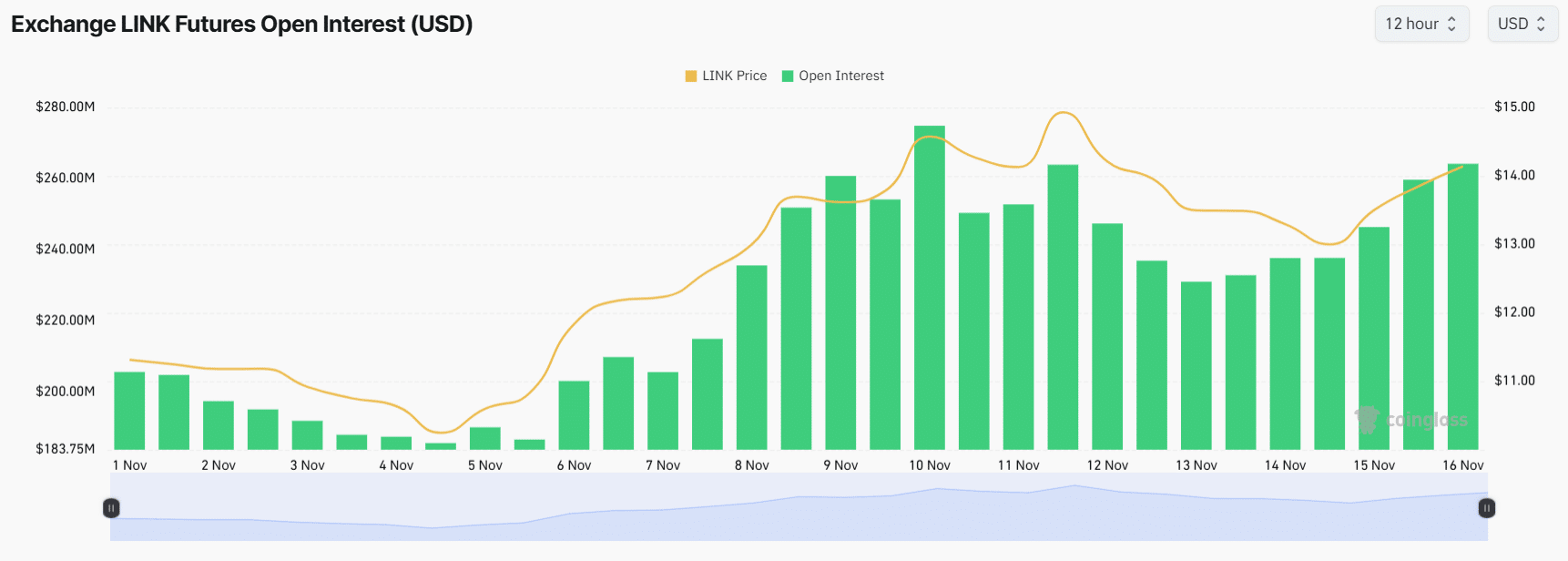

Additionally to technical analysis, data from on-chain indicators reinforced Chainlink’s optimistic forecast. Specifically, based on the findings of the on-chain analytics service Coinglass, Chainlink’s Open Interest (OI) increased by 9.5% within the past day, and this trend continues to rise as well.

Increasing Open Interest (OI) might be seen as an indication that more traders are showing interest in the asset, leading to an increase in active positions.

Major liquidation levels

As we speak, significant sell-off points are situated at $13.55 on the downside and $14.40 on the upside. Traders find themselves heavily invested or borrowing more than their initial investment at these price points.

If the stock’s outlook stays positive and its price reaches around $14.40, approximately $2.44 million in short positions will be forced to close. On the other hand, if the sentiment turns negative and the price falls to about $13.55, roughly $5.10 million in long positions might need to be closed.

By looking at these chain measurements and technical assessment, it appears that buyers are currently in control of the asset. This might enable Chainlink (LINK) to attain its predicted level within the upcoming days.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 03:03