-

LINK’s price has jumped to correspond to the uptick in its whale and social activity

However, key metrics suggest that a price bottom might still be in

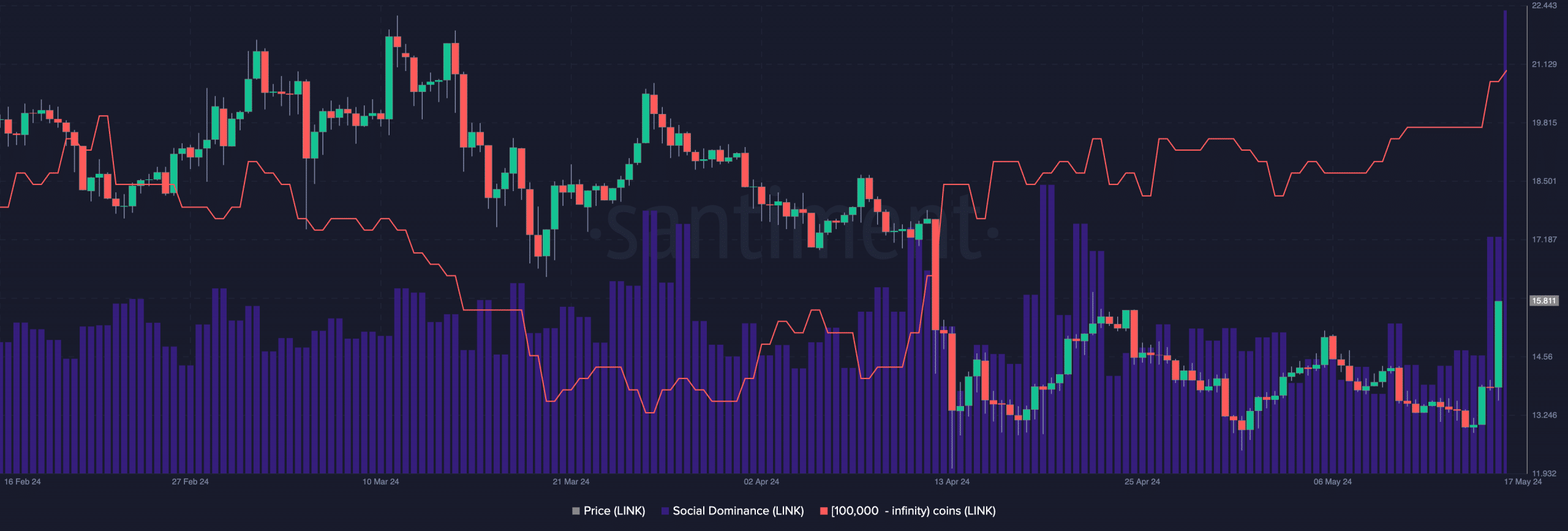

As a researcher with experience in analyzing cryptocurrency markets, I find LINK‘s recent price surge intriguing. The token’s whale and social activity have increased significantly, leading to its highest price level since March. Santiment’s data reveals that the number of LINK whales holding over 100,000 tokens has hit a seven-month high, while its social dominance is at its highest in seven months as well. These indicators suggest sustained bullish sentiment towards LINK.

In the past 24 hours, the price of LINK, the token that fuels the prominent oracle solution Chainlink, has experienced a significant jump of over ten percent. Currently priced at $15.81 based on recent market data, LINK is now reaching its peak value since March, as reported by CoinMarketCap.

On X’s platform, including what was previously known as Twitter, Santiment shared an insight: The surge in LINK‘s price can be attributed to an increase in significant investor (whale) transactions and heightened social media buzz.

As a data analyst, I’ve noticed an intriguing trend while compiling my latest report. At present, approximately 565 prominent investors, often referred to as “whales,” have amassed over 100,000 tokens in their possession – a figure not seen since October 2023. This group’s numbers have been on the rise since early May, with an increase of around 2% witnessed within just the past 16 days. Over the course of the last month, their token holdings have expanded by a significant 5%. Based on the data from Santiment, these developments underscore a growing confidence and interest in this particular asset.

From my analysis of the token’s social interactions, I can observe that its social dominance has reached a peak in the past seven months.

The measurement monitors chats surrounding an asset in relation to conversations about the leading 100 cryptocurrencies based on market value. At present, LINK holds a dialogue percentage of 1.8%, marking its largest representation in social discourse since November 2023.

LINK enjoys attention

An increase in an asset’s price and social media buzz are significant signs of a strong bullish trend. For instance, the sentiment analysis for LINK gave a reading of 1.808 at present, which is positive.

At the current moment, the altcoin’s 1-day chart shows encouraging signs of heightened demand, as key momentum indicators have risen. Additionally, its Relative Strength Index (RSI) stood at 60.67, and its Money Flow Index (MFI) was recorded at 62.99.

As a crypto investor, I’ve noticed that the recent indicator readings indicate more buying activity from market participants for LINK than selling activity at these current prices.

As a researcher studying the financial markets, I can confirm that LINK‘s price closing above its 20-day Exponential Moving Average (EMA) on May 16 adds to the bullish sentiment. Currently, the price is even trading above this significant level as I write this analysis.

As a researcher studying the cryptocurrency market, I would interpret a bullish signal for LINK as follows: When LINK’s price surpasses its average price over the past 20 days, this is an encouraging sign. Market participants view this crossover as a change in momentum from bearish to bullish trends.

Price bottom may not be in yet

The recent surge in LINK‘s price indicates a change in investor attitude towards this cryptocurrency. However, based on current on-chain data, it’s uncertain if a definitive price low has been hit.

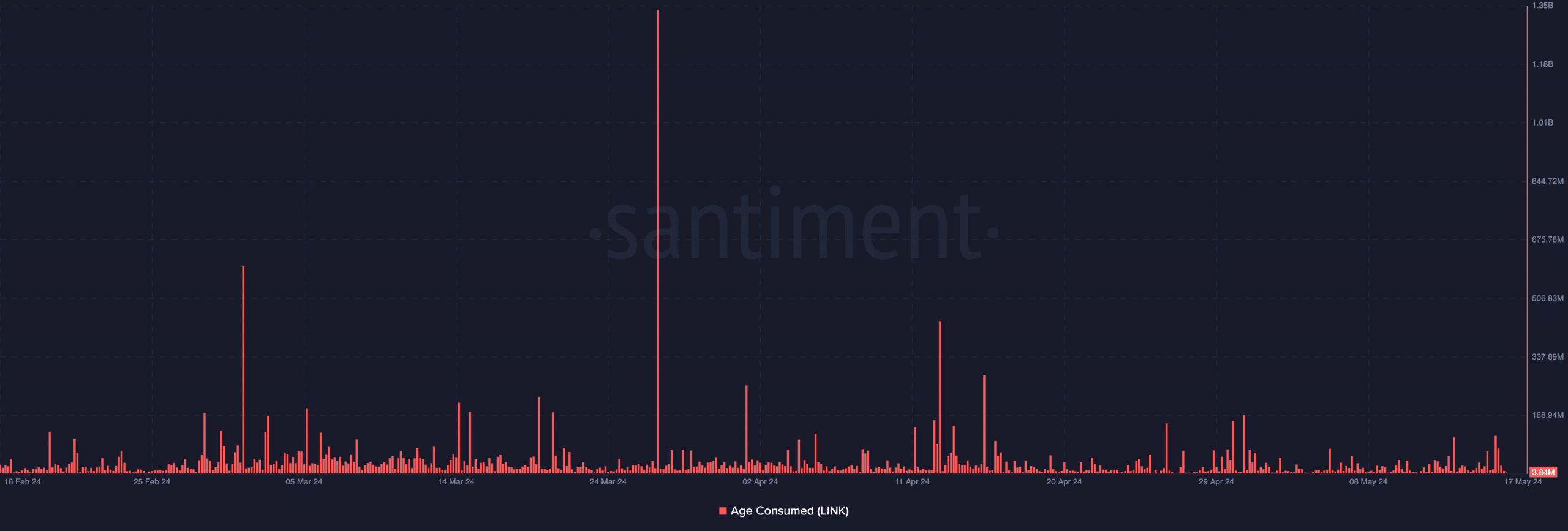

One effective method to evaluate this is by looking at a token’s “Consumed Age,” which monitors the transfer history of inactive LINK tokens.

The measurement is significant as it sheds light on the actions of long-term investors, who seldom transfer their tokens. Consequently, any transaction initiated by this group can significantly impact market dynamics.

As an analyst, I would interpret a surge in LINK‘s Age Consumed metric as indicating a significant increase in transactions involving tokens that had previously been inactive for extended periods. Conversely, a decrease in the Age Consumed metric suggests that coins with long idle histories remain untouched by traders or investors.

Starting from early May, the Age Consumed by LINK has remained quite low. This could indicate that its long-term investors have scarcely transferred their tokens.

In other words, the market patterns for LINK have remained relatively stable, with little change noticeable for those holding the token over a prolonged period.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-18 00:07