-

LINK has seen consecutive uptrends in the last two days.

It has remained in a bull trend despite its brief drops.

As a seasoned crypto investor with a keen interest in Chainlink [LINK], I’ve been closely monitoring its price action and on-chain metrics. Lately, I’ve noticed that LINK has seen consecutive uptrends in the last two days, which is a positive sign. However, it’s important to note that these uptrends have not been strong enough to offset the significant declines we witnessed in the past few days.

Recent data reveals that Chainlink (LINK) currently holds the top spot in the Real World Assets category for development activity. Simultaneously, the cryptocurrency’s price is moving upward, yet the count of active wallet addresses has been on a downward trend.

Chainlink leads in development activity

As a crypto investor, I’ve been closely monitoring the latest developments in the Real World Asset (RWA) sector using data from Santiment. And the news that really caught my attention is that Chainlink is leading the pack when it comes to development activity within this category. In simpler terms, more coders and developers are actively building on the Chainlink platform compared to other RWAs, which could potentially lead to greater innovation, functionality, and long-term value for its investors.

Among the 24 other RWAs listed on the chart, LINK stood out with a development activity score of 452 within the past 30 days. In comparison, the second-place network barely reached 35 points in the same timeframe.

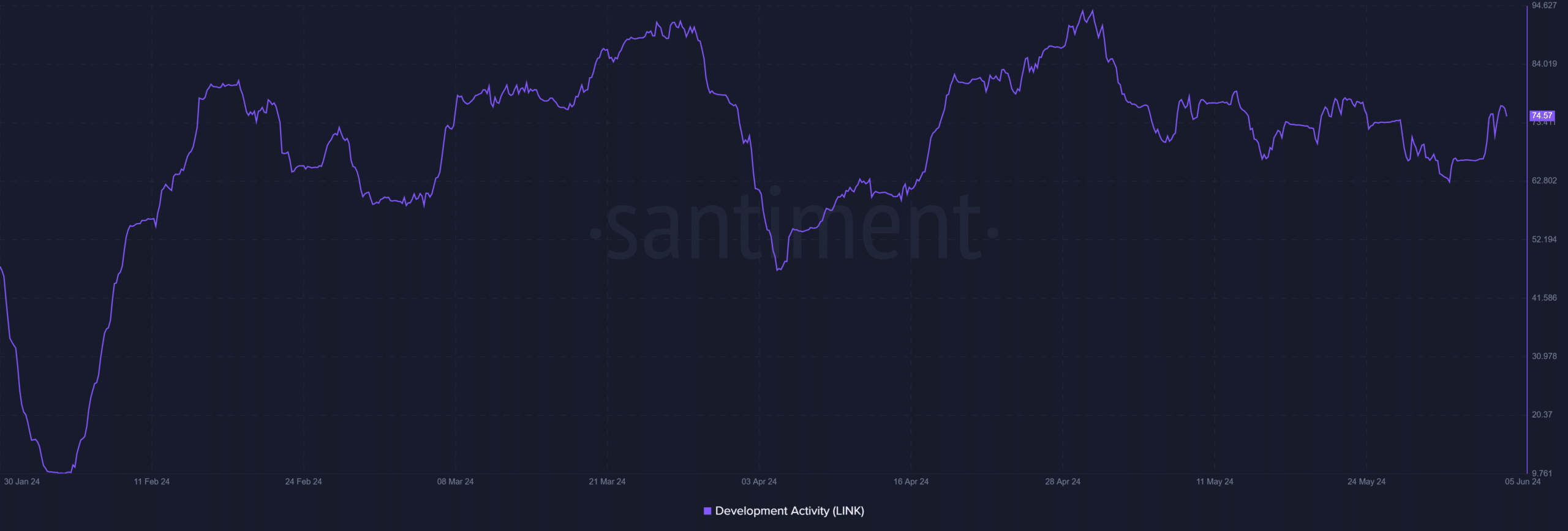

A look at Chainlink’s development activity trends on Santiment revealed a notable uptick initiating in January.

In April, there was a significant decline in development activity, but this downturn was short-lived as activity bounced back within the same month. Subsequently, development activity has persisted in climbing and has yet to reach the depths of its earlier lows.

As of this writing, Chainlink’s development activity was around 74.5.

Active addresses decline

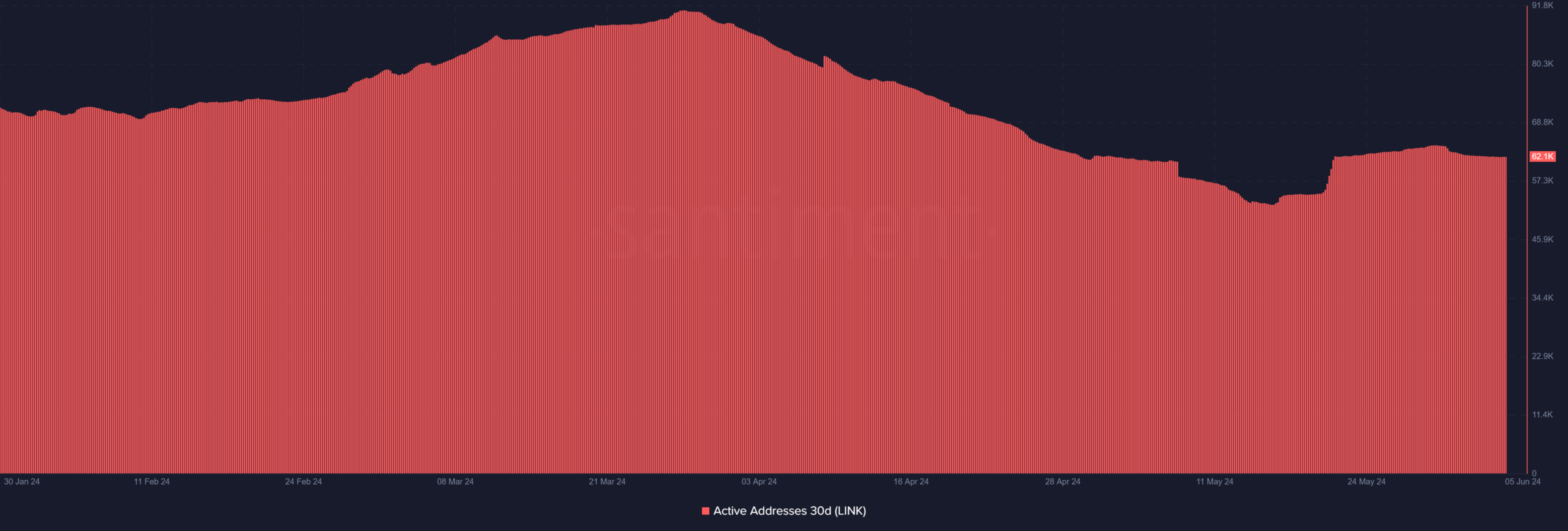

Based on my expertise, Other key on-chain indicators revealed decreased engagement compared to development progress. For instance, there’s been a minor decrease in the total number of active addresses on the network.

The Santiment chart indicating active addresses over the past 30 days has seen a modest drop since May 31st.

I’ve analyzed the data and found that on May 31st, there were approximately 63,300 active cryptocurrency addresses. However, as of now, the number has dropped to around 62,100.

In my research, I’ve observed that the number of active cryptocurrency addresses has surpassed 70,000 on multiple occasions, with some instances reaching as high as 80,000 over the past few months.

LINK’s uptrend not enough

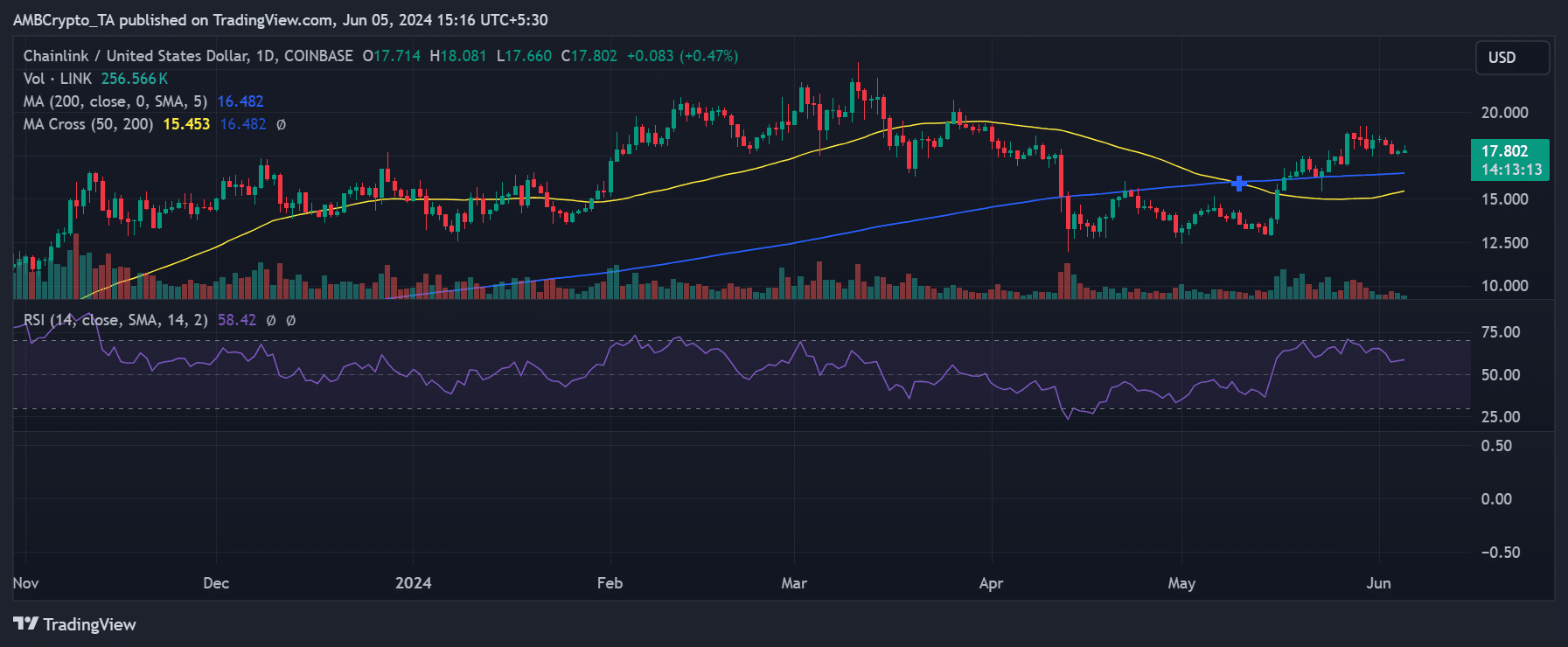

From my research perspective, as of now, Chainlink is priced approximately at $17.8 on the market, reflecting a minimal gain of under 1%. This represents the second successive upward trend following its previous rise to the $17.7 range, which also occurred with a similar marginal increase on June 4th.

Despite the recent upward trends, Chainlink has still suffered substantial losses over the past few days which outweigh these gains.

The yellow line representing Chainlink’s short moving average continued to lag behind the blue line, which is the long moving average. This situation suggests a less favorable price trend for Chainlink.

Realistic or not, here’s LINK market cap in BTC’s terms

Despite this, the current price is above both moving averages.

An examination of the Relative Strength Index (RSI) for LINK indicates that it is experiencing a bullish phase as its RSI value is now more than 56.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-06-06 05:11