- After a series of Change of Character (CHoCH) and Break of Structure (BOS) events, Chainlink found itself nestled at the crucial $12 support zone, as of the last update.

- A robust reaction at this juncture could propel LINK back towards the $16-$18 range, whereas a breach might see it tumble to $10 or even lower. 😱

The price of Chainlink [LINK] was trading around $12, marking an 11% decline over the past 24 hours. Such volatility is enough to make one’s heart flutter with both hope and dread.

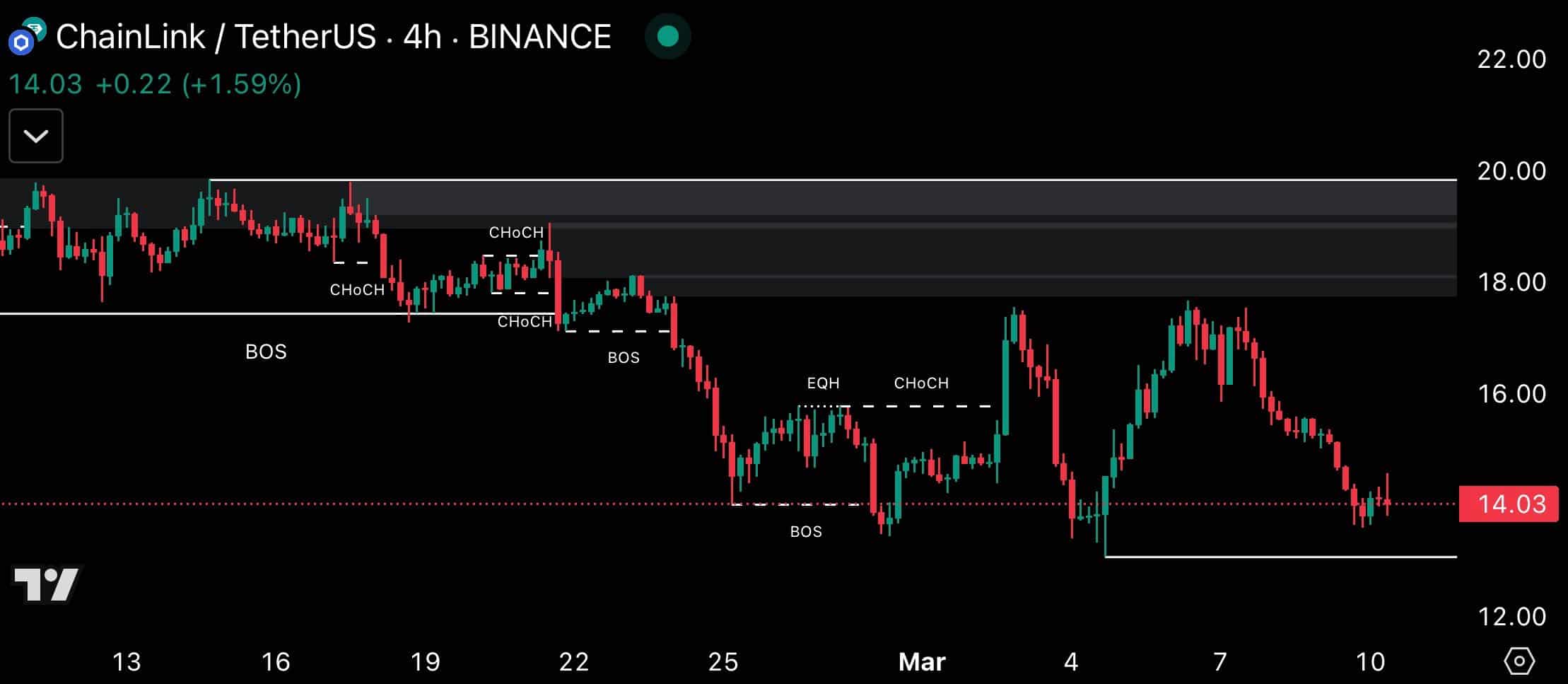

The 4-hour price action revealed a plethora of CHoCH and BOS points, signaling shifts in market structure and momentum. It is as if the market itself is a stage, with each point a new act in the grand play of finance.

Chainlink, having embarked on a downtrend from a lofty peak of $20.00, experienced CHoCH and BOS events at $18.00, $16.00, and $14.00, each a testament to the waning strength of the bulls. It is a tale of bears gaining the upper hand, much like a social gathering where the less popular guests suddenly find themselves in the spotlight.

A sweep of Equal Highs (EQH) around $16, followed by a BOS below $14.03, solidified the bearish outlook. It is as if the market has decided to play a cruel jest, leading the bulls on a merry chase before snatching victory from their grasp.

//ambcrypto.com/wp-content/uploads/2025/03/Screenshot-21.png”/>

A break below $12.00, where only 0.98% are at break-even, could result in a fall to $10.00, where there is little support. It is a scenario that would leave many traders feeling as if they have been abandoned on a deserted island, with no hope of rescue.

The 43.78% to 55.19% difference is a critical threshold; prolonged buying above $12 could indicate a bull run, while a fall below could trigger further selling. It is a delicate balance, much like a tightrope walker, where the slightest misstep can lead to disaster.

Furthermore, the “Active Addresses by Profitability” chart showed that most of these holders purchased LINK around $4.00. This makes it a key support level to watch, as it represents the early adopters who have stood by LINK through thick and thin. For these active addresses, 54.46% bought for less than $12.00.

Only 5.12%, or about 51.14M LINK, were at the money. The range of $4-$9.99 indicated a probable support region if LINK falls, with the bulls set to defend it to prevent further losses. It is a situation where the bulls are like a group of loyal friends, determined to stand their ground.

A fall to $4.00 is only likely if bear pressure overpowers the bulls. However, the 54.46% in profit can cause buying to salvage gains, limiting losses around $10.00. Breaking below $12.00 could mean testing $10.00, but staying above could see LINK reverse. The “at money” holders reflected little selling pressure, holding slight bullish sentiments unless volume blows down. It is a game of cat and mouse, where the outcome is as uncertain as the weather in March.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-11 13:16