- Ethereum recently saw a spike in positive netflow, with about 82,000 netflow to derivative exchanges.

- ETH has spiked by over 8% in the last 24 hours.

As a seasoned researcher with a knack for deciphering crypto trends and patterns, I’ve witnessed my fair share of market surges and dips. The recent spike in Ethereum’s [ETH] netflow to derivative exchanges and Bitcoin’s ATH breakthrough has certainly piqued my interest.

The increased movement of Ethereum [ETH] on trading platforms, coupled with Bitcoin reaching a fresh record peak, is sparking fresh curiosity within the cryptocurrency sector once again.

It’s been observed that there’s been a significant surge in Ethereum’s netflow on derivatives trading platforms, which could possibly indicate a shift in investor attitudes. At the same time, Bitcoin crossing the $75,000 mark has sparked optimism among investors everywhere.

Shall we delve deeper into how these advancements could impact Ethereum and predict if it might mirror Bitcoin’s trajectory?

Ethereum’s netflow spike reflects rising interest

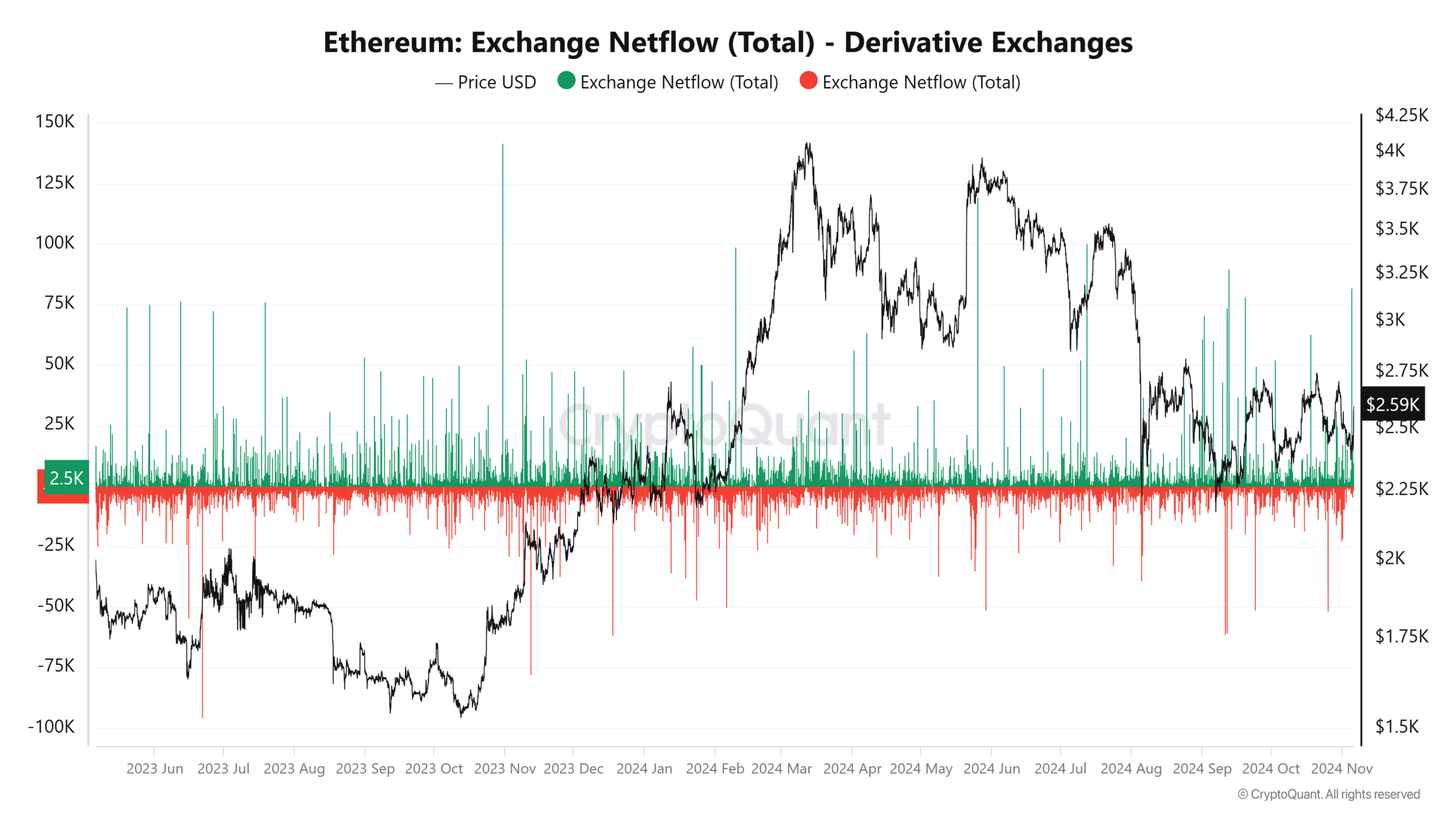

Lately, there’s been a substantial increase in the outgoing and incoming Ethereum transactions on derivative trading platforms, often referred to as the netflow. This netflow provides valuable insights about the investors’ overall attitude or sentiment towards Ethereum by showing the difference between assets entering and leaving these exchanges.

A generally favorable netflow indicates accumulation, implying that investors are transferring their assets to exchanges, intending either to trade or increase their positions through leverage.

Conversely, a continuous outflow (of assets) may signal a long-term investment strategy where these assets are being moved away from exchanges.

According to CryptoQuant’s data, there was a significant increase in netflow (approximately 82,000 positive readings), which corresponds with increased price instability.

Historically, these spikes have typically resulted in temporary shifts in prices. A surge in exchange deposits frequently indicates that traders are gearing up for significant market movements.

This action indicates that investors might be preparing for possible changes in Ethereum’s value, perhaps getting ready for larger price swings.

Ethereum’s price response to past netflow surges

Examining the flow patterns of Ethereum provides an intriguing observation: significant increases in exchange inflows frequently coincide with noticeable changes in its price.

During some past events this year, surges in outgoing funds (netflow) coincided with significant price hikes. This occurred because traders were strategically adjusting their positions to profit from the rise or protect against potential risks.

But, while netflow spikes don’t necessarily indicate a bullish market, they can also lead to increased volatility as traders prepare for potential price fluctuations in both the upward and downward directions.

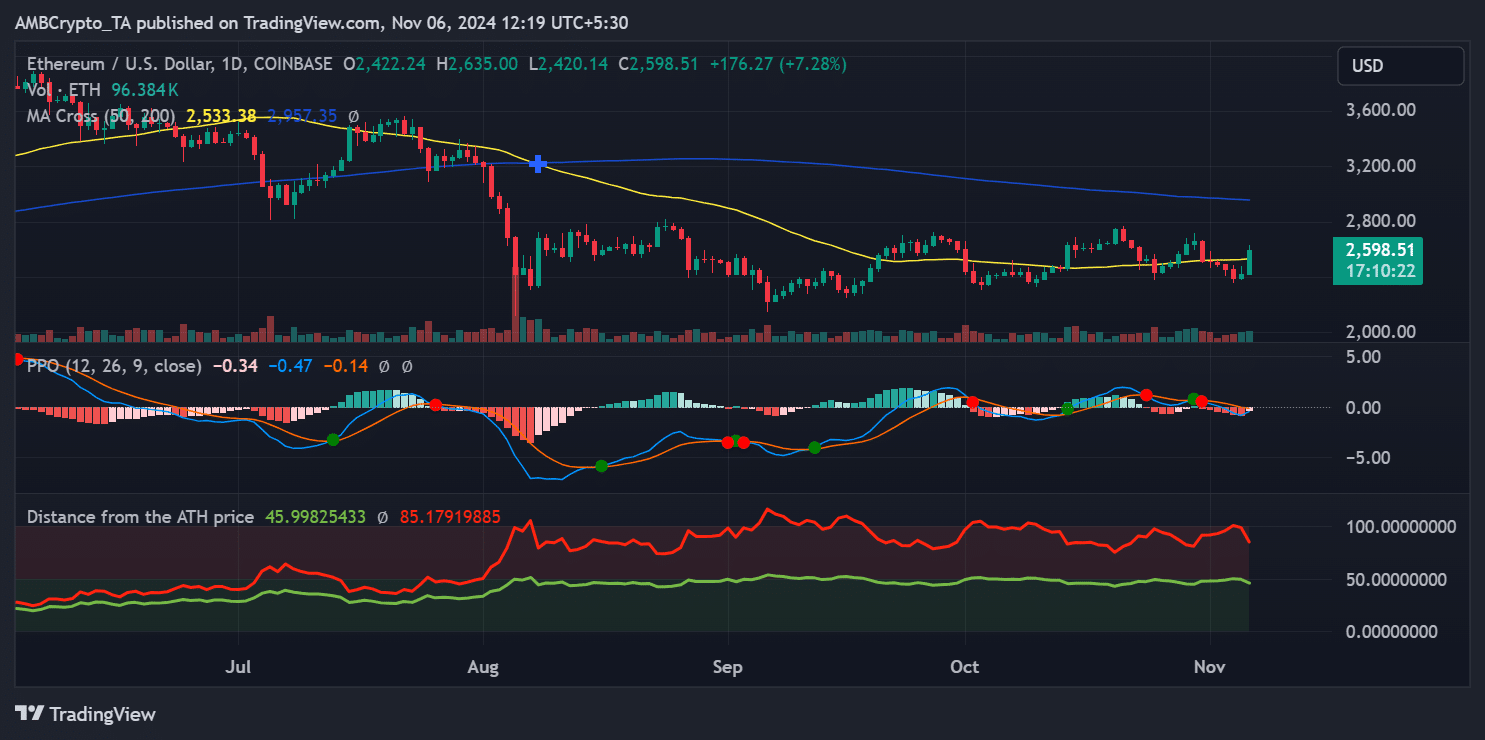

Right now, Ethereum’s price is hovering around $2,600, significantly lower than its all-time peak of approximately $4,800. Even though Bitcoin has seen a surge recently, Ethereum hasn’t managed to touch those previous record levels yet.

From my perspective as an analyst, the consistent inflow of funds (netflow) could signify increasing optimism among investors, suggesting they anticipate a broader market surge. It’s vital to monitor whether Ethereum can sustain this investor interest under the current circumstances, as its near-term direction heavily depends on it.

Bitcoin’s ATH and implications for Ethereum

The spike in Bitcoin’s value above $75,000 marks a fresh all-time high, fueling excitement throughout the market. This significant milestone could have far-reaching effects on the trajectory of Ethereum’s pricing.

Despite ETH currently trading around $2,600, which is significantly lower than its all-time high, technical signals point towards potential directions favoring a rise in value.

To get a clearer picture of Ethereum’s current standing, the Distance from All-Time High (ATH) measure indicates that Ethereum is currently approximately 45% lower than its maximum point. This significant difference implies that Ethereum might have potential for growth if the market outlook remains optimistic.

As a analyst, I’ve observed that Bitcoin’s all-time high (ATH) frequently triggers altcoin rallies as investors seek to diversify their Bitcoin profits by investing in other significant assets like Ethereum (ETH). Given ETH’s pattern of mirroring Bitcoin’s movements under favorable conditions, it has the potential to narrow this gap if the current positive trends persist.

Additionally, the Percentage Price Oscillator (PPO) offers valuable information about Ethereum’s current momentum compared to its past price trends.

At present, the Percentage Price Oscillator (PPO) is slightly below zero, hinting at a decrease in negative momentum. If the PPO moves into positive territory, it would lend support to a bullish outlook, implying that Ethereum might recover and experience an upward price push.

Ethereum/BTC pair stability and independent strength

The Ethereum/Bitcoin (ETH/BTC) pair is another valuable metric for assessing ETH’s performance. Currently, the ETH/BTC ratio is holding steady, implying that ETH is retaining its value relative to BTC, even as BTC achieves new highs.

If the ETH/BTC relationship becomes stronger, it might suggest that ETH is drawing interest from investors regardless of Bitcoin’s price fluctuations. This could pave the way for a prolonged upward trend in ETH’s price.

Realistic or not, here’s ETH market cap in BTC’s terms

A broader resurgence in Altcoin interest?

The rise in Ethereum’s outflow to derivative trading platforms and Bitcoin reaching its all-time high indicates a resurgence of interest in alternative coins. Since Bitcoin and Ethereum have historically moved together, if Bitcoin’s bullish trend persists, it’s likely that Ethereum will follow suit.

Although Ethereum hasn’t yet reached its all-time high, recent net flow information suggests a surge of market attention, which might indicate increased volatility in the near future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-11-06 15:04