-

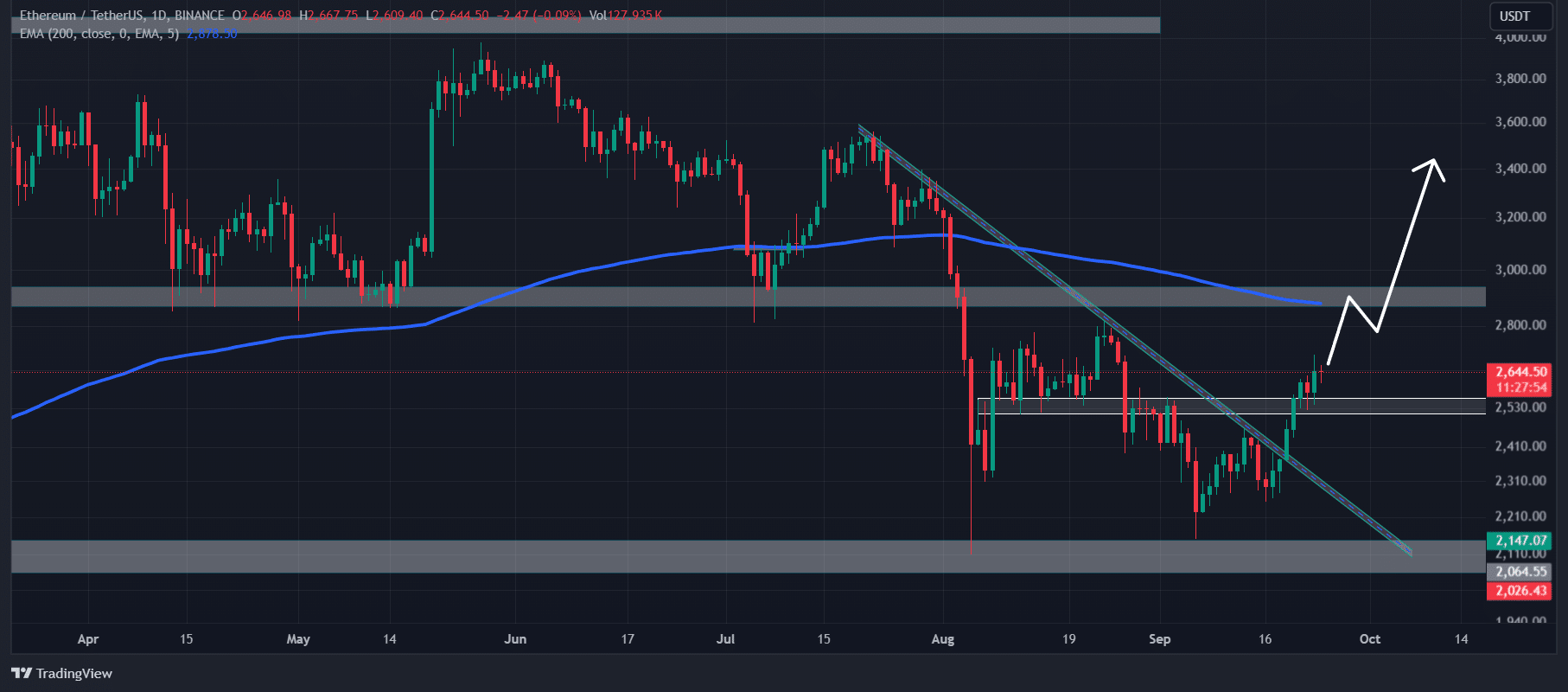

Ether could rise to the $2,900 level if it maintains itself above the $2,570 level.

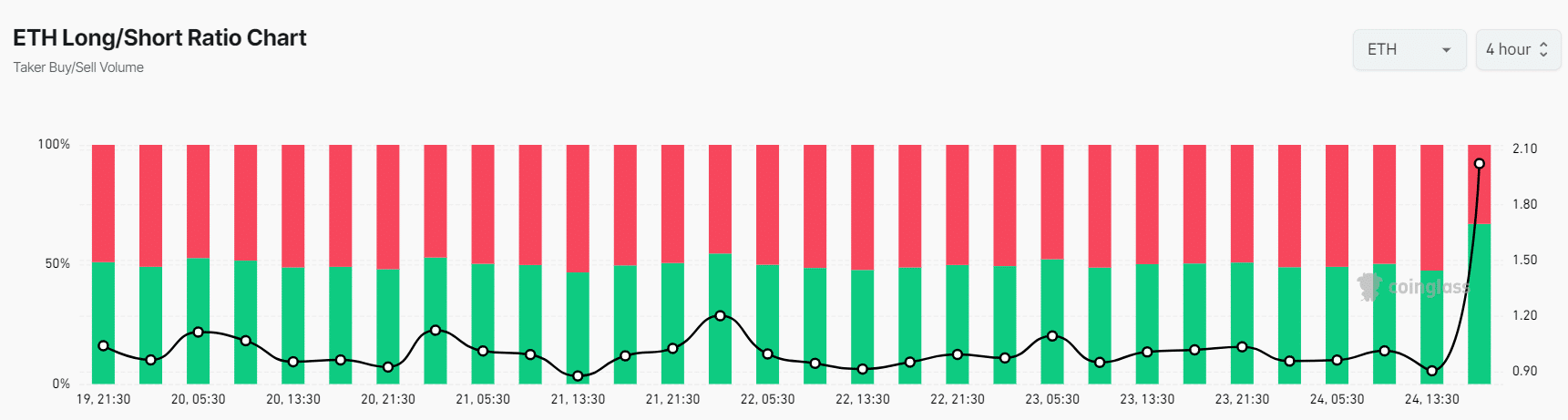

ETH’s Long/Short Ratio currently stands at 2.023, indicating extremely bullish market sentiment among traders.

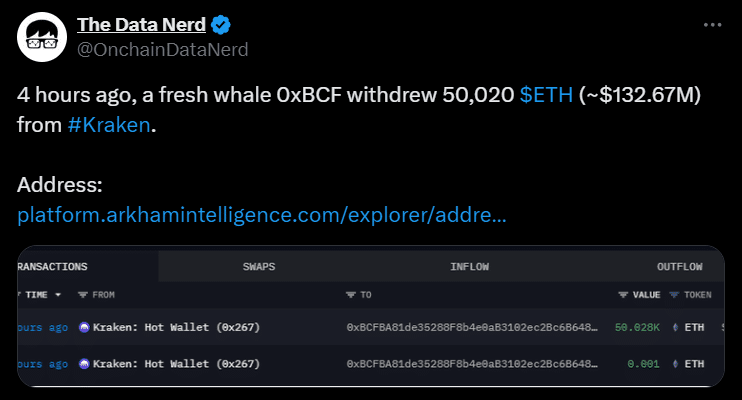

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the current state of Ethereum (ETH). The recent whale activity, as reported by TheDataNerd, is an interesting development that could potentially signal a bullish trend for ETH.

As a researcher focusing on the cryptocurrency market, I’ve noticed that Ethereum [ETH], the world’s second-largest digital currency by market capitalization, has been drawing attention from ‘whales’ – large-scale investors. This surge in interest seems to be fueled by its bullish on-chain metrics, suggesting a positive outlook for the cryptocurrency.

Ethereum whale on a buying spree

On the 24th of September, as reported by on-chain analytics firm TheDataNerd (formerly known as Twitter), a notable whale wallet identified as “0xBCFB” acquired a substantial amount of Ethereum valued at approximately $132 million, or 50,020 ETH, from the exchange Kraken.

This significant acquisition took place after Ethereum (ETH) surpassed its two-day holding pattern, following the breach of the $2,570 price barrier.

On the other hand, certain cryptocurrency investors view the current prices as a chance to buy more, amassing significant amounts, whereas others remain sellers, anticipating a drop in value in the near future.

Key levels

Based on the technical assessment by AMBCrypto, Ethereum seems optimistic even though it’s currently trading beneath its 200-day Exponential Moving Average (EMA), as observed on a daily chart.

In simpler terms, the 200 Exponential Moving Average (EMA) is a tool employed in technical analysis to help identify if a given asset’s price movement is trending upwards or downwards.

The significant surge past the important barrier at $2,570 followed by a brief period of stabilization hints at an upcoming upward trend.

According to past trends in Ethereum’s price, if it continues to stay above its current resistance point, it’s likely that the price might climb up to approximately $2,900. If the overall market outlook stays positive, it could potentially rise even higher.

ETH’s bullish on-chain metrics

The optimistic viewpoint is reinforced by data from the blockchain. As we speak, Coinglass’s Ethereum Long/Short Ratio stands at 2.023, suggesting a highly bullish attitude amongst traders, implying they are heavily betting on the price increase of Ethereum.

Additionally, its Futures Open Interest increased by 3.2% in the last 24 hours.

When constructing long positions, traders and investors frequently employ a strategy that involves both an increase in Futures Contract Open Interest and a Long/Short Ratio that is greater than 1.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As we speak, a significant majority – approximately 66.93% – of leading traders have taken long positions, whereas around 33.07% opted for short positions. This information derived from blockchain analysis indicates that the bulls presently have control over the asset’s direction.

As I write this, Ethereum (ETH) is hovering around the $2,640 mark, maintaining a steady trend over the last 24 hours. Interestingly, during this timeframe, the trading volume has seen a decrease of approximately 7%. This suggests a possible reduction in trader activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-25 01:11