- Satoshi Nakamoto’s registration of bitcoin.org 16 years ago sparked the birth of decentralized finance.

- Bitcoin’s retail ownership continues to rise, while Satoshi’s identity remains an unsolved mystery.

As a seasoned analyst with over two decades of experience in finance and technology, I have had the privilege of witnessing the birth and growth of countless innovations that have reshaped our world. Among these groundbreaking developments, none has captured my fascination quite like Bitcoin [BTC].

16 years back, on August 18, 2008, an anonymous pioneer named Satoshi Nakamoto embarked on a journey to transform global finance fundamentally by registering the domain bitcoin.org.

Based on my years of experience in the tech industry and following the evolution of digital currencies, I firmly believe that this milestone represents a pivotal moment in history – the dawn of the world’s first decentralized cryptocurrency. This innovation is not just another financial tool; it’s a testament to human ingenuity and resilience in the face of traditional power structures. It brings a new level of freedom, transparency, and security to our financial transactions – something I find truly inspiring as a tech enthusiast who values innovation and fairness.

Establishing the domain bitcoin.org paved the way for the creation and growth of Bitcoin [BTC], now recognized as a groundbreaking financial resource.

According to Bitcoin historian Pete Rizzo, this event holds a special place in history.

Rizzo stated in a recent tweet,

16 years ago on this day, Satoshi Nakamoto officially launched the first Bitcoin website, bitcoin.org. This platform has been a vital source for the distribution of Nakamoto’s open-source code ever since, serving as a symbol of financial liberty and empowerment to countless individuals worldwide.

The platform subsequently served as the venue for publishing Satoshi Nakamoto’s revolutionary whitepaper titled “Bitcoin: A Decentralized Digital Cash System,” first made public in October 2008, detailing the idea behind a currency that operates without central authority.

Bitcoin was officially launched in January 2009, bringing Satoshi’s vision to life.

From the moment it was first introduced, Bitcoin has experienced remarkable expansion and widespread usage across the globe. Originally a specialized digital money, it has transformed into a financially significant asset trusted by countless individuals worldwide.

The open-source nature of its code and its decentralized design have sparked the emergence of countless other digital currencies, as well as fueling the growth of a vast ecosystem built around blockchain technology.

Over time, Bitcoin’s worth has gone up and down, yet it has generally trended higher, which strengthens its status as a place to keep wealth and a means for transactions.

Who is Satoshi Nakamoto?

Even though Bitcoin has achieved great heights of success, the real identity of its creator, Satoshi Nakamoto, continues to be a significant enigma within the realm of technology and finance.

There’s been much debate over the identity of Nakamoto, with some theorizing that it may not be a single person but rather a team instead.

As a data analyst, I’ve come across speculations suggesting that Satoshi Nakamoto might be a collective of one or more anonymous individuals, a theory supported by statements from the FBI. However, it’s important to note that the FBI has neither confirmed nor refuted any specific identities associated with this enigmatic figure in the world of cryptocurrency.

Bitcoin in history

The anonymity of Bitcoin’s creator has added to the intrigue surrounding the crypto.

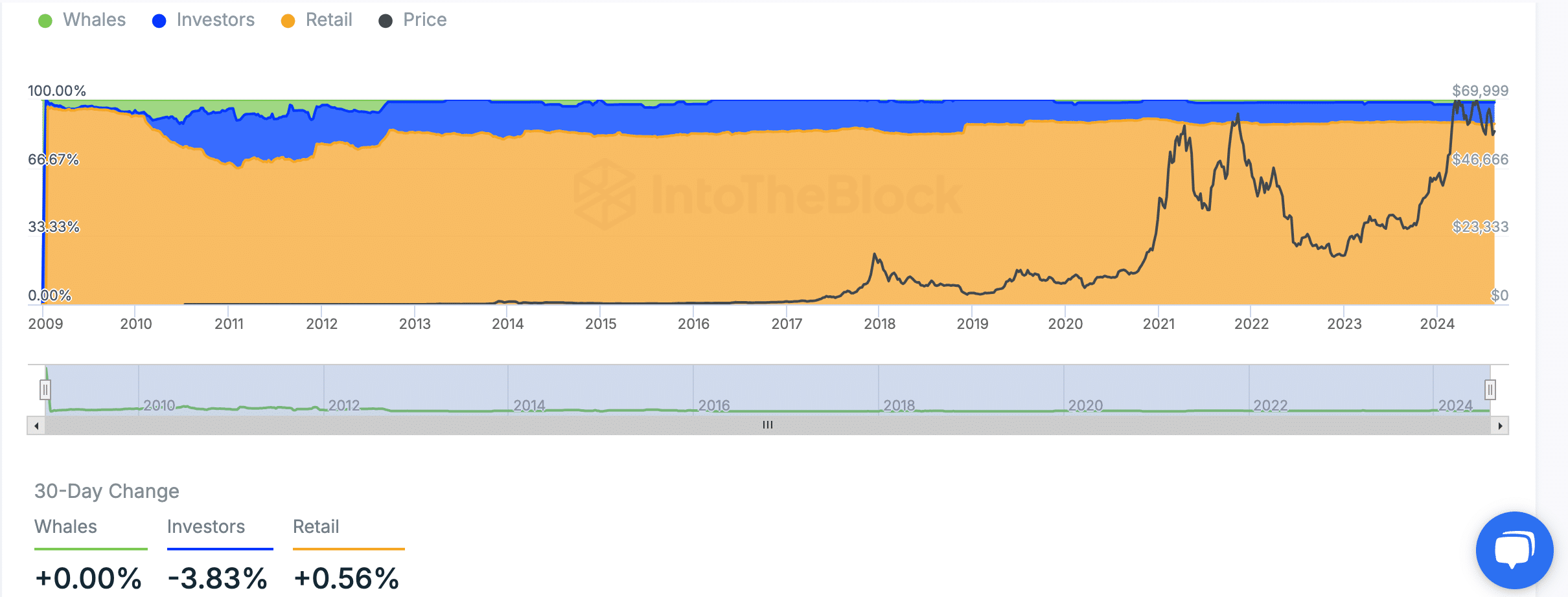

Based on data from IntoTheBlock, it’s clear that retail investors have consistently controlled a significant share of Bitcoin, with larger entities such as whales and institutional investors holding relatively lesser amounts.

Over the years, retail ownership has steadily increased, reflecting Bitcoin’s widespread adoption among smaller holders.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on my years of experience in the financial markets, I have noticed that market trends can be quite dynamic and often unpredictable. From what I see in these latest figures, it appears that investors are becoming more cautious with their holdings, as there has been a slight decrease of around 3.83%. On the other hand, retail participation is on the rise, with an increase of 0.56%. This could indicate that individual investors are becoming more confident in the market and are taking a more active role. As for the whales, their holdings remained unchanged, which suggests they may be holding back or waiting for further opportunities to make strategic moves. All these trends underscore the importance of staying informed and being adaptable in the ever-changing financial landscape.

As a long-time observer of financial trends and someone who has witnessed the rise and fall of various investment opportunities, I must say that the growing acceptance of Bitcoin into mainstream financial markets is truly remarkable. Having started my career in finance during the dot-com boom, I’ve seen firsthand how innovative technologies can revolutionize entire industries. However, what sets Bitcoin apart from other digital currencies or internet-based ventures is its broad appeal and potential to fundamentally change the way we think about money.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-08-19 11:36