-

A key indicator revealed that BTC might go above $90k.

If BTC reaches an ATH, altcoins like ETH and SOL are likely to follow.

As a seasoned researcher with extensive experience in the crypto market, I have witnessed numerous price trends and market shifts over the years. The recent bullish trend of Bitcoin (BTC) has once again ignited hopes of reaching an all-time high (ATH). In light of this, I wanted to delve deeper into the current state of the market and what we can expect in the coming week.

1. The current surge in Bitcoin‘s [BTC] prices has fueled optimism among investors that it may hit a new record high.

To gain a deeper understanding of the current state of the crypto market and anticipate potential developments in the upcoming week, AMBCrypto decided to conduct a thorough analysis.

Bitcoin road to an ATH

1. The proponents of Bitcoin, often referred to as ‘bulls’, managed to take charge in the market and propel Bitcoin (BTC) towards the $70k threshold. Given that this price point is near its record high, there’s a strong possibility that BTC might challenge or even surpass this mark in the coming week.

Based on data from CoinMarketCap, Bitcoin’s price had experienced a gain of approximately 2% within the previous 24 hours. At the moment of this composition, Bitcoin was being exchanged at the price of $69,630.41, and its market capitalization exceeded $1.37 trillion.

According to AMBCrypto’s analysis of Glassnode’s data, there is a strong indication that Bitcoin may hit a new peak based on the findings.

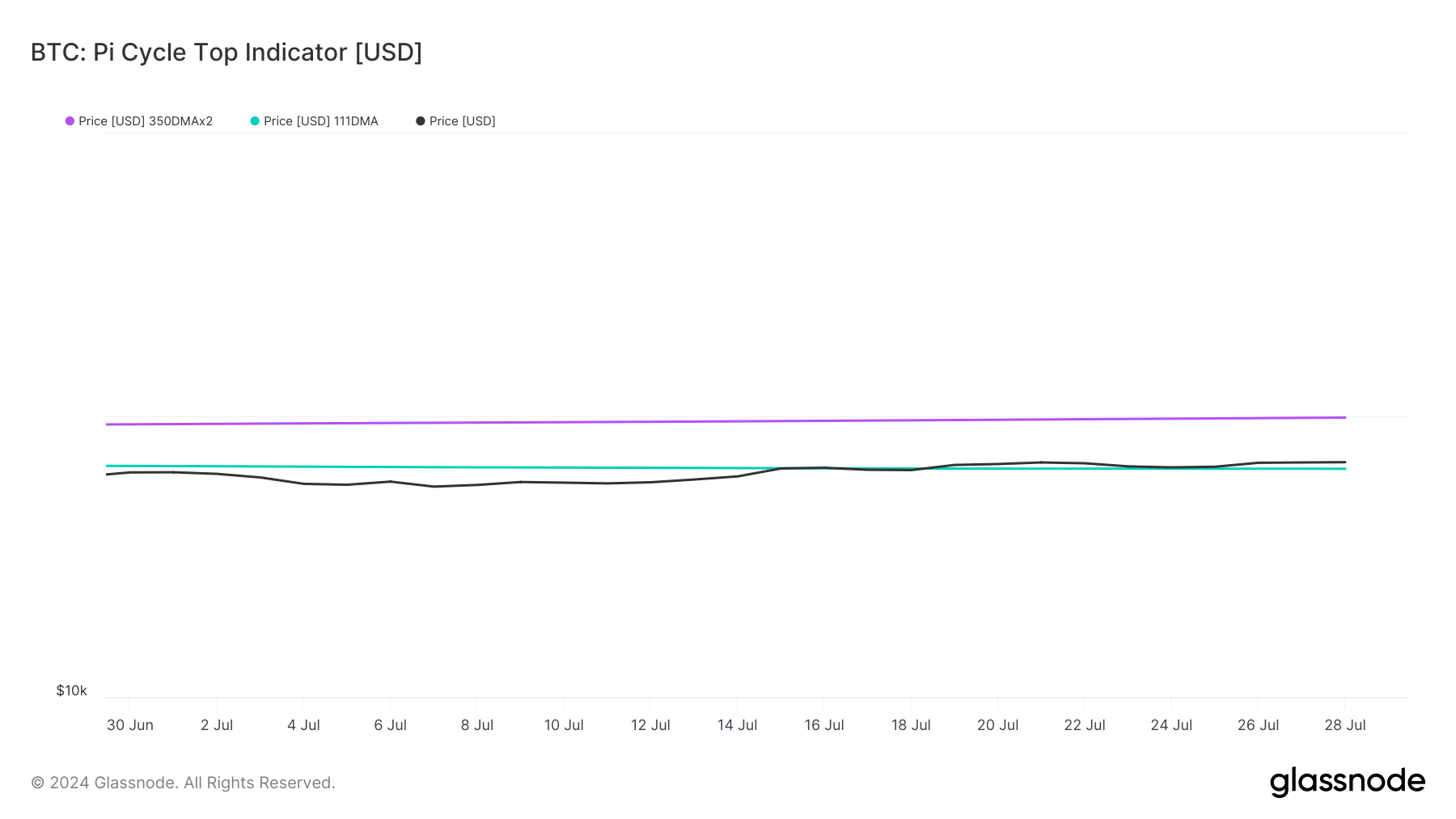

1. According to the Pi Cycle Top indicator for Bitcoin, the price appears to be close to a potential market minimum.

According to the data, it seems that the potential peak for Bitcoin could have been around $98,000. This implies a possible surge beyond its current all-time high (ATH).

What metrics suggest

1. Examining the data from CryptoQuant, it was found that the daily net deposit of Bitcoin into exchanges was decreasing relative to the seven-day average. Consequently, this suggested an increase in demand or buying pressure for BTC.

Instead of investors, the miners of Bitcoin were hesitant to part with their stashes. The Miner’s Position Index for Bitcoin showed that they were disposing of their holdings less frequently than the norm over the past year.

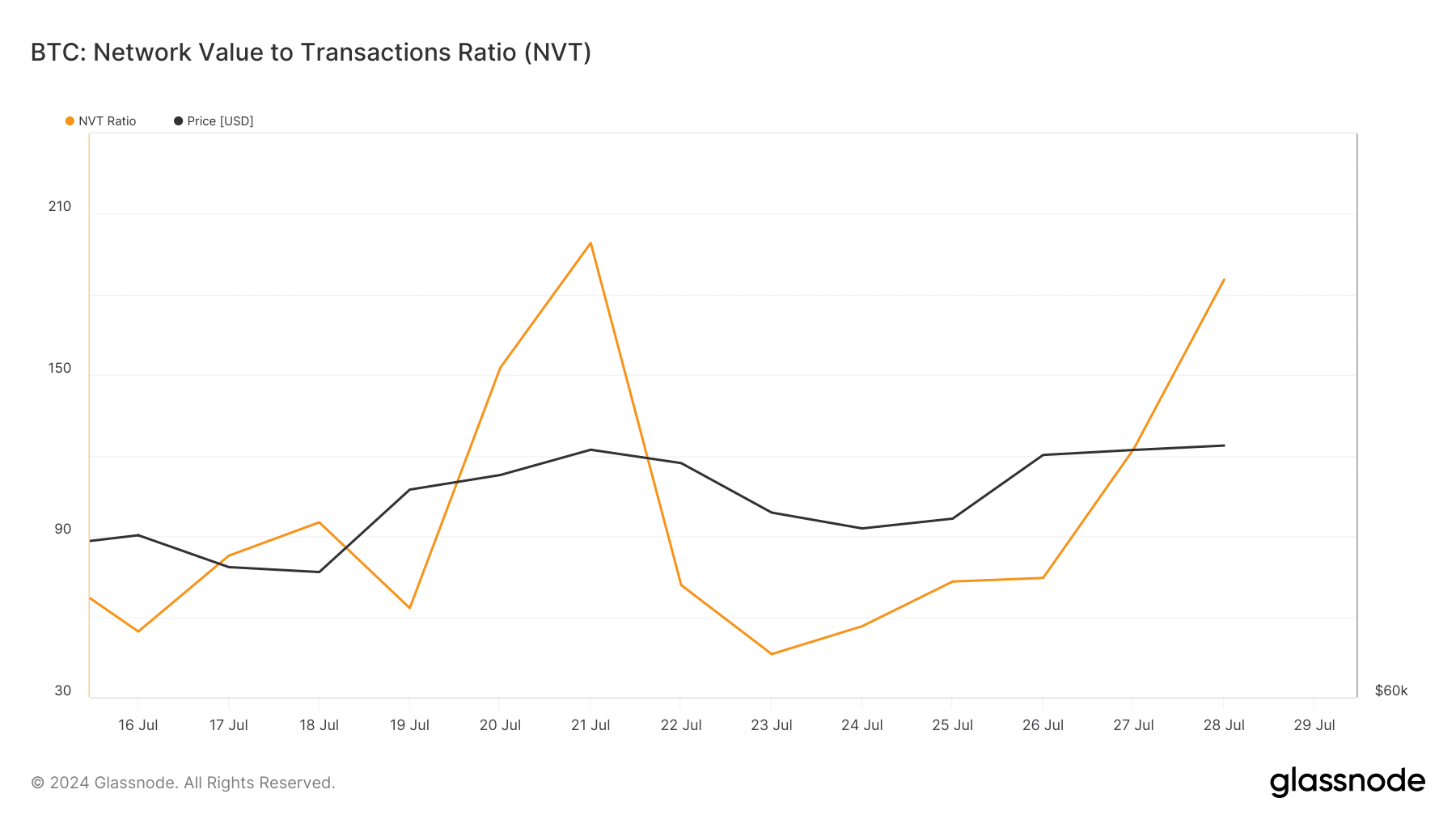

As an analyst examining the crypto market, I noticed a troubling trend: the Non-Fungible Token Value (NVT) ratio of the leading cryptocurrency has significantly spiked. This upward movement in the NVT metric often indicates that the asset is overvalued, which historically precedes price adjustments or corrections.

If that happens, then BTC might take longer to reach an ATH.

At this point in time, the Fear and Greed Index for Bitcoin stood at 71%, indicating a “greed” phase. This figure indicates a higher likelihood of a price adjustment or correction when it reaches such levels.

How will the market be affected?

In an ideal scenario where Bitcoin (BTC) hits its all-time high (ATH) this week, it’s clear that the entire cryptocurrency market would experience significant repercussions.

Historically, altcoins have generally mirrored Bitcoin’s price movements. However, noteworthy exceptions include recent strong showings from leading altcoins such as Solana (SOL), which experienced a significant increase of more than 6% in value over the past week.

Read Bitcoin’s [BTC] Price Prediction 2024-25

1. Similar altcoins such as Ethereum (ETH) have shown a bullish trend as well. Should Bitcoin (BTC) achieve its all-time high, it’s probable that these digital assets would continue to maintain their bullish sentiment.

At present, contrasting cryptocurrencies such as Dogecoin [DOGE] and Shiba Inu [SHIB], which are popular meme coins, were bucking the trend with their weekly charts displaying losses instead of gains.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-07-30 08:08