- Solana is quickly catching up to Ethereum on the fees front.

- However, the Ethereum ecosystem still commands investors’ trust.

As a seasoned crypto investor with a keen interest in blockchain technology and market trends, I’ve been closely following the Solana (SOL) vs. Ethereum (ETH) debate. While Solana is making significant strides on the fees front, I believe Ethereum still commands investors’ trust for several reasons.

On social media platform Crypto Twitter, the long-standing comparison between Solana (SOL) and Ethereum (ETH) reignited as news broke about potential fee advantage for Solana in the near future.

As a researcher studying on-chain data, I’ve noticed that according to analyst Dan Smith’s findings, Solana is rapidly approaching Ethereum in terms of transaction fees.

“Solana will flip Ethereum in transaction fees + captured MEV this month, maybe even this week”

As a researcher, I would describe transaction fees as the costs incurred for engaging in network activities, whereas Minimum Extractable Value (MEV) represents the maximum profit that validators can extract from each block they produce or confirm.

Solana vs Ethereum: fees and other fronts

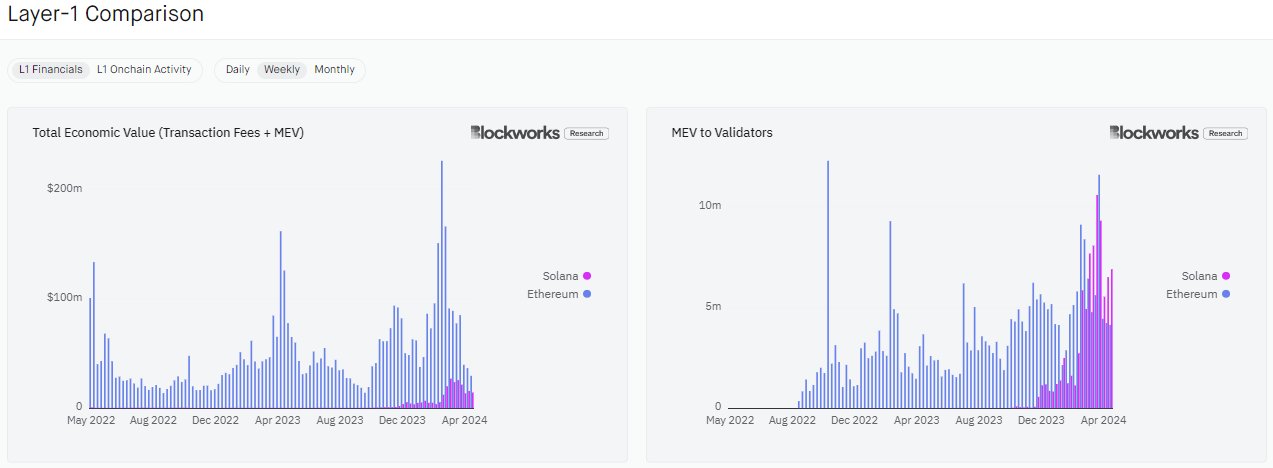

Smith reinforced his point by providing data, indicating a significant gap of approximately $300,000 in fees between Solana and Ethereum.

In the given year of 2024, Solana experienced a substantial increase as depicted in the chart, narrowing down the difference significantly between itself and Ethereum.

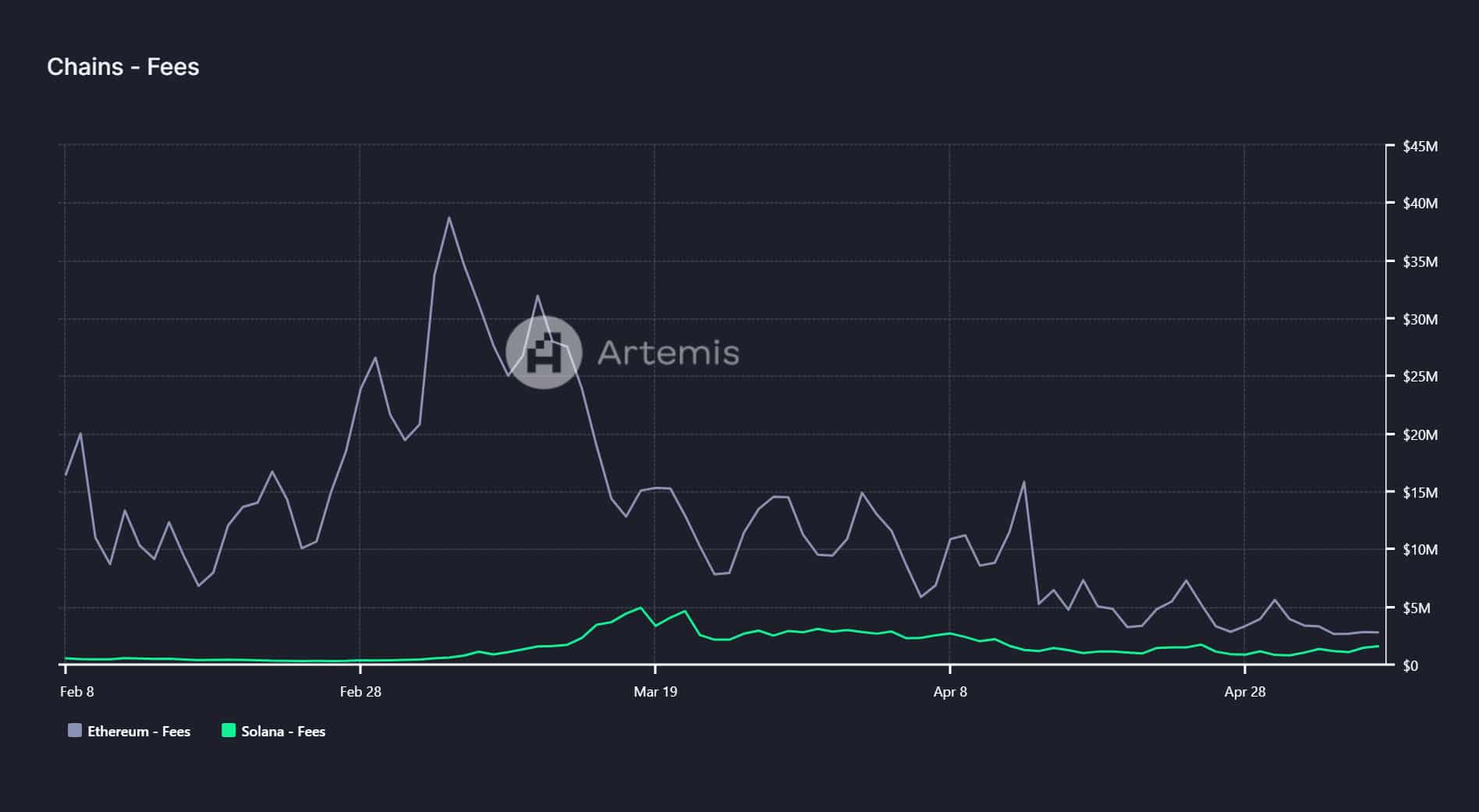

Based on AMBCrypto’s analysis of Artemyz’s findings, it was evident that Ethereum network fees experienced a noticeable decrease since late February.

On the 7th of May, Ethereum fees hit $2.8 million, while Solana had $1.6 million.

Some market analysts contended that Ethereum’s transaction volume ought to encompass that of Layer 2 solutions in order to accurately represent its true worth. In response, Dan Smith stated,

As an analyst, I would ponder over the question of whether transferring transactions involving Ethereum (ETH), utilized as a currency, to Layer 2 solutions significantly contributes value back to the Layer 1 (L1) to justify the reduction in L1 activities.

Despite its network challenges, Solana, on average, has cheaper transaction charges than Ethereum.

Reacting to Smith’s projection of SOL eclipsing ETH, crypto analyst Ansem wondered,

“And it is still 100x cheaper to transact on for users, really think about this & explain to me in detail why ETH is still worth 5x more by market cap”

The decentralized exchange scene is seeing significant progress as well, with Solana’s Jupiter exchange surpassing Ethereum’s Uniswap in terms of unique active wallets. This means more users are engaging with the Jupiter exchange on the Solana blockchain compared to Uniswap on Ethereum.

Many market analysts emphasized that the stock price of SOL was significantly underestimated, becoming even more so following its recent decline last week.

Despite Ethereum holding a significant advantage in terms of Total Value Locked (TVL) and token prices on the charts, other platforms presented noteworthy challenges.

As a researcher examining the cryptocurrency market, I discovered that Solana’s total value locked (TVL) was estimated at $4 billion at the current moment in time. In contrast, Ethereum boasted an impressive TVL of $53.3 billion. These figures highlight the fact that Ethereum currently enjoys a greater degree of investor confidence based on these metrics.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-05-09 09:11