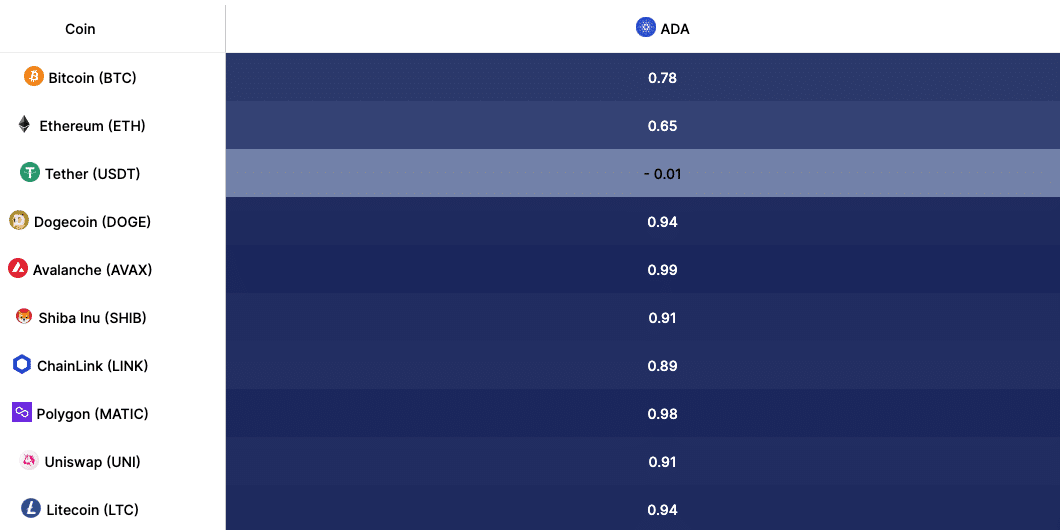

- The correlation coefficients respectively indicate nearly parallel market movements.

- On-chain data suggested that holders should anticipate further gains in the future.

As a crypto investor with some experience under my belt, I’ve learned that market correlations and on-chain data can provide valuable insights into potential investment opportunities. Based on recent analysis by IntoTheBlock, Cardano (ADA), Avalanche (AVAX), and Polygon (MATIC) have a strong correlation with each other, as indicated by their high correlation coefficients.

Based on the analysis by IntoTheBlock, Cardano (ADA) demonstrates a closer connection to Avalanche (AVAX) and Polygon (MATIC) among the leading cryptocurrencies.

At the current moment, the connection between ADA and AVAX was extremely strong, with a correlation coefficient of 0.99 over the past 60 days. For MATIC, the correlation was also strong but slightly less so at 0.98 during this period. Correlation coefficients measure the degree of association between two variables, ranging from -1 (perfect negative correlation) to +1 (perfect positive correlation). In this case, both ADA and AVAX, as well as MATIC, showed strong positive correlations.

Alternatively, a reading near +1 indicates robust trend direction, as observed with Cardano and the other two assets. At present, ADA‘s price is $0.45, representing a 26.40% decline in value since the beginning of the year.

A trio in deep waters

The price of AVAX stood at $36.94, representing a 11.73% decline during that specific timeframe. In contrast, the value of MATIC shifted to $0.71, which represented a significant decrease of 29.21%.

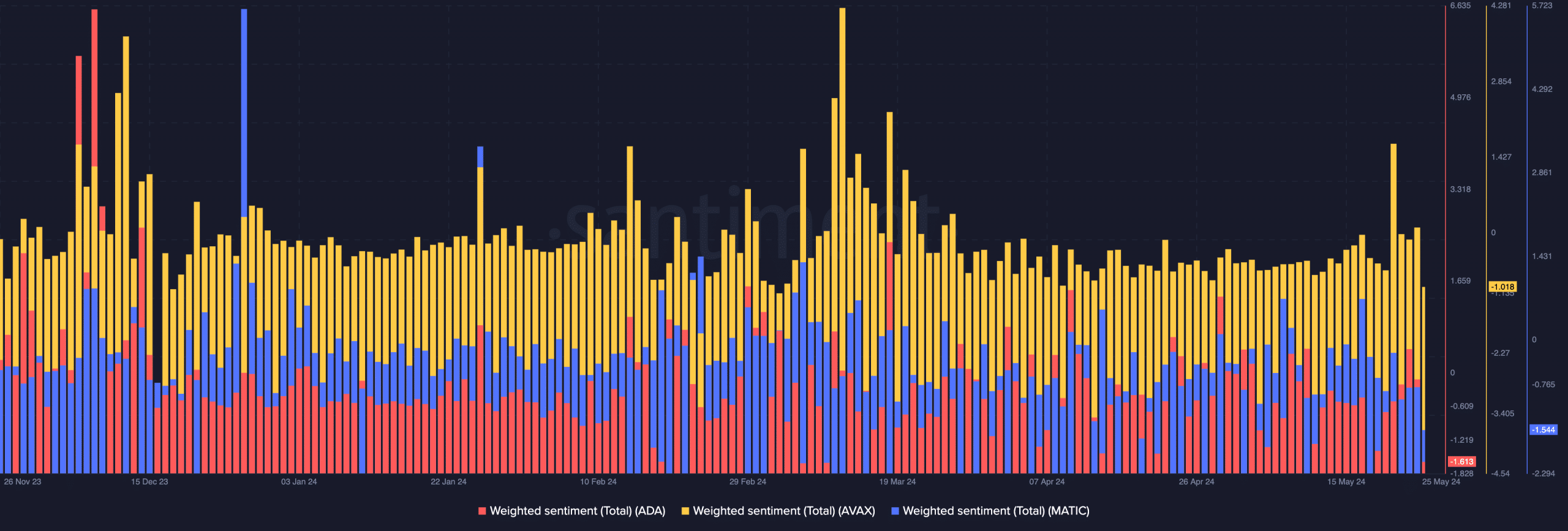

To determine whether Cardano’s trajectory would align with that of AVAX and MATIC, AMBCrypto examined the public perception towards these respective projects.

The Weighted Sentiment metric from Santiment indicates a score of -1.613 for ADA, whereas AVAX and MATIC had readings of -1.018 and -1.544 respectively.

The Weighted Sentiment measure reflects the distinct number of conversations around a particular asset, based on sentiment analysis of related comments. A favorable reading suggests that investors hold optimistic views and may boost their interest in the asset.

As a researcher examining the recent market performance of ADA, AVAX, and MATIC, I’ve observed that all three cryptocurrencies have experienced negative readings. This finding suggests a low level of confidence in their potential based on current trends. Consequently, there is a possibility that prices for these digital assets may decline once more.

As a crypto investor, I believe that when I come across extremely pessimistic views about the market, it might be an opportunity for me to add more coins to my portfolio. These bearish sentiments could potentially signal a buying opportunity before a significant price increase occurs.

The tokens may soon get back to the bull phase

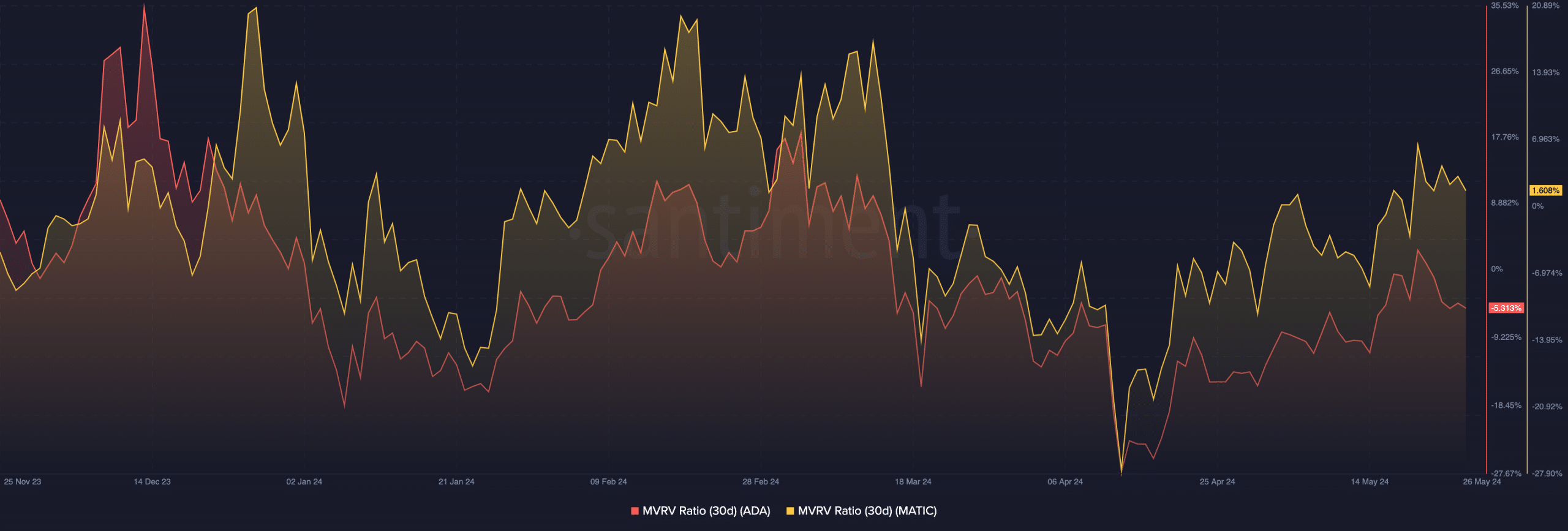

To verify this, let’s examine the Market Value to Realized Value (MVRV) ratio for the cryptocurrency in question. This ratio indicates whether a coin is potentially undervalued based on past purchases.

As a researcher studying market behavior, I would rephrase it this way: The greater the MVRV ratio grows for crypto holders, the more profitable their positions become, making them more likely to sell. Conversely, when the MVRV ratio decreases, it indicates that more holders are experiencing unrealized losses, potentially leading them to sell as well.

As a crypto investor, I would advise being cautious when considering selling your Cardano (ADA) holdings right now. Based on the current data, if every ADA investor who bought within the last 30 days were to sell, they would incur an unrealized loss. The 30-day MVRV ratio for Cardano stands at -5.313%.

During the bull market, MATIC‘s metric stood at 1.608%, but AMBCrypto observed a decrease in ratios. This observation implies that the tokens may have been underpriced in relation to the market’s upward trend.

Realistic or not, here’s AVAX’s market cap in ADA terms

If the prices start to rebound, the price of ADA may surge back up to $0.67. Similarly, if AVAX experiences a price recovery, its token could potentially reach $50.35 again.

In addition, a bounce for MATIC could send the price in the $1.06 direction.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-27 10:15