-

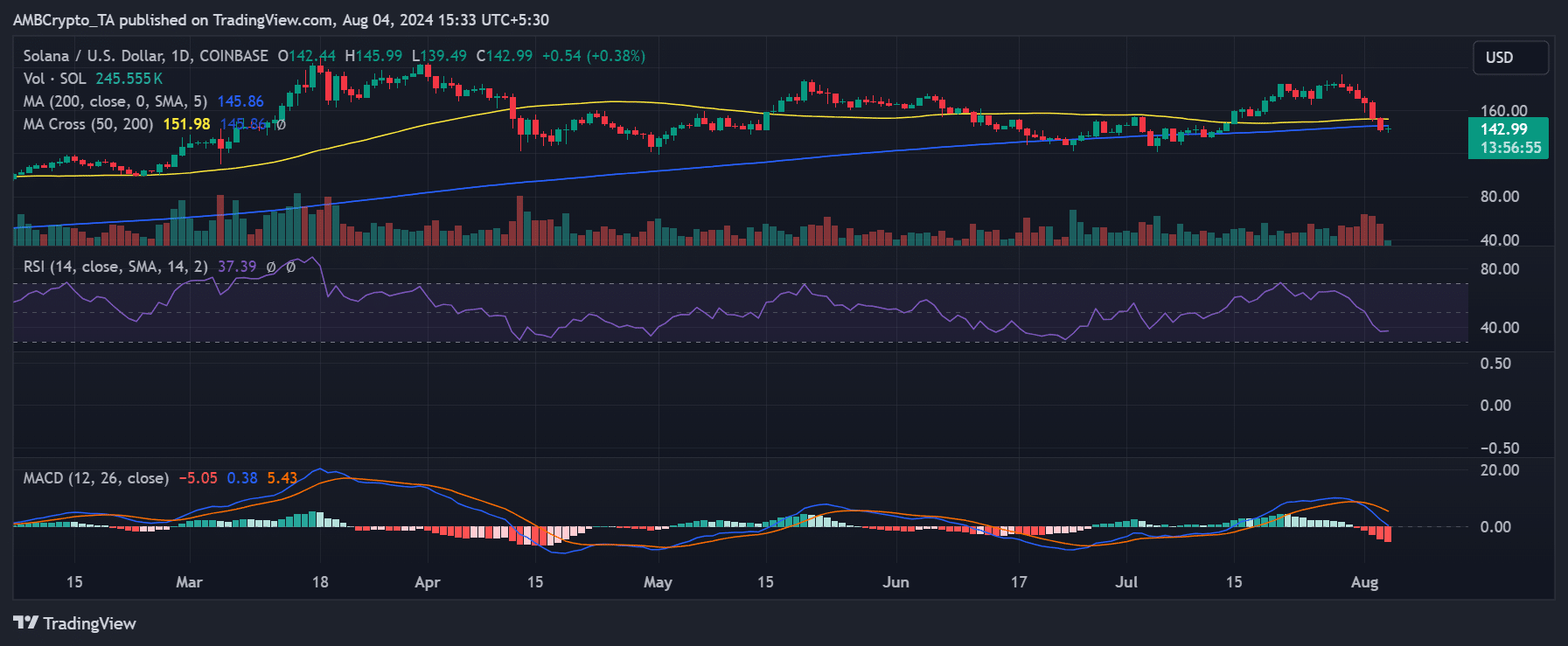

The SOL RSI showed it was now below 40.

SOL declined by over 22% in the last seven days.

As a seasoned crypto investor with battle-scarred fingers from countless market fluctuations, I can’t help but feel a familiar pang of unease when observing Solana’s [SOL] recent performance. The SOL RSI dipping below 40 and a staggering 22% decline in just seven days is not exactly the kind of chart I like to see on my screen.

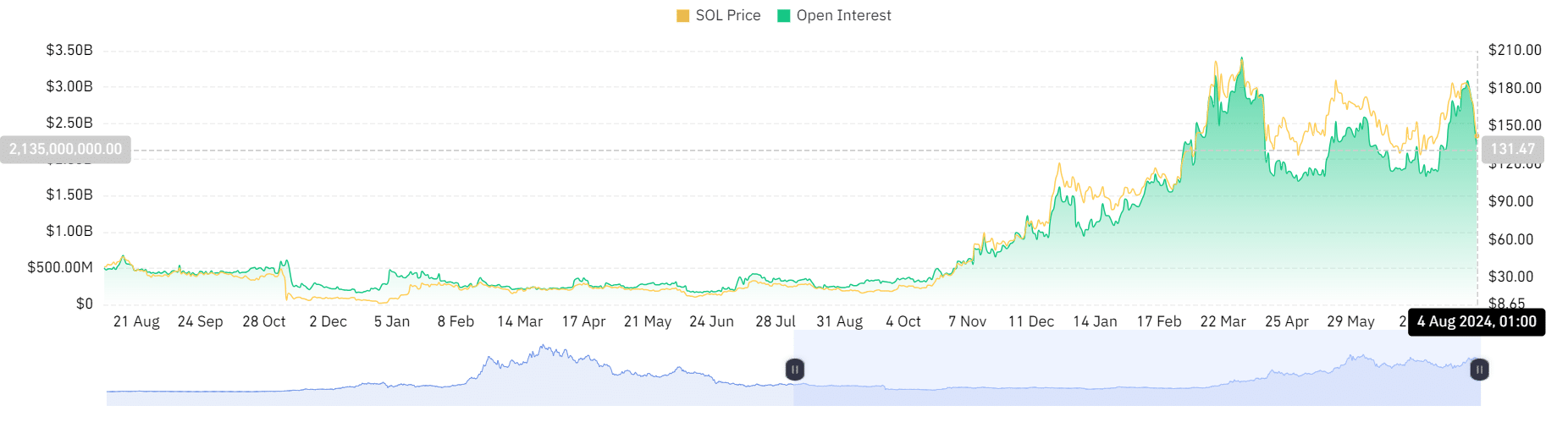

As a Solana [SOL] investor, I’ve noticed some troubling trends over the past week. The crypto market as a whole has been on a downtrend, but Solana seems to have taken a harder hit. This is evident in the consistent drop we’ve seen in open interest for Solana, suggesting that investors are growing increasingly pessimistic. It’s a challenging time, but I’m staying informed and cautious as I navigate these market fluctuations.

Solana sees a double-digit decline

Based on information from CoinMarketCap, Solana had the steepest dip among the top ten cryptocurrencies within the last week, with a fall exceeding 22%.

During the same timeframe, only Dogecoin experienced a similar drop, decreasing by approximately 18%.

It appears that Solana has been significantly impacted in the recent week, ranking as one of the top cryptocurrencies experiencing losses. As for the latest figures, Solana’s trading volume stands at about $3.3 billion; however, it has experienced a drop of more than 20% within the past day.

How Solana has trended

Examining Solana (SOL) over daily periods showed a persistent drop, with prices falling for six straight days, and each day’s decrease becoming more pronounced compared to the previous one.

As I analyze the market trends, it appears that the downward trajectory commenced for me on July 29th, marking a 1.29% decrease. This dip lowered the price from around $184 to $182.

On August 2nd saw the largest dip, amounting to 8.76%, that dragged the price down from approximately $167 to $152. This drop caused SOL to fall under its short-term average (represented by the yellow line), which had been acting as a support point.

On the 3rd of August, SOL witnessed a significant fall of approximately 6.6%, lowering its value to around $142. This decline caused the price to drop beneath its long-term average (represented by the blue line), which also functioned as another potential support point.

Currently, Solana is being traded around $142. Previously identified support zones (as shown by the yellow and blue moving averages) are now acting as potential resistance points instead.

Interest in SOL wanes

Over the recent days, there’s been a noticeable decrease in Solana’s open interest as observed on Coinglass. As of 31st July, the open interest stood at about $3 billion, however, it has subsequently fallen to roughly $2.2 billion.

As a researcher, I’ve observed a decrease in the cash influx towards Solana. This drop could suggest waning investor enthusiasm and potentially rising negative sentiments within the market.

Moreover, examining Solana’s funding rate revealed a negative value. This signifies that sellers were actively trading more than buyers, and there was a significant presence of short positions in the market.

Read Solana (SOL) Price Prediction 2024-25

Currently, it’s important to note that the funding rate has surged again, standing at approximately 0.0051%. This increase might signal a change in market opinion, possibly suggesting a transition towards longer positions, rather than the predominant use of short ones.

A higher funding rate indicates a potential increase in purchasing activity, possibly leading to price stability for Solana within the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-08-05 06:15