- Overleveraged positions in the futures market made it harder for a BTC breakout.

- The reset and liquidation cascades are necessary for a long-term healthy uptrend.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen more than a few market cycles that resemble the current Bitcoin [BTC] situation. The intense liquidations and overleveraged positions in the futures market have made it harder for BTC to break out past the $100k level, much like a rubber band being stretched too far before snapping back.

Despite briefly surpassing the $100,000 mark on several occasions over the past week, Bitcoin [BTC] has found it challenging to sustainably break through this significant barrier.

On December 9th, Bitcoin experienced a drop in price to approximately $94,200. So, what might lie ahead for Bitcoin traders?

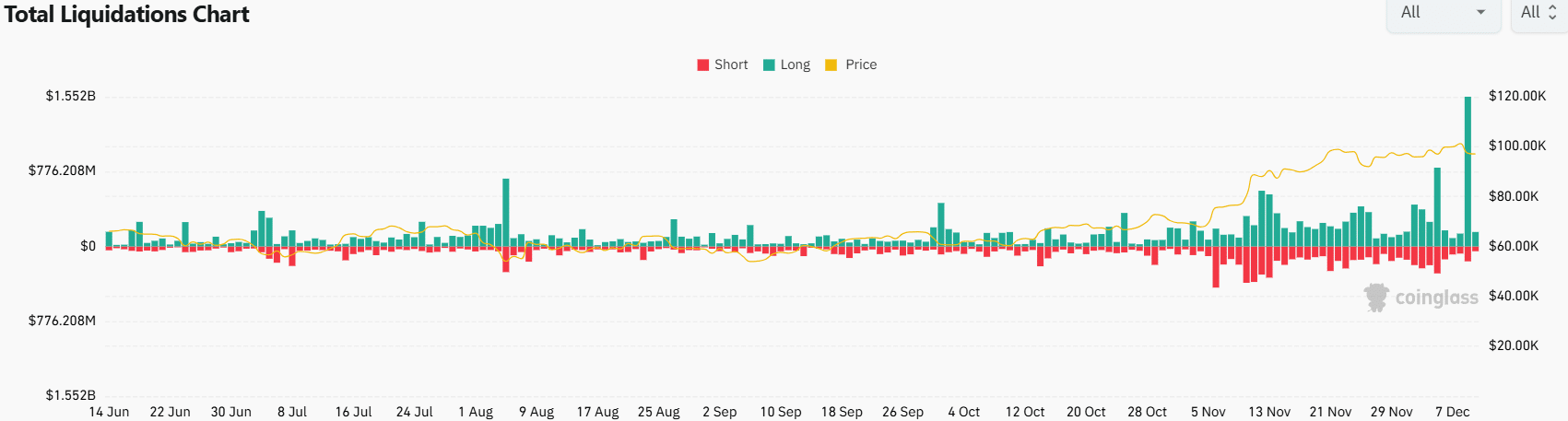

Liquidations reach $1.7 billion

On a single day, the total liquidations for Bitcoin pairs amounted to a staggering $1.7 billion. This massive figure could be attributed to an intense struggle in the futures market, which led to many overleveraged traders, primarily those around the $100k mark, being eliminated from their positions.

On the 5th of December, there was increased market turbulence with Bitcoin’s price oscillating near significant trading zones where large amounts of funds are typically held. On that particular day, approximately $1.1 billion in Bitcoin trades were closed out due to liquidation.

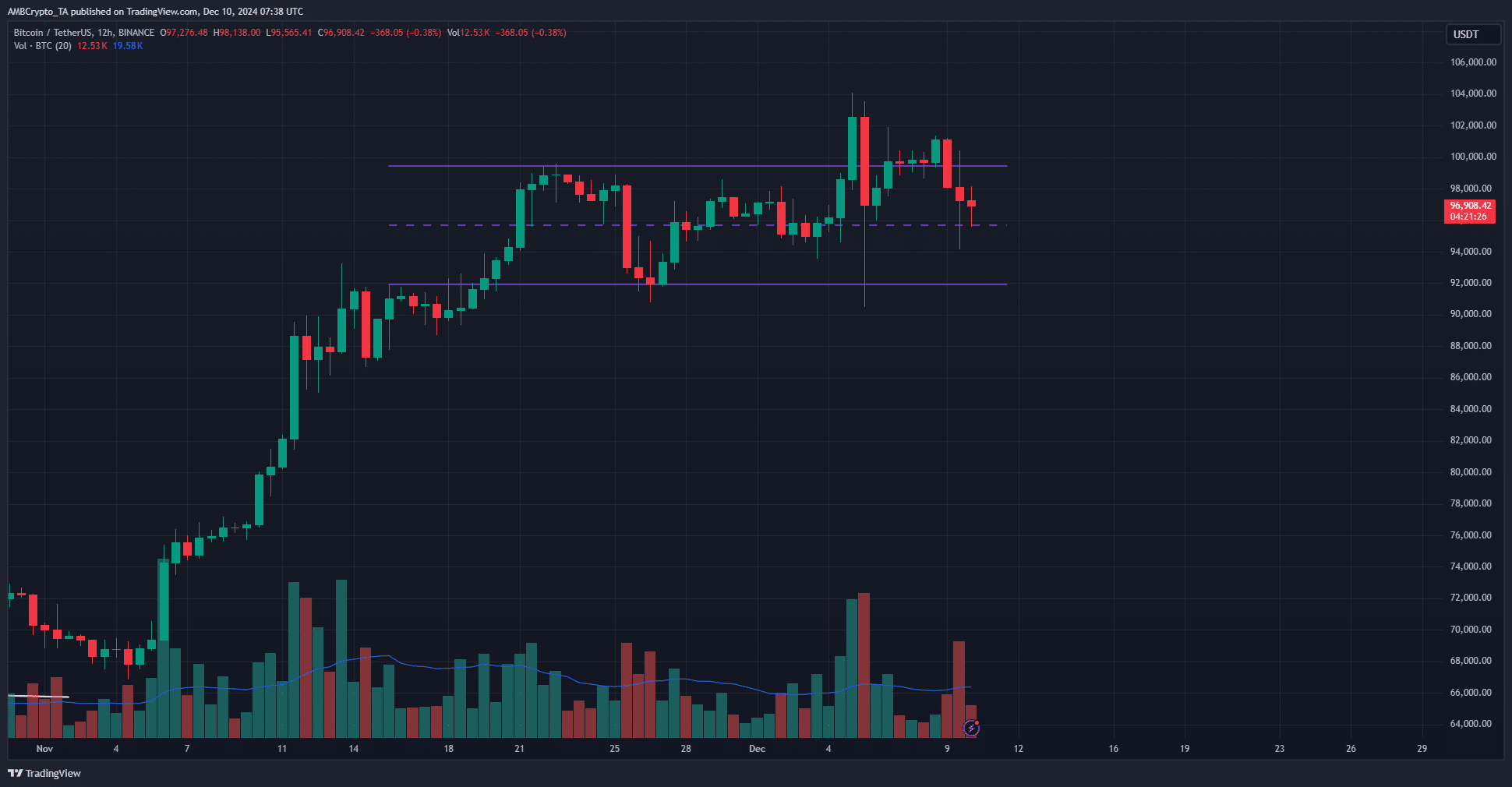

According to the 12-hour price analysis, Bitcoin (the leading cryptocurrency) was approaching a key mid-range support level at approximately $95,800. There’s a possibility it might dip further down to around $94,000 or even $90,000 before the bullish sentiment returns and takes control again.

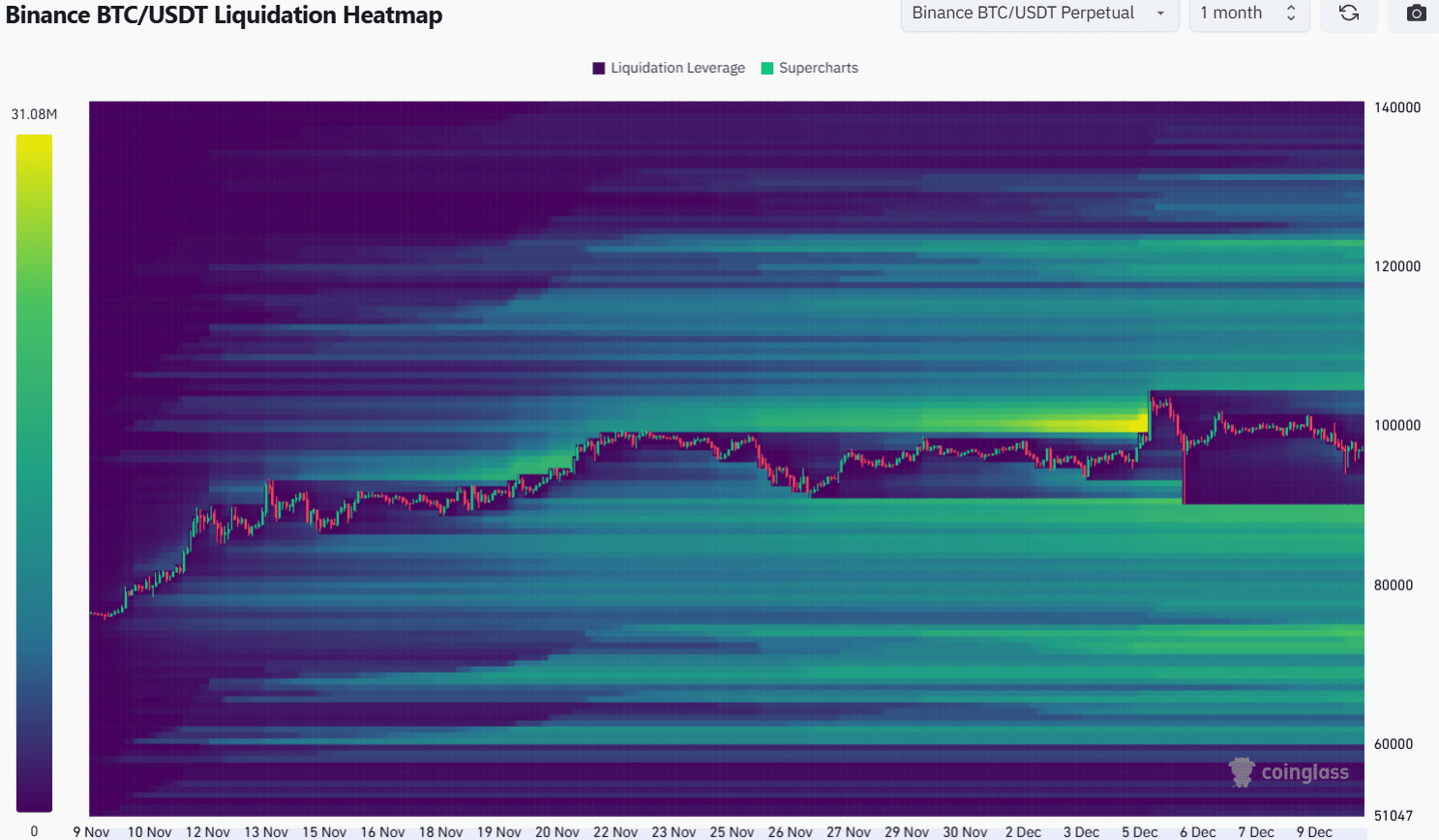

Bitcoin liquidation heatmap shows higher is likelier

According to AMBCrypto’s examination, significant clusters with high liquidity were effectively established and subsequently depleted during the last ten days, as depicted in their 1-month liquidation heatmap analysis.

As a crypto investor, I found myself captivated by the enticing proximity of the $100k milestone during the last days of November and early December. This allure triggered a surge in demand for liquidity, pushing the price up to an astounding $104k.

After some time had passed, there was a retreat back towards the $90,500 support from November 26th, which also touched an important area with high trading volume.

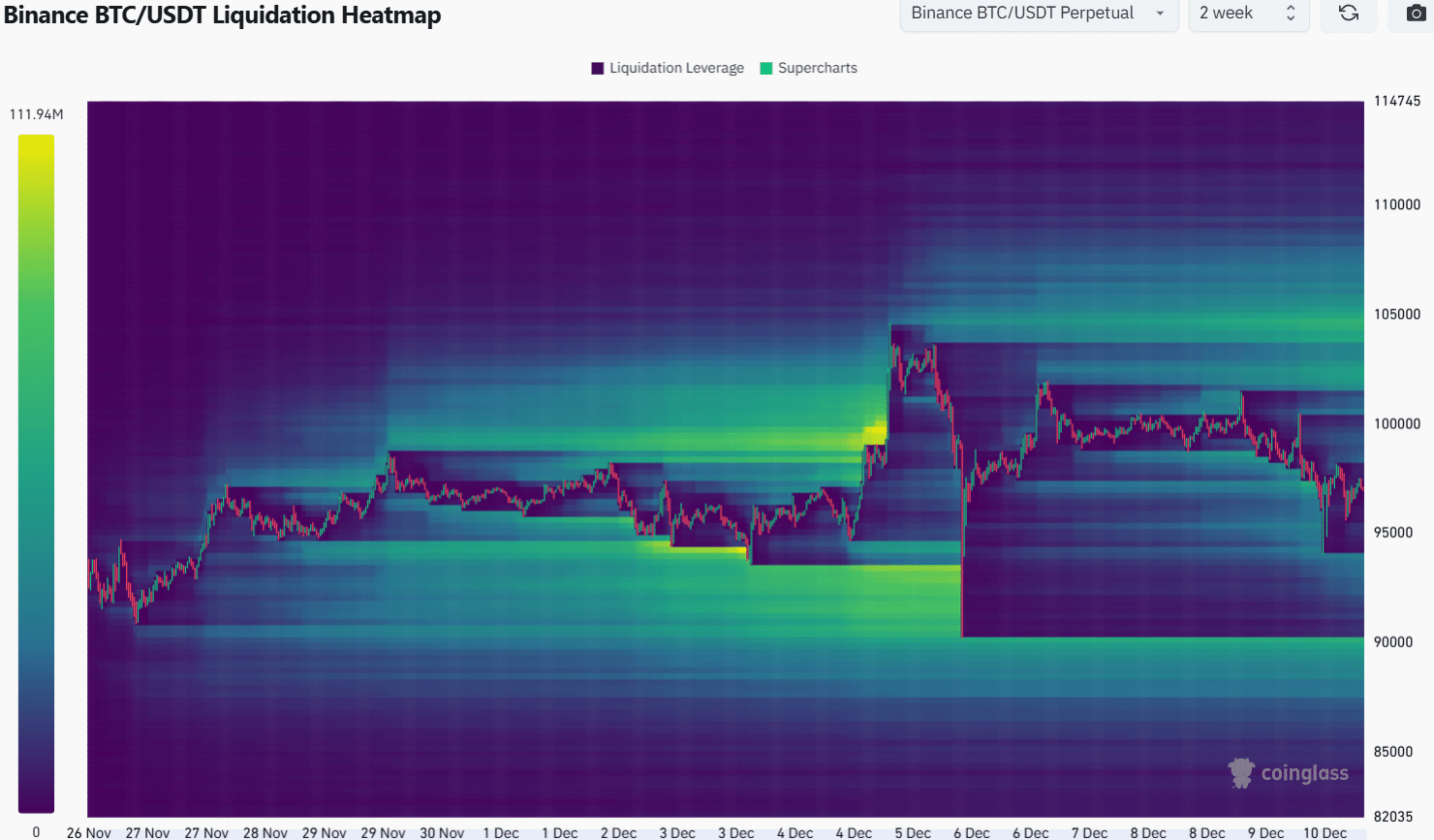

Looking back over the past month, there’s a possibility that the price could dip down to around $90k or even lower. However, when we focus on the 2-week timeframe, it appears that the liquidity pooling at approximately $105k is more substantial compared to the liquidity found at $90k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simpler terms, reaching $102,000 in value was quite appealing. Therefore, there was a slight probability of the price heading towards $102,000 and $105,000. However, it’s important to note that despite this possibility, traders should brace themselves for a potential drop down to $89,000 and be mindful of their risk management strategies accordingly.

The break of the short-term support at $94k can foreshadow a deeper drop.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-11 00:08