- Institutional players doubled on ETH as CME Futures OI hit a record high of $2.5 billion

- With ETH gaining ground against BTC, will the momentum be sustainable this time?

As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the recent surge in institutional interest in Ethereum (ETH) is nothing short of impressive. With CME Futures Open Interest (OI) hitting an all-time high of $2.5 billion, it’s clear that Wall Street is taking notice of this digital asset.

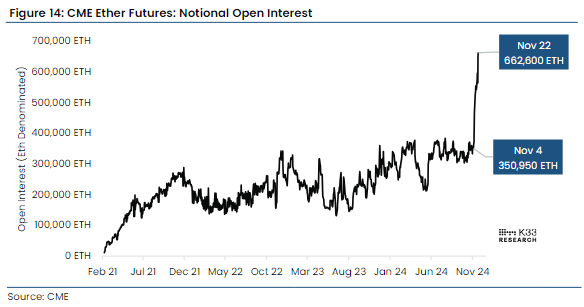

In the month of November, institutional demand for Ethereum [ETH] surged significantly, reaching an all-time peak in CME Futures Open Interest (OI) at approximately 662,600 ETH, which equates to a value of around $2.5 billion.

Indeed, as per K33 Research findings, there was a significant surge in Ether (ETH) quantity, jumping from approximately 350,950 ETH on November 4th, which preceded the U.S. Presidential elections by a day or so.

ETH closes in on BTC

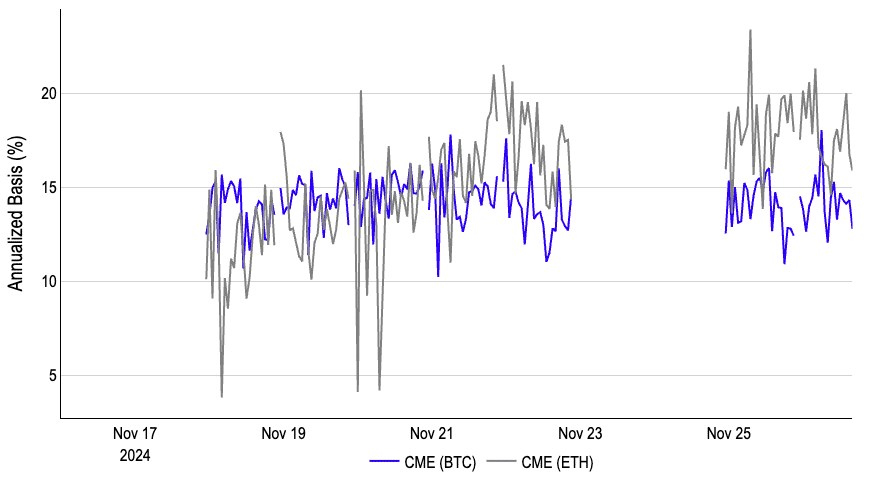

On November 25th, the trading volume for CME ETH Futures increased significantly. Additionally, the annualized basis for ETH – the extra value hedge funds receive when they buy U.S. spot ETH ETFs and sell ETH Futures – also saw a rise.

The basis for Ethereum’s CME contract has grown to encompass more than Bitcoin lately, having lagged behind it for a while previously.

Although an increase in institutional interest might generally boost ETH’s value, the use of hedging tactics by hedge funds could potentially subject the asset to dramatic price fluctuations caused by forced sell-offs during market turbulence.

It’s clear that Ethereum (ETH) has been gaining ground compared to Bitcoin (BTC), and this is reflected in the ETH/BTC ratio as it mirrors ETH’s performance in relation to Bitcoin.

Indeed, Ethereum (ETH) has seen an increase in inflows during the last week, which is indicated by the approximately 15% rise in the Ethereum to Bitcoin (ETHBTC) ratio.

This meant that ETH outperformed BTC over the past few days, especially during BTC’s latest slump.

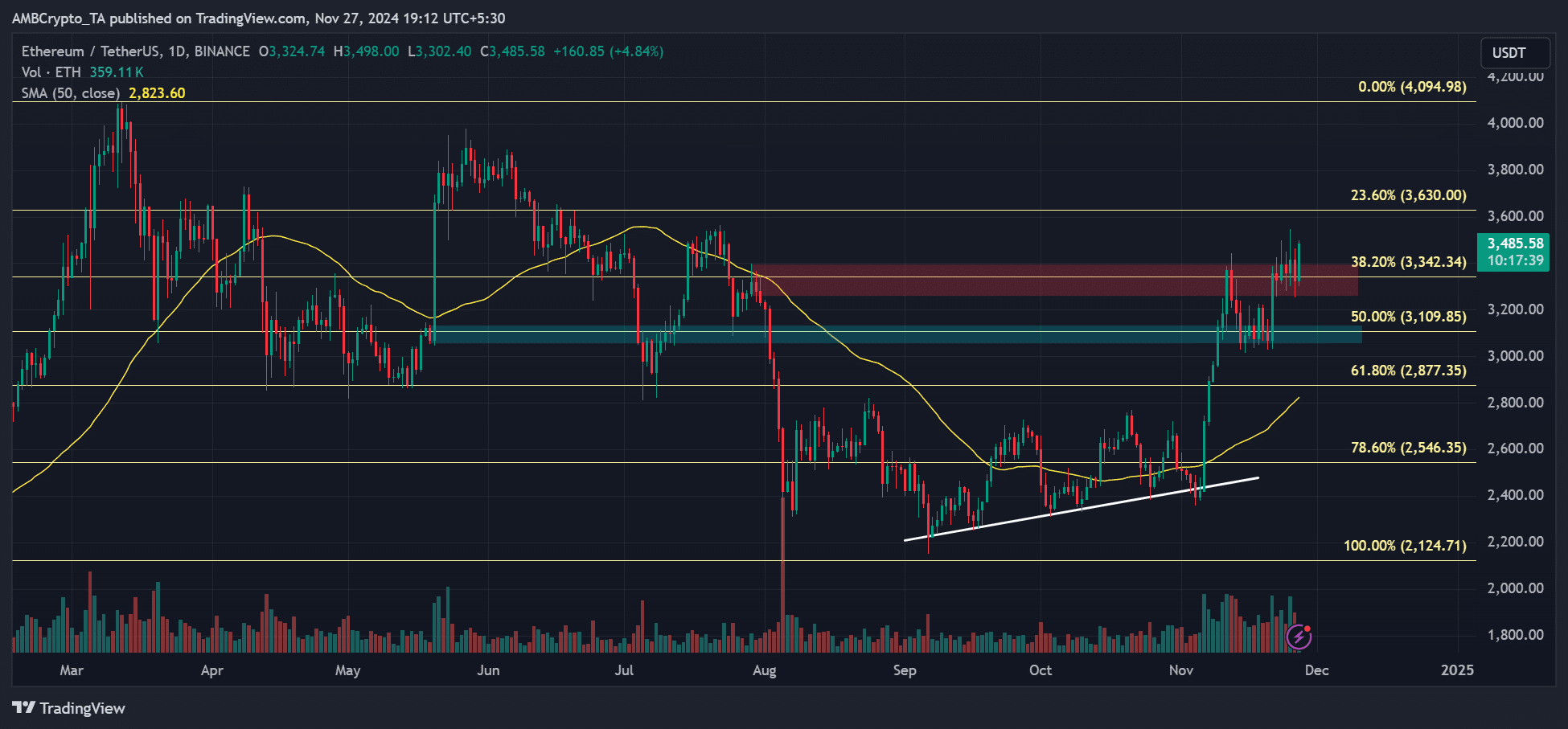

The sustainability of the trend would depend on the ETHBTC ratio clearly surpassing its 50-day moving average.

Read Ethereum [ETH] Price Prediction 2024-2025

As a researcher, I’ve noticed that in early November, there was a seemingly false breakout, which subsequently led Ethereum (ETH) to underperform. However, now, with the ETH/BTC ratio approaching its 50-day Moving Average, I find myself wondering: Could this time be different?

As I write this analysis, Ethereum (ETH) is currently priced at approximately $3,400, representing a 4% increase over the past 24 hours. My projections for the short term suggest potential growth towards $3,500 and even $3,600 in value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-28 10:15