- COMP crypto soared 50% in the past 30 days; will the uptrend extend?

- The rally was marked by increased whale interest and reduced sell pressure.

As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed numerous bull runs and bear markets. The current surge in COMP is particularly intriguing due to its strong fundamentals and the resurgence of DeFi.

Over the last fortnight, the Decentralized Finance (DeFi) sector has shown exceptional performance, with platforms such as Compound [COMP] experiencing significant gains. The COMP crypto token surged by approximately 50% over the past month, increasing from $38 to $74.

As I delve deeper into my study, it appears that the rally has encountered a barrier around the $80,000 mark. Now, the question arises: Will COMP be able to surmount this hurdle and aim for the $100 it surpassed in early 2024?

COMP crypto $80 hurdle

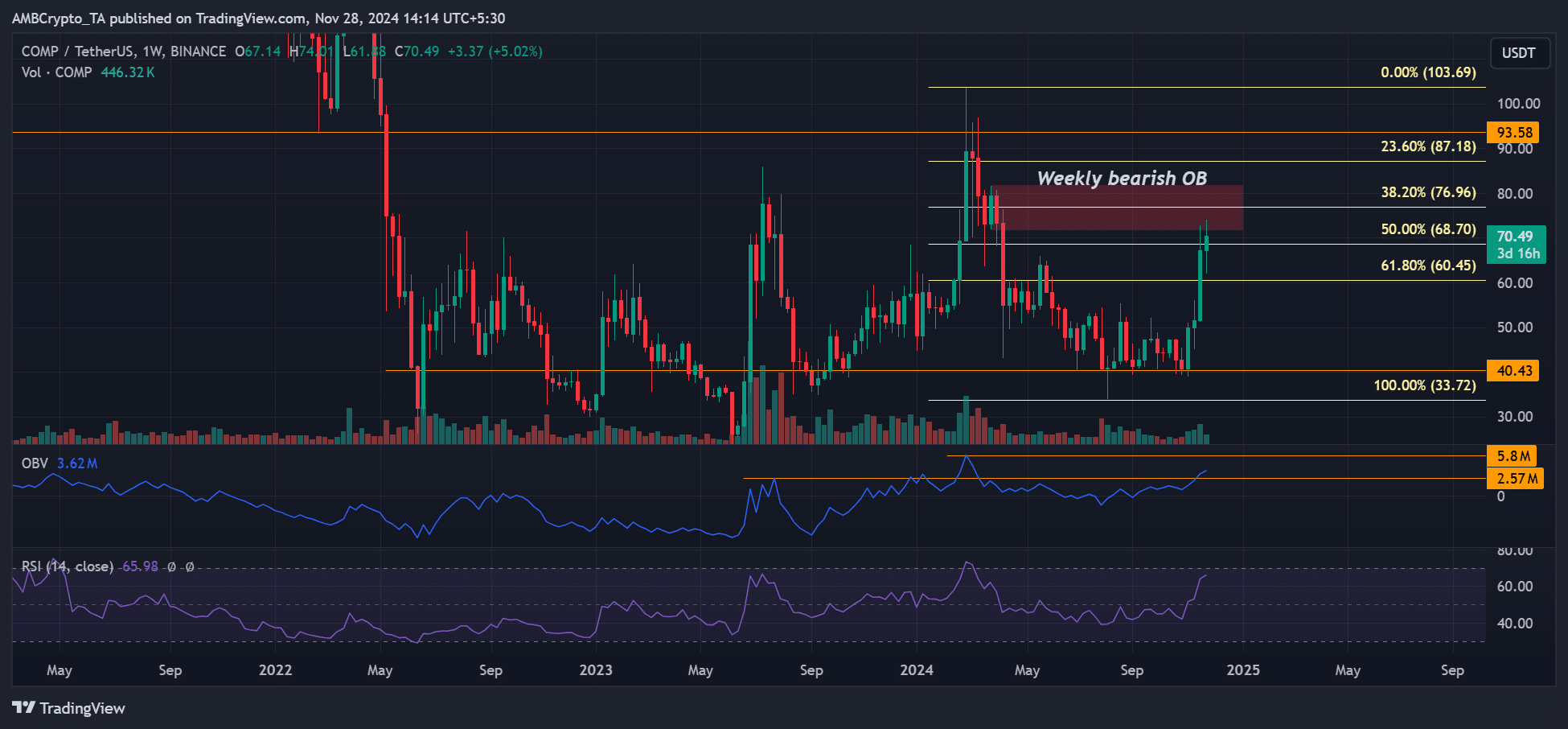

On the weekly chart, there was a red-marked Bearish Order Block (OB) ranging from $71 to $81. Typically, these Bearish Order Blocks function as areas where big traders can carry out their transactions, acting as potential supply zones.

Last week, the roadblock was struck, and despite this, COMP experienced a struggle as it moved into the current week, indicating that some investors might be taking their profits at that particular level.

If the market closes at more than $81 (which is considered a supply zone) on a weekly basis, it might suggest that the ongoing recovery is set to persist.

Should this happen, the psychological barrier at $100 might not be too far off. But for COMP to surge past that and towards higher prices, it needs to establish $93 as a supportive level first.

In simpler terms, the On Balance Volume (OBV) was lower than its March high, indicating there might be room for further growth. Yet, the Relative Strength Index (RSI) came close to showing signs of being overbought, hinting at a possible small dip or cooling off period.

On-chain was bullish

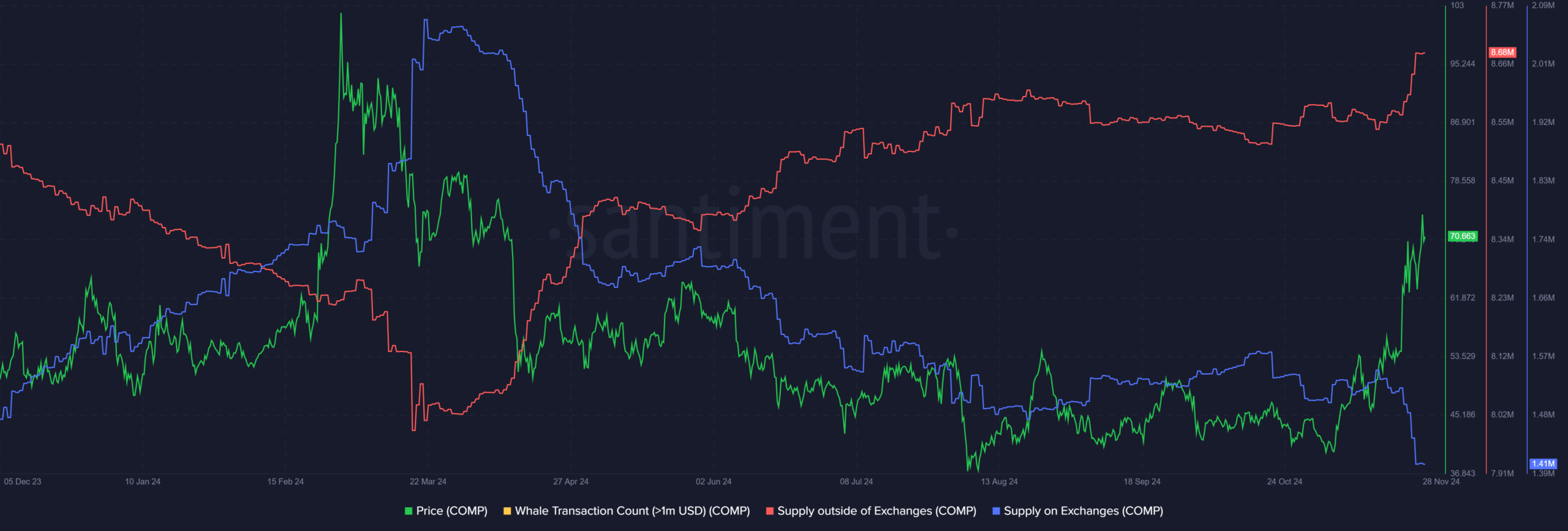

According to Santiment’s findings, the current surge is primarily fueled by robust purchasing activity (or spot buying), evident from a rise in assets leaving exchanges and moving into private hands (indicated by the increase in Supply outside of Exchanges, denoted as red).

Notably, the selling pressure on centralized exchanges (CEXes) continued to decrease, as indicated by the dwindling amount of supply on these platforms (shown in blue).

This suggested COMP had less headwind, which could tip it to clear the overhead roadblock.

In my analysis, the situation we’re observing now appears to deviate from the bullish trend seen in early 2024, as demand has dwindled and there’s a surge in selling activities. This suggests that the upward momentum might persist unless there’s a significant decrease in accumulation and an escalation of selling pressure.

Read Compound [COMP] Price Prediction 2024-2025

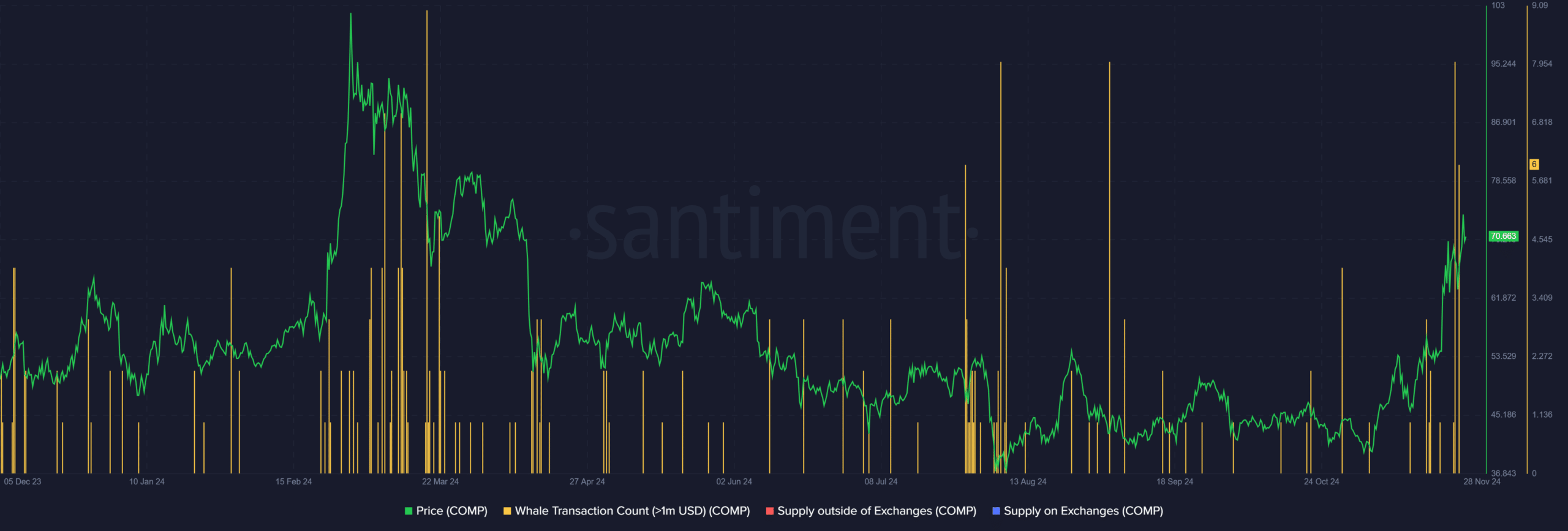

A recent positive on-chain indicator is the surge in whale activities, which may potentially drive up the price of COMP, assuming they’re not offloading it instead.

To summarize, the upward trend for COMP may persist due to the revival of DeFi and less selling pressure from Centralized Exchanges.

Read More

2024-11-28 18:15