- Conflux had a bullish daily structure since Monday

- The heightened volume could see the breakout reach May’s resistance levels

As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The current breakout by Conflux [CFX] has caught my attention, not just because of its impressive 33% gain in four days, but also due to the strong fundamentals that suggest this could be more than just a short-term pump.

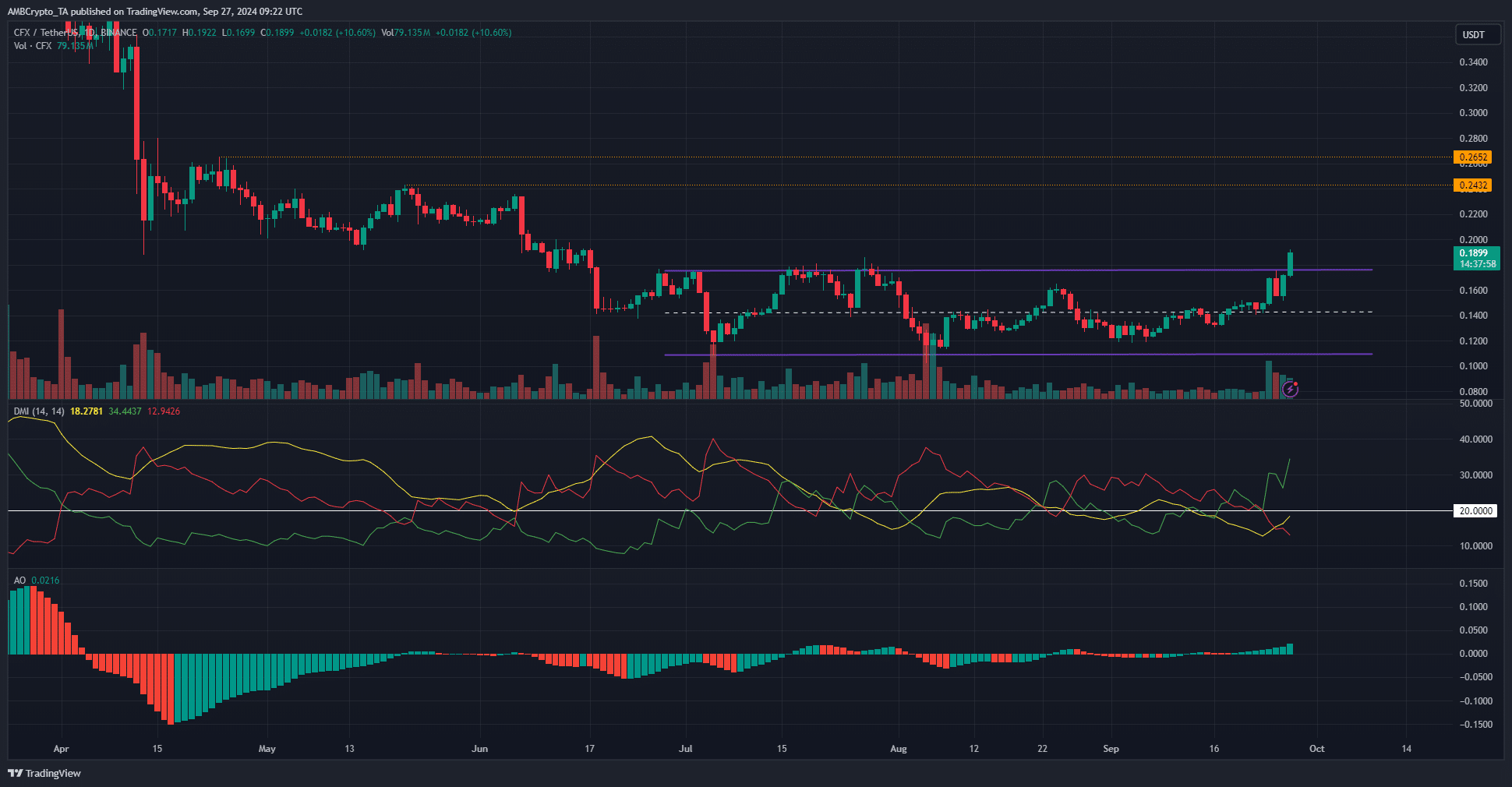

Since late June, Conflux (CFX) has been moving within a particular price range. However, it came close to breaking free from this range during early July and August. Remarkably, the bullish sentiments have regained strength, resulting in an impressive 33% surge over just four trading days.

Translating that into simpler terms: When the price surpassed the three-month barrier of $0.176, it indicated that the price was likely to climb above $0.2 soon. The previous trend of sideways movement was disrupted, and investors were aiming for a potential 40% rise in price.

Targets for the range breakout

Generally speaking, following a bear market, it’s common for assets to go through a prolonged period of consolidation that lasts for several months. This phase, often referred to as a range formation, offers long-term investors potential buying chances. However, it also necessitates strong conviction from these investors to keep their holdings even when faced with short-term market fluctuations.

The price surge beyond $0.176 happened on substantial trading activity. The DMI indicated a robust upward trend, as the +DI was significantly above 20, suggesting strength. If the ADX increases further, it will signal a favorable condition for the bulls.

In simpler terms, when the Awesome Oscillator exceeded its neutral point, it often leads to an increase in price. Since this range typically extends by its own size, a cautious prediction for CFX bulls would be a potential price rise to around $0.242.

This goal aligns with the resistance we encountered in May. Moving further north, $0.265 also represents a significant resistance point dating back to April.

Short-term bullish belief

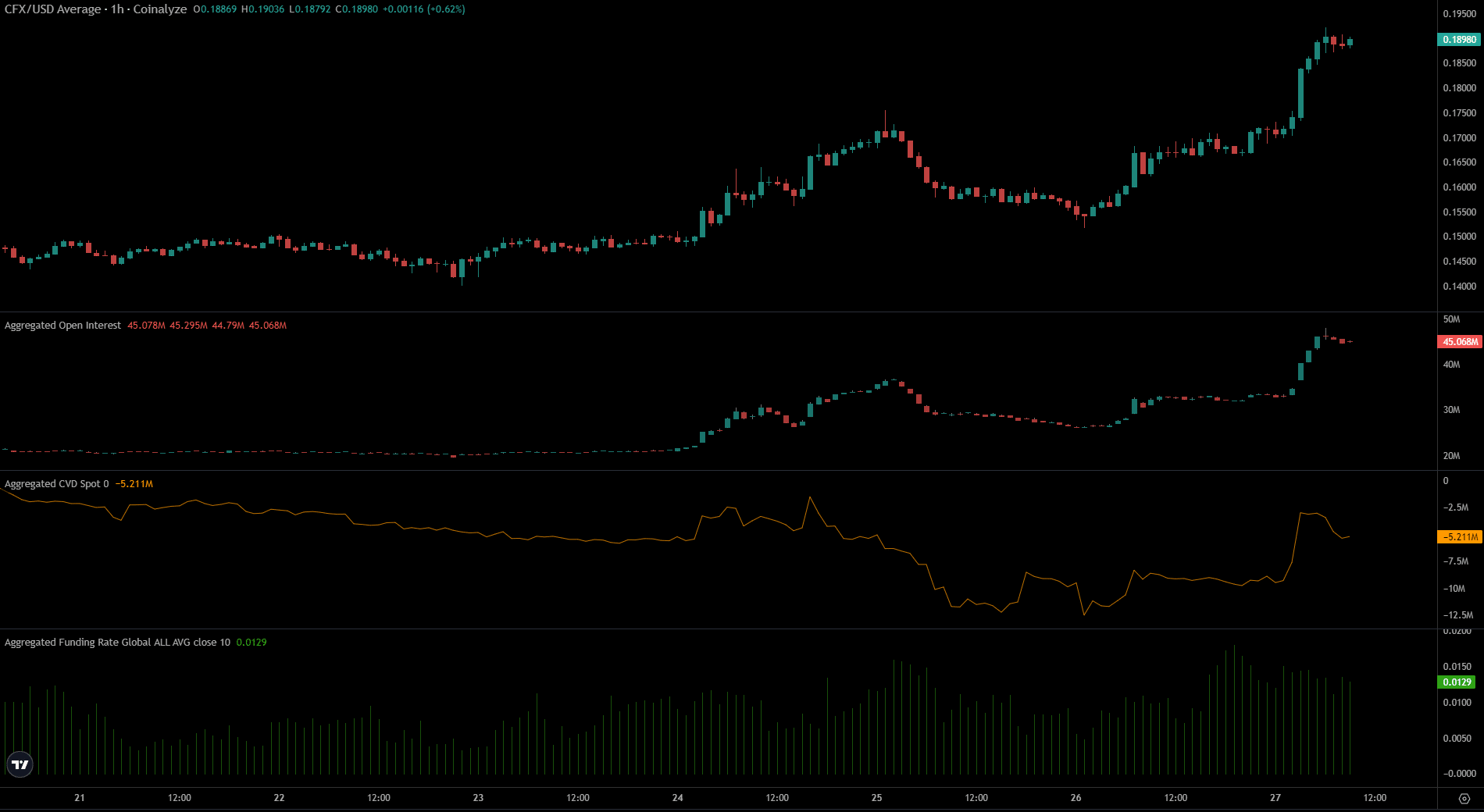

On September 23rd, the Open Interest for CFX contracts peaked at $20.9 million. However, over the last four days, this figure has significantly increased to a staggering $45 million.

A significant drop in the number of cases for Cardiovascular Disease (CVD) occurred a few days back, causing concern among optimistic investors. However, since then, there’s been an improvement, which has brought relief to those concerned parties.

Realistic or not, here’s CFX’s market cap in BTC’s terms

The funding rate was also high. Together, they signaled that the short-term outlook for Conflux was bullish. Another 30%-40% move higher appears likely.

Beyond that, it could get tricky and buyers might need more time to make the move happen.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-28 00:07