🚨👀 IRS DeFi Tax Rule Under Fire: Lawmakers Push Back Against “Overreach”! 🚨

- U.S lawmakers are pushing to repeal the DeFi broker rule, citing excessive government intervention

- Republican-led shift may ease crypto regulations as enforcement priorities move towards immigration

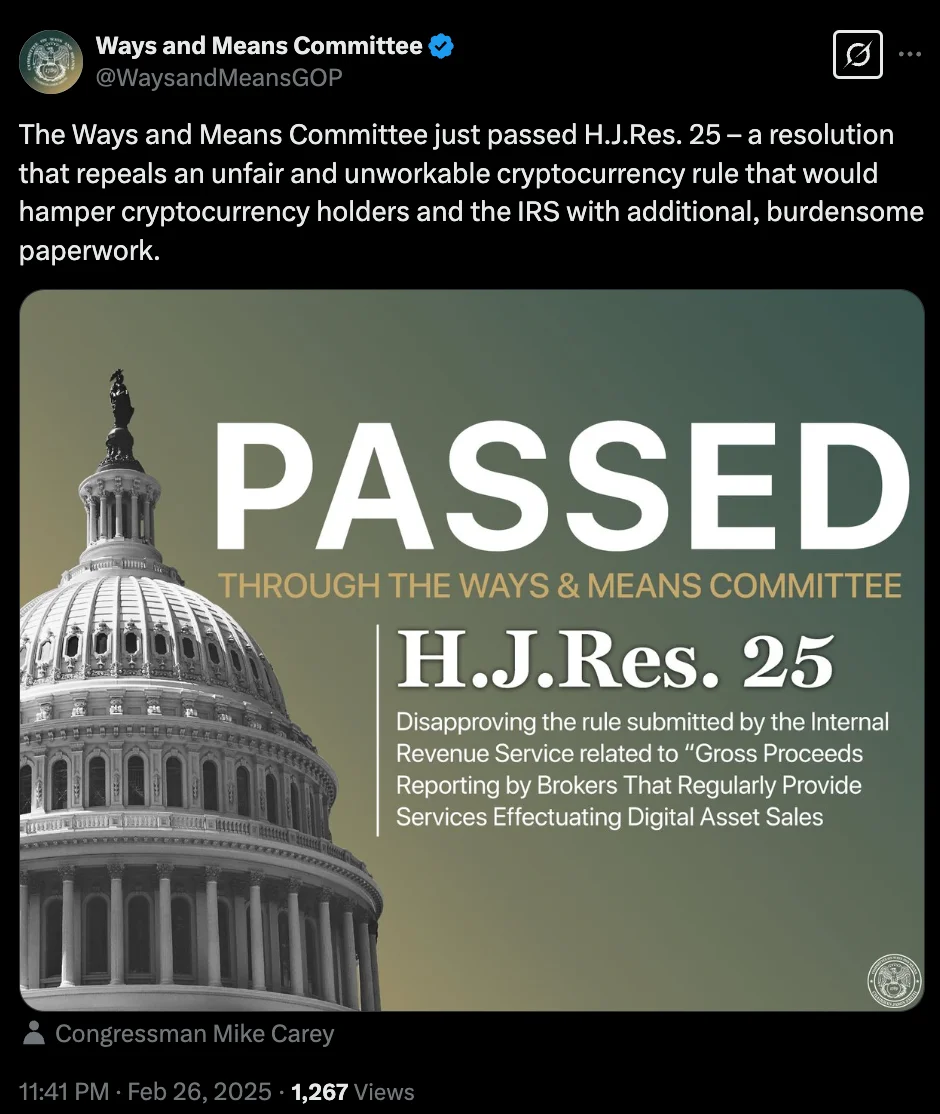

U.S lawmakers are pushing back against the infamous “DeFi broker rule,” which mandates decentralized exchanges and digital asset brokers to report transaction details to the IRS. On 26 February, the House Ways and Means Committee voted 26-16 to advance a resolution seeking to repeal the rule before its scheduled implementation in 2027. 🤯

Originally approved by the IRS on 5 December, the regulation aims to expand reporting requirements, compelling brokers to disclose cryptocurrency sale proceeds and taxpayer details. Ah, but who needs freedom when you can have regulations? 🤪

However, critics argue that enforcing such measures on decentralized platforms is utterly impractical and represents excessive government intervention. One might say, it’s a case of the tail wagging the dog. 🐕

Why are lawmakers criticizing?

House Ways and Means Chair Jason Smith (R-MO) criticized the IRS tax rule, stating that it aims to “unnecessarily regulate the providers of digital wallets.” Ah, but what’s wrong with a little unnecessary regulation? 😏

He argued that the regulation would place an undue burden on U.S.-based firms, while giving an advantage to foreign entities that are not subject to the same reporting requirements. One might say, it’s a case of playing favorites. 🤝

Echoing these concerns, Miller Whitehouse-Levine, CEO of the DeFi Education Fund, called the rule an “unlawful and unconstitutional overreach.” He emphasized on the need for its repeal to “protect Americans’ freedom of choice in how they transact.” Ah, freedom of choice, how quaint. 🙄

He said,

“We urge all members —and all who want to establish the United States as a hub for financial innovation—to act swiftly to uphold Congress’s original intent by supporting the motion to overturn this misguided rule.”

How is this move helpful for the U.S?

Needless to say, the effort to repeal the DeFi broker rule reflects a broader transformation in U.S crypto regulations, driven by the Republican Party’s control of both the Senate and the House. One might say, it’s a case of new broom sweeps clean. 🧹

With a surge of pro-crypto lawmakers in Congress, industry leaders speculate that the U.S could be on the path to becoming one of the most crypto-friendly administrations in history. Ah, crypto-friendly, how terrifying. 😱

This shift is already evident, as the SEC has withdrawn multiple enforcement actions against crypto firms throughout February – Sign of a more lenient regulatory approach.

Trump’s pro-crypto moves

Additionally, at the World Economic Forum in Davos, Trump also accused major banks, including JPMorgan Chase and Bank of America, of engaging in “politically driven de-banking.” At the time, he claimed that they were excluding conservatives under regulatory pressure.

While the banks denied any misconduct and Trump did not provide concrete evidence, his allegations nonetheless spurred a Republican-led investigation into potential financial discrimination.

Therefore, as the Trump administration reshapes its priorities, its impact on crypto regulations remains uncertain, leaving the industry anticipating potential regulatory relief. One might say, it’s a case of wait and see. 🤔

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2025-02-28 09:58